Excerpts from CareYourPresent – a crypto enthusiast

6 Simple Steps investing in cryptocurrency

When I first started this site, my intention is to go a bit advance to share on investing in Cryptocurrency as I believe in the future of Cryptocurrency and still believe so.

However, after receiving questions from readers/friends etc, I realized that I should also include more basic investment stuff in my site. Hence, the most fundamental question to anyone who want to start investing is

Many people heard about investment, but they don’t know how to start. Many people heard about Cryptocurrency, but they don’t know how to start.

How to start?

Many people would outsource and go to the “Financial Advisers” for advice. In most case, most of these people are salesman. They sell you their investment link policy, endowment etc and draw charts to “projected” how much you would get in xx years should you buy their products etc.

However, if you ask them further on what the investment strategy of this fund are, what shares/bonds they invest in, which sectors, which companies, do these funds hedge, are there rebalancing, I bet most of these “Financial Advisers” couldn’t answer.

Hence, don’t go to them to ask about investment especially for Cryptocurrency. So how to start? Please see the steps below.

Always remember:

Step 1: Understand yourself

This is the first step in investing in cryptocurrency regardless of what kind of investment that you wish to go into.

Many people tend to just go and buy without plan and thinking in advance first. Very likely this will result in losing your precious earned money sooner or later. Before you start doing any investment, the first thing is to understand yourself.

- Know your risk profile. Are you someone who can sleep well with higher riskier instrument? Can you sleep well if your portfolio drops 50%? Are you someone who prefer regular income from your investment?

- What is your objective of investment? Grow your money, finding 10x bagger? Just collect income?

- Know your end target/objective. How much do you target to achieve? This will determine the risk profile and the method to use.

Step 2: Plan your high-level portfolio management

This is call money management, knowing how to manage your own portfolio/money. First please know your own monthly/annual expenses, saving, income and how much you have available for investment from income monthly as well as lump sum currently.

Amount available for investment means you won’t need it for at least 3-5 years or even better 10-20 years given that big markets cycle is typically 10 years.

Please keep money for emergency funds too. After knowing your monthly cash flow and the amount you have available for investment, please plan your plan.

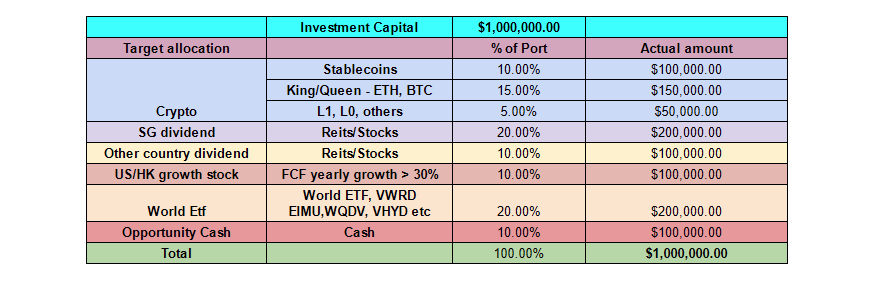

For example, if you have a million available and after understanding your own risk profile, you can work out a table like something below.

Step 3: Open relevant accounts

Before your can start investing, you will need to open brokerage accounts. You can consider to use my referrals below. Personally I am using all these accounts.

For Cryptocurrency, you can use FTX as your centralized exchange to on/off ramp. However, please take note to put in hardware wallets (please see step 4 for guides).

Another alternative which I am currently also using is Crypto.com. This is another platform that I am using the trade, on ramp, off ramp SGD to Crypto.

One good point about this platform is you can do FAST transfer to and from your Singapore Banks. Use my referral link https://crypto.com/app/h92xdfarkq to sign up for Crypto.com and we both get $25 USD

Step 4: Do research on investing in cryptocurrency

Regardless of what investment that you plan or will be doing, please don’t blindly listen to other people/gurus/crypto twitter shilling etc. Please spend time to read, research and learn and only invest in what you are comfortable in.

Hours need to be spent and there is no shortcut. Even after you have invested, you should continue to read to learn about the coins, stocks etc that you are invested in.

One key indication that you have done your due diligence is that you can sleep well without keep price monitoring every now and then after you have clicked the buy button.

For Cyptocurrency, you can refer the articles which I have wrote previously to learn more:

- Newbie starter guide for Cryptocurrency

- List of useful sites in Crypto such as Coingecko

- Risks and managing risks in DeFi

- Type of Crypto Coins

- De-mystifying terminologies in Crypto

- Don’t be fooled by APY/APR

- Investment using Metaphyiscs

- Real yield in Crypto

- What is Bitcoin Dominance

- Shark monitoring in Crypto

- Index Investing in Crypto

- For crypto you should use hard wallet if possible. You can refer to Guide to create Metamask wallet and Guide to understanding and managing Ledger/Crypto wallets

- Regression analysis in Crypto – example BTC and ETH

- Learn how to win in sideway or downtrend market

- Guide – Fund FTX by sending USD from Singapore DBS Remit

- Guide – Fund FTX by sending USD from Interactive Brokers

- Guide – How to send your precious Bitcoin to Ledger

- Guide – How to send ONE from Metamask to Harmony ONE wallet or CEX which only show ONE address

- Future of Cryptocurrency – SBT!

Step 5: Wait for the best opportunity to strike

Always have a plan (see sample below for a Singapore Stock Investor). After which think of what to do should the opportunity really arrive so that you will not panic when it come.

You will need both Gut and Patience after planning. Don’t always think to buy at the absolute bottom, good price can just buy. We are plan for good price but can’t always buy at the absolute bottom.

Most often, the most difficult button to click is sell. What if you click sell and price goes up further? Remorse? No, you shouldn’t. You have already earned.

What if it is the opposite case? You can’t predict exactly predict the market. For those who invest for years, buy and sell is always easier than buy and hold. Additionally it take real patience to wait for the best time to strike.

Doing nothing is the most difficult part of investment. There is always an urge to do some buy/sell/trading.

Personally I am holding some cash and waiting now. You can refer to my updates. However, please do your own due diligence, don’t just blindly follow me.

I could be wrong. Remember that your money your investment is your own responsibilities. I am just sharing that I am doing now.

See quotes from the famous investors below:

Step 6: Track your progress for MANY years and review regularly

After you buy/sell/invest for a few days/few months, always track your own progress. You can use the calculators/charts given by the brokerages to monitor you return or simply use XIRR function in excel to do so.

Continue to track and track for many years, take note of your mistakes, take note of your own risk profile, take note of what kind/which investment make you can’t sleep well and of course those that make you sleep well. Then review and improve. Always aim to win your past self.

Additionally, please remember to read widely and learn more everyday from anyone around the globe. This will let you see your blind spots and make you a better investor.

Lastly..don’t forget

Life is not just about money. Money is just a means to your life. No one CaRe about Your PresenT more than yourself. Please take regular breaks and care for your own life

If you want to receive regular updates about my site, please click here to subscribe. For more details on crypto, please click here

[…] If you want to receive regular updates about my site, please click here to subscribe. For more details on crypto, please click here […]

[…] If you want to receive regular updates about my site, please click here to subscribe. For more details on crypto, please click here […]