Excerpts from Maybank report

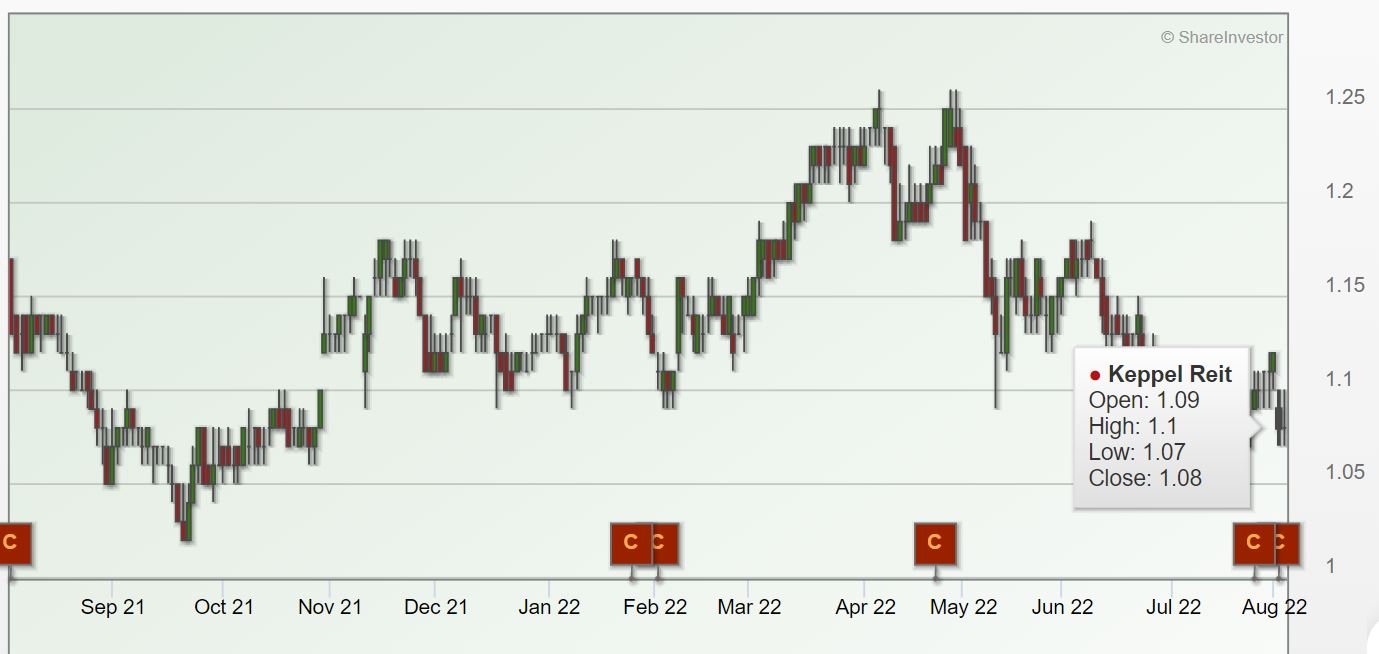

Keppel REIT (SGX: K71U)

- Keppel REIT is one of the largest S-REITs at SGD9.0b AUM, with significant exposure to Singapore’s Grade-A office market (at c.80% of NPI) and financial institution tenants (at c.29% of its NLA).

- Occupancy to improve on the back of strong demand recovery, and rents expected to accelerate against tight near term Grade A office supply.

- Pivot to Australian suburban office assets has extended its portfolio WALE and suggests longer term growth upside.

- Gearing is low and balance sheet strong to support DPUaccretive deal opportunities, either from its sponsor Keppel or third parties.

Reiterate BUY. Risk reward is favourable at 5.5% FY23E yield, with limited downside from interest rate and cost sensitivities. We raise our DDM-based TP (COE: 6.6%, LTG: 2.0%) to SGD1.25 from SGD1.20.

Sound fundamentals, favourable risk-reward

Keppel REIT’s 1H22 DPU rose 1.2% YoY/3.1% HoH, as the Keppel Bay Tower acquisition helped offset its divestment of 275 George St. (Brisbane) in Jul 2021 and lower contribution from 8 Chifley Square (Sydney).

Fundamentals remain sound, backed by tailwinds in office demand, improving occupancy and accelerating rents. Leasing velocity is strong, and we raised DPUs by 3% to factor in a stronger rental recovery and lower interest costs.

Keppel REIT higher occupancy, costs cushioned

Portfolio occupancy increased to 95.5% (from 95.1% in 1Q22) as strong backfilling at MBFC, 8 Chifley Square and Pinnacle Office Park offset the transitory vacancies at OFC, ORQ and Keppel Bay Tower.

Based on leases under documentation, management expects occupancy to climb to c.97% in the coming quarter(s).

We think margins are well-cushioned, as KREIT has raised service charges at MBFC and ORQ to offset higher utility costs, while these are passed through in Australia and South Korea.

Positive leasing, stronger rental reversion outlook

Leasing activity was strong at 407k sf (vs 475k sf in 1Q22) with new demand and expansion led by tech (c.20%), financial (c.20%) and real estate sector tenancies (c.17%).

Rental reversion was at +8.7% for 1H22 and +7.5% for 2Q22 with average signing rents higher at SGD11.43 psfpm (from SGD11.15 psfpm in 1Q22 and SGD10.56 psfpm in 4Q21).

Rents have climbed sharply since May due to tight supply, and management expects a double-digit positive rental reversion into FY22, helped by low SGD9.82 psfpm expiring rents, and backfilling of vacancies at MBFC left by SCB and DBS.

Gearing healthy, low interest rate sensitivity

Gearing fell to 37.9% (vs 38.7% at end-Mar 2022) while its interest cost was lower at 1.93% (vs 1.98% in FY21). KREIT has lifted its fixed-rate borrowings to 73% (from 63%) and refinanced FY22 borrowings, while a 50bps hike in borrowing cost could lower DPUs by 2.4%.

Cap rates tightened HoH for MBFC (by 15-38bps), and management has not observed expansion for prime CBD assets. While we expect KREIT will continue to eye AUM growth in core markets, deal visibility is low amid interest rate volatility.

You can find the full report here and the company website here.