In my previous uSMART review article (If you have not read it, do check it here first), I talked about how it is standing out from its competitors by offering light-hearted learning content & courses on the platform.

On top of that, there are a variety of SMART features to make investing easier such as SMART Orders and the ability to deposit funds using eGIRO (supports 9 banks in Singapore).

With that said, we are going to share 4 interesting features of how uSMART can help you in your investing journey.

1. Zero Commission, NO hidden charges

First off, users can welcome uSMART’s 4th anniversary with their “No to Hidden Charges” campaign launch.

From now till 31st December 2022, uSMART is not charging any commission for ALL (SG, HK & US) markets and US settlement fees! From my knowledge, this effectively make it the cheapest for SG market hands down!

2. Say ‘Hi’ to High-Priced Stocks with Fractional Shares!

The option of Fractional Shares investing is probably the real game-changer here.

For many donkey years/decades, the real barrier to investing in some of the renowned growth US stocks like Alphabet, Amazon and even Berkshire Hathaway is their astronomically high price per share.

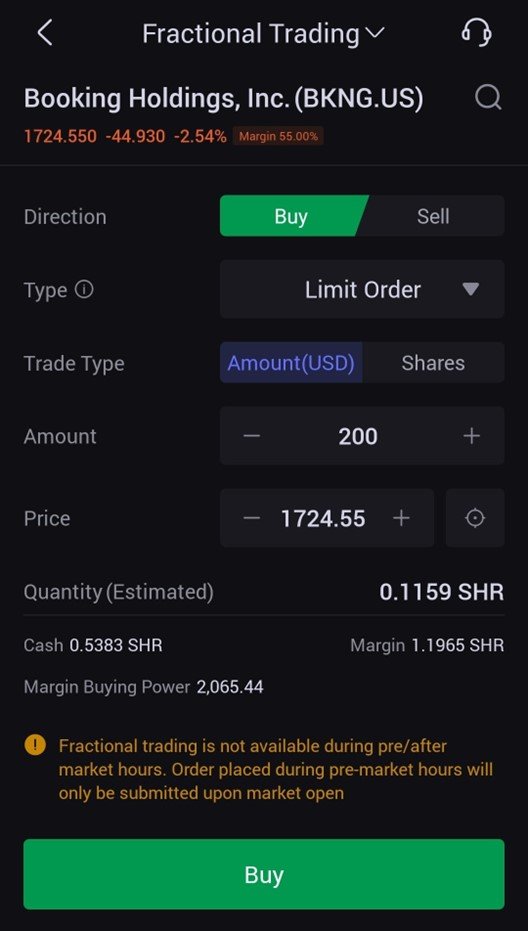

One good example is Booking Holdings’ stock price trading at above US$1,000 in the past 5 years. Booking Holdings is the parent company of Agoda and Priceline.com.

Based on the screen grab’s price, a minimum lot size of 1 share would translate to US$1,767.98 or around S$2,400 based on 1.4x USD/SGD FX.

It would be out of reach for most people who can only fork out a few hundred bucks for investment every month. Either that or you have to wait for a few months to get just 1 share – and with leftover funds sitting around.

Both ways doesn’t seem palatable to many average joe investors. But all these is about to change with uSMART’s fractional shares feature!

Fractional investing enables an investor to buy and sell stocks at a fraction of a single share.

For instance, if we purchase 0.1 share of Booking Holdings, this would cost us “only” ~S$240, which makes it more enticing to grab around 0.5 shares for every S$1,000 funds you set aside.

On top of that, it allows you to fully deploy your funds as compared to leaving it un-invested if the remaining amount isn’t enough to buy one more share.

Lastly, you can even get exposure to various companies at one go with your ‘limited budget’ due to the low capital requirements.

Suppose you have US$600 that you want to split equally into Alphabet, Amazon and Booking Holdings stocks, you can purchase fractional shares by value. Simply key in US$200 and uSMART app will automatically execute the trade for you!

Based on their 4th July share prices, you can purchase around 0.11, 0.09 and 1.82 shares respectively.

Now that you are no longer restricted by your capital, it’s time to snap up those pricey blue chip stocks and diversify your small portfolio! Maybe it’s also good for me to do it for my family and kids portfolio in future too~

Next up, I believe one of the things that intrigue many investors’ interests is how they can find winning stock ideas quickly and easily.

