On 15 October 2021, Ecomate Holdings Bhd (Ecomate) issued its IPO Document and opened its invitation to subscribe its IPO shares at RM 0.33 a share. Its date of listing is set to be on 8 November 2021.

Here, you may study the company in greater detail by downloading its Prospectus at these links: Part 1 and Part 2.

Alternatively, you may read this write-up, where I summarized 8 things that you need to know about Ecomate before you invest in it:

#1 Ecomate’s Business Model

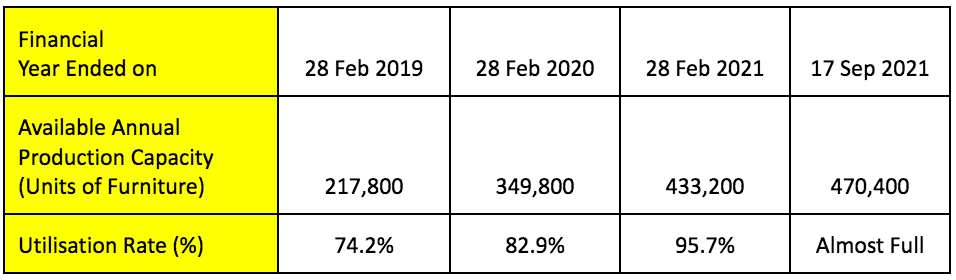

Ecomate designs, manufactures, sells, and exports Ready-to-Assemble furniture in two factories located at Muar, Johor. Mainly, they include bedroom and living room furniture. It had begun its operations in 2016 with two production lines in a portion of its first factory, Factory A.

In 2018, Ecomate had expanded its operations by renting the remaining portion of its first factory, Factory A and its second factory, Factory B. This has increased its number of production lines from two to four in 2018.

Then in 2019, Ecomate added one more production line at Factory A. Thus, Ecomate is now operating a total of five production lines at two factories with a total production capacity of 470,400 units of furniture per annum.

#2 Financial Results

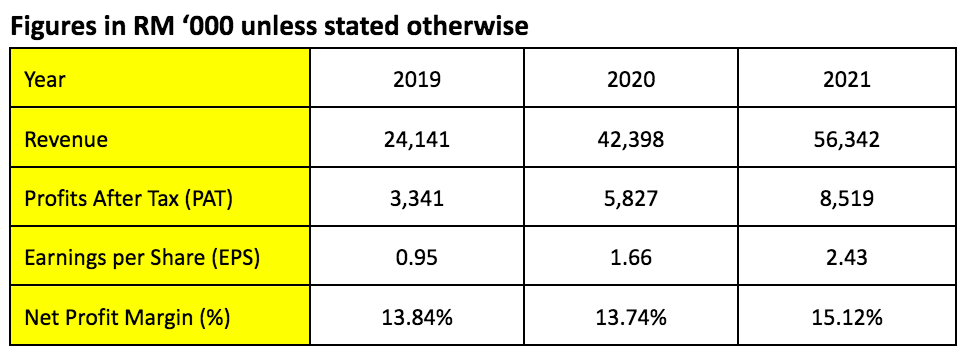

Ecomate reported an increase in revenues and earnings for the last three years. Revenue has grown from RM 24.1 million in 2019 to RM 56.3 million in 2021.

In that three-year period, it has increased its earnings from RM 3.3 million in 2019 to RM 8.5 million in 2021.

The rise in its revenue was contributed by a growth in local sales and exports to Asia, Australia, and North America.

Its earnings has risen in tandem with its rise in revenue as Ecomate had maintained a stable net profit margin in 2019-2021.

#3 Financial Position

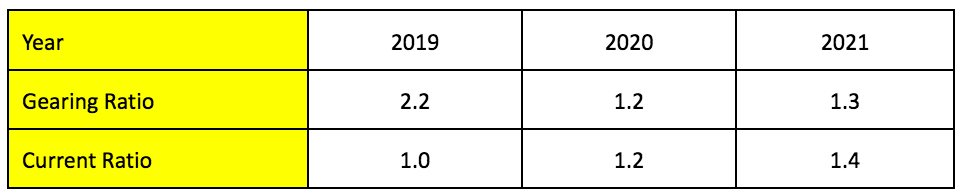

Ecomate had reduced its gearing ratio from 2.2 in 2019 to 1.3 in 2021. The drop in gearing ratio was due to a growth in total equity for that three-year period. It is because of its increased retained earnings in that period.

Ecomate had grown its current ratio from 1.0 in 2019 to 1.4 in 2021. This is due to its increase in the amount of cash and inventories during the three-year period.

#4 Utilization of IPO Proceeds

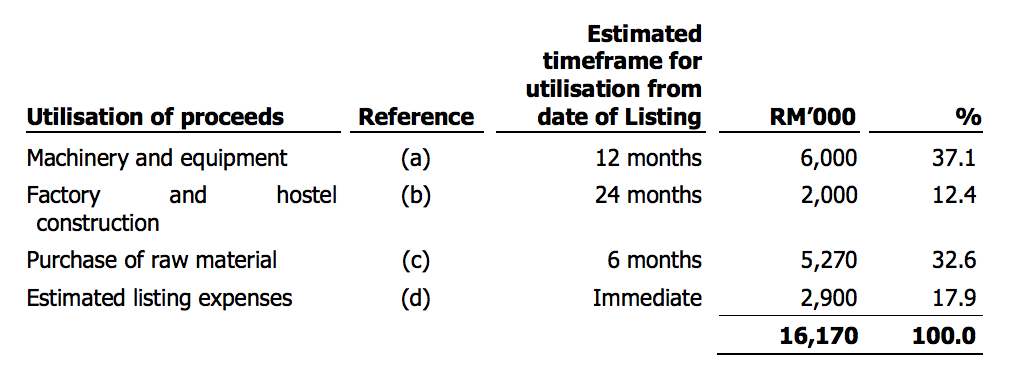

Ecomate plans to raise gross proceeds of RM 16.17 million from its IPO Exercise and of which, it intends to allocate them for the following purposes:

Machinery and Equipment

This consists of one unit of edge banding machine, panel saw, CNC machine, air compressor, dust collection system, two screw packing machines, and as well as two forklifts. It would grow its production capacity by 79,200 furniture per year.

