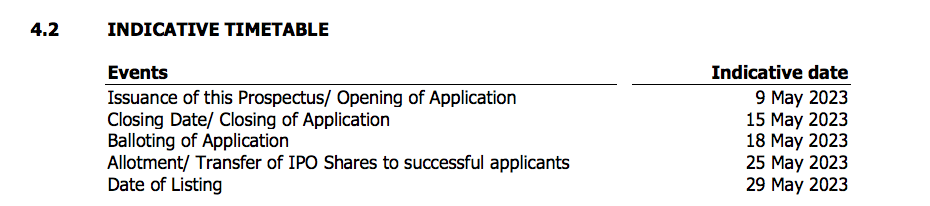

On 9 May 2023, Cloudpoint Technology Bhd (Cloudpoint), an established IT firm issued its IPO Prospectus (Part 1 and Part 2) and thus, extended an invitation to subscribe its shares at 38 sen a share.

Upon listing, Cloudpoint would lift up the company’s market capitalisation to RM 202.0 million. The IPO subscription shall end on 15 May 2023 and its listing date is set to be 29 May 2023.

Source: Page 19 of Cloudpoint’s IPO Prospectus

Here, I’ll summarise 9 things to know before subscribing to its shares. These are as follows:

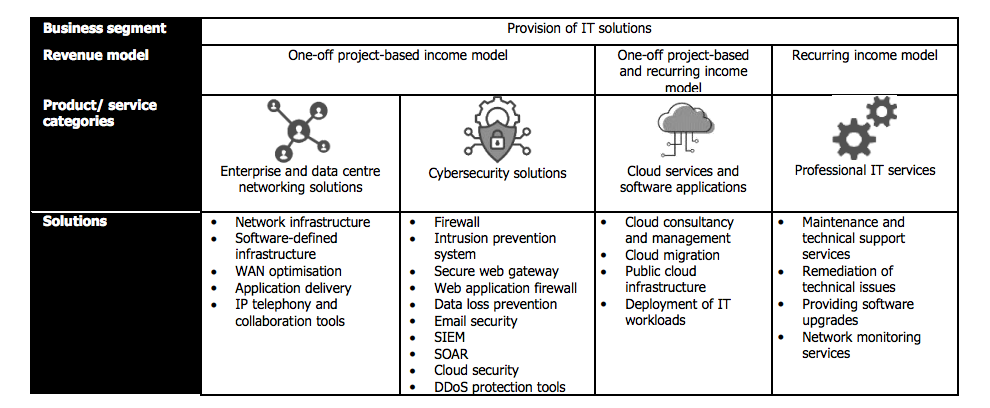

1. Business Model

Cloudpoint has 2 revenue models:

- One-off project-based income

- Recurring income

For its one-off project-based income, it comprises of:

- Sales of hardwares

- Software licence subscription fees.

- Implementation service fees.

- Cloud consultancy services and the use of cloud-based infrastructure.

- Cloud migration services.

For its recurring income, it consists of upgrading, maintenance & support works under contracts that span between 1-3 years. Cloudpoint charges annual fees & periodic (monthly or quarterly) service fees for such IT contracts to its clients.

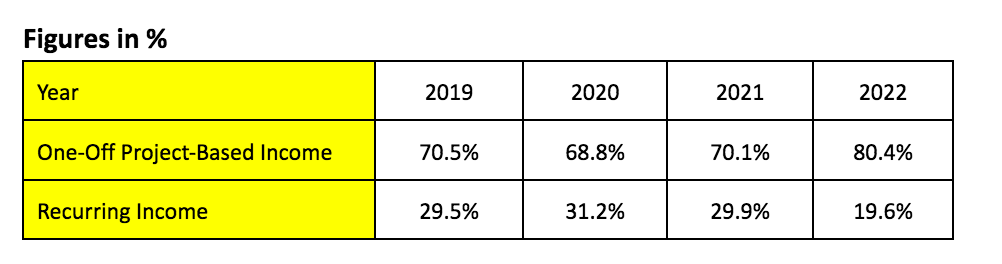

Source: Page 10 of Cloudpoint’s IPO Prospectus

The revenue mix between the two models in 2019-2022 is as follows:

