It was an unfortunate event that Saudi Arabia’s refineries and oil fields were bombed on September 14th.

Luckily there were no casualties involved in this incident. However, this has caused huge disruptions to Saudi’s oil production and exports.

It is estimated that roughly 50% of the kingdom’s outpuroughly 50% of the kingdom’s output, OR about 5% of global supply would be disrupted.

Crude oil prices surged overnight on this news and increased by $15 upon the opening of the market. Stocks of oil-related companies soared along with the prices on Monday.

SGX has its fair share of oil related companies and here are 3 Oil & Gas companies that stands to benefit from the Saudi oil Attack:

1. China Aviation Oil

China Aviation Oil was listed on SGX since 2001. It is the largest physical jet fuel trader in the Asia Pacific region. The group is also the key supplier of imported jet fuel to the civil aviation industry of China.

China Aviation Oil has grown tremendously over the past 9 years. It has grown its revenue 274% from USD 5.5 billion in 2010 to USD 20.61 billon in 2018. It has also strengthened its portfolio by diversifying out of Asia into Europe, Middle East and USA.

China Aviation Oil has its own storage units where aviation oil could be stored before selling to end-users. This allows China Aviation to sell previously stored lower priced oil at higher current market prices. This in effect allows gross margin to increase without much maneuvering of operations. Thus, China Aviation stands to benefit from this price increase.

China Aviation Oil last traded at $1.25 with a dividend yield of 3.6%.

2. Interra Resources Limited

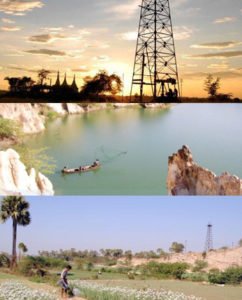

Interra Resources Limited is listed on the SGX mainboard. It is engaged in the business of petroleum exploration and production.

The group’s portfolio of production, development and exploration assets comprises four petroleum contract areas in Indonesia and Myanmar.

Interra Resources Limited has started to earn positive profits since 2017. Previously, its cost of production was far too high and hence resulted in negative net profits for the group. It has since optimised its operations, allowing the group to reap good profits from its resources.

Costs of producing the petroleum from the assets are expected to remain at the same level with the optimisation in place.

With assets under the company and cost remaining roughly the same, the increase in oil prices is expected to boost the bottom line of the company.

This will result in a positive effect on the net profit, and hence earnings per share of the company.

Interra Resources Limited was last traded at $0.029 and does not pay out any dividends.

3. Rex International

Rex International is an oil exploration and production company listed on SGX. Since the company listing in 2013, the company has achieved two offshore discoveries, one each in Norway and Oman.

The group also offers Rex Virtual Drilling screening services to other oil exploration companies.

During such times of extreme price increases, companies with physical oil assets are favoured.

With assets under the company’s helm, Rex is able to monetise its production to achieve higher profits. Moreover, any divestment of assets now will reap better valuation than before.

There are analysts in the market making forecast that if Saudi is not able to come back online by mid 2020, oil will be severely lacking in the world.

This will then propel even small oil producing companies like Rex in the limelight.

Rex International was last traded at S$0.087 and does not pay out any dividends.

Do you know that Master Investors like Warren Buffett has his own Unique Investing System which you can emulate yourself? We have distilled it into a simple 10-Step Checklist for you to decide how or when to buy/sell your stocks.

Simply click to receive your copy today!