Let’s face it – even when we have done all the necessary homework, investors tend to procrastinate when it is the time to buy stocks.

Buy too soon and you may regret when the price drops further. Wait too long and you may miss out on a bargain just because you didn’t pull the trigger in time!

A quick and easy method is to go for dollar cost averaging also known as “DCA”. DCA allows you to invest a fixed amount of money into a particular investment at regular intervals – building your stock holdings over time instead of a lump sum purchase at a single price point.

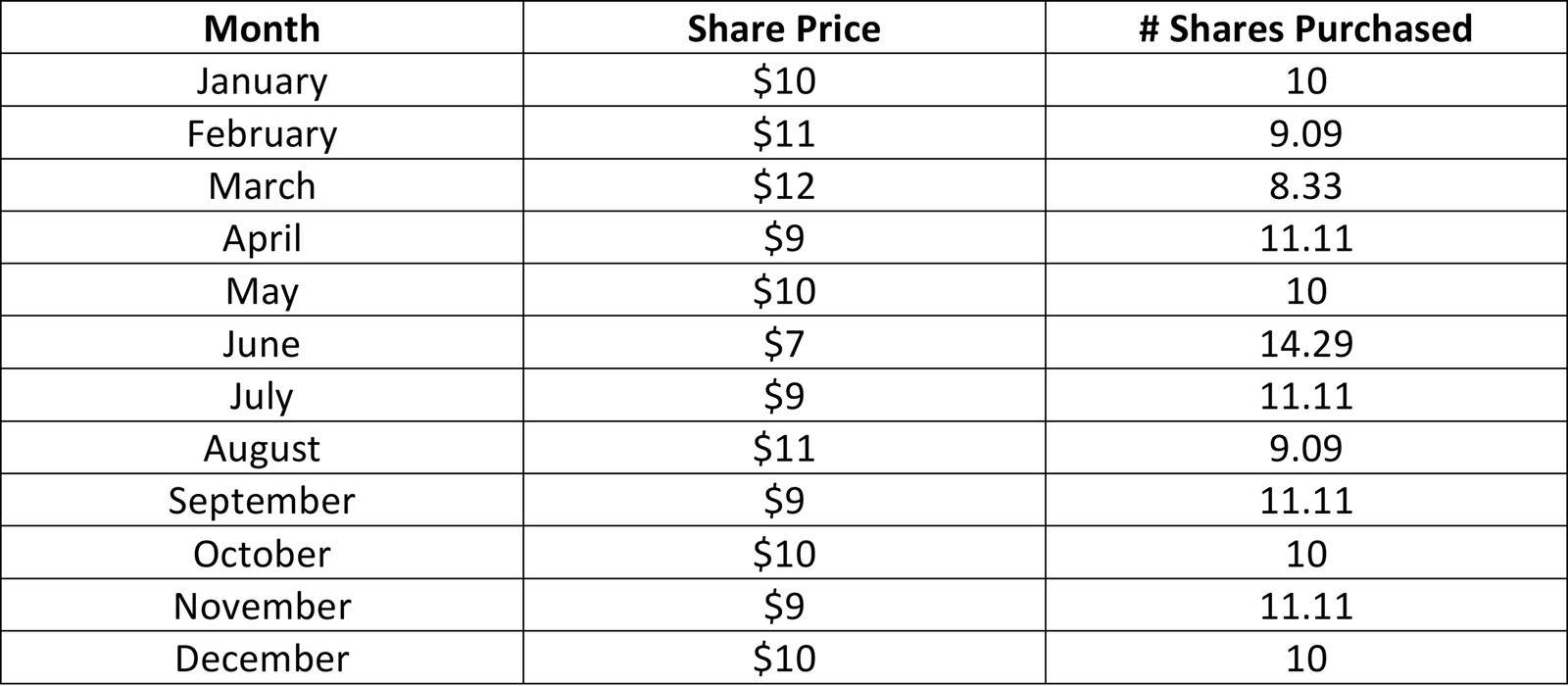

Let’s take a look at a quick example and how you can benefit from this simple DCA strategy.

How DCA Works

Assume you want to invest $1,200 into Stock A either by a lump sum on 1st Jan or split the purchase equally across 12 months.

If you bought Stock A at $10 using a lump sum of $1,200, you would own 120 shares outright.

However, if you go by the DCA route as shown above, you will own 125.24 shares with the same $1,200 invested. This means that your average price per share would be $9.58 instead of $10 if you opt for the lump sum method – a 42cents or 4.2% extra discount.

In short, when Stock A increases in value over the long term, you’ll benefit from owning more shares by adopting DCA method.

Now let’s go through 3 main benefits of Dollar-Cost Averaging.