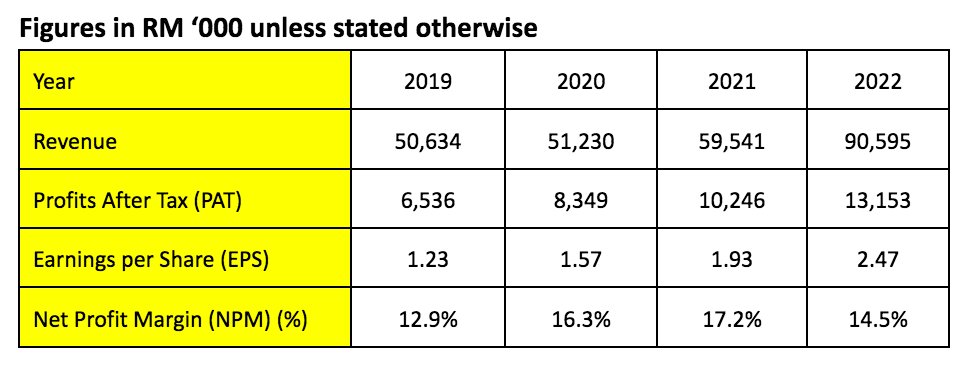

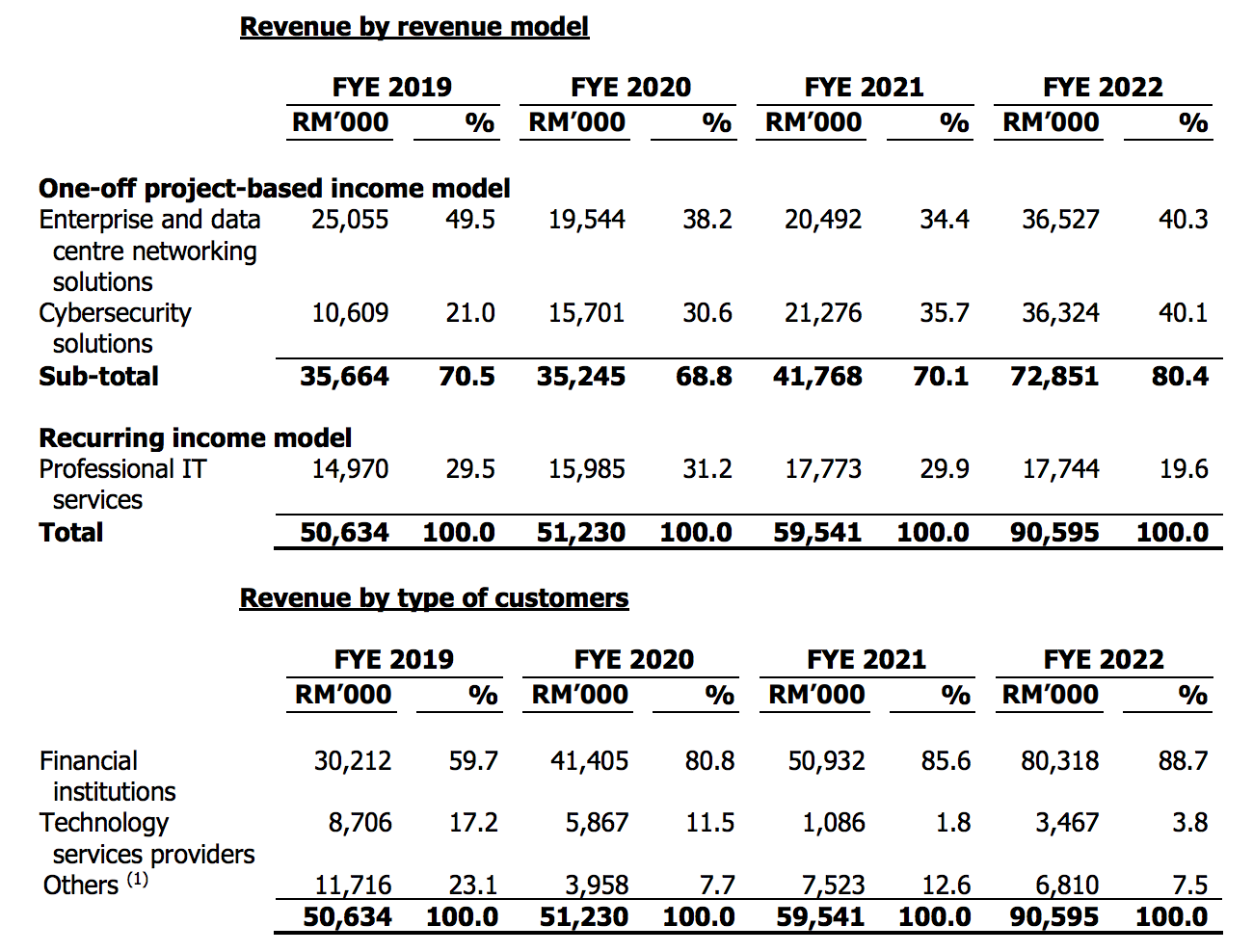

2. Financial Results

Source: Page 175 of Cloudpoint’s IPO Prospectus

In 2019-2022, Cloudpoint grew in revenues and PAT. Mostly, this is attributed to its growth in Cybersecurity solutions offered to financial institutions during that period. Its NPM had remained stable at 10%-20%.

