There have been many posts on how much to invest in stocks i.e. what percentage of your portfolio should be comprised of stocks?

If you want to read a detailed guide on the optimal % of stocks, check out this article by Fool.com.

On the other hand, the above is not what i am looking for.

I am looking for the answer to one question that plagues me and a lot of other investors too (i believe):

How Much Should You Invest In A Single Stock?

In fact, i remembered reading about the importance of position sizing.

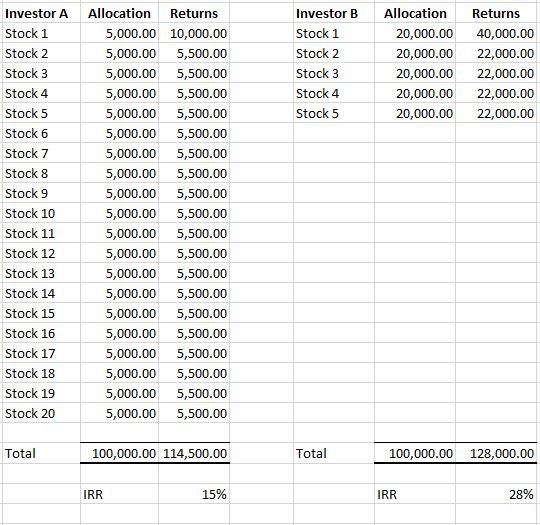

Imagine both investors A and B have $100,000 each.

Investor A likes to play it safe and invest equally into 20 different stocks.

Investor B likes concentrated bets and only invests in 5 different stocks.

Assuming in the past year, 1 stock jumped by 100% and the other stocks all increased by 10%.

Investor A Internal Rate of Return (IRR) will be 15%, not bad.

But Investor B IRR will come up to 28%, almost double that of Investor A.

Think about it, both of them started off from the same base and nothing has actually changed. But Investor B is ahead much more just because he concentrates his investment in the one that delivers a better return.

However, the reverse is also true. Investor B will also lose out more if ‘Stock 1’ tanks by 50%.

So what’s next?

On one end, you want to have a big enough position that you can make some money if it works for you.

On the other end, you don’t want it so big that if it goes against you it crushes your whole portfolio.

Dilemma isn’t it?

Luckily, i found this wonderful quote/speech from Warren Buffett sometime back:

“Charlie and I operated mostly with 5 positions. If I were running 50, 100, 200 million, I would have 80% in 5 positions, with 25% for the largest. In 1964 I found a position I was willing to go heavier into, up to 40%. I told investors they could pull their money out. None did.

The position was American Express after the Salad Oil Scandal. In 1951 I put the bulk of my net worth into GEICO. There were various times I would have gone up to 75%, even in the past few years. If it’s your game and you really know your business, you can load up.”

– Warren Buffett, 25 February 2008

Here’s more from the legendary investor:

- “Over the past 50-60 years, Charlie and I have never permanently lost more than 2% of our personal worth on a position. We’ve suffered quotational loss, 50% movements. That’s why you should never borrow money. We don’t want to get into situations where anyone can pull the rug out from under our feet.”

- “In stocks, it’s the only place where when things go on sale, people get unhappy. If I like a business, then it makes sense to buy more at 20 than at 30. If McDonalds reduces the price of hamburgers, I think it’s great.”

Read also: https://www.smallcapasia.com/7-interesting-things-i-learn-from-warren-buffett-documentary/

Conclusion

To sum up, holding concentrated bets make perfect sense when you know what you are doing. You would be even happier to see them ‘selling at discounts’ because they would be great undervalued buys. And as a word of caution, concentration and leverage (borrowing money) doesn’t end up well together.

Fancy an Ebook that teaches you the hallmarks of multi-bagger stocks and how to find them? Simply click here to receive your copy of a brand-new FREE Ebook titled – “100 BAGGERS” by Christopher W. Mayer today!

Last but not least, do remember to Like us on Facebook too as we share the latest investing articles and stock case studies for you!