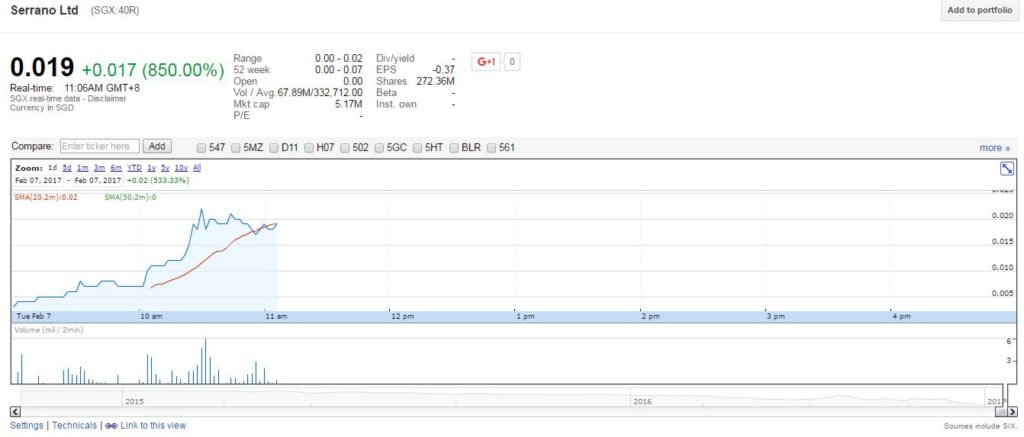

What events have caused it to hit such a rock-bottom price and then surged so high today?

We are going to whip out our magnifying glass and look deeper into them here…

But before that, here’s a quick background of the firm.

Serrano Ltd Background

According to its SGX Stockfacts, Serrano Limited (http://serrano.com.sg/) provides interior fit-out solutions for property development and refurbishment projects in Singapore and Southeast Asia. It operates through two segments, Interior Fit-Out Business, and Wholesale and Retail Furnishings Business. It is also engaged in residential renovations.

What Happened? (part 1)

Before we talk about why its share price has moved up so much, lets backtrack a bit and zoom in to why the share price has hit such a low of S$0.002 first.

- The company is laden with tens of millions of debts and creditors like Maybank and UOB are chasing after them frantically… see sources below:

http://www.businesstimes.com.sg/companies-markets/serrano-told-to-pay-s334m-within-a-week-bankruptcy-proceedings-against-director

http://www.straitstimes.com/business/companies-markets/serrano-gets-letter-of-demand-from-uob-to-repay-banking-facilities-in - The person at the helm, aka. the CEO, is declared bankrupt too.

http://www.businesstimes.com.sg/companies-markets/serrano-ceo-declared-bankrupt

Simply put, the heydays of the company is over and the future for them is bleak and strife with uncertainities. Without a doubt, the share price has gone into a free-fall ever since it was listed back in year 2014. In fact, I have written on its IPO in the past & warned of the following: huge short-term borrowings, terrifying finance costs and negative operating cash flow.

What Happened? (part 2)

Apparently, a white knight appears to save the day – resulting in the soaring of share price once the trading halt is lifted. Here is the link.

According to the latest press release, the Investment amounts to approximately S$6.3 million and will be used to

(a) contribute to the general working capital of the Group to finance existing ongoing projects (36.5%)

(b) effect the Cash Distribution (63.5%)

Now that the company is given a new lease of life, many people have jumped in to capitalize on this opportunity.

Buy or Avoid?

Although we know that the company is saved, much is still unknown about their 2 saviours (Mr. Quek Wey Lon & Winmark Investments Pte. Ltd) as well as their future plans for the company.

In addition, the company operates in a the interior furnishing industry which is facing stiff competition and the sharp slowdown in Singapore’s housing market too.

Last but not least, it is probably unwise to jump in right now as a small investor and “hope for the best” because…. there are probably BIG fishes swimming in the sea right now (those who pushed up the prices so high).

Fancy an Ebook that teaches you the hallmarks of multi-bagger stocks and how to find them? Simply click here to receive your copy of a brand-new FREE Ebook titled – “100 BAGGERS” by Christopher W. Mayer today!

Last but not least, do remember to Like us on Facebook too as we share the latest investing articles and stock case studies for you!