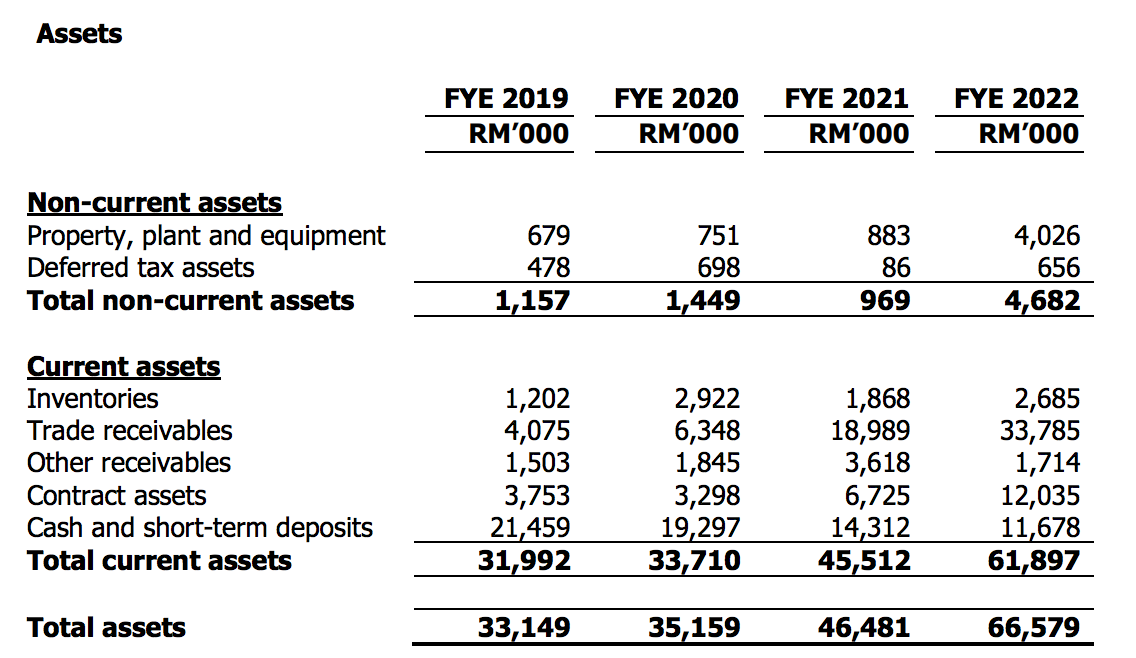

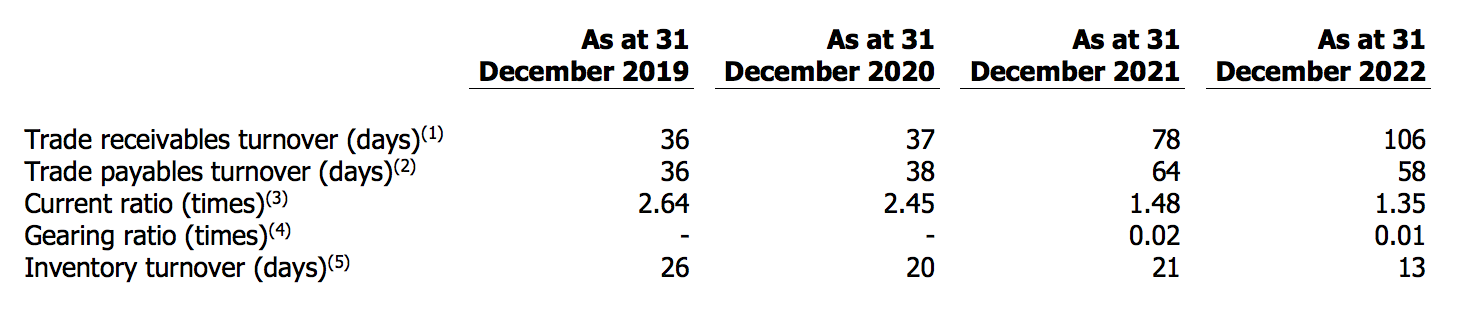

3. Trade Receivable Days

Source: Page 189 of Cloudpoint’s IPO Prospectus

Cloudpoint reported a rapid increase in trade receivables in the period, rising as much as RM4.08 million in 2019 to RM33.79 million in 2022.

At the same time, its cash and short-term deposit had dropped from RM 21.5 million in 2019 to as much as RM 11.7 million in 2022.

This is despite reporting a rise in revenue and PAT in the 4-year period. As a result, Cloudpoint’s trade receivables days had increased significantly, from 36 days in 2019 to 106 days in 2022 which has exceeded its normal credit policy of 30-90 days.

Source: Page 208 of Cloudpoint’s IPO Prospectus

