The Singapore property market is still stable pom pi pi!

You might have heard on the news on how 88% of J’den residences was sold on the launch day itself as seen below:

Yes, while there are concerns over Singapore’s red-hot property market and housing supply is started to increase, it means that the property market is going to just remain stable as Singapore is still doing pretty okay (in terms of security, employment opportunities etc).

This is assuring news for some of Singapore’s property developers and management companies; and we have picked 4 of them to share with you below…

#1 GuocoLand Limited

GuocoLand Limited (GuocoLand) is involved in the businesses of property development, investment, and management. It has a presence in Singapore, China, Malaysia, and Vietnam.

The Singapore market is the main contributor to GuocoLand’s revenue at 72.3%, followed by Malaysia (12.8%) and China (10.9%). Its main property portfolios in Singapore include Aquarius by the Park, Bishan Point, Cavendish Park, and Harbour View Towers.

GuocoLand has emerged from the pandemic, with revenue growing by 33.4% to SG$863 million in 1H 2023 from SG$661 million in 2H 2022, driven by increased contributions from Singapore and China markets.

Profits have also more than doubled to SG$187 million in 1H 2023, resulting in a high profit margin of 21.2%. This is one of the highest it has been since GuocoLand registered a 55.5% profit margin in 2016.

GuocoLand currently has 3 residential property projects under development which could benefit:

- Midtown Modern: Located on Beach Road, GuocoLand Midtown, and has 558 units available for sale. It is built directly above the Bugis MRT interchange station.

- Midtown Bay: Also located on Beach Road, GuocoLand Midtown with 218 units.

- Meyer Mansion: Located on Meyer Road, East Coast, and has 200 units available for sale. A 6-minute walk from the upcoming Katong Park MRT station.

Furthermore, GuocoLand is also trading at a low price-to-book ratio of 0.3 times with a 4.1% dividend yield.

#2 CapitaLand Investment Limited

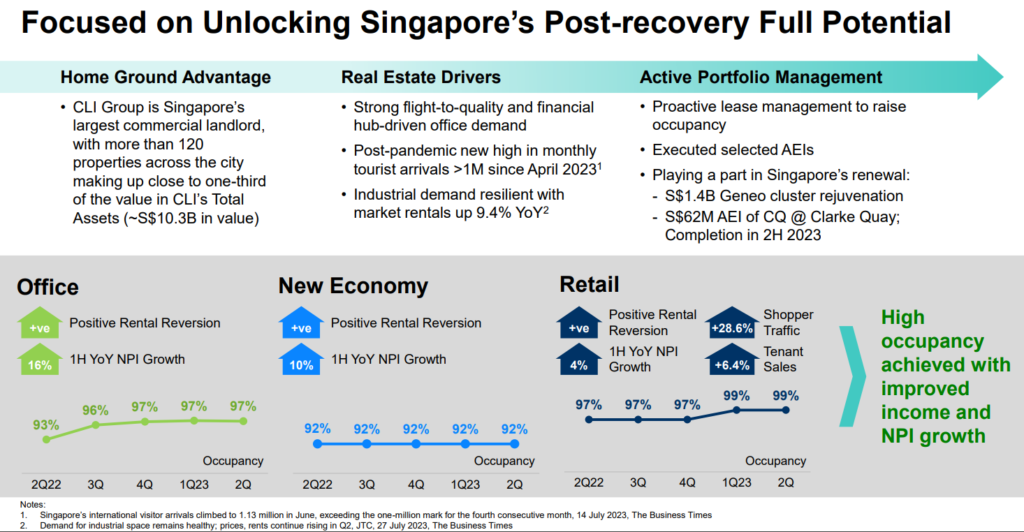

CapitaLand Investment Limited (SGX: 9CI) is s property investment management company with a presence in Asia Pacific, Europe, and North America. It manages about SG$24 billion in property value across the world and has a 95.8% occupancy rate.

CapitaLand’s portfolio in Singapore consists of three main segments, namely retail, office, and integrated developments. Key developments include the likes of Bedok Mall, Bugis Junction, CapitaGreen, Raffles City Singapore, and the Atrium at Orchard. Singapore contributes around 20% to CapitaLand’s revenue in 2022.

In terms of financial performance, revenue declined slightly to SG$1.345 billion in 1H 2023 from SG$1.354 billion in 1H 2022. Likewise, profits also declined to SG$417 million from SG$480 million over the same period due to the downward valuation of its properties.

CapitaLand could be worth taking a good look at for the following reasons:

- Higher profitability in its Singapore assets

While Singapore does not contribute the most to the revenue of Cland, it contributes the most to total Earnings Before Interest, Tax, Depreciation & Amortisation (EBITDA) for the company at 46% in 2022. - Slightly higher return on asset

CapitaLand generates a return on assets of 2.8% compared to its peers’ average of 1.6%.

At its current juncture, market analysts have CapitaLand at a BUY investment call with an average target price of SG$4.03.

Notwithstanding, it trades at a higher price-to-book of 1x as investors could be pricing in a recovery in valuations for its properties in 2023 and 2024.

#3 Frasers Property

Frasers Property (FP) develops, owns, and manages property assets in the residential, retail, commercial & business parks, and industrial & logistics sectors in 70 cities across the world.

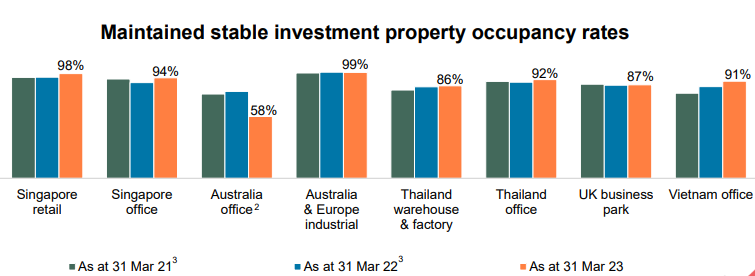

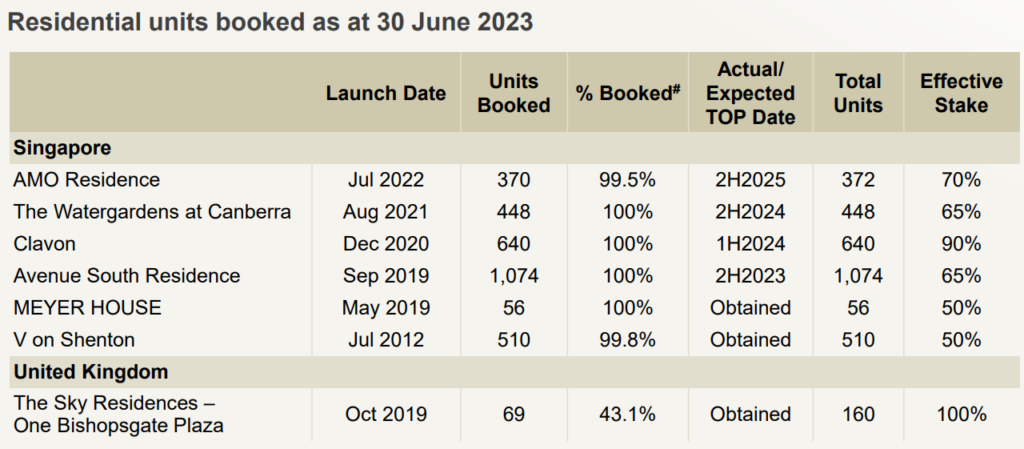

Singapore remains the biggest country in terms of property assets at 35%, followed by Australia (27%), Europe (20%), and Thailand (13%) as of March 2023.

FP registered a strong financial performance growth in 1H 2023 (Sep 2022 – Mar 2023), with revenue growing by 15.6% to SG$1.9 billion. Meanwhile, its net profit declined to SG$420 million in 1H 2023 from SG$481 million in 1H 2022.

FP could be well positioned to benefit from the current hot property market conditions through:

- High portfolio concentration in retail and commercial & business parks sectors

Both retail and commercial & business parks sectors encompass about 43% of its property assets. FP currently has 13 shopping malls and six office and business space properties in Singapore. - Near-full occupancy rates

Office and retail sectors in Singapore’s property segment registered occupancy rates of 98% and 94% respectively. - Residential sector in Singapore achieved higher sales in 1H 2023 (Sep 2022 – Mar 2023)

Singapore contributed higher profits at SG$332 million in 1H 2023 compared to SG$169 million in 1H 2022 due to higher selling prices from its residential developments.

In the market, analysts currently have an OVERWEIGHT recommendation with an average target price of SG$1.31. This implies a share price upside of 60.7% (as of 5 October 2023), with FP giving a dividend yield of 3.7%.

FP is now trading at a low price-to-book ratio of 0.3 times and sports a 5.5% dividend yield.

#4 UOL Group

UOL Group (UOL) is a Singapore-listed property group involved in the residential, commercial, and hospitality sectors. It manages around SG$22 billion of assets in 14 different countries.

Singapore continues to be the main contributor in revenue to UOL at 78% of revenue in 2022. Meanwhile, most of UOL’s revenue is derived from property development at 62% of revenue, followed by hotels (17%) and property investments (16%).

For the 1H 2023, UOL’s revenue has normalised to SG$1.4 billion from SG$1.7 billion in 2H 2022 as the Singaporean economy reverts to normalcy after a strong year in 2022. However, impressively, profits have actually grown by 21.4% to SG$230 million from SG$190 million over the same period.

Hence, UOL offers a competitive edge in the Singaporean property market:

- High return on asset

UOL generates a 1.9% return on assets compared to its peers’ average of 1.6%. - Recent good track record of gains on investment properties

UOL is in the process of disposing Parkroyal Kitchener Hotel to Midtown Properties for a price of SG$525 million. This implies a gain of SG$446 million. - High proportion of recurring income

Recurring income here means that UOL generates consistent revenue and cash from its properties, which stabilises its cash flow. Its operating cash flows (before working capital changes) were steady at an average of SG$718 million per year.

Market analysts have UOL at an OVERWEIGHT investment call with an average target price of SG$7.89. In terms of valuation, UOL is trading at a price-to-book ratio of 0.5x and dishes a decent 2.4% dividend yield.

Conclusion

Trends come and go, and they are typically supported by underlying demand from clients and customers. The recent hot property market in Singapore is no different as expatriates return from overseas to stay and do business in Singapore.

Hence, it is important to identify potential Singaporean companies that could benefit from these trends in the short- and medium-term. Who knows, they might boost your portfolio in the future.