There have been many rattling about how high Oceanus Group (SGX:579) share price has shot up and came tumbling down aka. Pump and Dump.

I see that its pretty important to look at Oceanus on a fundamental level to inject some calm or sanity into the market.

Here goes:

Oceanus Quick Background

I extracted the below from the UOB Kay Hian analyst report and also bold-ed the juicy parts.

Oceanus Group started as an abalone producer. In 2014, Oceanus experienced financial difficulties due to poor management and industry challenges.

Current CEO Peter Koh was a shareholder before he joined Oceanus at end-14. Peter has driven a strong turnaround as promised by growing revenue significantly, and he now aims to take Oceanus to a higher level with his wide business connection and management track record.

The key initiatives undertaken by Peter include:

- cost cutting in Dec 14;

- clean-up operations in 2016; and

- strengthen the balance sheet in 2017 after reducing its debt to zero.

Alacrity Investment Group (Alacrity) became Oceanus’ largest shareholder in mid-20 after taking over the stake from a creditor group. Alacrity is an investment arm of an Indonesia conglomerate that has interest in the retail and logistics sector. It has long-term plans to help Oceanus expand its presence in the aquaculture chain.

In late-20, former minister Yaacob Ibrahim joined Oceanus as an independent director, and this could strengthen corporate governance and show better confidence in the company.

From the brink of bankruptcy, Oceanus has successfully cleaned up its business since 2017 and grown its revenue manifold from 2018-20.

The recent setting up of Season Global will enable Oceanus to attract MNC brands and expand its China distribution business in a big way. Oceanus targets to build a foodtech company and to become a regional player.

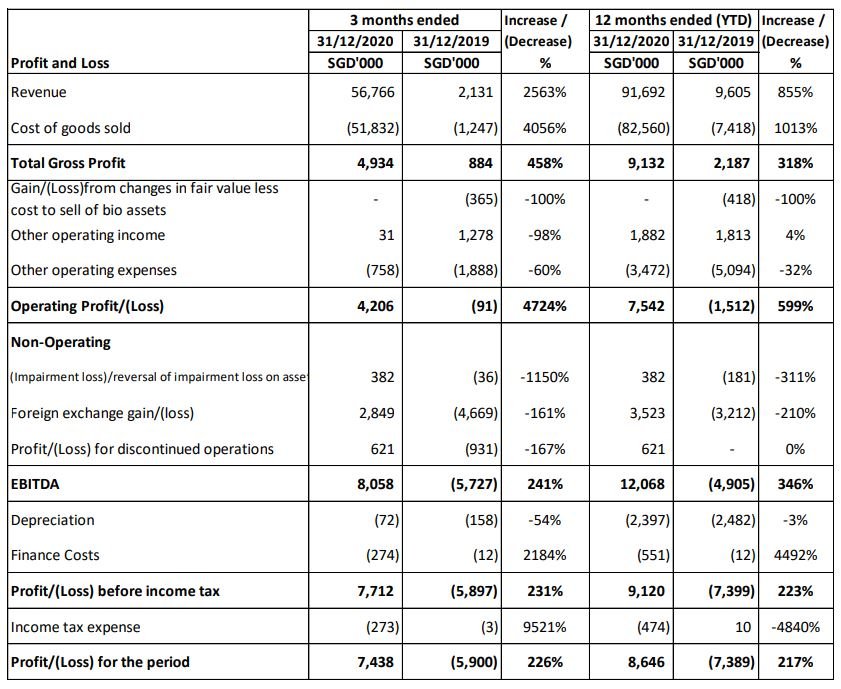

Adjusted P/E and P/B [FY2020 results]

I believe a lot of people have already read Oceanus latest FY2020’s results and the exciting growth prospects.

That said, much commentary now revolves around whether it is over or under-valued based on the numbers.

With that, the 1st step would be to adjust for some abnormalities first.

- Other Operating Income: the Group had received one-off proceeds for a long-outstanding balance arising from a prior sale of a processing facility in China. These proceeds were awarded following the winning of a court case. So it makes sense to deduct this one off S$1.5 million amount.

- Foreign Exchange Gains: A huge 3.5 million and we try to remove this non-recurring amt as well.

- With that, keeping all else constant, we derive the net profits to be S$3.646 million.

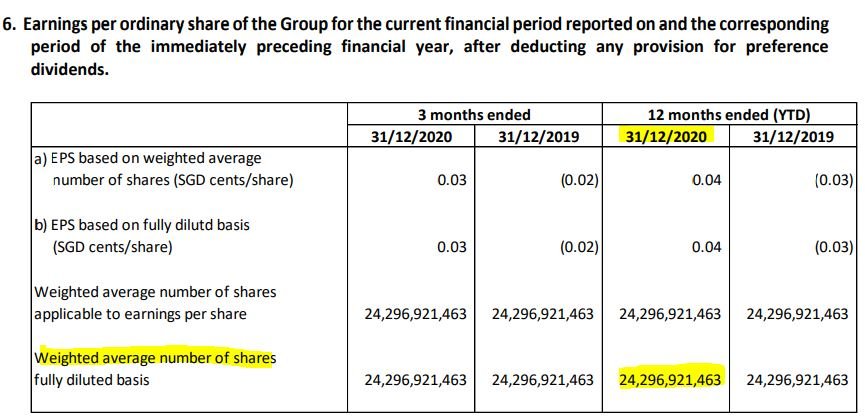

Dividing by the total # of shares, we will get a EPS of S$0.00015. Taking the 10th last traded share price of S$0.023, we get an adjusted P/E ratio of 153.27x.

