Pchain ICO Review

So what is Pchain?

Pchain or Promotion Chain, aims to bring about a decentralized promotion system to resolve the issues facing traditional promotion industry today.

You can check out their whitepaper here.

The Big Problem: Small businesses have to do marketing (promotion) effectively to uplift their brand awareness and in turn, make profits.

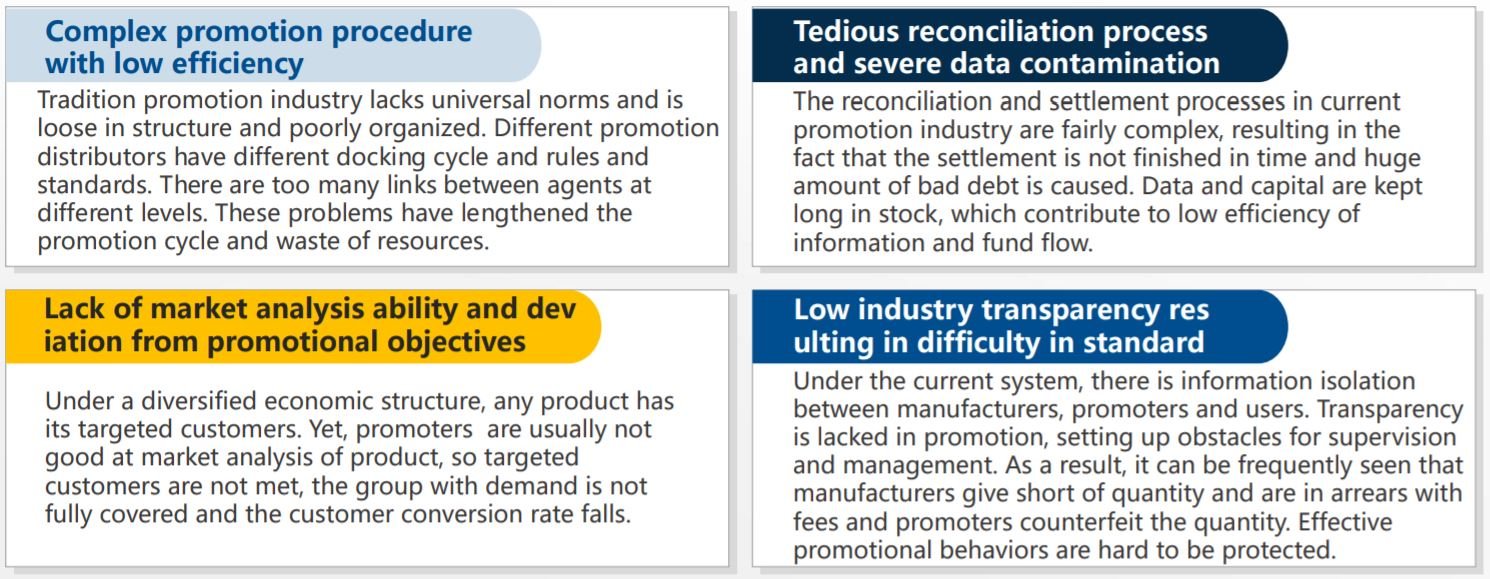

This can be broken down into 4 big issues as shown below:

In short, under existing industrial structure, product manufacturers have almost no controlling power over promotional behaviors. Promotion only relies on previous experience, money input and luck. Therefore, promotional effects cannot be guaranteed.

On the other side, promoters are restrained by intermediate links, so they have no say on products and cannot make any decision. They are faced with not only low returns but also arrears or cut payment.

Pchain is the solution to the problems above…

Pchain ICO Value Proposition

In essence, Pchain develops a decentralized platform which gives back the power to manufacturers when it comes to promoting their brand/products.

Here’s how Pchain works (in layman terms):

- Manufacturers can draw up promotion tasks and rules & release to the task-board

- Promoters take on the tasks and accomplish them according to the Manufacturers’ rules to claim Pchain tokens.

Benefits of Pchain for Manufacturers

- Mechanism has time-stamp and tamper-resistance, so that promotional results are authentic, costs are lowered and efficiency is raised.

- A broadcast can increase product exposure and the number of users in promoters’ community, thus achieving added value.

- Transparency of promotion chain can help achieve product copy right protection, brand value creation and adding and wider influence

Benefits of Pchain for Promoters

- Taskboard is available to the whole network. Smart contract, credits accumulation, and PC can facilitate effective promotion and quick settlement, protect promoter rights and diversify profitability means.

- Most updated and comprehensive task information means that Promoters can go for more targeted projects to promote.

- The PC deposit rules of promoters’ community can effectively increase product reliability of manufacturers and guarantee stable income for promoters.

- Assuming tokens’ price increases, it will lead to more earnings for promoters as the community keeps expanding.

Pchain Token Metrics

In total, 21 billion tokens (PC) will be mined. Team will be allocated 4.7% (1 bil PCs) and 23.8% will be catered for setting up Promotion Chain’s operations. If I am not mistaken, 11 bil PCs will be kept as reserves and only released in the future when the ecosystem gets bigger.

1.5 Bil PCs are used in the global promotion of Pchain including roadshows, exhibitions and cooperation with media. And out of that, 6.66 million PCs will be airdropped for FREE when you attend the Huobi Talk on 23/2/18 20:00 GMT.

Get FREE Tokens; visit the link below:

https://www.youtube.com/HuobiPro/live

Psst… Huobi.Pro recently launched its new platform called HADAX. And in this whole week up to 28 Feb 2018, HADAX is currently offering free tokens when you tune in to their LIVE Youtube event!

Find out more details here -> https://www.smallcapasia.com/huobi-hadax-exchange-vote-for-token-listing/