Listed on SGX on 12 March 2020, United Hampshire US REIT (“UHREIT”) is one of the newer Real Estate Investment Trust (“REIT”) that might not catch much attention from the investment community. For those who are not familiar with this REIT, it was established with the principal investment strategy of investing in a diversified portfolio of stabilised income-producing grocery-anchored and necessity-based retail properties and self-storage properties, located in the U.S.

The CEO is Mr. Gerard Yuen, who played a pivotal role in the successful listing of UHREIT when he was the Chief Financial Officer. As CEO, Gerard works closely with the Board to determine the strategy for UHREIT and oversees overall day-to-day operations, working closely with the investment, asset management, financial and compliance personnel to achieve the strategic, investment and operational objectives of the REIT.

I caught up with Gerard recently and took the opportunity to post some questions to acquire a better understanding of the REIT. Without further ado, let’s jump into some key takeaways from our discussion.

Takeaway #1: Addressing the Elephant in the Room

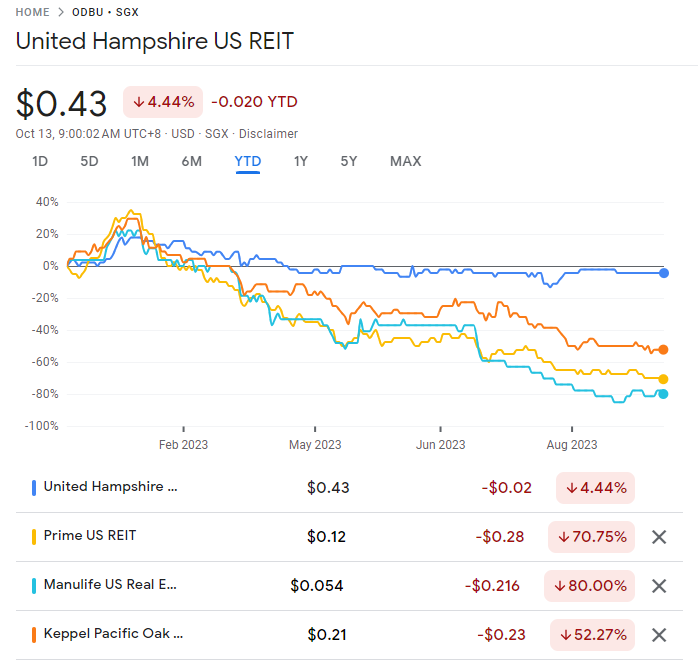

Before we touch on other aspects of UHREIT, let’s address the main ‘elephant in the room’ first. The recent turbulence in the share prices of US office S-REITs has raised concerns among many REIT investors.

Many investors may not realise that UHREIT unit price has stayed relatively stable as compared to US office property REITs and has delivered a positive year-to-date total return of 8% (including March 23 and September 23 dividend payout of 5.62 US cents). It’s crucial to differentiate UHREIT from the US Office and Hotel REITs because they own very different asset classes that perform very differently.

With a focus on predominantly grocery-anchored and necessity-based retail properties, UHREIT has stayed resilient, withstanding economic uncertainties, backed by a diversified, cycle-agnostic tenant base providing day-to-day necessity goods and services. The REIT’s Self-Storage properties have also performed well, benefitting from work from home dynamics, coupled with an undersupply of self-storage facilities in the New York Metro Area. This contrasts with the US Office REIT sector which is facing headwinds from a weak business outlook and pressure from remote work.

From UHREIT’s latest 1H2023 results presentation, we can see that UHREIT’s top 10 tenants comprise of familiar retail brands like Walmart, Lowe’s Companies, LA Fitness and Home Depot.

Based on the Trade Sector Breakdown, essential services comprise 63.3% of the whole portfolio and as a whole, it translates to a long Weighted Average Lease Expiry (“WALE”) of 8.1 years – pretty awesome if you compare the figure to other S-REITs with an average 3 – 5 years WALE.

Takeaway #2: Not Resting on Their Laurels

On top of that, UHREIT isn’t merely maintaining the status quo; it’s actively pursuing growth opportunities too.

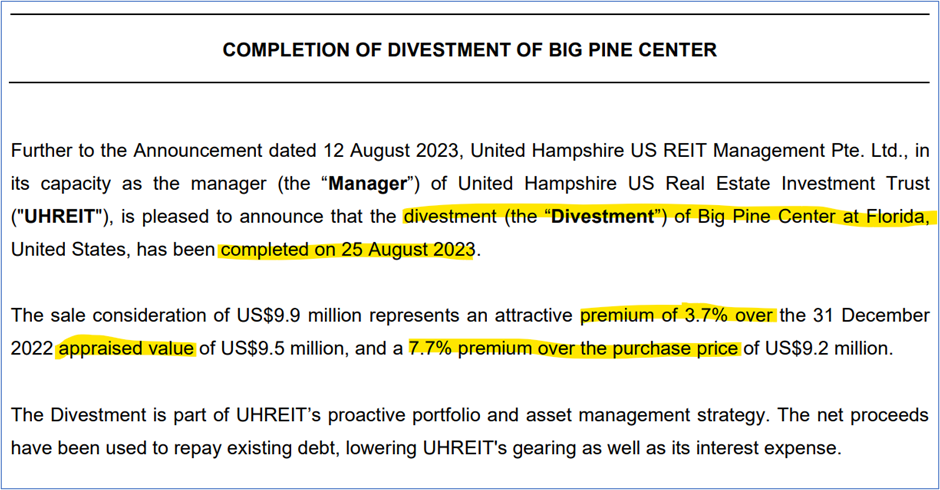

If you were to keep track of its track record since IPO, UHREIT has completed several yield-accretive acquisitions as well as several opportunistic divestments at a premium above valuation.

One recent example is their divestment of Big Pine Center, done at a good premium of 3.7% over the appraisal value of US$9.5 million, and a 7.7% premium over the purchase price of US$9.2 million.

In addition, I noticed that UHREIT also embarked on Asset Enhancement Initiative (“AEI”) early this year. It has undertaken an expansion project on existing excess land at its Floria property, Port St Lucie to construct a new 63,000 sq ft store, which has been pre-leased to Academy Sports + Outdoors and is on track to be completed in 2024.

In my opinion, this proactive approach from the Manager to pursue AEI and investment opportunities sets itself apart from other REITs which simply go for the traditional ‘rights issue for acquisitions & repeat’ strategy.

While the strategy to enlarge a REIT’s portfolio size via issuance of rights units has worked its charm during a low interest rate environment, it is detrimental and highly dilutive in this current ‘higher for longer’ interest rate outlook.

UHREIT has proven that it can continually optimise its portfolio through successful acquisitions, divestments and AEI, which should be something worth highlighting for REIT investors these days.

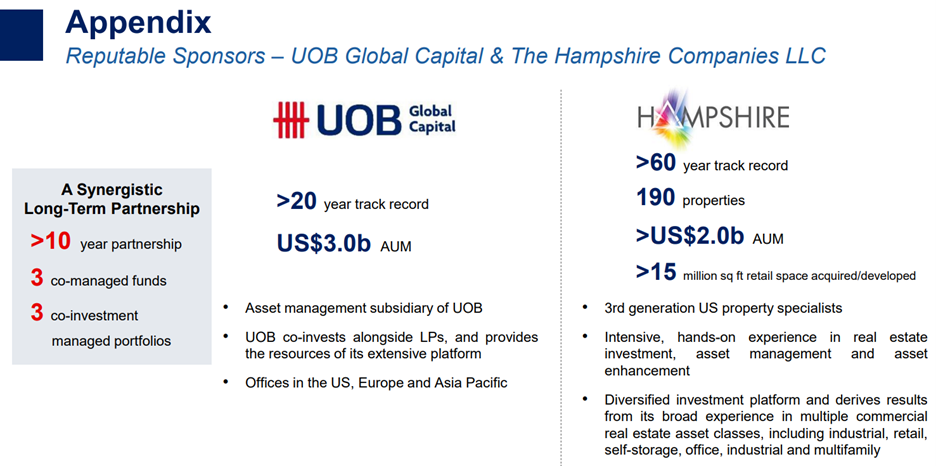

Takeaway #3: Strong Sponsors and an Experienced Management Team

When we talk about strong sponsors, the common names like CapitaLand, Frasers and Mapletree will pop up.

That said, not many would have been aware that UHREIT actually benefits from two reputable sponsors, UOB Global Capital LLC & The Hampshire Companies LLC (hence the name United Hampshire US REIT).

UOB Global Capital is a subsidiary of United Overseas Bank Limited and has a US$3.0 Billion AUM while Hampshire is a privately held, fully integrated real estate firm with over 60 years of track record. Hampshire currently owns and operates a diversified portfolio of 190 properties across the U.S. and a US$2.0 billion AUM. Hampshire is also the asset manager of UHREIT.

Together, they have a synergistic long-term partnership of over 10 years and co-managed 3 funds together.

To top it off, UHREIT boasts of a dynamic management team. As previously mentioned, CEO Gerard Yuen has more than 20 years of experience in investment banking, finance and the public sector. UHREIT’s senior management team also comprises highly experienced professionals with experience in real estate, finance and accounting and investor relations.

The Chairman Mr. Tan Tong Hai, the former President and Chief Executive Officer of Starhub Ltd, is a well-known corporate leader in Singapore. Mr. James Hanson, President and CEO of The Hampshire Companies, and Mr. David Goss, co-founder and Managing Director of UOB Global Capital are also on the Board.

With such an experienced leadership team in place, UHREIT is well-equipped to navigate the complexities of the real estate market and continue its growth trajectory.

Takeaway #4: Consistent Operational Performance since IPO

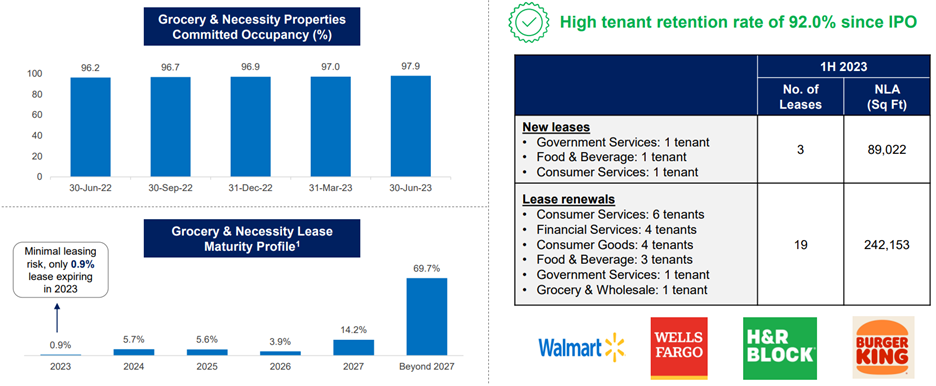

UHREIT has demonstrated a remarkable track record of consistent operational performance with a high tenant retention of 92.0% since its IPO.

Adding on to what I have shared throughout the whole article, grocery & necessity properties tend to have long leases.

From the picture above, we can see how it plays out as the REIT has minimal leasing risk with only 0.9% lease expiring in 2023 and the bulk ~70% balance expiring only beyond 2027.

According to an article by WSJ, the demand for retail space has remained robust despite inflation pressures, high interest rates and some liquidations going on. This is due to a combination of factors:

- Supply of retail space has gone down sharply as construction has slowed down big time since the 2008-09 financial crisis.

- Remote working from home trend has propped up demand in sub-urban areas.

- Predictions about how E-commerce will wipe out physical retail is not materializing. In the contrary, Retailers have started using online analytics to pinpoint locations for successful stores.

The decline in supply and heightened demand bodes well for UHREIT, offering it more pricing power to further increase asking rents in the future.

