As a long-time investor and a Running Man fan (i watched all the episodes!), I truly enjoyed this episodes 543 & 544.

Maybe because it reasonates with me in terms of the entertainment value and seeing how the stock market ups and downs ‘play’ with investors’ emotions.

Of course, everyone knows that this is a TV reality show and everything can be fake etc… But I still feel that there are plenty of investing lessons to be learnt here.

Here are 5 important ones that I want to highlight on:

#1 You need a Game Plan

Few ,if not very little, investors ever started investing in stocks by saying:

“Okay, i am going to retire by age 65 and i will invest in a few stocks to achieve 12% annually to hit that goal”…

O_O of course not!

More often than not, it will get started like this:

- Friend: Hey i have made money in the stock markets.

- You: interested to make a quick buck too and ask for information.

- Friend: Buy this and that etc… for good returns.

The next thing you know it, you are vested in these stocks but you don’t even know what to do next. Imagine all the below questions running through your mind as time goes by…

- Will you sell if it goes down 30%? or it skyrockets 100%?

- How much will you invest in each stock?

- How many stocks should you have in your portfolio?

These are all the things and more that investors need to consider when investing in individual stocks.

Hence, having an investing game plan is important if you want to build your wealth in a consistent manner. With an investing game plan, you will have lesser stress and execute winning financial moves more often.

#2 Knowing a little info. is Dangerous

One example that reasonate with me greatly is how a lot of them debate on the level 1 information – whether the oil price increase will affect share price of a chemical company.

For those who want to know the real reason – check out this link here. Oil prices are a big input for the chemicals industry, and the increase in oil price -> higher costs -> share price will actuall drop.

But the lesson here is simple. Borrowing a quote from legendary Warren Buffett:

“Charlie says we have three boxes: “In,” “Out” and “Too hard.” You don’t have to do everything well. At the Olympics, if you run the 100 meters well, you don’t have to do the shot put…” — Warren Buffett

This is what Buffett means by the “too hard” pile – the investments that are too difficult to understand. Instead, you should go for other investments/stocks you are familiar with or have good understanding about.

#3 Keep check of your Emotions

The above makes an exemplary case especially when all the US tech/SAAS stocks are the craze now.

You are making some decent gains in the market but realize that others are performing far better than you, and you become jealous – greedy as a result.

In fact, throughout the whole episode, you can literally see how some of them are jealous of the top few people i.e. Kwang Soo says it doesn’t feel good when he earns profits.

This jealousy/greed is also what fuels the stock market to keep going higher until the bubble eventually burst.

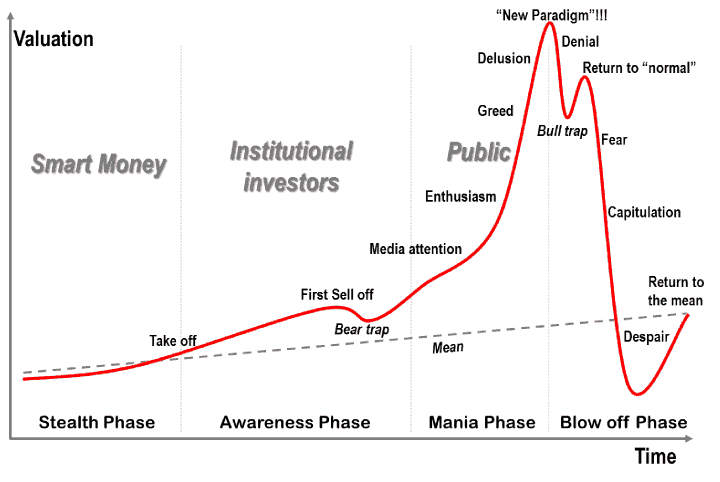

Take a deep look at the stock market cycle chart above and the emotions that arise together with the stock prices.

You would realize why it takes so long for the share prices to go up but the crash will happen in such a short period.

When people are fearful, it escalates much faster as compared to when people are greedy and that downwards spiral will cause more and more people to sell off their holdings.

In fact, when Kwang Soo was losing money at the start, he keep saying that he simply want to get back his original investment and avoid the markets altogether.

This is a very common thing to occur during panic selling and you have to make sure it doesn’t happen to you.