That’s where the uSMART Intel subscription comes in handy.

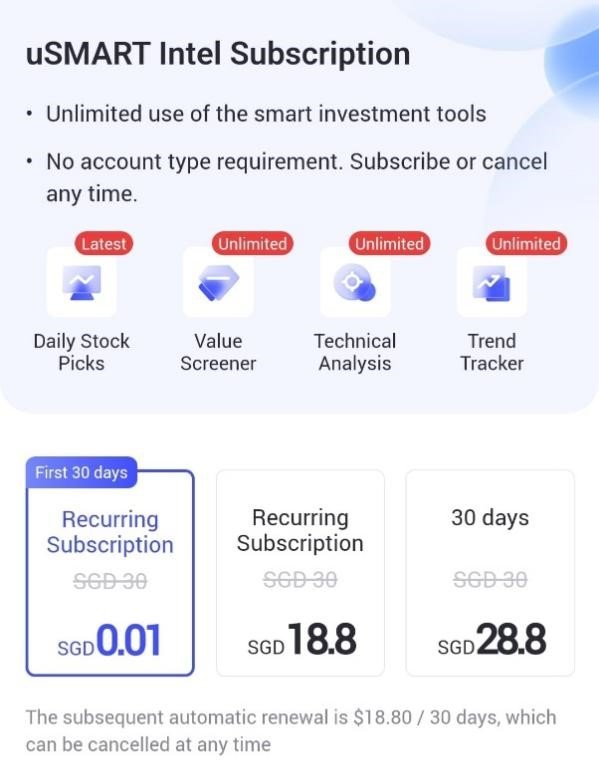

uSMART Intel Subscription

For new users, you can sign up for the uSMART Intel subscription at just S$0.01 for a 30-day trial.

Once you are subscribed as an ‘Intel’ member, you will get unlimited use of the smart investment tools:

- Latest Daily Stock Picks

- Unlimited usage of Value Screener

- Unlimited usage of Technical Analysis

- Unlimited usage of Trend Tracker

All these tools enable an investor to tap on the pre-selected metrics to generate interesting stock opportunities.

On this note, I have signed up for the uSMART Intel subscription myself at only S$0.01 (for the first 30 days trial) and decided to showcase how you can take advantage of the information inside with the 2 features highlighted next.

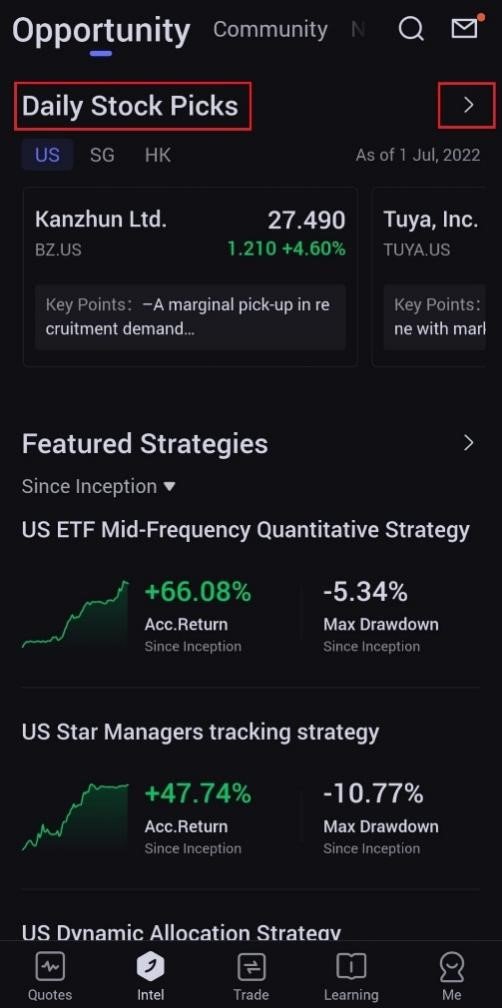

3. Daily Stock Picks

Under the ‘Intel’ tab in uSMART app, you will see the ‘Daily Stock Picks’ area on top. These daily stock picks are those deemed to be stocks with high potential price increase in the upcoming days.

Once you click the “>” arrow, you would see a whole list of stock picks designed to offer high potential price increase in the upcoming days and their success rates.

For instance, under the “HK” tab, investors can see familiar company names like Yum China (KFC parent company), China Rail company, Cathay Pacific and more.

After you click on a particular company like Yum China, you will get a short research analysis about the stock.

A combination of the quantitative (auto-screening) and qualitative (short write-up) stock analysis is probably the fastest way you can skim through a company before you decide to do more in-depth research.

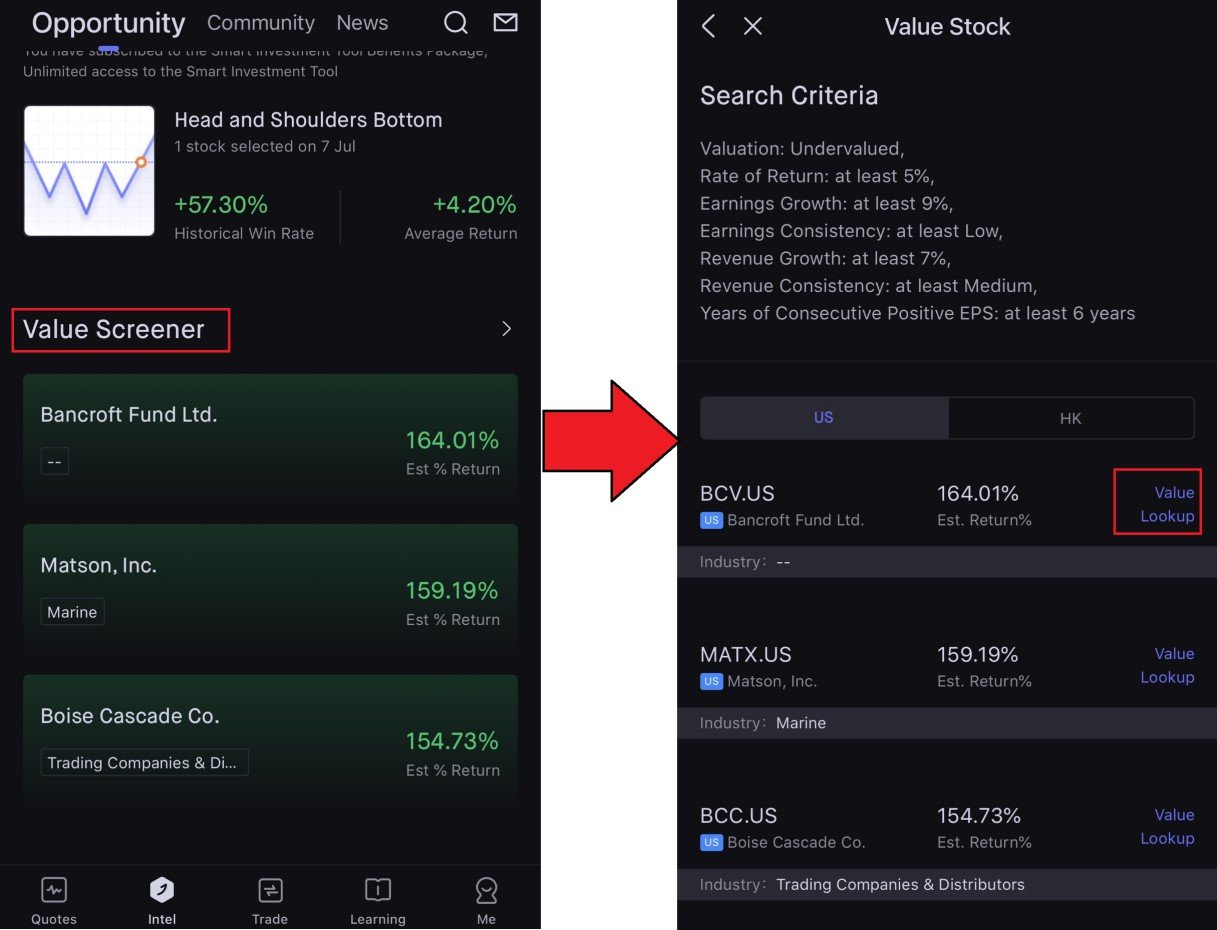

4. Value Stock Screener

Next up is another popular feature that everyone looks for in a trading platform/app – the stock screener.

