Year 2022 marks the period where we step into both the world of normalcy and turbulence at the same time.

“Normalcy” because we take our Masks off and hangout outside with family and friends.

“Turbulence” because of the geopolitical + economic chaos happening in the world – causing things like high inflation and interest rates.

Good bye 2022; Hello 2023

So how should you invest in 2023 to stay ahead of all this uncertainty? With GST going to 8% and interest rates are off the roof?

I don’t know about you but personally I have 4 investing mantras or principles that I follow and wish to share with you all in this post + video (link below).

1. Knowing thyself

Have you ever heard of the idiom – 知 己 知 彼, 百 战 百 胜?

Translated to English, it means Know yourself, know your enemy; hundred battles, hundred won.

When it comes to investing, many investors don’t know what type of investments are suitable for themselves. They simply just “chargeeeee” towards the enemy such as cryptocurrencies and high growth sexy stocks because they hear of people bragging of their stories on how they make 10x return of a particular stock or whatsoever.

Ultimately, you get lost in the big ocean full of the big whales and sharks and you don’t even know what hit you.

If there’s one key takeaway for this video, it is to find out about your own risk tolerance and invest based on that. For example, if you are 60 years old and near to retirement, you shouldn’t invest the way youngsters do because they have a much longer runway than you!

Instead, you should invest in dividend paying stocks and REITs…

Hold on.. I know what you are going to say:

“Wah but REITs all go down because of high interest rates what?!”

That brings us to the 2nd point.

2. If you fail to plan, you plan to fail.

The 2nd investing mantra is to stick to the plan.

When markets turn choppy, even experienced investors can become too focused on short-term movements.

This can lead to hasty decisions, such as trying to time the markets or for instance, buying into US tech stocks at their all-time highs.

Therefore it’s crucial to have a well-structured plan in place so that you can stay committed to it.

Take for example myself. I am still putting money into the robo-advisors every month for me, for my wife and my kids.

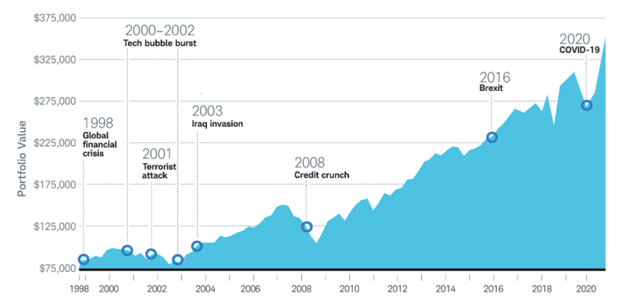

Because history has proven that stock markets have gone up in the past against all odds be it the global financial crisis, tech boom bust, Euro credit crunch and more.

And think about it, You can even take advantage of undervalued quality stocks you like such as Starbucks, Microsoft and more…

As Warren Buffett once said,

Given that everyone is fearful of high interest rates and an impending recession, isn’t it a good time to be greedy?

Essentially, the stock market is a device for transferring money from the impatient to the patient.

3. Build your portfolio

Third, after finding out your own risk profile and coming up with a plan, the 3rd principle is to build your portfolio or asset allocation.

The majority of us should always diversify our portfolio because the advice of concentrating your bets and watching it carefully is really meant for people who want to go big or go home.

Just take the recent SaaS stock or crypto boom and crash for example. Many YOLO investors think that these trends are the future until reality hit them hard.

On the other hand, if you have taken the advantage of the oil price boom and invested in O&G companies like Occidental Petroleum and Chevron, you will be sitting with more than 50% gains in year 2022.

And you don’t have to even invest in stocks when valuations are frothy. Those who are risk averse and kept a lot of cash as dry powder can grin from ear to ear as they plow them into government bonds that pay a 4% yield right now!

Hence, having a good asset allocation allows you to be better positioned to spread out the risks and tap into opportunities as they emerge. More importantly, it can give you the peace of mind, knowing that your portfolio will withstand the test of time.

4. Invest in things you know

The last principle is a unique one as I am going to share with you the story of Peter Lynch – one of the most successful and well-known investors of all time.

During his tenure at Fidelity between 1977 and 1990, Peter Lynch produced an annual return of 29% by growing the assets of the Magellan Fund from $18 million to $14 billion.

When asked about how he pulled off this remarkable feat, his advice is to invest in companies you know:

“Never invest in an idea you can’t illustrate with a crayon.”

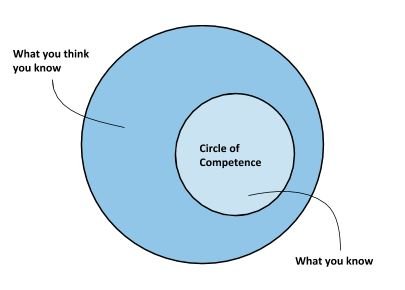

Before you rush off to buy shares in a company making your favourite products, you need to know that Peter Lynch is referring more of staying within your circle of competence and investing in companies that you understand well.

One of the company I know well is Zoom Video. I use it almost on a daily basis to liaise with 3rd parties and even my kids school teachers because of the convenience it brings us!

For my wife, you can say she’s addicted to Instagram. Always showing me how the other influencers are living the high life and travelling overseas etc. Yes, IG is part of Meta Platforms aka Facebook and you may say that it’s a controversial one now that Mark Zuckerberg is just spending billions of dollars on the metaverse with limited impact.

Hence, while knowing the company serves as a good starting point, investors still need to do more research into the business’s competitive position, growth prospects etc.

Conclusion

To sum it up, how I will invest in 2023 is to go for the big 4 investing principles…

- Focus on my investing style and circle of competence

- My plan is to continue my dollar-cost averaging into Robo-advisors, and buy stocks on sale now that everyone is fearful of a recession

- On the asset allocation part, Right now, I am 60-40 in stocks and cash so I intend to increase it gradually to 90-10 in the next 2 years

- And finally I will go for quality companies I am familiar with such as Zoom Video, Airbnb, Microsoft and more.

So what about you? What is your investing style and companies you are familiar with?

Comment below and let us know…

Dear James,

Not sure if it’s a coincidence, but I do invest following your 4 principles, albeit unconsciously….

1) I do dividend income investing. It’s simple & I’m good at it.

2) I’ve been investing regularly for more than a decade now, through rain & shine. I don’t use robots though, I DIY.

3) I’m 50 in dividend stocks/Reits, 50 in cash/bonds.

4) I’m mostly into SReits & SG dividend stocks. The only time I ventured overseas, I got scalded by AliBaba, but he’s already out of ICU & recovering well….

Dear Minx, thanks for your comment and its great to hear that!

Yeah.. i thought about this and think that the basic principles will work be it people doing growth, quality, dividend or even ETFs investing styles!

I really like Alibaba too because we use taobao on a regular basis.. i diy fix the wooden furniture too hahah