#4 Don’t believe in hearsay

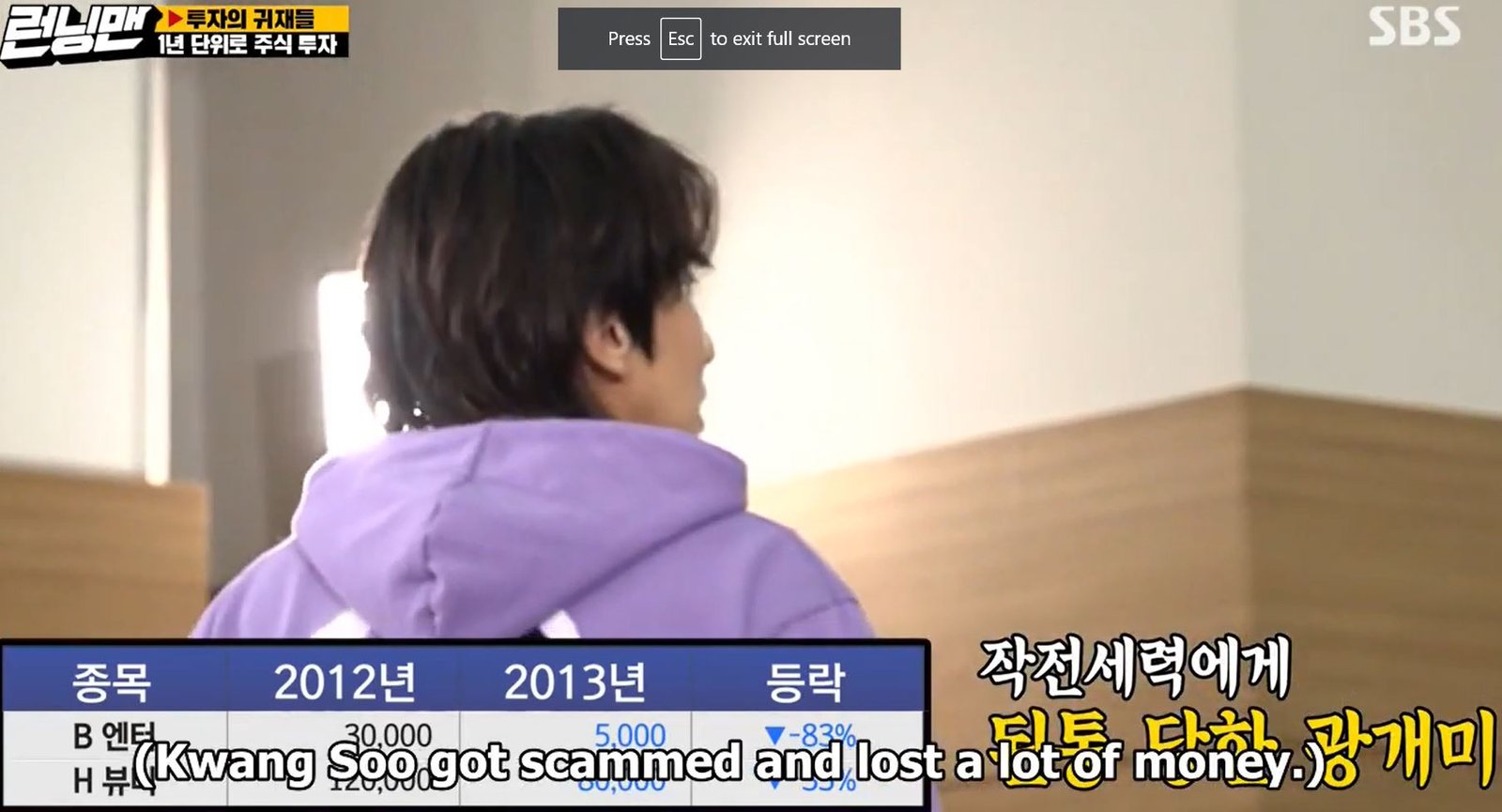

Again, the most funny parts are where Kwang Soo keeps getting scammed by Se Chan.

Although its hilarious because we’re dealing with virtual money here, it will come and haunt you in reality.

And this scenario actually happens a lot in real life. You may hear your relatives or friends talking about a stock that they heard will get bought out, have killer earnings or soon release a groundbreaking new product.

Even if these things are true, they do not necessarily mean that the stock is “the next big thing” and that you should rush into your online brokerage account to place a buy order.

This isn’t to say that you should balk at every stock tip. If one really grabs your attention, the first thing to do is consider the source.

The next thing is to do your own homework so that you know what you are buying and why. For example, buying a tech stock with some proprietary technology should be based on whether it’s the right investment for you, not solely on what a fund manager said in a media interview.

Next time you’re tempted to buy based on a hot tip, make sure you have done all your homework beforehand.

#5 Diversify, diversify, diversify

Okay, i saved the best for the last… the reason why Jee Seok Jin went from 25 years of investing experience to being the last in this Investment Game.

At the last moment (last year), he dump all his money into 1 stock that he thinks wouldn’t go down anymore.

This statement [this share price has went down so much and cant go down any more] is one of the most common investing mistakes beginners make.

Noble Group went down from $2 to $0.20, did a share consolidation of 10:1 and further dropped to < $0.10 again before going bankrupt.

Luckin Coffee nose-dived from US$60 to US$1+ simply after it reported that the top management team is inflating sales and it is currently filing for bankruptcy.

In short, even if you are a savvy investor, its wise never to put all your eggs into 1 place and ‘hope for the best’.

Conclusion

Last but not least, i just want to share that this is one of the best episodes of Running Man (at least for me). They probably have thought up this concept after the Reddit fiesta.

Kudos to them and I sincerely hope investors can benefit from the 5 lessons i shared above as well.

Cheers and Invest wisely! Huat ah!