Multiple Growth Prospects for Oceanus

I think UOB KY report has also done a pretty mesh-up of Oceanus various growth prospects.

But I will streamline them into 3 main paragraphs below.

1) Revenue ramp-up set to continue

The bulk of Oceanus’ revenue (around 70%) comes from the distribution of seafood products through a JV with a China FMCG conglomerate.

The latter has around 40 years of track record, more than 1,000 stock keep units from foodstuffs to alcohol and generates around S$200m revenue.

Oceanus expects this distribution division to drive significant growth with the opening up of more markets, especially in China.

2) High-tech Farming Boom

With global panic buying during the coronavirus pandemic, food security has been thrust into the spotlight.

With that, the government is in urgent need to ensure an “adequate supply of safe food” and come up with the “30 by 30” goal to produce 30 per cent of Singapore’s nutritional needs locally – a figure that currently stands at less than 10 per cent – by 2030.

And Oceanus is in a prime position to ride this tailwind of the government support – either through grants or red-tape wise.

In fact, based on its slide above, Oceanus has envisioned the 2021-23 period to be its tech-up phase. To achieve its goal of building a foodtech company with regional presence, Oceanus aims to establish intellectual properties, build a network of key partners and embark on a global deployment of Oceanus foodtech hubs.

In Sep 20, Oceanus invested an undisclosed amount in Universal Aquaculture, which has developed a novel shrimp farming facility in Singapore. This could help develop in-house technology with a low capex business model.

In Nov 20, Oceanus signed an agreement with Hainan Raffles Group to set up the world’s first Oceanus foodtech Hub in Hainan, China, a key aquaculture centre for shrimp and fish farming in the region.

3) Exiting from the SGX watch-list

Based on the profitability of RMB6.1m achieved in 9M20, Oceanus is on track to fulfil the condition to exit from the SGX watch-list.

In Jan 21, Oceanus announced that it is no longer in the SGX list that requires mandatory quarterly financial reporting. This is an upgrade of confidence from SGX as it is loosening its reporting requirement for Oceanus.

Changing growth prospects to numbers?

Oceanus has just turned around its business and there’s no actual/definitive way of putting all that growth prospects into numbers.

Hence, i shall use my tikam skills here.

1st one is the revenue potential of the shrimp growing segment via Universal Aquaculture.

Here’s the details from the news here:

When the first harvest from Universal Aquaculture’s Tuas South Link facility is ready come June, the sweet, juicy flesh of live vannamei prawns will be much easier to get hold of.

For a start, the farm will be able to produce between 150kg and 200kg a day of the crustacean – also known as Pacific white shrimp, white-legged shrimp, king prawn, or bai xia.

As the high-tech system is modular and can be easily deployed at a larger industrial plot, chief executive Jeremy Ong said some 1,000kg of the prawns can be produced per day when the firm opens an additional site some time in the third quarter of next year.

So what does all that mean? Check out my ballpark calculation below.

Casual Ballpark Calculation

Firstly, I want to apologize because i don’t go to the supermarket to look at prawn prices so i am going to use the online price as a ballpark figure @ S$10/kg.

According to this url link, shrimp farming can be very profitable with 30+% gross margins! Assuming a more conservative 20% margins, here’s what i got.

| KG | 1000 |

| 2H FY2021 (# of days) | 180 |

| Total production (KG) | 180000 |

| Price/KG | 10 |

| Profit Margin | 20% |

| Total profits | 360,000.00 |

That means it will likely yield S$0.36 million for half year ended in FY2021 (S$0.72 million annualized).

As for the Group’s Distribution segment in fast-moving consumer goods (“FMCG”) goods, it has contributed S$84.7 million in revenue in 12M 2020 (S$6.5 million in 12M 2019).

Based on the calculation of my adjusted profits of S$3.65 mil, the margins are relatively low at 4.3% although its expected. Assuming a slowdown of the spectacular revenue growth to 100%, FY2021 profits will come in at S$84.7 * 2 * 4.3% = S$7.28 million.

Using the same 4.3% margins and stable revenue of S$6.9 mil from the farm lease-model as well as contract farming arrangements and the Group’s Services segment, we can look at net profits of around ~S$0.3 million.

Adding it all, i think its safe to assume that we can get at least S$8 million profits for Oceanus in FY2021 (excluding one-off items). It would translate into an EPS of S$0.00033 and 69.8x P/E ratio based on share price of S$0.022.

Of course, the numbers above do not include the co-funding govt grant of up to $1.5 million to cover infrastructure and building costs etc. But even if we assume that the $1.5 million would be parked as ‘Other Income’, the P/E ratio would still sit as a lofty 58.8x.

Again, that’s my estimated calculation. Do let me know your thoughts… especially on the prawn pricing! lol!