Transferring money from Singapore on a regular basis? Or maybe you need to send a large money transfer of Singapore Dollars to buy property overseas?

The following comparison looks at the currency exchange rates, transfer fees and transfer limits with top providers for money exchange in Singapore to help decide who will suit your transfer needs best.

If you’re thinking of InstaRem, CurrencyFair or Transferwise, each has differences in what they charge to transfer money from Singapore. Let’s look at this in more detail.

What should Singapore investors look for in a money transfer service?

How to Choose a Money Transfer Service

Investors in Singapore might ask the following questions, when trying to choose a money transfer service:

- Who is better for large money transfers from Singapore: Transferwise, CurrencyFair or Instarem?

- Who has the cheapest money transfer fees?

- Who offers the better exchange rates for Singapore Dollars?

And ultimately which provider will save money on your currency exchange.

InstaRem

To begin, let’s look at what the InstaReM fees are for money transfers from Singapore for different amounts and in popular currencies.

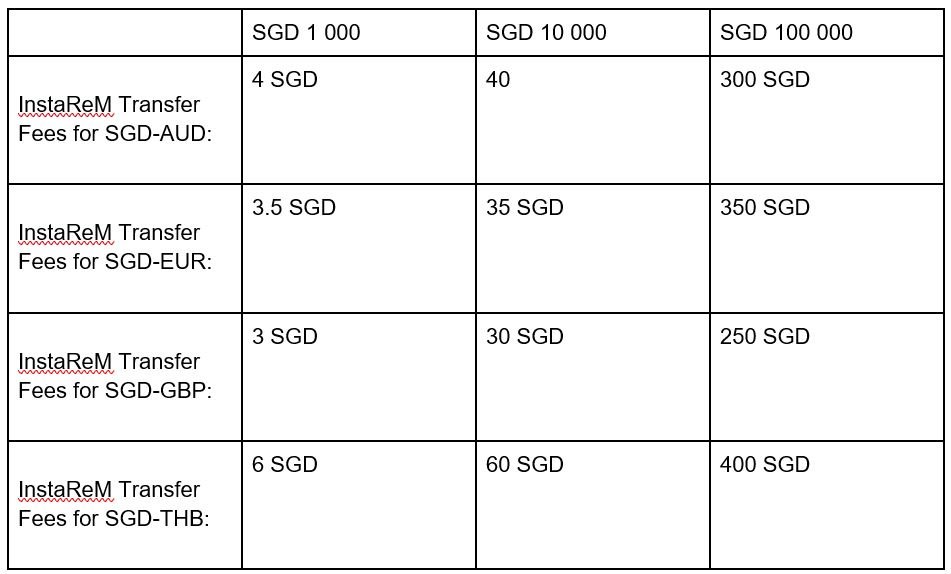

To send $1 000, $10 000 or $100 000 Singapore Dollars by bank transfer with InstaRem in AUD, EUR, GBP and THB at the time of the comparison, the fees were:

InstaReM fees:

(Based on fees and rates charged at the time of a desktop comparison on 27 Jan 2020)

InstaReM exchange rates:

InstaReM uses exchange rates sourced directly from Reuters and instead of a margin, InstaReM adds a nominal fee to this exchange rate. However the caveat for this “Zero-Margin FX rate” is that this is applicable only for certain currencies and certain trading hours.

CurrencyFair

With CurrencyFair, there is one fee charged to transfer money by bank transfer to the recipient. This fee is typically $5 (or the currency equivalent) and is the same, no matter the transfer amount.

So whether you are transferring $1 000 or $100,000, the fee to transfer out is the same.

To send $1 000, $10 000 or $100 000 Singapore Dollars by bank transfer with CurrencyFair in AUD, EUR, GBP and THB at the time of the comparison, the fees were:

CurrencyFair fees:

Right now, new CurrencyFair customers in Singapore can get 3 months of unlimited free transfers. Find out how here.

CurrencyFair exchange rates:

CurrencyFair’s fees do not vary by destination, or amount sent, and the exchange rate offered is never more than 0.6% in excess of the currency market rate. Better yet, some customers can even beat that rate, using the CurrencyFair peer-to-peer marketplace.

TransferWise

TransferWise exchange rates:

TransferWise works by guaranteeing the same rate as the “mid-market rate” or currency market rate–but their fees are where the real cost of a money transfer could very quickly add up. The fee for converting currencies with TransferWise in Singapore can range from 0.35%-1%.

To send $1 000, $10 000 or $100 000 Singapore Dollars by bank transfer with TransferWise in AUD, EUR, GBP and THB at the time of the comparison, the fees were:

SUMMARY

There are many providers for international money transfers from Singapore.

We encourage people to shop around to get the best value available for their currency exchange in the fees charged and the exchange rates offered.