Investors who look at China Evergrande saga would probably be spooked and in turn, avoid the Singapore property developers in fear of contagion.

On the local context, one company that seems to be trading on the cheap (4.9x FY22F P/E) but neglected by investors is none other than Oxley Holdings.

In this article, we are going to address the company’s relatively higher debt load and how it is strengthening its financial position via divestments and future billings.

About Oxley Holdings

Oxley is a home-grown property developer with a diversified portfolio, including property development, property investment and project management.

The Group has a business presence across nine geographical markets, including Singapore, the UK, Ireland, Cyprus, Cambodia, Malaysia, China, Vietnam and Australia.

The Group specialises in the development of quality residential, commercial, industrial and hospitality projects. Since its incorporation in March 2010, Oxley has launched a portfolio of 48 projects across various countries, of which 36 have been completed.

For those who want to know more about Oxley can also refer to our past article here.

Oxley’s current financial position

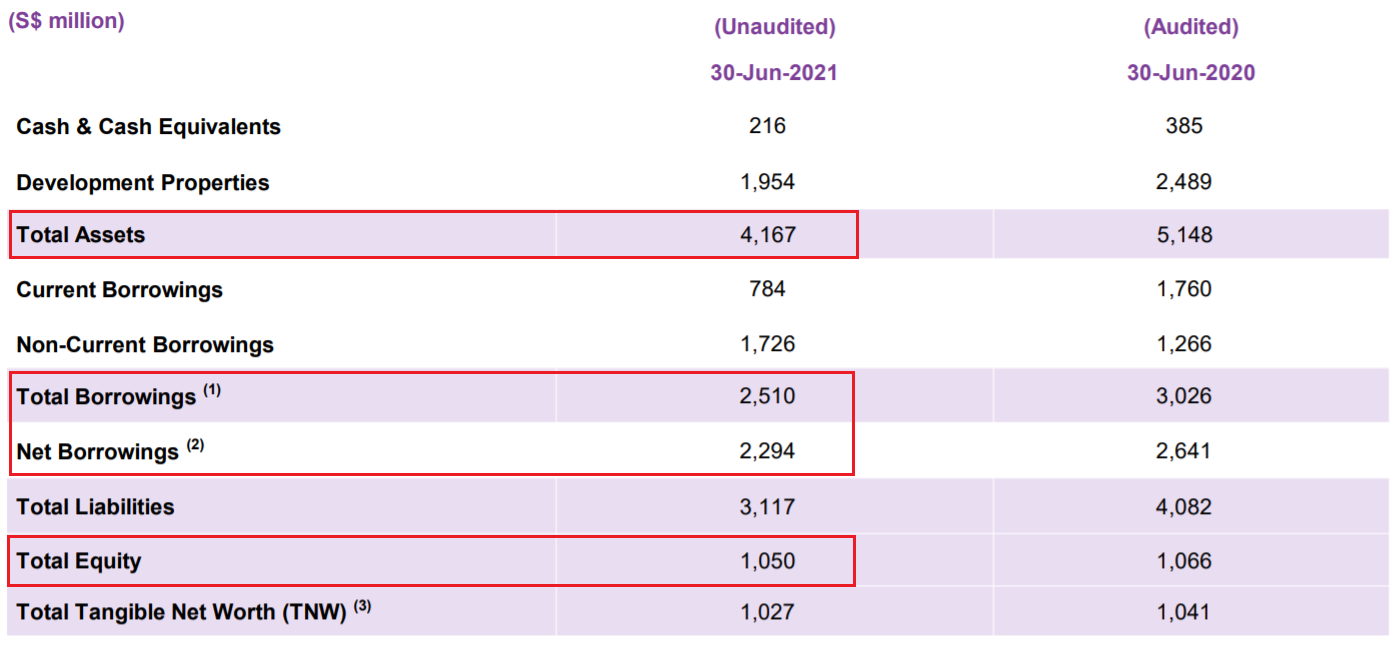

From the above, we can see from the highlighted parts that Oxley do have a high Net Debt/Equity of ~2.2x as of FY2021 ended 30 June 2021.

All these are going to change in 2022.The net borrowings have seen a considerable decline since the past year from S$2.64 billion to S$2.29 billion and there is a clear debt repayment strategy in place as shown below.