Quick update: 84.2% of the outstanding receivables amounting RM33.79 million as at 31 December 2022 has been collected in April 2023 as per disclosed on page 211 of the prospectus.

Based on a channel check: Almost 90% of Cloudpoint’s revenue is from financial institutions and have good payment track record too.

4. Financial Position

On 31 December 2022, Cloudpoint has zero long-term borrowings.

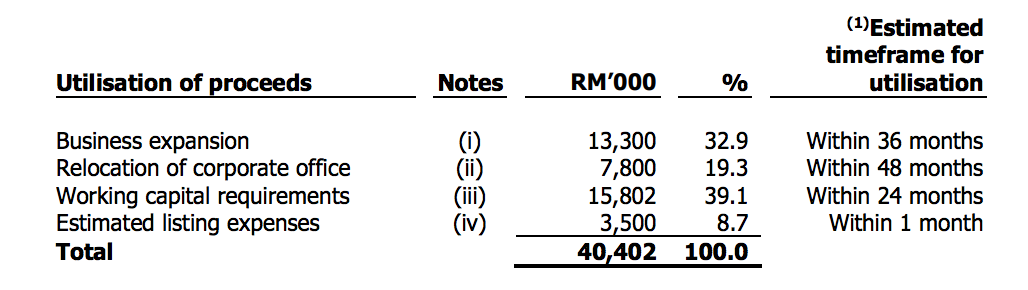

5. Utilisation of IPO Proceeds

Cloudpoint plans to raise RM 40.4 million in gross IPO Proceeds and uses them:

Source: Page 26 of Cloudpoint’s IPO Prospectus

1. Business Expansion (RM 13.3 million)

This refers to Cloudpoint’s initiatives to:

- Establish a new SOC.

