Singtel is the biggest and oldest Telco in Singapore backed by Temasek Holdings. It has been considered a “blue chip” for decades due to its relatively stable dividends and finances.

However, times are rapidly changing with the disruption coming from newer entrants like Circles.Life and TPG etc.

On the flip side, Singtel has been awarded both the digital banking license and the 5G license too.

Hence, the question begets: is Singtel a good dividend stock at current prices? Let us do a quick examination of Singtel below.

#1 Profitability of Singtel

Sourced from ShareInvestor.com

Revenue has been stagnant/dipped slightly over the past 8 years – hovering around the $16-17 billion region. Net profit has been slowly increasing from 2016 to 2018, but however took a dip after that.

One important thing to note is that FY2018 profits received a boost due to the disposal of Netlink Trust at $2.03 billion.

Another crucial thing is that FY2020 was impacted by the fine of its subsidiary Bharti Airtel of $1.80 billion.

If we were to nett off these transactions, it can be taken as if Singtel’s net profits have also remained pretty constant around $3 billion annually.

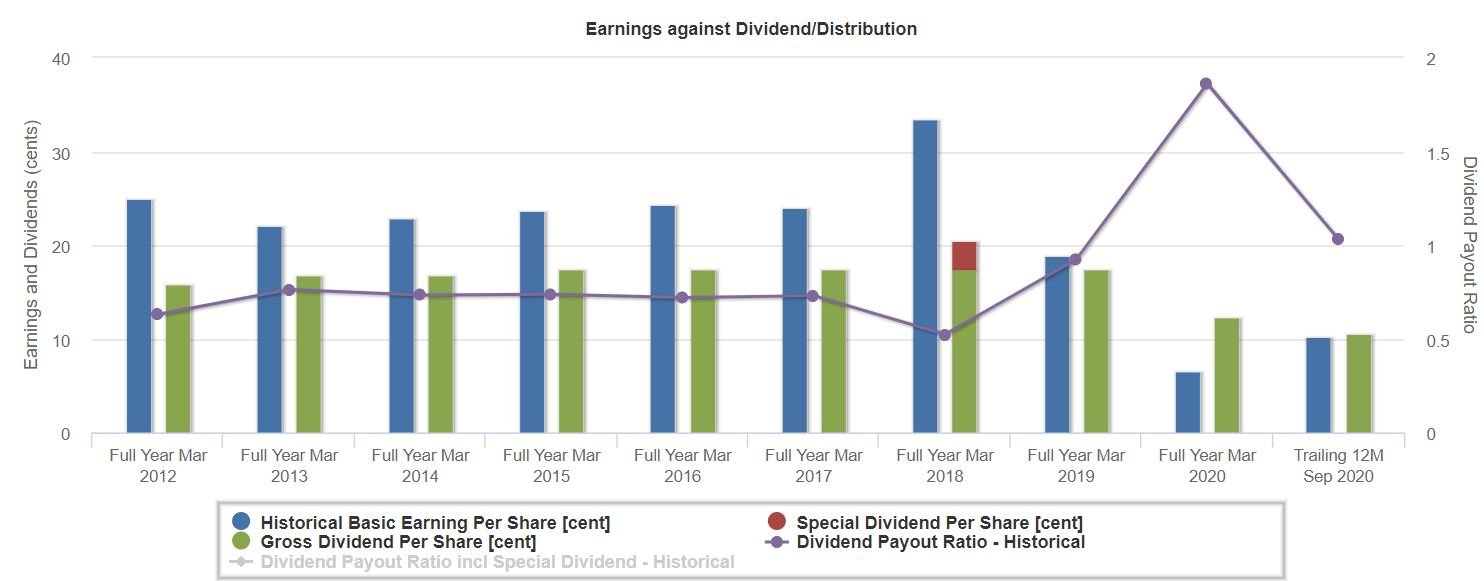

#2 Dividends and Earnings per share

Sourced from ShareInvestor.com

One of the main reasons that investors love Singtel’s stock is its consistent dividends.

Up till FY2019, Singtel has been consistently paying out $0.175 per share while 2018 was a bumper year of $0.205 because of the disposal of Netlink.

That said, FY2020 dividends (green bar) took a hit due to the sharp dive in earnings per share (blue bar).

Going forward, it remains to be seen if the dividends will go up again because it ultimately depends on the earnings. If Singtel has to spend a lot on Capital Expenditure (Capex) on both 5G and Digital Banking, its earnings are likely to remain flat – hence dividends as well.

#3 Singtel winning the Digital Bank license

One of the biggest impetus for Singtel is the approval of digital banking license from MAS.

Singtel has teamed up with the startup juggernaut Grab by holding a 40% stake in the digital banking entity.

Digital banking has been a key focus not just in Singapore but throughout the world. It is expected to be the next front runner for the Fin-tech scene.

However, there are many questions that still requires answers right now:

- How much costs would Singtel incur?

- How much runtime before the entity hits profitability?

- How will MAS regulate the digital banks?

According to Tech Wire Asia which interviewed Tonik CEO Greg Krasnov — who just received a digital bank license from regulators in the Philippines, he said,

“There are two basic models […]. One is where the bank offers a simplified, accessible, and convenient current account used for day-to-day transactions by the consumer. The other model is where the bank focuses on attracting longer-term consumer deposits and lending them out as consumer loans.”

Hence, its boils down to 2 things:

- Can Singtel-Grab attract us to deposit money inside their digital bank?

- Can they monetize the transactions?

As a ‘loyal’ Grab customer, i personally think they can do that. Grab already has the “AutoInvest” function within its app and its customers have already ‘subconsciously’ top up money into the GrabPay Wallet (i personally have set a recurring theme to top up $50 each time when the balance runs dry).

Hence, there is a good chance this digital banking license will succeed and make profits over the long run – we always have to take the risks that Grab is still unprofitable today.

Conclusion – Is Singtel a good dividend stock?

The million-dollar question asked by all investors – is Singtel a good dividend stock? How does Singtel stack up against other blue chip dividend stocks like DBS, OCBC, Starhub and more?

Based on the above pointers, Singtel’s profits is likely to suffer from the near term with high ‘start-up’ costs for both 5G infrastructure and Digital Banking license.

The current banking giants like UOB and DBS will not just sit on their laurels and let digital banks take away their market share established since a long time ago. Moreover, with COVID-19 still a concern, Singtel subsidiaries in other parts of the world are still reeling from the damage.

Over the long term, Singtel continues to churn out Free Cash Flow from its mainstay operations and upcoming ‘ventures’ and would be able to pay out steady dividends as well.

But investors should also be aware that any growth prospects would be uncertain. Singtel has a bad record when it comes to monetizing the investments abroad be it in India, Thailand etc. Hence, its probably best to assume that the dividends growth would be limited at best.

Billionaire Warren Buffett is arguably the most successful investor of all time.

Learn the secrets to Warren Buffett’s investment success by downloading the Free Guide below: