Are you caught in a bind not understanding what others are talking about while scrolling Reddit, Cryptocurrency related forums or Slack groups?

Just a year back, I was also left scratching my head when I first got involved in Cryptocurrencies. Therefore, I decided to put together a list of the Cryptocurrency Lingo/Slang which can help out others as well.

Cryptocurrency Lingo

HODL

A spin on the investing lingo ‘hold’ — Hold On for Dear Life. A crypto trader who buys a coin and does not see himself selling in the foreseeable future is called a hodler of the coin.

FOMO

Short form for ‘fear of missing out’. The feeling when you see a huge green dildo on a chart and you don’t own that coin, so you sell other shit to buy into it freaking out. As crypto trading is still very much driven by emotions rather than valuation, FOMO is a huge factor to consider when swing trading in crypto.

FUD

Short form for ‘fear, uncertainty and doubt’. Usually used in the form of “xxx spreading FUD again.”

Example: JPMorgan’s Dimon spread FUD by saying Bitcoin is a fraud that will eventually blow up.ATH

Short form for “All-Time High”. Therefore it means the highest historical price of a specific coin.

Whale

A huge player who has a substantial amount of capital. Whales are often the market movers for small alt-coins too due to their huge capital.

Pump and Dump

The recurring cycle of an Altcoin getting a spike in price followed by a huge crash. Such movements are often attributed to low volume, hence the ‘pump’. Traders who pump, buying huge volumes, may wish to invoke FOMO from the uninformed investors and then dump, or sell, their coins at a higher price.

Shill

The act of unsolicited endorsing of the coin in public. Traders who bought a coin has an interest in shilling the coin, in hopes of igniting the public’s interest in that particular coin.

Bag Holder

A term to refer to a trader who bought in at a high and missed his opportunity to sell, leaving him with worthless coins.

Margin Trading

Margin trading with cryptocurrency allows traders to open a position with leverage and trade without putting up the full amount.

Simply put, it increases your buying power through leverage on your existing positions/funds and allows you to buy more cryptocurrencies than what you usually can.

Example: You have a capital of USD 10,000 and gets a 300% leverage on Bitcoin. Now, you can buy/short up to USD 30,000 worth of Bitcoin.

Huobi Pro is a popular cryptocurrency exchange that has been offering margin trading of various cryptocurrencies such as Bitcoin and EOS for a few years now. To create an account and start margin trading, click here.

Long

A position that a trader takes. To take a long position on something is to believe its value will rise in the future.

Short

A position that a trader takes. To take a short position on a coin is to believe its value will fall in the future.

Limit Order

An order placed at a future price that will execute when the price target is hit.

Borrowing Rate

When you open a leveraged position, you will be borrowing coins at a pre-determined rate. This rate will be added to reflect your position’s overall profit and loss.

Lending Rate

Some exchanges have lending accounts. You may deposit your coins into these lending accounts to lend your coins for others to execute their leveraged trades. The lending rate fluctuates throughout the day based on the demand for shorting the coin.

Fill or Kill

A limit order that will not execute unless an opposite order exceeds this limit order’s amount.

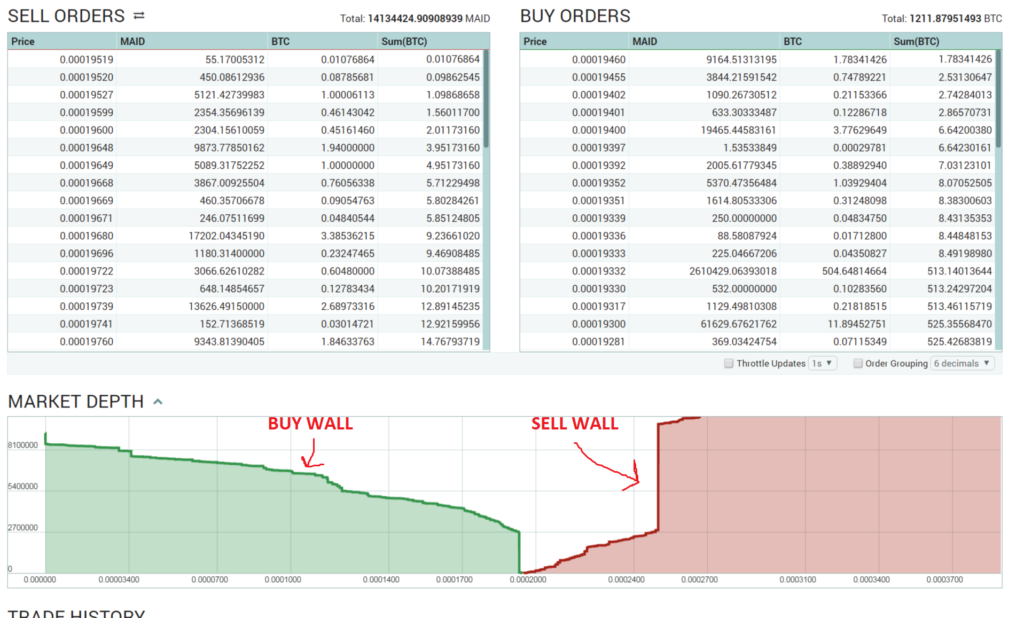

BUY | SELL Wall

A wall as seen in the depth chart of exchanges is an amalgamation of limit orders of the same price target.

Altcoin

“Alternate coin” so it is everything other than Bitcoin (BTC). Bitcoin is the main index for cryptocurrency market. If BTC goes up, other coins go up. If BTC goes down, other coins go down.

Circulating Supply

The price of a coin has no meaning on its own. However, the price of a coin, when multiplied by the circulating supply, gives the coin’s market cap.

Market Cap.

A stock’s market cap refers to the market value of the company’s outstanding shares.

In the cryptocurrency market, the market cap is used to illustrate a coin’s dominance in the entire cryptocurrency market.DDOS

Short form for ‘Distributed Denial of Service’.

A well-timed DDoS attack at exchanges during volatile movements may be devastating as traders will not be able to execute any order manually and will be at the mercy of their pre-set, or the lack of, limit orders.ICO

Short form for “Initial Coin Offering”, which takes a page from the usual IPOs investors know.

Coins bought during ICOs are usually sold for a profit when the coin first hits exchanges. This is due to the initial hype which increases demand for the coin.

On the supply side, ICOs create entry barriers as the buyer has to set up his private wallet to receive the coins from the ICO purchase.Arbitrage

The act of buying and selling on different exchanges to earn the difference in the spread. Arbitrage opportunities occur due to differences in exchange reputation, community coin preferences and ease of bank funding.

Take note that fees, limits and prices could change anytime when you are transferring your coins between exchanges, especially during volatile times.BTFD

“Buy The Fucking Dip” – When people are running around and selling because of fear, this is the time to buy.

Moon

A crypto slang that means such extreme bullish movement of a coin that it is heading to the Moon.

Example: Huobi Token (HT) has mooned over the past 2 months. Its coin price jumped 300+% from USD 1.7 to USD 5.6 at the time of writing – in a mere 2 months’ time! You probably won’t find this kind of ballistic returns anywhere else!

To own Huobi Token (HT), you have to create an account with them. For more info, click here.

Sourced from coinmarketcap.com

Weak Hands

Those who cannot be patient and sell at loss when the market is down.

Token Airdrop

Simply put, an Airdrop means a coin/token is distributed to the community for free or for small tasks. This is done to ensure early distribution and to have as many people with “skin in the game” as possible.

An Airdrop aims to build a huge community easily as people will pay attention to the coin they hold. Furthermore, they tend to promote this coin for profits, and this may cost the Development Team little to achieve the goal of advertisement.

Simply put, it increases your buying power through leverage on your existing positions/funds and allows you to buy more cryptocurrencies than what you usually can.

Simply put, it increases your buying power through leverage on your existing positions/funds and allows you to buy more cryptocurrencies than what you usually can.

Sourced from

Sourced from