In times of economic uncertainty, investors turn to dependable names that help to shelter their portfolio from sharp declines. Dividend stocks qualify as safe havens because of their track record in giving out dividends to investors.

These dividends act as a steady stream of passive income that helps to boost your earned income. We identified 3 Singapore dividend stocks yielding more than 5.7% that could add to your buy watchlist.

You can see another 4 Dividend Growth Blue Chip Stocks in the video here:

1. Sing Investments & Finance Ltd

Sing Investments & Finance Limited was incorporated in Singapore on 13 November 1964 and was listed on the Singapore Stock Exchange in July 1983.

The company has more than 50 years of lending experience in the financing arena in Singapore. Their services include fixed deposits, savings account, personal financing such as housing loan, car loan and corporate financing such as machinery loan, shipping loan, etc.

For the first half ended 30 June 2023, revenue is up 106.5% to S$71.0 million. However, profit after tax was down 16.6% to S$16.4 million mainly due to higher interest expenses.

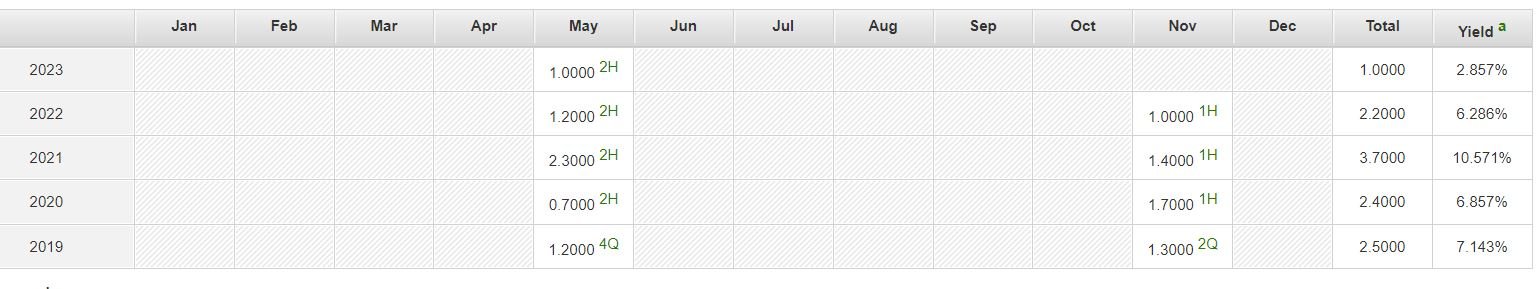

Dividends are usually just distributed once at the end of a financial year. Sing Investments has a consistent track record of paying dividends to its shareholders and has increased its dividend from 6 cents in 2019 to 10 cents in 2022 which translates to a dividend yield of 10%.

Going forward, this financial institution should also benefit from higher interest rates environment. Sing Investments also boasts a positive outlook, as it aims to expand its loan portfolio to meet the higher demand for financing solutions from the small and medium enterprises (SMEs) sector.

You can view the company website here.

2. Venture Corporation Ltd

Venture Corporation is a leading provider of technology services, products and solutions, with established capabilities spanning innovation, design and development, product and process engineering, design for manufacturability and supply chain management in diverse technology domains.

The Group is well-known for its deep know-how and expertise in various technology domains. These include life science, genomics, molecular diagnostics, medical devices and equipment, healthcare, luxury lifestyle and wellness technology.

For the first half ended 30 June 2023, revenue is down 11.9% to S$ 1,582.2 million while net profit is down 19.7% S$140.0 million on a year-to-year basis due to softened demand and inventory adjustments from its customers.

That said, Venture has been paying consistent dividends of 75 cents per share for the past 4 years which translate to a dividend yield of more than 6%. With a robust financial position and a moderate dividend payout ratio of 46.5%, Venture Corp should be able to maintain its dividend payouts.

On top of that, the company has mentioned that new product introductions (NPIs) with both existing and new customers are on track to be rolled out next year. The adoption of Venture module solutions by its life science and industrial customers is also picking up pace, which will complement their core EMS++ business going forward.

The Venture Group intends to expand participation in new high-growth technology domains to deliver long-term sustainable growth and greater value for its shareholders.

Check out the company website here.

3. HC Surgical Specialists

HC Surgical Specialists Limited is a medical services group primarily engaged in the provision of endoscopic procedures, including gastroscopies and colonoscopies, and general surgery services with a focus on colorectal procedures across a network of clinics located throughout Singapore.

In its full year results ended May 2023, revenue was down 1.2% to S$19.07 million. However, net profit drop even more by 56.1% to S$2.9 million. The drop in profit was mainly due to the fair value loss on financial assets – HC Surgical’s stakes in Medinex and Singapore Paincare Holdings.

The company declared a total of 2 cents for FY 2023 which translate to a dividend yield of 5.71%. Even though the company’s dividends have fluctuated in recent years, the firm operates in a defensive healthcare sector and is likely to continue dishing out dividends.

On the growth prospects, the company just acquired a new associate, Total Orthopaedics Pte. Ltd. The Group believes that this will offer synergy to the Group’s principal activities of general surgery and endoscopy services, while increasing the utilization rate of the Group’s facilities.

The Group will continue to look for opportunities and suitable partners in its expansion plans, in addition to reinforce the Group’s specialist platform to support the next generation of specialists.

You can view the company website here.

Conclusion

These are the 3 Singapore dividend stocks yielding 5.7% or more which you may wish to add to your watchlist. Of course, investors need to do their own due diligence before investing.

Our Dividend Kaki Membership Pro is finally here! Many investors took years to understand investing in right dividend stocks and REITs, but you can have it all in our Dividend Kaki model portfolio.

If you have just started investing, Wait no longer and click on the link to join here: https://www.patreon.com/Invest_Kaki! so you can catch up quickly.