Wilmar was founded in 1991 and since then it has cemented its status as one of the biggest food processing company in the world. It has propelled itself into rank 285 in the Fortune Global 500 company.

During the pandemic, food security and production has become an evident priority across the world and this has made food production companies extremely valuable. Wilmar with its leader status in certain products were very much helped by the new normal.

Brands that Wilmar produces might not be recognizable in Singapore but it is widely known in China. Wilmar has just conducted an IPO for its subsidiary (Yihai Kerry Arawana Holdings) in China on 15 Oct 2020.

Since then, Yihai has gained lots of traction with its share price jumping more than 400% in just a few months.

With all the positive hype behind Wilmar, is it a good decision to buy at current prices now? Let us dive in to do a quick analysis of the company.

#1 Profitability of Wilmar

Sourced from ShareInvestor.com

Revenue has steadily increased in the past 5 years, and has increased from $54.8 billion to roughly $60 billion. There was a blip in the revenue for 2019 where revenue dropped back to $57.5 billion levels, likely due to poor soft commodities prices during that period of time.

An impressive feat is that net profits of Wilmar has been steadily increasing as well. Even during 2019 where its revenue dipped, its net profit increased. Notably, its net margin improved across the years, achieving a 3.3% for trailing 12 months. This goes to show that Wilmar controls its costs well.

#2 Wilmar’s Dividends and Earnings per share

Sourced from ShareInvestor.com

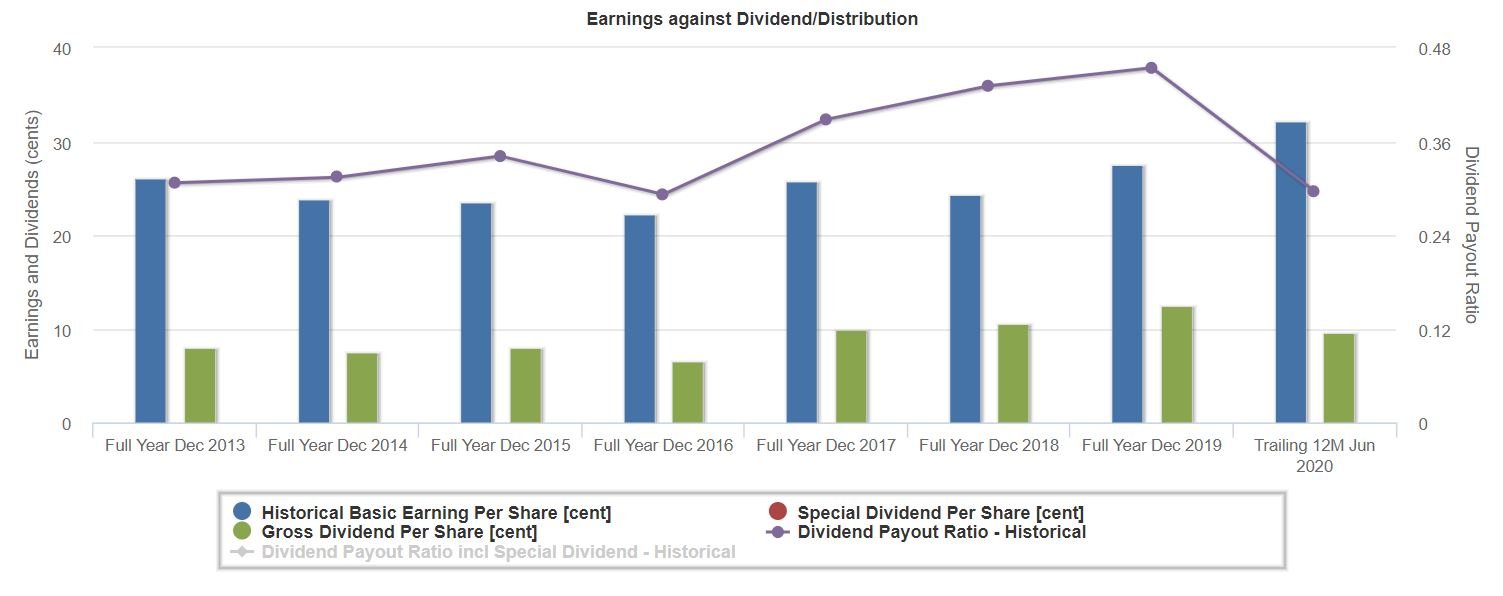

Singaporeans love dividends and Wilmar is one company that has managed to increase its dividends per share over the years. Dividends per share paid out increased from $0.08/share in 2013 to $0.125/share.

It does not have a consistent dividend payout plan. Its payout ratio hovers around 30-45% across the years. As seen in the blue bars above, earnings per share has been increasing over the years and this usually equates to more dividends paid out.

However, a caution of note is that as Wilmar is primarily in the commodities industry, there may be times of down beaten commodities prices. This may adversely affect the earnings per share and thus the dividends.

#3 Listing of Yihai Kerry Arawana Holdings

One of the highlights for Wilmar this year is the listing of its China subsidiary where Wilmar owns 89.99% of it. Its subsidiary produces cooking oil that is widely known and used in China called “金龙鱼”.

With a household brand name under its arsenal, Yihai’s share price skyrocketed right after its IPO. Yihai kerry arawana’s IPO price is CNY 25.7 and is trading at CNY 119.7 as of 16 Jan 2021 – almost 4x jump since IPO!

An interesting fact is that Arawana’s current market cap is bigger than Wilmar’s market cap. The management team has also highlighted to analysts that they feel that Wilmar is currently undervalued and exploring options to ‘unlock value’.

Two such measures are already underway – shares buyback and a special dividend coming Feb 2021. Further M&A are also on the cards.

Last but not least, the IPO listing has resulted in a big windfall of RMB 13.9 billion. This huge amount of cash is definitely helpful in helping Wilmar to cement its cooking oil position further in China, where it has 40% of market share now.

Conclusion – Is Wilmar a bargain?

The most important question in investors’ mind now is – is Wilmar a bargain right now (even after running up by so much)?

One major risk that investors have to beware is how intertwined the commodity prices have on Wilmar’s profits. That said, as the world economy and China’s domestic consumption amps up, it will be a boon for Wilmar again.

Hence, it is evident that there are many positives (stable dividends and has decently good growth prospects) for Wilmar International right now if it can continues to narrow the gap with its subsidiary.

Based on its latest share price of $5.22, Wilmar is trading at a P/E ratio of 18.7x and dividend yield of 2.4%.

Billionaire Warren Buffett is arguably the most successful investor of all time.

Learn the secrets to Warren Buffett’s investment success by downloading the Free Guide below:

[…] Is Ascott Residence Trust a good dividend REIT now? Read More […]

[…] […]