Ecomate would house these machinery and equipment at the additional spaces cleared at Factory A, which were used as a warehouse. It rented another bigger warehouse in November 2021 to store raw materials and finished inventories.

Factory and Hostel Construction

Ecomate is building its third factory, Factory C situated at Muar, Johor. Factory C would consist of three production lines and a hostel.

The construction cost is as much as RM 9 million, of which Ecomate intends to allocate RM 2 million raised from gross proceeds to fund this construction.

Purchase of Raw Materials

This includes particle boards and medium-density fibreboards (MDF).

#5 Major Shareholders

Koh Cheng Huat and Jason Koh, his cousin, would remain as major shareholders of Ecomate where they each own 33.1% shareholdings of the company.

After its IPO listing. Koh Cheng Huat is appointed as Executive Director of Ecomate while Jason Koh would be leading the company as its Managing Director.

#6 Risks

Ecomate has revealed several risks that are inherent to its business operations; below are 2 main ones to take note:

Concentration Risk

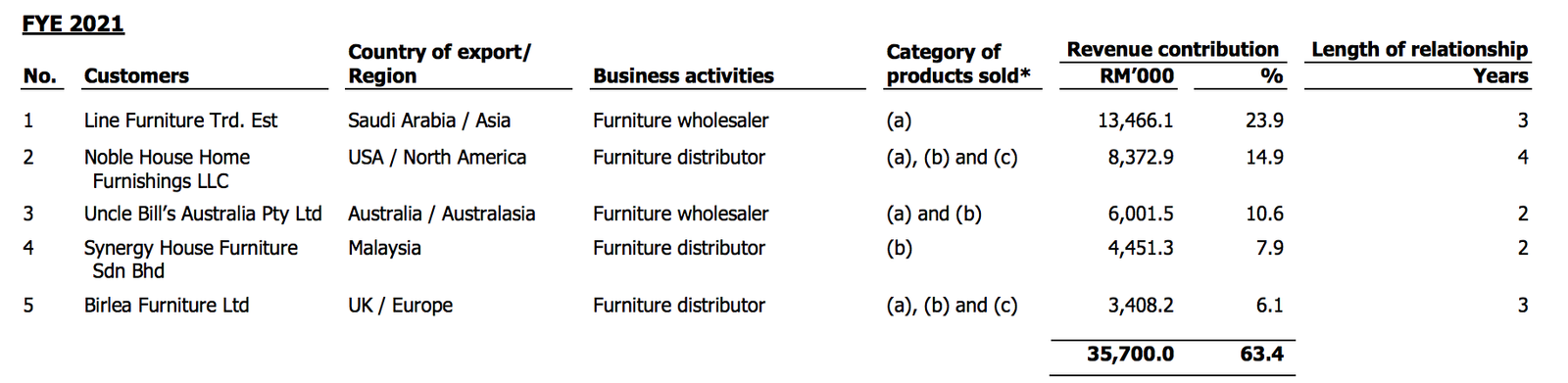

In 2021, Ecomate generated RM 35.7 million (63.4%) of its revenue from 5 main customers as follow:

However, it revealed that in the financial year 2022, Ecomate did not earn sales from its two biggest customers in the financial year 2021 namely, Line Furniture and Noble House Home Furnishing.

Hence, Ecomate’s financial results would vary depending on its ability to secure continuous sales from its major customers in the future.

Foreign Exchange Rates

Ecomate had generated 75%-85% of its group revenues from the export market in 2019-2021. Thus, Ecomate would be subjected to foreign exchange risks.

#7 Dividend Policy

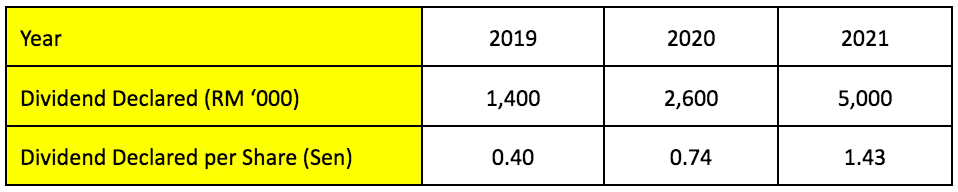

Ecomate does not adopt a formal policy on dividends. In the past three years, it had declared the following amount of dividends:

#8 Valuation

After its IPO listing, it would have 350 million ordinary shares issued and hence, it would have market capitalisation of RM 115.5 million.

The IPO share is offered at P/E Ratio of 13.56x based on its earnings of RM 8.519 million in 2021. 1.43 sens dividends divided by IPO price of 33 sens will translate into a decent 4.3% dividend yield.

Conclusion

Ecomate reported a growth in revenues and earnings in 2019-2021. Of which, it was contributed by its two biggest customers namely, Line Furniture and Noble House Home Furnishing during the period.

Investors should also take note that these two customers were missing in their top positions as the largest customers in FY2022.

On a bright side, it intends to grow its production capacity by constructing Factory C, its Factory #3 in Muar, Johor, which is home to numerous furniture manufacturing companies namely, Wegmen, Mobilia, Lii Hen, Sern Kou and Homeritz.

Thus, investors may study these companies and make comparisons of their stock fundamentals and valuation to make better investment decisions on stocks in this sector.