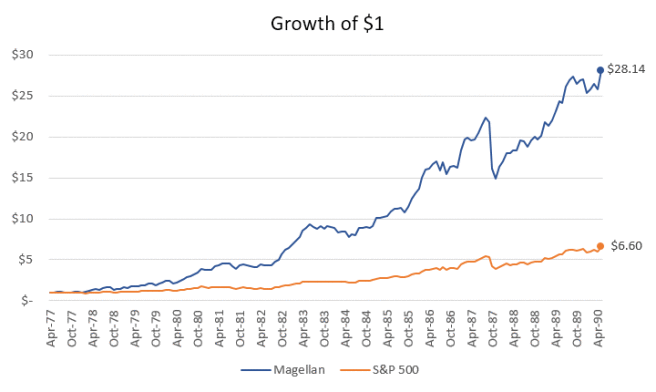

During his 13-year tenure as the head of Fidelity Investments’ Magellan Fund, Peter Lynch made a name for himself by achieving an average 29.2% annual return of over a 14-year period.

These gains were nearly twice the 15.8% return that the S&P 500 posted during the same period. totally eclipsing the performance of the S&P 500. For some perspective, that would have turned a single $10,000 investment into over $361,000 in that span.

As fears of a global recession mount, investors might take solace in one of Lynch’s quotes: “Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in the corrections themselves.”

That said, he is also known for many more meaningful quotes which we will share with you below:

Peter Lynch Quotes on Risk Management

1. You should always know what you own and why.

2. Buying stocks without studying the company, it is same as betting without taking time to understand the cards.

3. The amount you make is not important. What matters is how you save and invest the money you make.

4. Always run a business, which an idiot can effortlessly run because it’s an idiot who will eventually run it.

5. You should not forget that a share means owning part of a company-it’s not lottery.

Peter Lynch Quotes to Empower Investing

6. If you want make money in stocks, you must not fear them.

7. Losing money in stock investment is nothing to be ashamed of. Shame is holding onto stock or investing more while the fundamentals are doing badly.

8. Domination in business is healthier than competition.

9. Wall Street will not give you an investor’s edge, you already have it. You can do better than the experts if you invest in business and industries that you understand.

10. Every stock is part of company. Find out how the company is doing.

11. Stocks are like children-get what you can manage effortlessly.

12. Keep your money in the bank until you find the right company to invest in.

Peter Lynch Quotes to advocate ‘Simple’ Investing

13. You shouldn’t invest in ideas that you cannot illustrate effortlessly with a crayon.

14. What you own may be the best stock you can own.

15. Dropping price is the cure for stock taken for granted.

16. Start buying when analysts get bored

17. The biggest mistake a trader can do is to invest in stock they know nothing about. But, ignorance is still bliss in America.

18. I am invested all the time. It is the best feeling ever, getting caught with pants up.

Peter Lynch Quotes on Market Timing

19. A lot of money has been wasted by investors getting ready for correction or looking for ways to get corrected. But very little has got lost in real corrections.

20. In marketing business, if you score 6 out of 10, you are good. You will never score 9 out of 10.

21. It natural for human to keep doing something that gives them pleasure and promises them success. That’s the reason the word’s population keeps increasing and doubles after every four decades.

22. If you keep turning the rocks, you will win the game. That’s why I keep doing it.

Peter Lynch Quotes to encourage people in business

23. I studied philosophy and history and it was the best preparation I would get for stock market instead of doing statistics.

24. Stocks are for people for people trained to quantify everything rigidly because stock investment is an art and not science.

25. Stock maths is simple and nothing beyond grade 4.

26. Investing is the most important course. But it’s not taught in high schools and junior high schools.

27. Women have always watched men handling and botching finances.

28. Numbers are worth a thousand words

Peter Lynch Quotes on Long Term Investing

29. If you own shares of big companies, you can relax; time is on your side.

30. Always know your priorities if you want to succeed in stocks.

31. Setbacks are part of investment. No one can predict them, so there is no way to avoid them.

32. As long as you have several big winners on your side, the few minuses that do not work will not worry you.

Read also: https://www.smallcapasia.com/top-29-warren-buffett-inspirational-quotes-of-all-time/

While you are at it, we’ve found 7 other exciting companies flashing on our watch-list right now. And they are poised to skyrocket >100% in the years to come. Simply click here to uncover these ideas in our FREE Special Report!