With more than 7,000 sales agents under the company, PropNex is the largest real estate agency in Singapore after a merger with the Dennis Wee Group in 2017. It is also the second real estate brokerage to list on the Singapore Exchange after APAC Realty.

Here’s a quick glance into the details of PropNex’s IPO.

You can also find the prospectus here.

1. PropNex Profile

The company comprises 4 main business segments:

(i) Real Estate Brokerage

Under this segment, the company derives its revenue from commission earned from sales and rental of residential, commercial and industrial properties.

PropNex has a huge market share in the Singapore real estate market under this segment. According to Frost and Sullivan, a business consulting firm, PropNex has 42.7% market share in the residential primary private market and 45.3% leading market share in the residential HDB resale market.

This segment is also the single largest contributor to the company’s gross profit. In FY2017, it has contributed 94.8% to the company’s gross profit, which is equivalent to S$33.7 million.

(ii) Training

PropNex is involved in providing training for salespersons through its Life Mastery Academy. It is a Council for Estate Agencies (CEA) accredited provider of Continuing Professional Development (CPD) courses. The objectives of CPD scheme are to ensure salespersons possess the necessary professional knowledge in estate agency work.

The Training Services segment has contributed S$710 thousand (2.1%) to PropNex’s gross profit in FY17.

(iii) Property Management

PropNex provides a one-stop professional consultancy to manage boutique and high-end condominiums. It offers specialised solutions in property management, building diagnostic and facility management.

Some of the more renowned properties under the company’s portfolio include

- The Ladyhill@Orchard,

- The Edge at Cairnhill and

- 1 Moulmein Rise.

This segment has contributed S$1 million, which is around 3.1% to PropNex’s gross profit in FY17.

(iv) Real Estate Consultancy

The real estate consultancy business was just established recently. It is geared to provide auction and corporate sales services and investment or en bloc services.

PropNex have not reported any revenue or profit under this segment in FY17 yet.

2. IPO Details

The offering will close at noon on 28 June 2018 (Thursday) and expected to commence trading on 2 July 2018 (Monday).

A total number of 42.5 million new shares will be on offer during the IPO period at a price of S$0.65 a piece. Some 40.375 million shares were placed to institutional and other investors in Singapore and internationally, while the remaining 2.125 million shares will be offered to the public.

Concurrently, 50 million shares will be sold at the offer price to 4 cornerstone investors, namely:

- Affin Hwang Asset Management Berhad

- FIL Investment Management (Hong Kong)

- Nikko Asset Management Asia

- Value Partners Hong Kong

If you want to compare the cornerstone investors to Apac Realty, they include FIL Investment Management (Hong Kong) Limited (same investor!), Qilin Asset Management, family office owned by Chairman of Soilbuild Group; and Asdew Acquisition Ptd Ltd.

One thing that has caught my eye was that Value Partners Hong Kong, which was founded by renowned value-based investor Cheah Cheng Hye, has agreed to subscribe to the IPO.

It keeps me wondering, “What kind of ‘value’ does his management firm find in PropNex?”

3. Use of Proceeds

Upon listing, the company will raise gross proceeds of S$40.9 million, with S$2.9 million going towards listing expenses. In comparison, competitor APAC Realty raised S$58 million during its IPO in Singapore last year.

PropNex plans to use the remaining proceeds mainly for:

- Local and regional expansion: S$12 million

- Enhancement of real estate brokerage business: S$8 million

- Expansion in range of business services: S$7 million

- Enhancement of technological capabilities: S$6 million

- Working capital purposes: S$5 million

PropNex currently does not have a fixed dividend policy. However, the company intends to recommend and distribute dividends of at least 50% of announced net profit after tax attributable to the owners of the Company for the period in FY2018 and FY2019.

4. Financial Highlights

Revenue for the company has been increasing over the past 3 years. The revenue has increased from S$204.8 million in FY2015 to S$361.3 million in FY at a CAGR of 32.8%.

In tandem with the growth in top line, the profit attributable to the owners of the company recorded a significant CAGR of 58.3%, from S$6.5 million to S$16.3 million in the same period.

