Uni-Asia Group Limited is an alternative investment group specialising in creating alternative investment opportunities and providing integrated services relating to such investments.

The Group’s alternative investment targets are mainly Handysized Dry Bulk Cargo Ships and Property Investment.

Business Model

Their business model revolves around acquiring assets at competitive prices and offering solutions that meet client needs. After which, the company will operate and/or manage these assets to improve their value and boost the recurring income.

Maritime and Property Key Businesses

With that in mind, its easy to see why Uni-Asia focuses its portfolio on maritime and property investments.

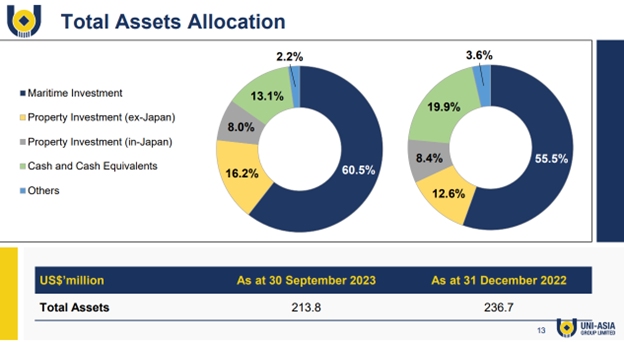

A quick look at their asset allocation shows that their maritime investments contribute a major 60.5% of their portfolio as at 30 September 2023 whereas their property investments account for another 24.2%.

In the maritime sector, the Group maintains a fleet of 9 fully-owned and 7 jointly-owned dry bulk carriers, ensuring a consistent and reliable source of income through operational cash flows.

Their ongoing approach involves securing a blend of short-term and long-term charter agreements at varying rates, with the objective of optimising charter earnings during market upswings and fortifying against potential downturns.

In the latest earnings report, the Group has successfully concluded the sale of its oldest ship, M/V Uni Auc One, on November 10, 2023. It is noteworthy that the ship was free of any attached mortgage at the time of the sale, and all proceeds from the disposal have been seamlessly integrated into the Group’s cash balance.

As for the property segment, the Group invests in Hong Kong and Japan property projects.

In the first 3 HK projects, Uni-Asia had recovered capital and received/recorded strong positive returns in the past (i.e. HTR35, CSW650, and K83 in the picture above).

With economic activity in Hong Kong and China picking up post-Covid, it will provide a significant opportunity for the Group to generate substantial revenue by divesting its Hong Kong projects.

As for Japan, the Group typically invests and develops small residential property projects branded as the “ALERO” Series. This “ALERO” reputation has been established because every ALERO project that the Group invested in had been profitable since the Group started this series in 2011.

Stable Financial Position

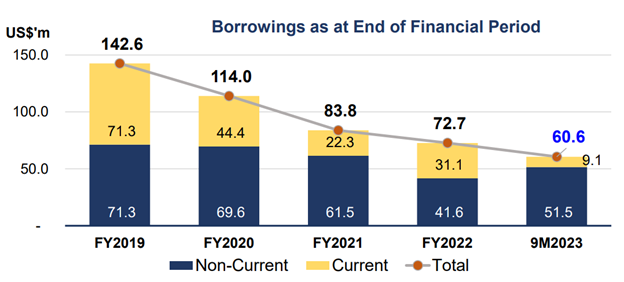

Despite being in a high capex industry (shipping and properties), the Group’s total borrowings has declined steadily over the past few years due to scheduled repayment and prepayment of existing borrowings.

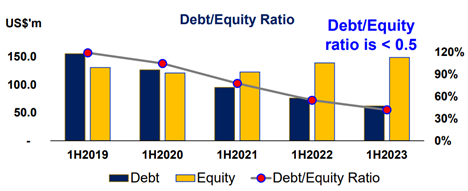

If you take a look at the chart above, Uni-Asia possesses a strong financial position with the debt/equity ratio coming in below 0.5x as of 1H2023.

Consistent Dividends

Uni-Asia Group has been delivering dividends to shareholders on a consistent basis since 2012. The Group’s gross dividends per share grew from 0.6 Singapore cents per share in FY2014 to 9.5 cents per share in FY2022.

The Group also dished out 2 cents and 5 cents in special dividends for the year 2021 and 2022 respectively, underpinned by the higher charter rates post-pandemic.

Taking into account the 5 cents in special dividends in FY2022, the total dividends per share would have exhibited a staggering 48% CAGR over the 8-year period from FY2014 to FY2022.

Last but not least, the Group has US$27.9 million cash on hand and generated operating cash flows of US$9.8 million for 9M2023. This is more than enough to pay out a decent 5 cents dividend per share amounting to an approximate US$4 million, and continue its debt reduction exercise in the long run.

Leadership Renewal

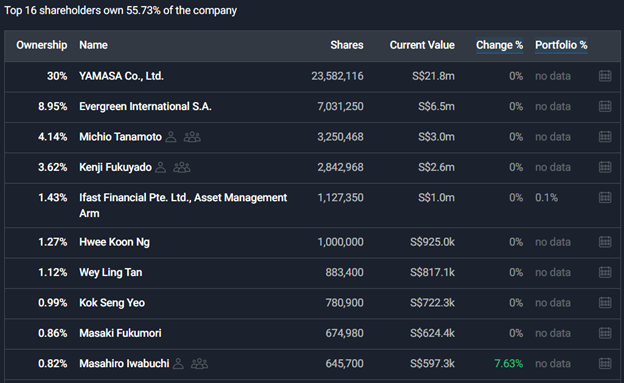

In the context of succession planning and leadership renewal, Executive Director Mr. Masahiro Iwabuchi will take on the role of Chief Executive Officer (CEO), succeeding Mr. Kenji Fukuyado. This transition will take place upon Mr. Fukuyado’s retirement on February 29, 2024.

The top 2 shareholders – YAMASA Co., Ltd and Evergreen International – are both in the property investment space, and own a 30% and 8.95% stake respectively in Uni-Asia. The similar nature of their businesses will harmonise effectively with Uni-Asia’s ongoing operations.

In addition, we can see that Chairman Michio Tanamoto and CEO Kenji Fukuyado both own a decent interest in the company. Incoming CEO Iwabuchi has also increased his stake in the firm by 7.63%.

Undemanding Valuation

Uni-Asia’s value is underpinned by its book value of ~S$2.30 per share as of 30 September 2023. At the time of writing, the firm’s share price is trading at roughly S$0.925/share, translating into an attractive 0.4x P/B ratio, significantly below the industry average of 0.9x.

It is worth highlighting that a significant portion of its balance sheet is supported by tangible assets, primarily consisting of property, plant, and equipment (mainly comprising the Group’s shipping vessels), along with investments, investment properties, and cash.

On top of that, this article points out that prices for bulk carriers have remained high, despite the declining trend in the dry bulk market. Increased newbuilding expenses, inflation, and substantial cashflows from high ship chartering rates have resulted in owners’ reluctance to sell vessels at reduced prices, and have led to buoyant second-hand prices in the market.

Hence, Uni-Asia may be able to lock in the positive gains by divesting its smaller vessels going forward.

Conclusion

In a nutshell, Uni-Asia remains a dividend favourite due to its focus on maritime and property investments, which will churn out recurring cashflows. An undemanding 0.4x P/B valuation also positions it as an attractive choice for investors seeking both capital and dividend returns in the realm of alternative investments.

[…] Source link […]