- Enhance its existing NOC.

- Establish a public cloud infrastructure.

SOC is a facility to monitor cyber threats and attacks that impact an enterprise’s network infrastructure. NOC allows it to carry out network monitoring services.

Meanwhile, the setting up of a public cloud infrastructure would enable it to be more efficient and scalable in offering cloud-related services to its clients.

2. Relocation of Corporate Office (RM 7.8 million)

Cloudpoint operates from rented offices at Solaris Mont Kiara. It would relocate its operations to 2 new units of corporate offices, which it purchased at Pavilion Damansara Heights for RM 7.32 million.

Upon relocation, it shall discontinue its rental of the offices at Solaris Mont Kiara. The relocation shall eliminate the risk of potential disruption from an abrupt rent termination of its current premise.

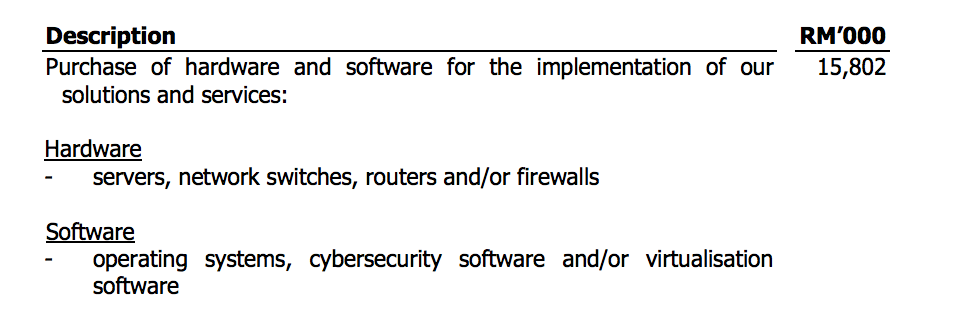

3. Working Capital Requirements (RM 15.8 million)

This refers to its purchases of hardware and software as follows:

Source: Page 33 of Cloudpoint’s IPO Prospectus

4. Estimated Listing Expenses (RM 3.5 million)

The remaining 3.5 million will go to the IPO expenses – around 8.7% of the overall proceeds – which is not so bad…

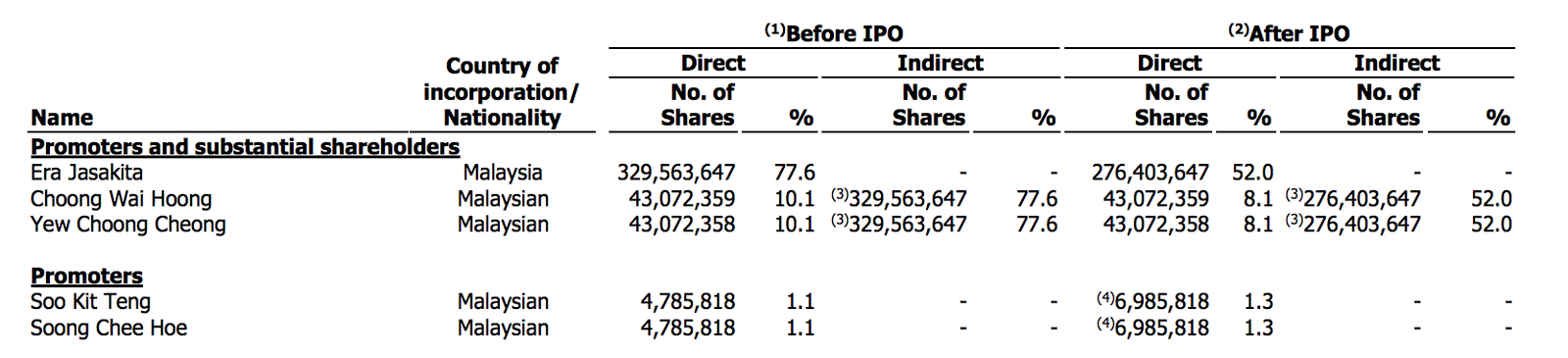

6. Major Shareholders

Source: Page 40 of Cloudpoint’s IPO Prospectus

Choong Wai Hoong and Yew Choong Cheong shall remain as main shareholders of Cloudpoint via 8.1% direct shareholdings each in the company and as well as their interest in Era Jasakita.

Choong Wai Hoong is appointed as the CEO. Yew is appointed as the Executive Director (Head of Sales) of the company.

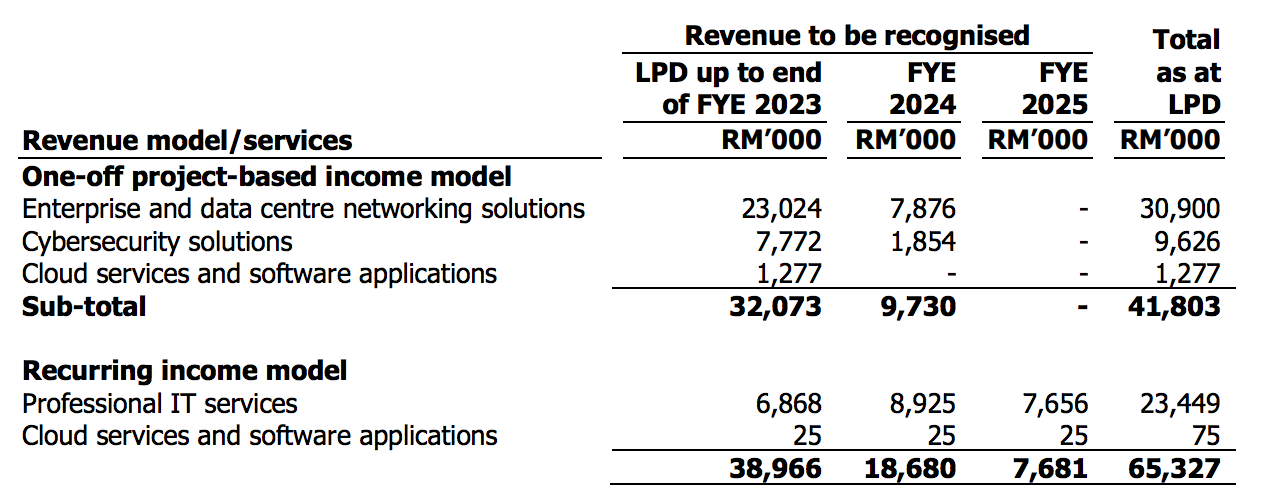

7. Order Book

On 10 April 2023, Cloudpoint has an order book of RM 65.3 million as follows:

Source: Page 215 of Cloudpoint’s IPO Prospectus

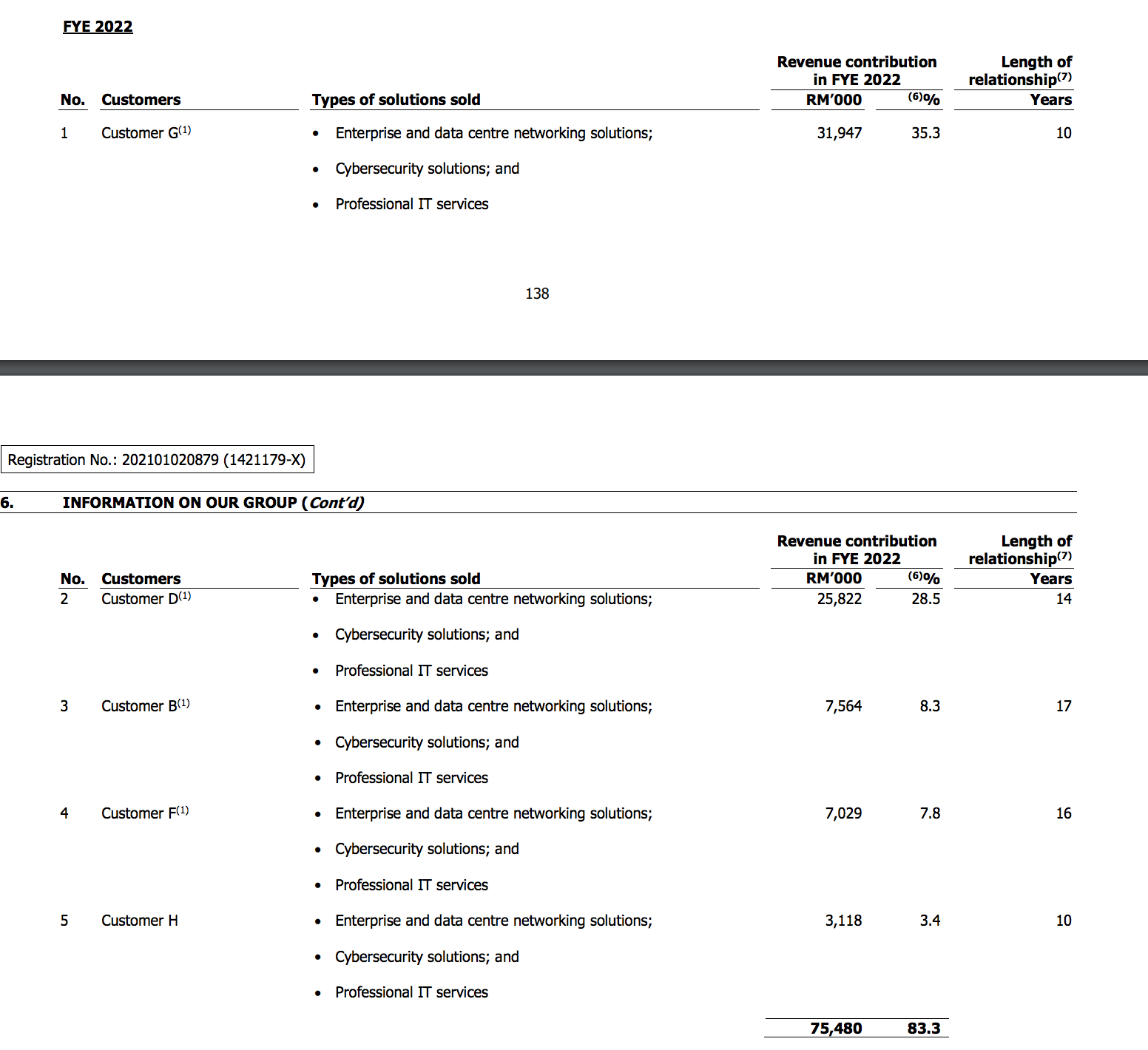

8. Major Customers

Cloudpoint generated 83.3% of its total revenue in 2022 from 5 key customers:

9. Valuation

Based on 38 sen, the IPO offer is valued at P/E Ratio of 15.38 (2022 EPS).

At this stage, Cloudpoint did not adopt a formal dividend policy but it had paid out RM 8 million in dividends or 1.5 sen a year in 2020-2022.

This shall equate to an attractive 3.95% dividend yield if we used the average dividend divided by the IPO price.

Conclusion

Cloudpoint grew its cybersecurity solutions sales to financial institutions for the last 3 years. This had resulted in higher revenues and PAT in 2019-2022.

For this period, it is evident that its trade receivables grew significantly and had its cash reserves dwindling during the period.

In the immediate term, Cloudpoint would continue to have concentration risk as it depends on a few key customers for its sales and profits.

As investors, it is important to weigh in both its pros and cons, make meaningful comparisons with its peers, and assess its valuation to make a better and informed decision on it.