The semiconductor industry has been in the doldrums since 2023. According to SEMI, semiconductor growth is expected to resume in 2024, with sales forecast to reach a new high of $124 billion in 2025.

This could be a sign that the slump is ending soon with a recovery poised to take place. Here are 4 Singapore semiconductor stocks that could explode when the industry recovers

Avi-Tech Holdings

Avi-Tech Holdings started as a provider of burn-in solutions and has since expanded to include manufacturing and printed circuit board

assembly services and engineering services.

Avi-Tech is now the leading total solutions providers for the semiconductor, electronics, life sciences and other emerging industries.

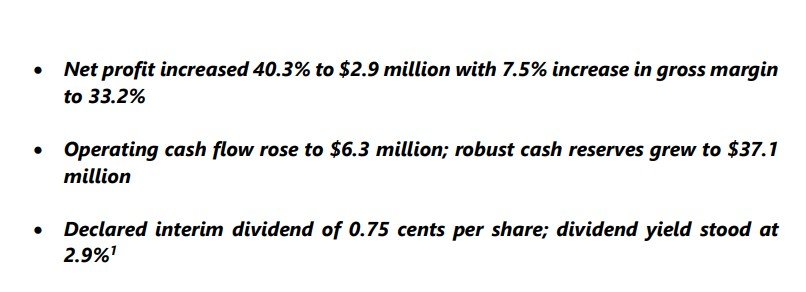

Avi-Tech reported net profit increased by 40.3% to S$2.9 million in its half year ended 31 December 2023. The company declared an interim dividend of 0.75 cents. If include last year final dividend of 1 cent, the full year dividend will be 1.75 cents which translate to 7% yield.

The management indicated that major semiconductor companies such as Infineon, Intel, and Texas Instruments are maintaining their investments in expansion and production facilities this year.

Hence, the company is confident on the growing demand for semiconductors, particularly in the automotive and industrial sectors. You can view the company website here.

Grand Venture

Grand Venture Technology (GVT) is a trusted manufacturing solutions and service provider for the semiconductor, analytical life sciences, electronics, aerospace, medical and other industries, with operations in Singapore, Malaysia and China.

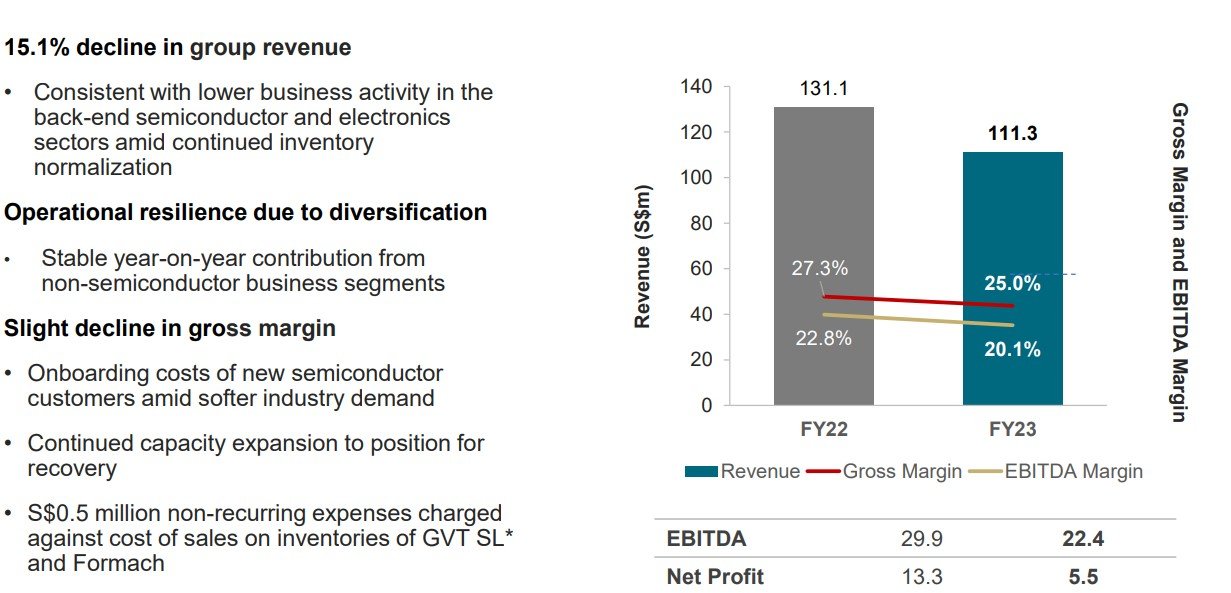

Grand Venture reported revenue dropped by 15.1% to S$111.297 million for the full year ended Dec 2023. This is consistent with lower business activity in the back-end semiconductor and electronics sectors amid continued inventory normalization.

Net profit dropped by 58.4% to S$5.5 million. The company declared a final dividend of 0.1 cent per share.

The company is cautiously optimistic of an improvement in the prospects of the semiconductor industry from the later half of 2024, as it expects that technological and production innovations in artificial intelligence applications will drive semiconductor demand.

You can view the company website here.

Micro-Mechanics

Micro-Mechanics designs, manufactures and markets high precision parts and tools used in process-critical applications for the semiconductor and other high technology industries.

In its 3Q24 results, Micro-Mechanics reports revenue declined by 8.7% to S$13.6 million due to soft conditions in the semiconductor industry. However, net profit is up 12.8% to S$1.8 million for 3Q24 due to the diligent efforts to control costs.

The company CEO is cautiously optimistic that the worst of the downturn may now be over. You can view the company website here.

Frencken Group

Frencken Group is a high-technology capital and consumer equipment service provider of complete and integrated one-stop outsourcing solutions to a diversified customer base comprising of renowned global companies in the medical and semiconductor industries.

For the full year ended 31 December 2023, Frencken reported revenue dipped by 5.5% to S$742.8 million. This is due a challenging macroeconomic environment and slower business conditions for companies operating in the semiconductor sector.

Net profit attributable to equity holders of $32.5 million in FY2023 is a decrease of 37.4% from S$51.9 million in FY2022. The company declared a final dividend of 2.28 cents. You can view the company website here.

Conclusion

With the expected recovery in the semiconductor sector, these are the 4 Singapore semiconductor stocks that could benefit when the industry recovers. However, investors need to do their due diligence before investing in any of these stocks.