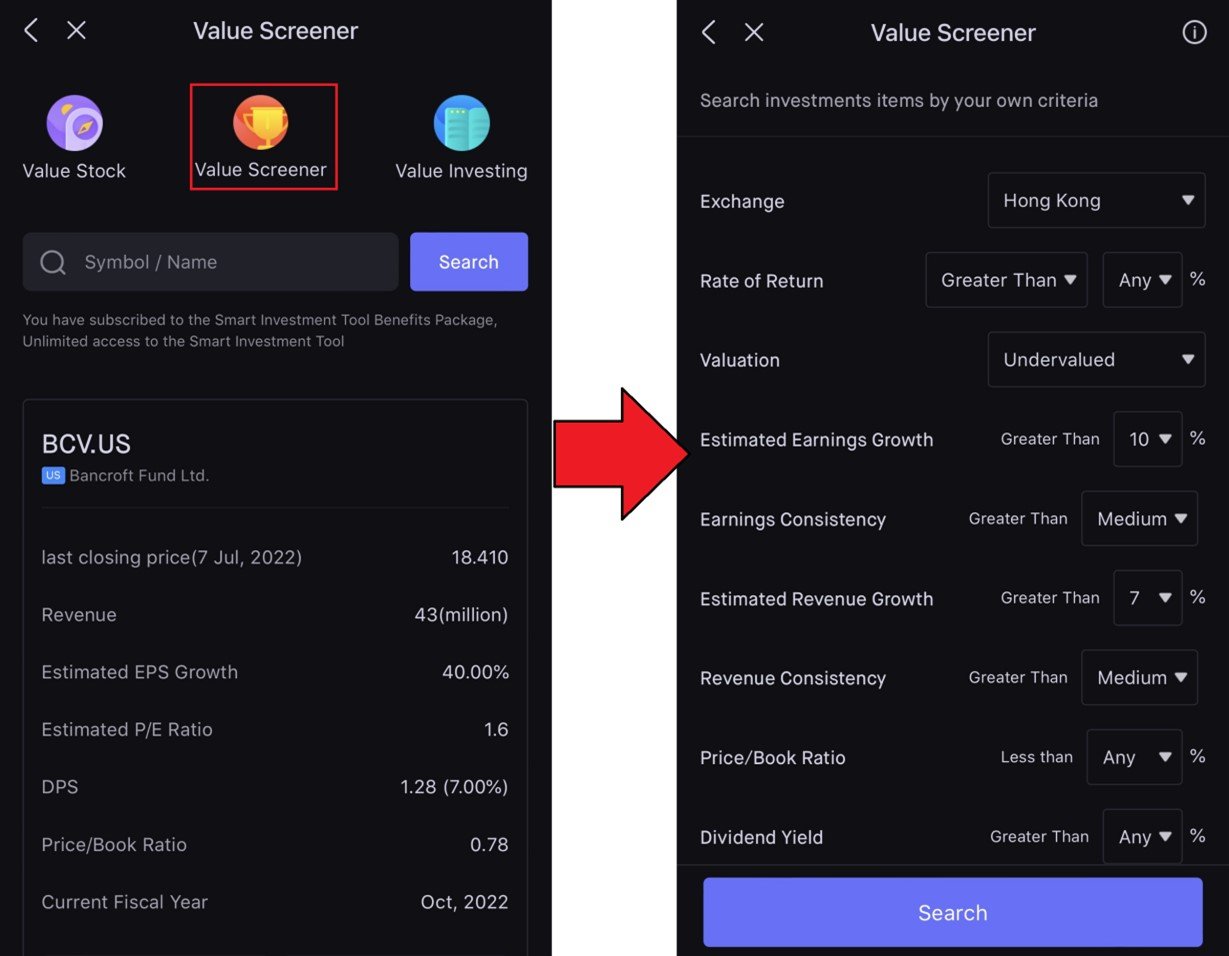

For uSMART, there are 2 ways to utilize this.

Firstly, more proficient users can go for the customized screener and input your desired numbers in the fields.

The fields are already populated in advance but you can just change the metrics to your liking by following the steps above!

If you prefer to keep it simple and not change anything, you will see the screen below after you select the Value Screener function.