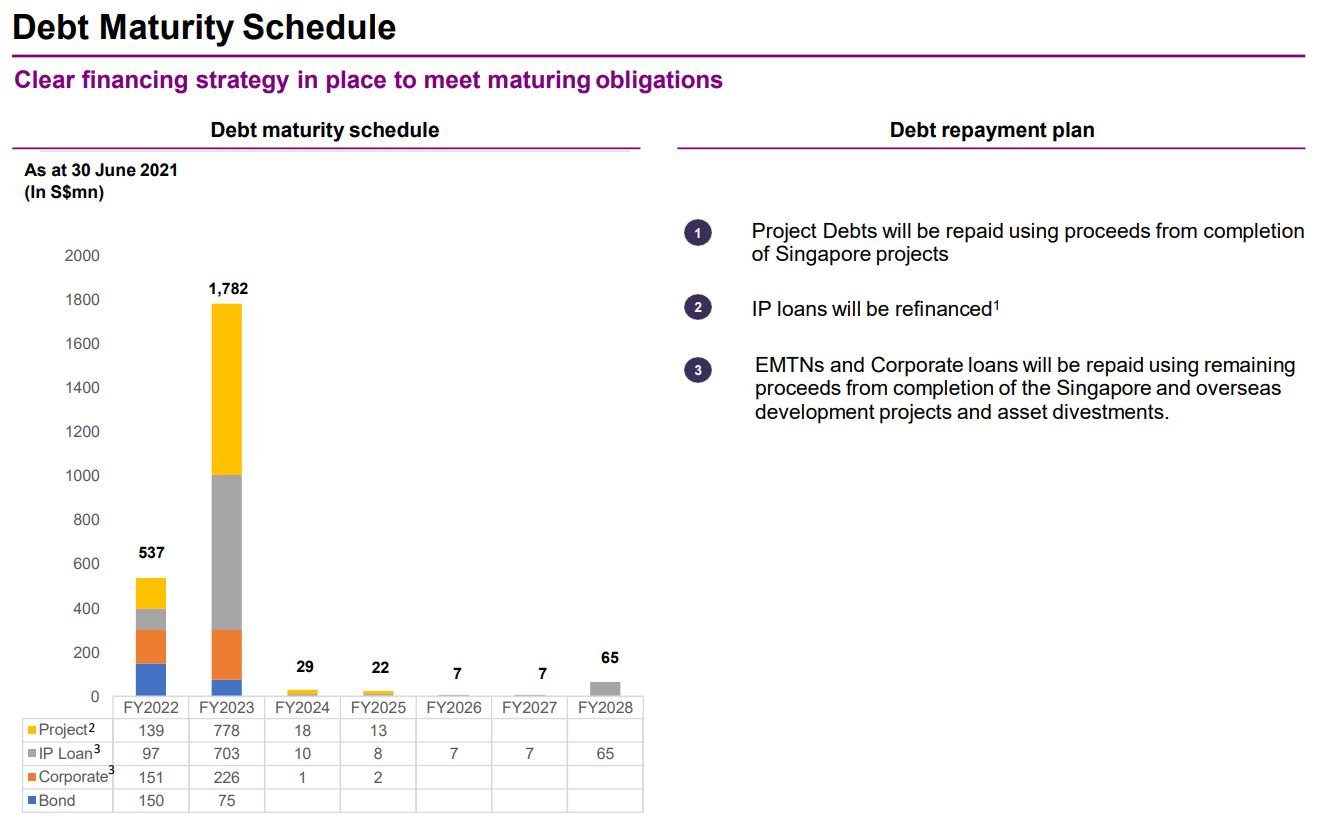

While a large part of the debt is due in FY2022 and FY2023, they have already segregated the borrowings into 3 types and look to refinance/settle them as per below:

- Project Debt (total S$948 million) – to be repaid from Singapore projects’ completion

- IP Loan (total S$897 million) – to be refinanced

- Corporate loans (total S$380 million) – to be repaid from asset divestments, overseas and Singapore projects’ completion

Below, we will look at how the various parts play out to cover the bulk of the debt.

Future Progress Billings [SG Projects]

According to the press release, approximately 91% of the Group’s Singapore residential units has been sold as of 8 August 2021, representing 87% of the total GDV or approximately S$4.3 billion.

The Group’s effective stake of secured sales amount to approximately S$2.6 billion while future progress billings from the sold units amount to approximately S$1.7 billion.

So just simply taking the S$1.7 billion inflow would be able to clear off 2 types of the debt – project debt and corporate loans totalling S$1.33 billion.

This is also reiterated during the AGM Q&A B2:

“With the completion of the following Singapore development projects in the years 2021 and 2022 and repayment of the underlying loans, the Group’s gearing ratio is expected to decline by approximately 1.00 based on the equity as at 30 June 2021”.

On top of that, the borrowings are also ‘protected’ against the overseas projects and asset divestments which I will cover below.