3 Benefits of Dollar-Cost Averaging (DCA)

1. Manage Your Emotions

The most common investment mistake is that people let their emotions get the better of them. Too often, investors worry about what the market is going to do in the short time due to the tense media news and hype.

Furthermore, history has shown that it is difficult to predict market swings, and no one can do it consistently, not even the professional investors. Hence, investing a lump sum at the wrong time can be risky and adversely affect a portfolio’s value significantly.

The dollar cost averaging strategy will mitigate this by smoothening out the investment amount that is put to work.

2. Lower Costs of Purchase

With sky high inflation and looming recession risks, no one can expect how long a bear market will last.

By investing a fixed amount periodically, one can actually take advantage of market downturns to buy more shares when prices are low.

Over time, one can accumulate more shares when prices are cheaper (as shown in the above example), leading to more upside potential in the long term.

3. Automated Investments

Lastly, investors usually struggle with procrastination because they are afraid of losing money. This is a cognitive bias called ‘Loss aversion’ bias, in which they tend to prefer avoiding losses, even if it means giving up the potential for gains.

This is where DCA really shines because the regular money commitment enforces disciplined investing to fulfill your wealth building plan and build good investment habits going forward.

Now that you know the benefits of DCA, let’s dive into the SMART Plan!

What is SMART Plan?

uSMART has launched a new DCA tool called the SMART Plan which enables you invest a fixed sum for as little as S$100/US$100 on a regular basis based on your chosen interval from daily, weekly to monthly.

There are more than 10,000 US & SG stocks/ETF available for SMART Plan.

As to where to find the ‘SMART Plan’ icon and discover the whole list of eligible in the uSMART APP, check out this short clip – https://youtube.com/shorts/ksAomhoazcU?feature=share.

The investments can also be easily funded with the money in your uSMART trading account, automatic e-GIRO deduction from your bank or combination of both deduction methods.

How to create a SMART Plan in 4 steps

Once you have decided on a particular stock (or a few stocks), the next phase is to create a SMART plan for it.

uSMART has already done a good sequence flow here; but I am also going to just display the 4 steps below for your reference too.

[SMART Plan] Step 1

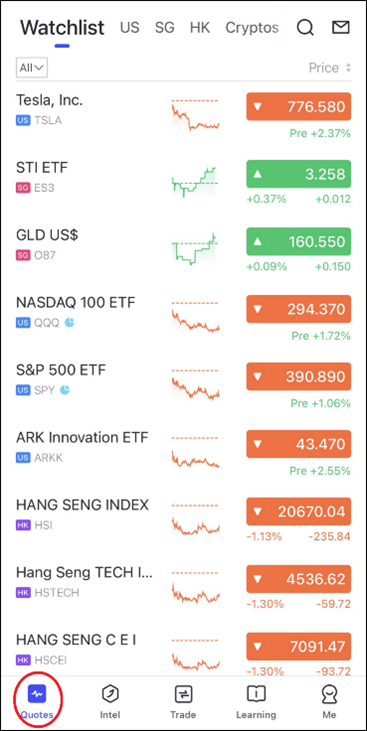

Under “Quotes” button, search for the Stock or ETF you want to subscribe a SMART Plan for.

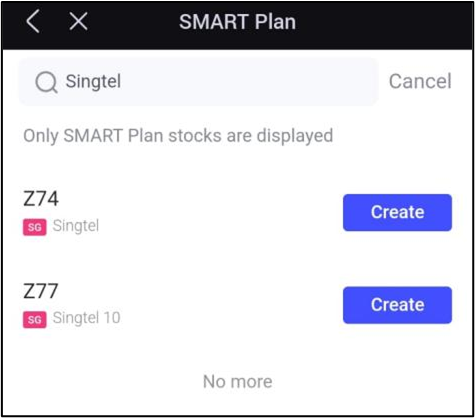

Another alternative way is to go via the “Trades” button -> “SMART Plan” -> search for the Symbol/Name of the Stock or ETF as shown below.

[SMART Plan] Step 2

After you find the Stock or ETF you wish to subscribe to SMART Plan, select the “Trade” button. More options will appear and you can click on “SMART Plan”.

[SMART Plan] Step 3

Next, enter the details for your SMART Plan based on the picture below.

- The regular amount you wish to invest per order.

- Choose where to deduct your funds from.

- Select your investment frequency i.e. daily, weekly or monthly (only available from 1st to 28th of the month)

- Select the time you wish your order to be placed (from 9.30am to 4.30pm)

- Select your debiting bank account.

- Once you have entered and verified the information, click “Confirm” to submit.

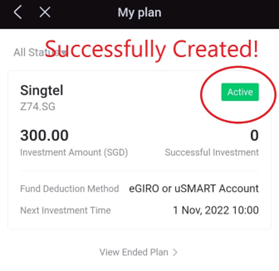

[SMART Plan] Step 4

Once you have subscribed to SMART Plan, the status will be shown as “Active”.