The was a huge surge in revenue and net profit in 2017 due to the merger between PropNex and DWG in the second half of 2017. By the way, reading through the “Management’s Discussion” gave me further insights as to why:

The company reported that the revenue growth was supported by the growth in commision income from Agency Services due to higher resale market transactions volume and higher rental market transaction volume.

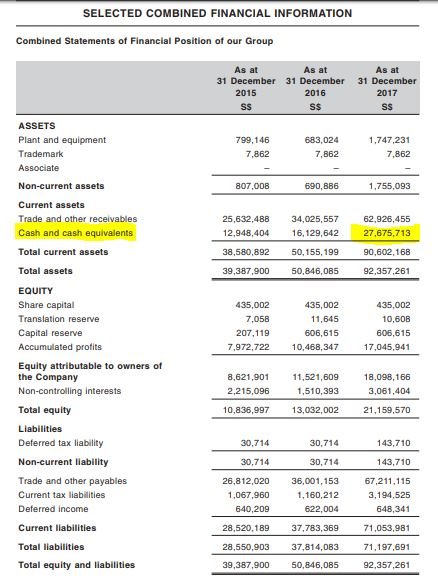

Besides that, I have noticed the significant increase in Finance Income for FY2017. It was due to the increase in overall fixed deposit and bank balance by approximately S$11.6 million from S$16.13 million in FY16 to S$27.7 million in FY17.

PropNex seems to have a strong balance sheet too. With a cash and cash equivalents of S$27.7 million as at 31 December 2017 and no debt, the company was sitting on net cash.

5. Growth Prospects

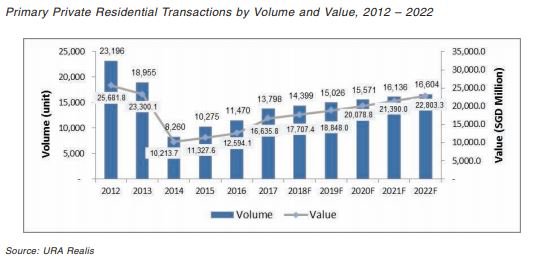

The prospects of PropNex will be much dependent on the housing market trend in Singapore. Moreover, the local property market has shown signs of recovery since the last housing bubble in 2010-2013.

The en-bloc sales are on the rise with a 7-year high of S$8.1 billion recorded in 2017. Generally, the number of new units launched in the next 1 to 2 years in the property market is expected to rise.

Looking forward, PropNex intends to expand its presence regionally. The company aims to improve its market share in ASEAN countries through franchising, licensing, strategic alliances, JV and M&A.

In fact, PropNex has entered into Indonesia market since 2016 and has around 600 salesperson and 15 offices currently. The company is also expanding its business in Malaysia and Vietnam recently in 2018.

Conclusion

With an IPO price of S$0.65 and earnings per share of 5.3 cents, this translates to a P/E of 12.3 times. In addition, assuming adjusted EPS of $0.044 & dividend payout of 50%, it translates into at least a 3.3% yield based on IPO price. F

or some comparison, APAC Realty Ltd which was listed on SGX lasted September, is currently trading at a PE around 11x times.

As we can recall, APAC Realty offered some 4.4 mil shares to the public and IPO price was $0.66. The IPO deal certainly looks juicy for Propnex as the public only gets allotted 2.1 mil shares at $0.65.

Overall, I am positive in the short term and maintain neutral over the long run. As the property market in Singapore is currently on an uptrend, the company would probably see further upside in net profits. Furthermore, there are some of the renowned asset management firms like Fidelity Investment Management and Value Partners vested in the IPO.

In the long run, the earnings of the company will be highly dependent on the cyclical Sg’s property market. This explains why i am staying neutral over the long term.

Do you know that Master Investors like Warren Buffett has his own Unique Investing System which you can emulate yourself? We have distilled it into a simple 10-Step Checklist for you to decide how or when to buy/sell your stocks.

Simply click to receive your copy today!

Last but not least, do remember to Like us on Facebook too as we share the latest investing articles and stock case studies for you!