Overseas Projects and Asset Sales

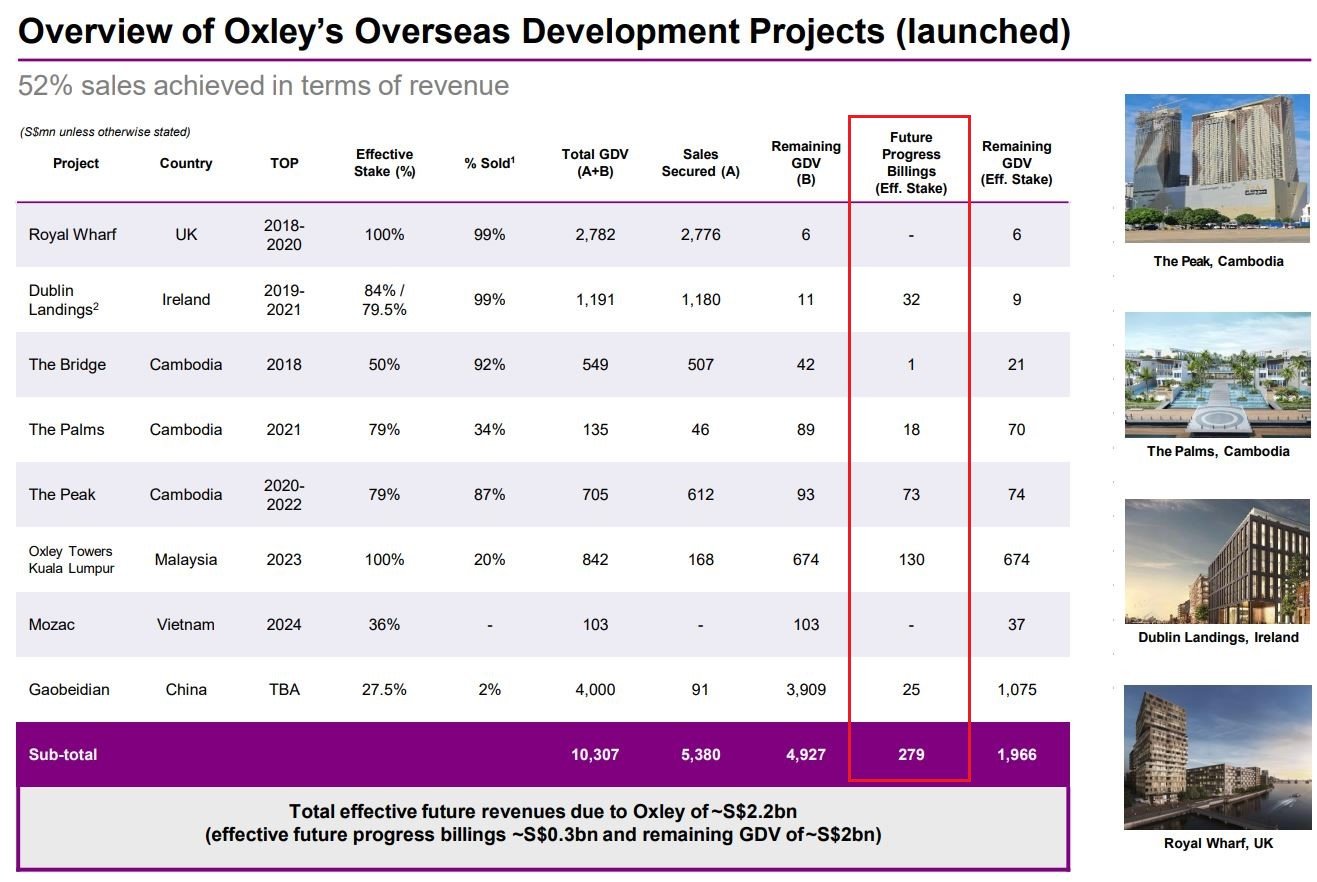

Taken from the FY2021 results, future progress billings amount to S$300 million with total gross development value (GDV) of almost S$10.3 billion to be recognized in future!

For those uninitiated, total gross development value (GDV) represents the estimated valuation of the property projects on the open market once all development works have been completed.

Last but not least, Oxley has divested the land parcels in North Sydney, Australia for gross proceeds of approximately S$96.3 million. The Property had a book value of approximately S$60 million as at 30 June 2020 and it translates into an estimated S$36.3 million gain for the divestment.

As there is no outstanding bank loan secured by the asset, the entire amount of the net proceeds will contribute positively to the cashflow of the Group.

Oxley Executive Chairman and CEO, Mr Ching Chiat Kwong, is upbeat about the sale and commented,

“The sale of the land parcels in Sydney generates material positive cashflow for the Group, which strengthens our cash position and balance sheet. This will unlock shareholder value, and is in the best interests of the shareholders.”

Bright Outlook Ahead

In an interview with SGX, Oxley CEO also shares some of his future plans in 3 focus areas:

- Township development

- Leveraging on work-from-home trend

- Focused on ESG and human capital

Below are some excerpts of his commentary:

“Township development with governments minimises our capital investment, and hence, lowers our risks. It provides a stable recognition of earnings over a longer period of time, compared to plain vanilla property development projects. This will be our focus for the next few years.”

“the work-from-home trend arising from the COVID-19 pandemic presents another opportunity for property developers who know how to reposition themselves.”

“We’re always looking out for good, talented people to join us and grow together,” and by how Oxley will focus on its Environmental, Social and Governance (ESG) strategy, which revolves around its biggest asset – human capital.

Conclusion – Oxley Share Price at all time low

Oxley is actually a frontrunner beneficiary in the recent property boom in Singapore. They were early buyers of enbloc sites in 2017/2018, before land prices and construction costs skyrocketed. Hence, they enjoyed bigger profit margins compared to those recent land site buyers.

Investors are missing out on a hidden gem clouded by the confusion caused by Evergrande default. I reckon this stock will see good appreciation over the next 12-24 months as the Company announce good profitability and stronger balance sheets.

Keep a watch on your radar screen.

For more reading: