COVID-19 has decimated all hospitality related industries. Airline, hotels, tourism industries have been wiped out since the lockdown in the early part of 2020. The aforementioned industries are still in the doldrums as we progressed into 2021.

Hospitality REITs have without a doubt been affected badly and shunned by investors for the gloomy outlook ahead.

One such REIT is Ascott Residence Trust (Ascott). Its share price literally dived 50% from S$1.36 on 20 Jan 2020 to $0.68 on Mar 2020, although it has now recovered to $1.07.

With that in mind, investors may wonder if there is still any potential upside. Below, we will provide an analysis and our opinion on Ascott.

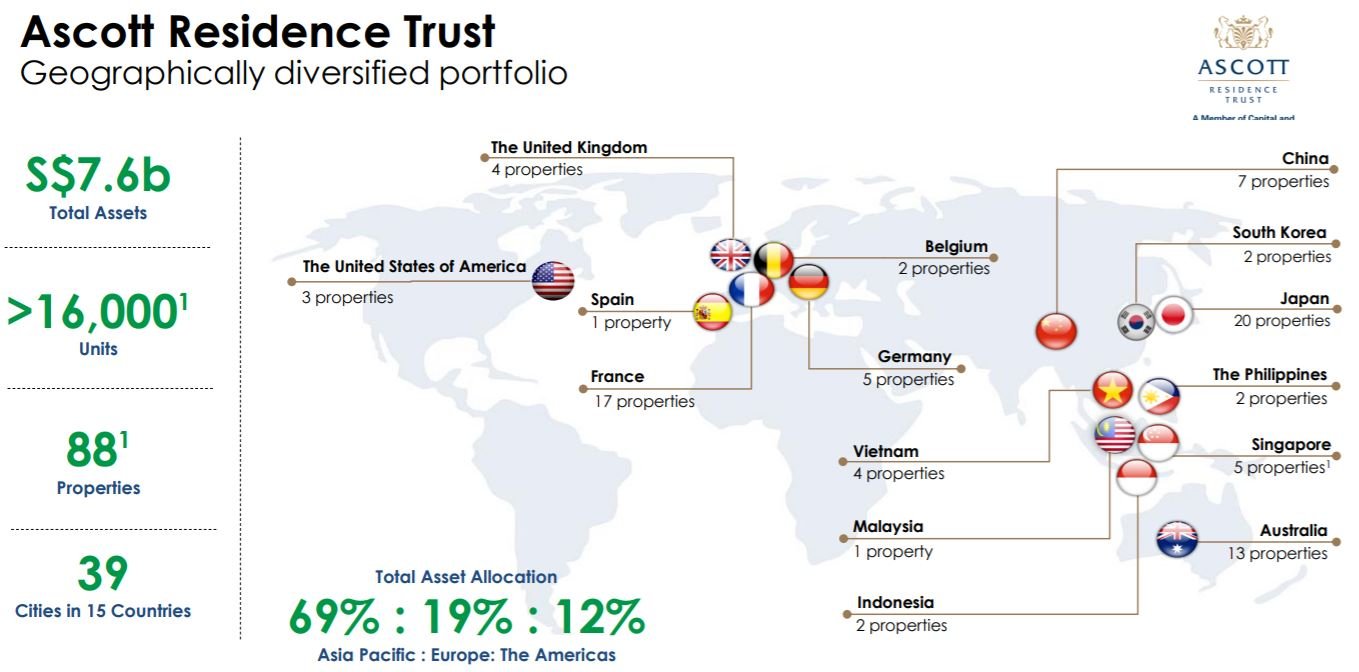

#1 Portfolio of Ascott Trust

Sourced from Ascott Residence Trust 2020 H1 Presentation Slides

As seen in the picture above, Ascott has properties across 15 countries and 39 cities. 56 of its properties (63% of its total properties) are in Australasia regions.

Comparatively, Australasia regions are less affected by the virus as compared to Europe and America. Most of the Asia regions such as Singapore, China, Vietnam, Australia are no longer in lockdown. Domestic tourism has also been touted in these countries and this will definitely help Ascott in its recovery.

Evident from the spread of Ascott’s portfolio is its diversification of risks. Though Europe/Americas regions are still affected, Asia will aid its recovery.

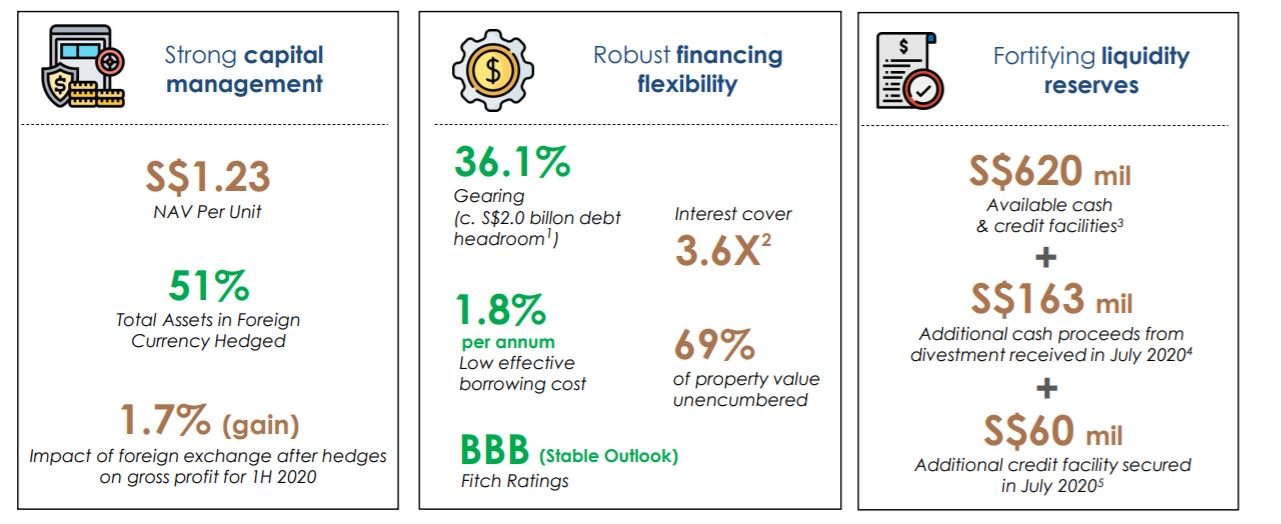

#2 Ascott Trust’s Financial Position

Sourced from Ascott Residence Trust 2020 H1 Presentation Slides

Looking at the balance sheet strength of Ascott, it is clear that Ascott has a comfortable gearing level of 36.1%. It also has a interest coverage of 3.6X, which is a signal of healthy coverage. Moreover, the recent low interest rate environment is helpful to Ascott as its effective borrowing cost is only at 1.8%.

The above gearing gives it an additional 13-14% of debt headroom for expansion when needed. With blood on the streets, especially in the hospitality sector, this may be a good opportunity for Ascott to acquire properties on the cheap.

Ascott has a P/B ratio of 0.87x currently. CDL Hospitality Trust which has the closest portfolio to Ascott is currently at 0.86 P/B.

#3 Sponsor and asset enhancement analysis

Sourced from Ascott Residence Trust 2020 H1 Presentation Slides

Ascott is backed by a really strong sponsor – Ascott Limited with a 40% sponsor stake in the REIT. It is one of the world’s leading international lodging owner-operators.

With reference to the figure above, there are many properties under Ascott Limited that could be acquired under Ascott REIT. With the comfortable debt headroom that Ascott REIT possess, there is a good opportunity for it to acquire a property that is yield accreditive.

Furthermore, Ascott REIT could take this chance to improve its asset through enhancing the value that could be brought to the customers.

Final Thoughts on Ascott Residence Trust

The vaccine for the virus has just been released and the quantity of vaccinations produced are still not sufficient. Though medical companies are trying to produce as many as they could, the “herd community” effect will likely not be achieved in 2021.

Ascott Trust is very much dependent on the revival and movement of the whole world. It is only prudent to expect the bottom line of Ascott to remain muted/slow growth in the foreseeable 1-2 years.

However, investors are always forward looking. If Ascott Trust is able to take advantage of the current low I/R environment and snap up attractive assets, it may be able to deliver stronger growth ahead on top of its ~7% distribution yield.

Billionaire Warren Buffett is arguably the most successful investor of all time.

Learn the secrets to Warren Buffett’s investment success by downloading the Free Guide below:

[…] 5 Best Financial Planning Tips for Young Singaporeans Read More […]

[…] 5 Best Financial Planning Tips for Young Singaporeans Read More […]

[…] […]