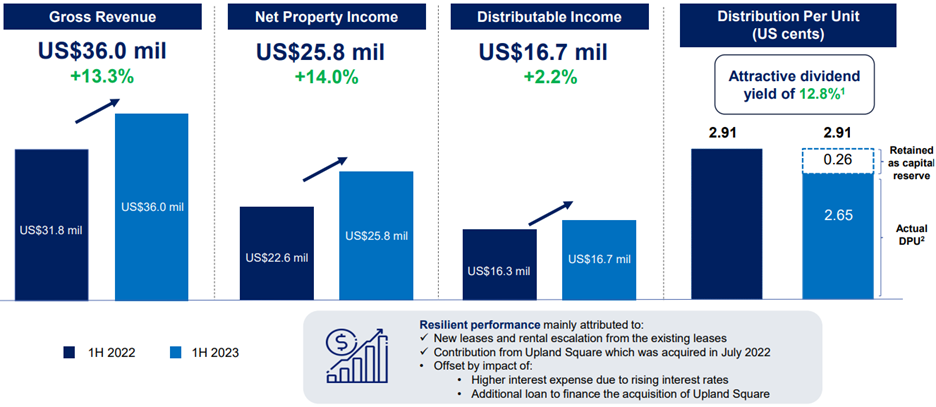

Moving on to the recent financial performance, UHREIT has done well in growing the top- and bottom-line too. 1H2023 gross revenue is up 13.3% to US$36.0 million and net property income is up 14.0% to US$25.8 million on a year-to-year basis.

This stable performance is a testament to the REIT’s well-structured portfolio composition and effective management.

Takeaway #5: Attractive Valuation and Yield with Efficient Capital Management

Last but not least, we are always looking for the best bang for the buck as investors.

UHREIT stands out to me due to its low price-to-book ratio of only 0.6x and an impressive yield exceeding 12%.

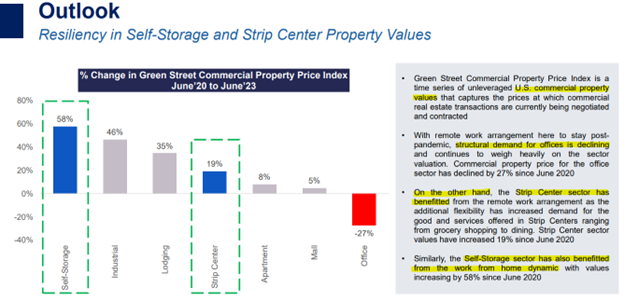

One may say that the high interest rate environment is impacting REITs’ property values, especially the US-domiciled REITs. While this notion makes sense but it’s true only to a certain extent.

You can see that based on the Green Street Commercial Property Price Index, for the 3-year period from June 2020 to 2023, strip centers (shopping centers) and self-storage sectors in the US have increased their valuations by 19% and 58% respectively, underpinned by the work-from-home trend that’s here to stay.

To sum up, this combination of stable portfolio assets, attractive valuation and mouth-watering yield is hard to come by if there isn’t any fear imposed by the macro-economic risks out there.

Conclusion

In a landscape where US commercial real estate is facing a boatload of challenges, United Hampshire US REIT stands as a bright spot due to its unique portfolio, comprising of grocery-anchored and necessity-based retail properties along with modern self-storage facilities.

Moreover, I feel that UHREIT ticks all the boxes even when you refer to things like the management team, operational performance as well as the enticing cheap valuation and high yield.

Long story short, UHREIT does sound like a compelling hidden gem where you can get the best of both worlds – potential capital gains while you milk that >12 % yield that comes your way.

Want to find out if this stock is in our watchlist? Check out our full REITs + Dividend portfolio on Patreon. We also offer insights into interesting analyst reports as well as macroeconomic developments. Follow us for FREE on Patreon now!

[…] by The Singaporean Investor 3) Discover SGX: 3 Reasons to Invest in AIMS APAC REIT by ProsperUs 4) United Hampshire US REIT: Why you should take a closer look at this resilient S-REIT with over 12% y… 5) 4 REITs […]