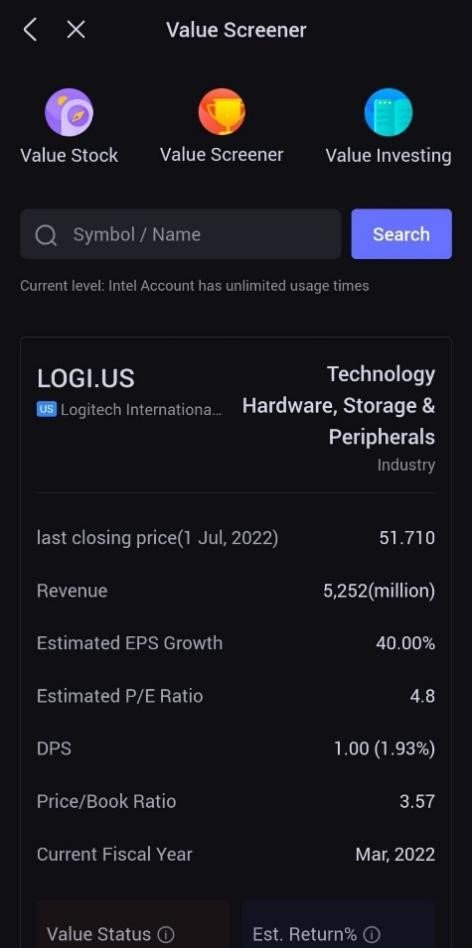

For my case, I scroll down and found Logitech as one of the stocks and I clicked on the ‘Value Lookup’ button on the right.

Immediately, you can see a quick overview of the Logitech stock with its estimated P/E ratio, earnings-per-share growth and even dividend yield.

Scrolling down further, you can also do a deeper (and faster) analysis with the financial metrics’ graphs at one single glance as shown below:

Last but not least, you can even look at the financial numbers on a year-to-year basis to see if there’s a sudden one-off spike you need to take note of.

For the case of Logitech, its revenue and EPS skyrocketed 76.5% and 115.3% on a YoY basis respectively, mainly due to the soaring demand of its IT products during Covid-19 lockdowns.

Conclusion

Putting it together, the uSMART app really provides a wholesome approach for stock investors.

You can take full advantage of uSMART’s features through the exciting features mentioned:

- Sign up for the Intel add-on to get stock ideas and perform quick analysis

- Diversify your portfolio using fractional shares investing

- Enjoy the zero comm and settlement fees until end 2022

On top of that, you can easily get up to speed with their Intel tab geared towards stock analysis and Learning tab which offers bite-sized content, Q&A and even courses. The icing on the cake would be their dedication towards ultra low or ZERO fees to help investors make better returns.

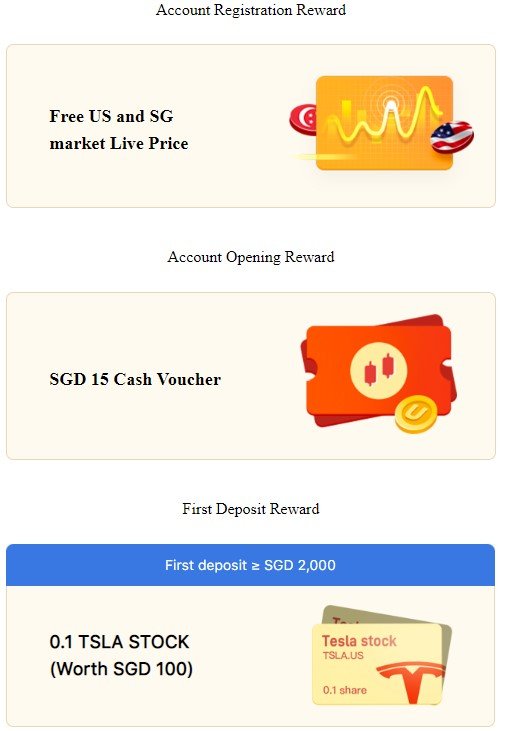

All in all, we hope you find the article to be useful and if you are ready to give it a try, you can use my to sign up.

On top of a S$15 cash voucher reward upon signing up, you’d also be entitled to a FREE 0.1 Tesla shares worth S$100 or a comprehensive “Investment Master Course” worth SG$720 if you perform a first deposit of SGD2000 or higher.

Get started by signing up for a uSMART account today by clicking on the link below:

Sign up for uSMART account today

Additional Reading: uSMART Review – The SMART broker is here!

Disclaimer: This article is written in collaboration with uSMART Singapore but the views and/or opinions expressed in the article are of my own. This article is intended for information purpose only and should not be construed as financial advice. This article has not been reviewed by the Monetary Authority of Singapore.