By default, many investors are more comfortable investing in established companies, commonly known as blue chips, due to their perceived stability and familiarity.

In contrast, shares with small market capitalization (market price of each share multiplied by the number of shares) tend to carry a bad reputation and are shunned.

Some of the common negative associations that come with small-cap shares include them being risky, lacking in quality, and occasionally, being outright frauds.

The latter association in particular, could perhaps be attributed to the many S-chips (China-based companies listed in Singapore) that were suspended from trading after being flagged out by audit reports or investigations.

Small Cap Stocks still outperform Large Cap

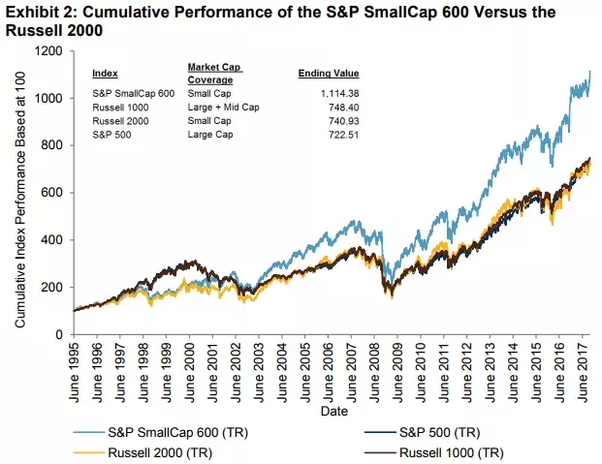

That said, according to Moneychimp’s inflation-adjusted annualized returns for 1927-2005, small cap value outperformed large cap value by almost 3 percentage points.

While it doesn’t mean much in a single year, it can lead to some astronomical returns gap over the long run.

With that, let us pound on 3 reasons why Small Cap Stocks can be promising investments.

#1 – Huge Potential of Growth

First and foremost, when investors look at companies with huge market capitalisations today, they forget that these companies had also started off as small businesses. In light of that, a small-cap shares is basically a building block which offers new investors a chance to participate in its future growth.

Put another way, small-cap shares are like raw diamonds with the potential to become attractive, polished gems. And as the diamonds become polished, investors could then sit on long-term capital gains that are huge multiples of their initial investment.

Riverstone Holdings (SGX: 5ME) are just 1 example of small cap stock that delivered tremendous growth in the past. Its share price jumped from S$0.365 in 2 Jan 2014 to S$1.19 in Jan 2019 – 326% returns in 5 years!

Lastly, it makes sense that the larger a company grows, the slower its rate of growth will become. Take for instance – Singtel. It has a market cap of S$53.9 billion and its hard to fathom any double or triple jump in its share price.

Read also: https://www.smallcapasia.com/why-you-should-consider-investing-in-small-cap-stocks/

#2 – Mutual Funds and Unit Trusts Commonly Avoid Small Cap Stocks

Mutual funds and unit trusts often have an investing mandate that prevents them from investing huge sums of money in small cap shares.

Furthermore, a small percentage of cash inflow from a fund might cause a large swing in the share price of a company with a small market capitalization as such companies simply lack the size to absorb big investments.

In return, such institutional restrictions can provide a great advantage to small or individual investors in the form of a lack of interest from the big boys.

This can create buying opportunities for individual investors who are able to separate the wheat from the chaff within the small cap universe and invest in promising firms early on at cheap prices.

# 3 – Small Caps generally go under the radar

This point follows through from the last. Since institutional investors often aren’t interested or allowed to invest in small-cap shares, this disinterest also spreads to the analyst community, resulting in small cap stocks seldom gaining much research coverage.

This thus creates the possibility that small-cap shares with great underlying businesses may be materially undervalued. In such situations, investors have the opportunity to gain extra profits owing to pricing inefficiencies that occur.

Conclusion

All in all, while there are many associated negatives surrounding small cap stocks, the inherent advantages should be a good reason why investors should also dig for hidden gems in the small cap space.

We’ve found 7 other exciting companies flashing on our watch-list right now. And they are poised to skyrocket >100% in the years to come. Simply click here to uncover these ideas in our FREE Special Report!