By now, everyone would have heard of the Novel Corona Virus (nCoV) or commonly known as ‘Wuhan Virus’ because of its origins. According to https://thewuhanvirus.com/, the number of infections has been jumping by a few thousand cases every day – causing widespread alarm over the whole world.

COV-19 – Not Deadly but Highly Infectious

That said, there is one positive lining amid all the panic and rife worries – the fatality rate of nCoV is not as deadly as the predecessor SARS – around 2% in Hubei & 0.2% outside Hubei versus 9.65% for SARS.

However, nCoV is much more infectious than SARS because it can be spread when the carrier has no symptoms beforehand aka asymptomatic. And that was how it has managed to spread from China to all parts of the world:

- Singapore raises DORSCON level to Orange

- 64 people infected on a giant cruise ship – Diamond Princess

- Panic buying in Hong Kong

With the Wuhan virus on the loose and no ‘confirmed’ cure yet, the Chinese government has also pushed back factory activities’ dates and restricted on the free movement out in the streets.

Quiet Streets Outside

Hubei city which has a population of around 11 million is locked down and even become like a ‘dead town’ with everyone staying at home to limit exposure as much as possible.

Given the rise in the nCoV cases in Asia countries like Singapore, Japan and Hong Kong, this similar scenario may also be on the cards if things go out of hand quickly.

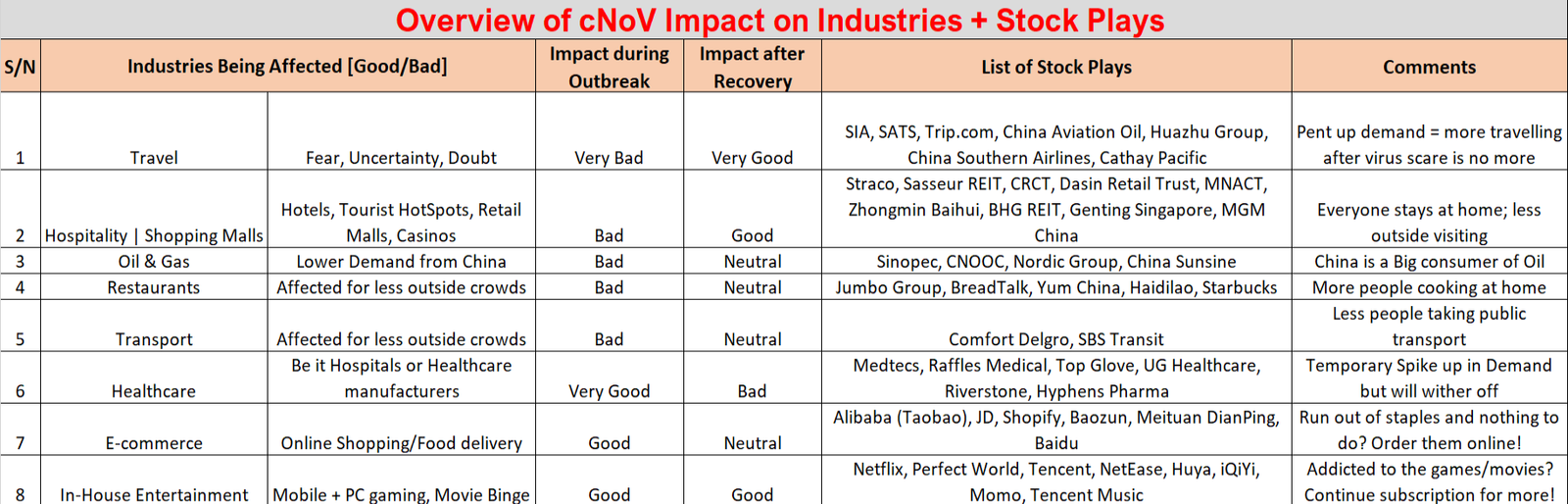

With that in mind, we came out with a list of industries and stocks on how they will likely perform for the 2 periods:

- During the virus outbreak &

- After the virus dies down.

COV-19 Impact on Companies/Stocks

>> FREE Report: 5 China Stocks To Buy For the Wuhan Virus Recovery <<

Let’s be honest. Many people want to be ‘safe than sorry’ and hence, curbing their usual activities and choosing to stay at home.

Imagine multiplying that ‘behaviour’ across the hundreds of millions of people in China, Singapore, Hong Kong etc…

It will definitely have a huge impact on the economy especially when China is also the manufacturing hub in the world and a big economic superpower.

Here’s an overview of the cNoV impact on various industries + stock plays:

From the onset, we can see that the Oil, Restaurants and Transport sectors would be negatively affected but not necessarily rebounding after the virus goes away. In my opinion, demand will simply go back to their usual levels, and its not like people will drink 2 or 3x more Starbucks drinks just because I haven’t drink it for some time.

Healthcare sector is enjoying a FOMO (Fear Of Missing Out) moment and we already have counters which skyrocketed beyond their fundamentals. Hence, they may be a good short-term play if the virus situation keeps worsening. However, once the virus scare goes away, people are likely to dump them for those bargain counters.

The Travel + Hospitality industries are literally forsaken right now as people avoid going to crowded places. On top of that, China’s huge middle class accounts for many countries’ tourist numbers too. That said, they are likely to rebound strongly due to pent up demand – my family wanted to go overseas but worried about the stigma we will receive being Chinese as well!

Lastly, E-commerce and Entertainment industries have the most to gain from this outbreak and beyond. With people stuck in the house, they will pivot towards food delivery, online shopping and entertainment options like gaming, music and movies etc.

Conclusion – When & What Stocks To Buy

Taking a page from Sir John Templeton investing quote, we – as investors, should invest at the time of maximum pessimism – Instead of selling in panic (or hoarding groceries in panic).

Furthermore, IMO, governments these days are better prepared due to the previous SARS case. Although the virus is still spreading, the rebound of stocks will come once lesser and lesser people are diagnosed with the illness – a slowdown in cases means we are winning the battle.

Therefore, investors shouldn’t panic and sell all their Chinese stocks on the coronavirus news. Instead, they should keep a level head, await further developments, and remember that stronger companies will bounce back over the long term. In fact, China is already executing to pump billions into the markets amid growth fears.

That said, the question remains – what stocks should you be buying to ‘capitalize’ on this temporary outbreak, especially when there is a huge list of companies as shown above?

With that in mind, we have come out with a FREE report highlighting 5 China stock plays for this Wuhan virus situation.

Click on the url link below to download it now: