First things first…before we kickstart on this article’s main gist on how to invest your CPF Savings…

If you are new to the CPF Investment Scheme (CPFIS) and wonder if you are eligible, click on the beginner guide below first:

https://www.smallcapasia.com/how-to-invest-your-cpf-money/

With that, you are in the right place if you want to learn how to beat the CPF interest rate (2.5% or 3.5%) by investing in stocks.

According to a poll I conducted in InvestingNote, 50 out of 124 respondents (~40%) voted that they managed to surpass the 2.5% CPF rate.

It sort of resonates well with the report card delivered by the CPF Board where 49% beat the 2.5% p.a. interest rate.

In other words, more than half the CPF members are ‘losing out’ by not putting their CPF funds to better use. There are several reasons behind this finding which includes:

- Poor investing approaches – e.g. treating stock market like casino

- Prefer stable yield of 2.5% with negligible risks

- No idea how to start

A quick google search shows that a large part of the content is catered towards how to open your CPFIS account, your eligibility and what you can invest in etc. Little information really talks about the strategies on how to invest your CPF savings wisely.

We decided to change all that… and also how to “re-program” your 2.5% CPF return into an advantage rather than an opportunity cost.

With that, we present to you our 3 key strategies (some poll respondents are already doing them as well):

#1 Go for Safe Stocks with Decent Dividend Yields

When you think of 2.5% as the minimum return you should receive, it is better to achieve this through safe dividend stocks with >2.5% yield. Following which, any capital gain would then be a bonus.

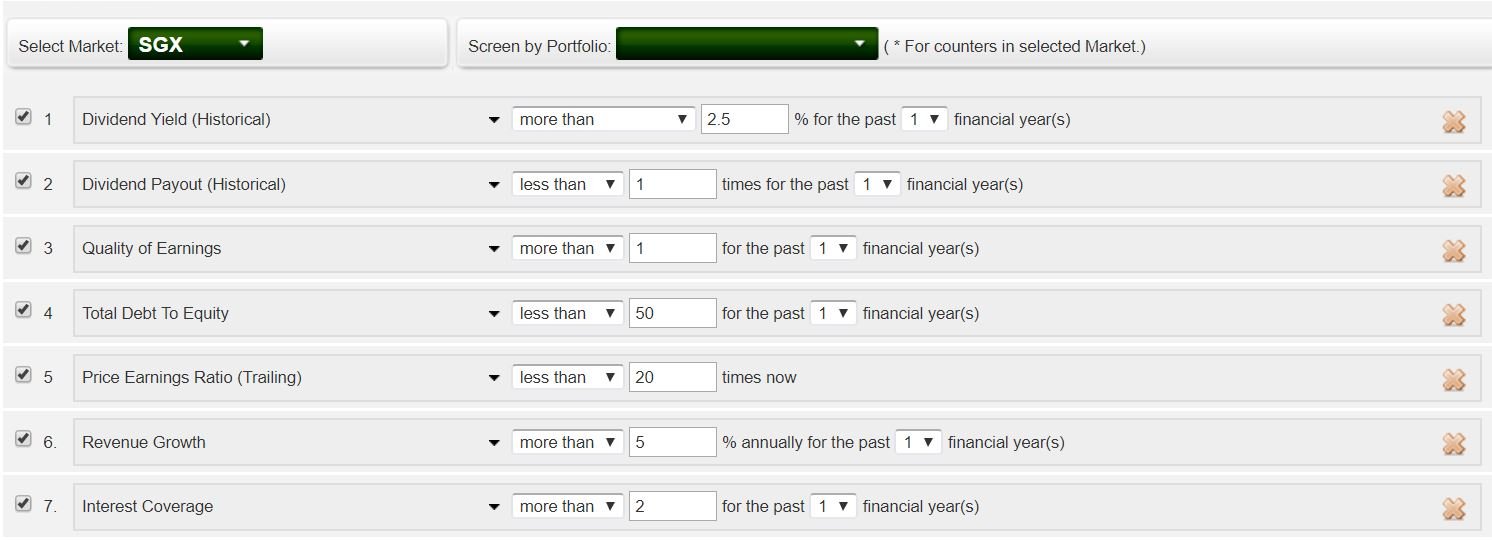

Here is the parameters I used in Shareinvestor:

