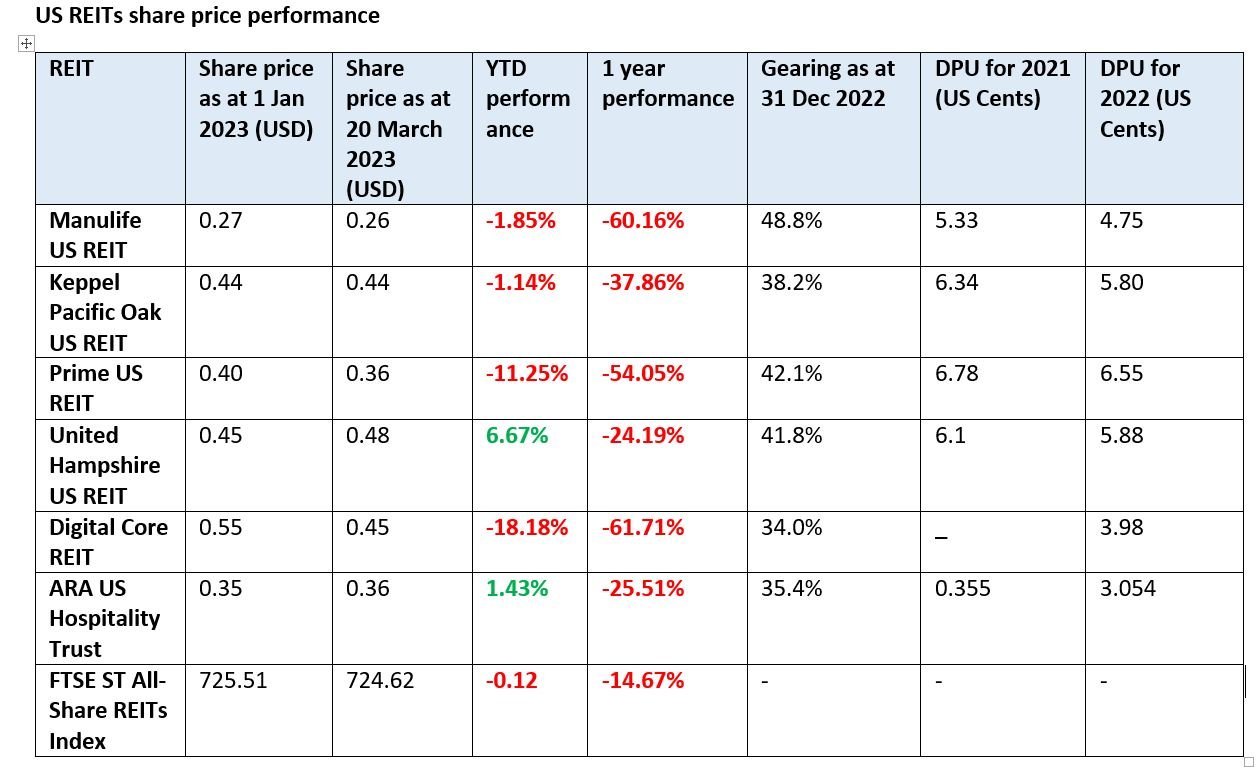

The FTSE REIT index has fallen about 0.12% YTD and 14.67% in the past 1 year. However, a quick look at all the US-based S-REITs show that they have taken a worse beating than the index.

* Eagle Hospitality Trust is not included in the table as it has been suspended.

* Digital Core does not have FY 2021 DPU as the REIT was listed only in Dec 2021

From the table above, its easy to see how the fall in DPU correlates to the share price decline even though United Hampshire US REIT and ARA US Hospitality Trust seems to have stabilised and rebounded slightly in the past few months.

Hence, in this article, we try to touch base on the 6 US REITs listed in Singapore and understand why the share price of the REITs continue to underperform.

1. Digital Core REIT – Worst Performer

Despite a relatively high occupancy of 98% for all their freehold properties, Digital Core REIT is still the worst performer among all the US REITs.

Digital Core REIT has the lowest gearing among the US REITs and is in the so-called booming Data Centre business.

However, the DPU for FY2022 shows a different story as shown below:

The recent share price drop can be attributed to several factors such as:

- Lower DPU compared to forecast

- Possible Economic downturn

- Murky outlook in the Tech Sector given the recent mass layoffs

- Silicon Valley Bank bankruptcy: >60% of their tech startup customers are based in Silicon Valley!

Long story short, investors think that Digital Core REIT’s tenant customers are facing a confluence of issues and the growth story of Tech Boom has been in the yesteryear.

Although the current >9% FY2022 yield seems attractive for the REIT, investors should look at the macro trends and whether the worst is over for Digital Core REIT.

2. Three US Office (Musketeers) REITs

For the US office REITs, we will not be diving too much on it as we have written about them in a previous article here.

The US office REITs share price is relative stable this year except for Prime REIT. This could be due to the share prices has already declined a lot in 2022 and perhaps reached a consolidation phase…

That said, the gearing ratio for the US office REITs are very high except for Keppel Pacific Oak REIT. The DPU for all the US office REITs has dropped too. Hence, investors need to take note of these factors before jumping into the REITs.

In addition, with the uncertain economic outlook given the recent banking crisis, property valuations may fall and will further affect the gearing ratio and the DPU.

3. ARA US Hospitality Trust – Tap on Travel Rebound?

ARA US Hospitality Trust reported a huge increase in DPU due to the reopening of borders and the pent-up demand in travel post-Covid.

Excluding the disposal of 5 hotels, the portfolio valuation has increased significantly too; which then led to the gearing ratio dropping from 42.8% in 2021 to 35.4% in 2022 (simply because equity increased!).

Given the continued demand for more hotel stays and a decent yield of 8.6%, could ARA US hospitality Trust be the outperformer among the US REITs this year?

4. United Hampshire US REIT – The sole, resilient US REIT?

We saved the “best” for the last -> United Hampshire US REIT (UHREIT) because its share price has risen by a decent 6.67% excluding dividends!

Quick background – it owns a diversified portfolio of grocery-anchored and necessity-based retail properties and modern, climate-controlled self-storage facilities located in the US.

UHREIT reported a decent set of results with FY2022 net property income up 12.4% and adjusted DPU is up 9.3% YoY.

The REIT is the best performer in terms of share price probably given the resilient nature of groceries (people still need to buy groceries even during recession).

In addition, UHREIT is among the few US REITs that has no re-financing requirements till 2024. This will mitigate any impact from any rising interest rates in the US.

However, the gearing ratio of 41.8% is relatively high and hence investors need to monitor the gearing ratio closely.

Given the long weighted average debt to maturity of 4 years and 81.4% fixed-rate debt, the REIT is well poised to ride out any uncertainties in re-financing given the recent banking crisis.

With an alluring 12.2% yield coupled with the properties’ resilient nature, UHREIT may be the standout outperformer among the US REITs going forward.

Conclusion

REIT investors are attracted to the US S-REITs’ attractive 8 to 17% distribution yields in recent times.

However, with the current turmoil in the US economy and how inflation has not been tamed to the target rate of 2%, it will be prudent to look at REITs that can thrive going forward or at least sustain the DPU.

There are also many other attributes to examine such as their portfolio quality, capital management and growth prospects as well.