And voila! You’ve just created your first DCA SMART Plan. Simply repeat the process if you want to do DCA for as many stocks as you wish to subscribe on a plan for.

I have also included a video recording to make it easy for you – check it out here:

https://youtube.com/shorts/6gtLrHFyKdo?feature=share

Now, here are some common FAQs that you should take note too.

SMART Plan Common FAQ

- Is SMART Plan available for both buy and sell orders?

SMART plan is only available for buy order.

- What are the charges for SMART Plan?

There is no extra fees for using SMART Plan but standard fees and charges apply for all order done under SMART Plan.

Please refer to its pricing guide to better understand the different fees and charges involved.

- What is the order type available for SMART Plan?

The order for SMART Plan will be done using Market order, means you will take the prevailing current market price.

- What currencies will be used to settle the trades executed from SMART Plan?

All trades will be settled in traded currency of the chosen stocks/ETF.

- Will I be subjected to debit interest charge for using SMART Plan?

There will be no debit interest charge for Cash Account type as there are checks for sufficient funds before order is placed.

If your deduction method for Margin Account is from “uSMART Securities Account”, it may result in margin loan, alternative currency loan or debit interest.

Auto conversion of deficit currency balances is not available and debit interest will be charged for the deficit currency balances.

- If my investment instruction is in USD and the fund deduction method is e-GIRO, how much SGD will be deducted from my e-GIRO?

If your deduction method is “e-GIRO Bank Account”, the SGD equivalent will be deducted from the “e-GIRO Bank Account”.

Due to currency fluctuation, each deduction of SGD equivalent will differ in accordance with the prevailing rate. If the “e-GIRO Bank Account” Deduction Method is unsuccessful for consecutive 3 Investment Dates, the Investment Instruction will be suspended.

- Is my money and assets held with uSMART Securities Singapore Pte Ltd (“USPL”) safe?

uSMART is regulated and supervised by The Monetary Authority of Singapore.

In compliance with section 104 of the Securities and Futures Act (“SFA”) and the provisions of the Securities and Futures Regulations (SFR), uSMART protects your monies and assets by keeping them in client segregated accounts separated from their own with proper record keeping and controls put in place.

Section 104A of the SFA provides that monies and assets belonging to customers are not available for payment of uSMART debts and shall not be liable to be paid or taken in execution under an order or a process of any court.

Conclusion [uSMART Plan]

In conclusion, many investors love the simplicity and consistency that dollar-cost averaging brings to their investing process.

To top it off, when you automate your investing using a SMART plan, it provides you the flexibility of the amount, investment time (you can set it to one day after your monthly salary) and even automatically exchange the currency at the time of transaction.

All these can give you the peace of mind to focus on long term growth without having to fixate on market fluctuations.

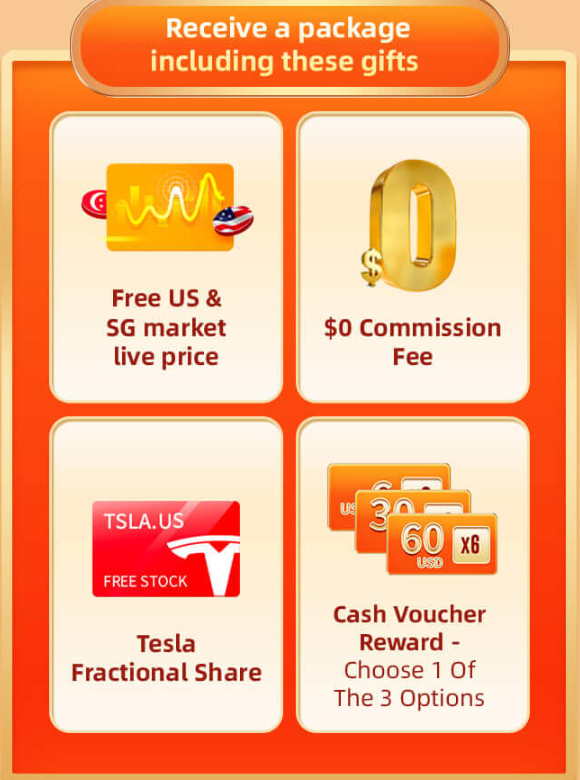

If you are ready to give DCA a try, you can click the below picture to sign up .

Get started by signing up for a uSMART account today by clicking on the link below:

Sign up for uSMART account today

Additional Reading:

Disclaimer: This article is written in collaboration with uSMART Singapore but the views and/or opinions expressed in the article are of my own. This article is intended for information purpose only and should not be construed as financial advice. This article has not been reviewed by the Monetary Authority of Singapore.