Quality of earnings measures the extent of deviation of a company’s operating cash flows from its reported earnings. Hence, an earnings quality ratio < 1.00 could indicate possible problems such as fictitious receivables or unrecorded payables.

The interest coverage ratio is a measurement of a company’s ability to handle its outstanding debt. Generally, an interest coverage ratio of at least 2 is considered the minimum acceptable amount for a company that has solid, consistent revenues.

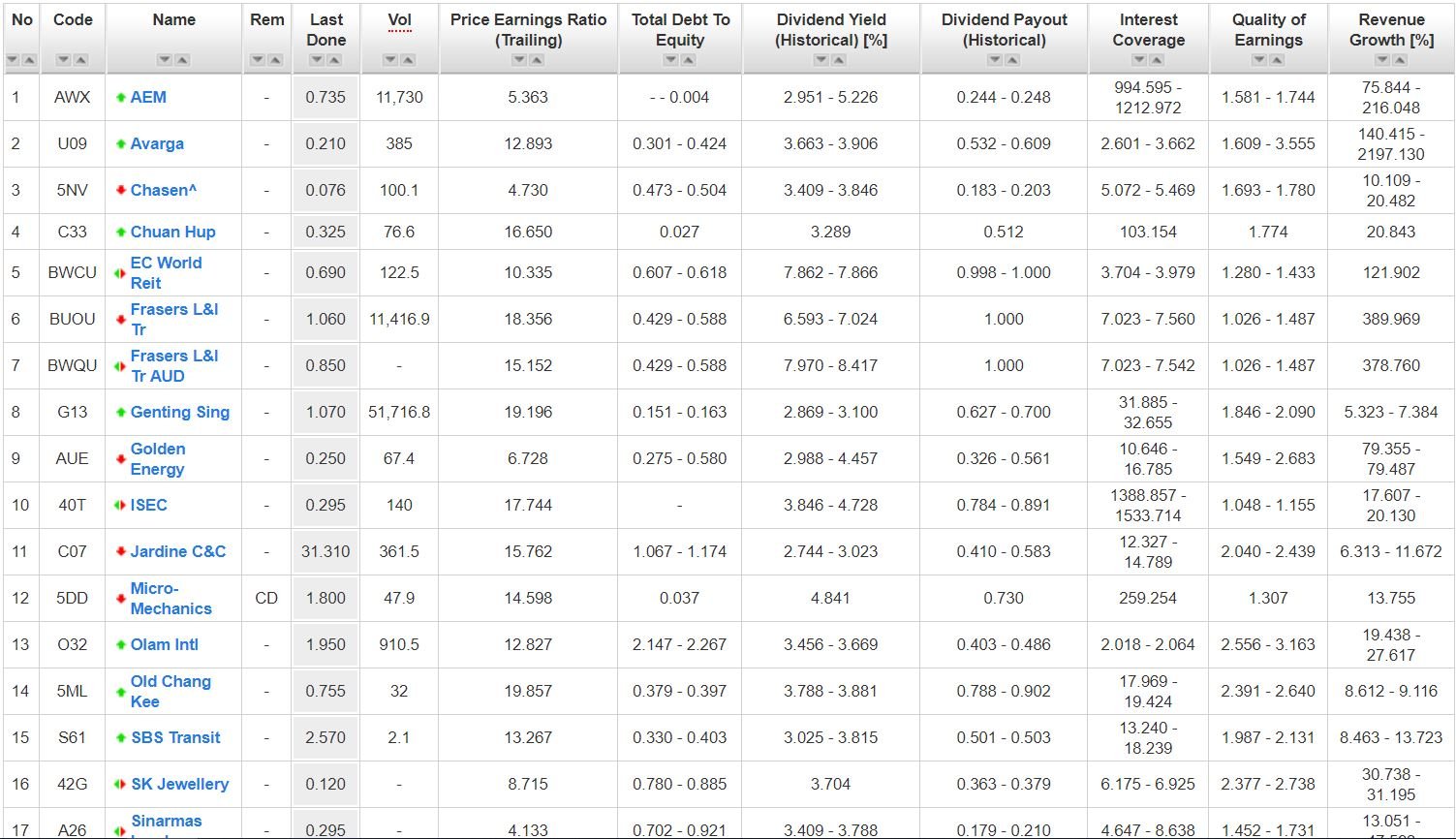

Adding in the other parameters (>2.5% yield and dividend payout < 1x), here are the results I got…

Of course, the above list is not definitive of what you should go ahead and buy now.

Take for example Chasen^. On June 5, 2017, Chasen was added to the SGX Watchlist for failing to meet the minimum trading price of 20 cents for Mainboard companies. The company has till June 2020 to meet the criteria or face delisting.

Genting Singapore is another stock on why you should understand the stocks first. Genting’s growth stems from whether they can continue to build more casinos and resorts in future. The current RWS in Singapore has limited growth prospects although it continues to churn out cash for dividends payment.

Another point to note is that safe stocks also may have periods of downturn – leading to potential capital loss. This brings us to our 2nd point below.

#2 Only Buy during Crisis/Temporary Correction

I did a simple poll asking people whether they have used CPF to invest before and how it fared.

50 out of 124 respondents indicated that they had done better than 2.5%. And among the 80+ comments in the poll, a couple of them mentioned that they had invested during dips and held on to them for at least a few years.

I feel that this is a very practical strategy. When you are unable to find any bargains, it is prudent to keep the CPF where it is, generating a 2.5% return while you wait for undervalued stocks.

Personally, I had invested in DBS and OCBC in year 2016 when they are trading at Price-to-Book below 1 and giving more than 3% dividend yields during that time. On top of getting higher than 2.5% return from CPF, I am investing in the 2 stable blue chips of all time.

While this strategy sounds good on paper, the fact is that you have to ascertain whether the market/stocks are ‘cheap’ enough or continue its downward decline. Thus, if stock picking is not your cup of tea or you simply lack the time to do it, you may also deploy your CPF funds to mutual funds.

#3 Invest in Mutual Funds

Many people have the stigma that mutual funds are out there to charge you fees and destroy your returns. In fact, research has shown that up to 95% of mutual funds underperform the benchmark index.

“Should you give up on mutual funds then?”

My answer is “no”.

The reason is simple, you can only invest in STI Index (through ETF) when it comes to investing from your CPF funds. And the STI returns over the past 5 years has been dismal – it is almost flat if you exclude the dividend gains.

On the other hand, a simple search in Fundsupermart led me to a fund called First State Dividend Advantage Fund, which has achieved 9.4% CAGR during the same period. More impressively, it also delivered consistent performance over the past decade with 9.3% CAGR.

In a nutshell, I feel that DIY investing in mutual funds (not through insurance plans) is a feasible option so long as you focus on the right ones.

If you are looking for a systematic way to pick the Top 5% funds, you can check out my ebook in InvestingNote. Inside, we talked about the benefits of investing in mutual funds and how you can sieve through the winning funds using a few important criteria.

Conclusion

Investing your CPF savings is a different ballgame because you are racking up opportunity costs of 2.5% from the very beginning. There are also other restrictions where you can only invest in Singapore stocks or some pre-determined securities.

There is also limited information on this area. Therefore, this post is created to give retail investors a better understanding on the various ways to invest their CPF savings.