Margin Trading can be a risky game to play. Yet, if used correctly and with prudence, it can also help us reap better returns on our investments.

For a quick background, let us explain what is margin trading and how does it work when it comes to trading cryptocurrencies.

What is Margin Trading?

Margin trading with cryptocurrency allows traders to open a position with leverage and trade without putting up the full amount.

Simply put, it increases your buying power through leverage on your existing positions/funds and allows you to buy more cryptocurrencies than what you usually can.

By buying or selling on margin, traders can scale up their buying power or Leverage, potentially generating multi-fold profits beyond what their initial funds could have done (although you need to pay interest on it which we will cover later).

Leverage here refers to the ratio of the transaction size to the actual investment used for margin. For example, a 2x or 200% leverage means that you can open an order worth $2,000 with only $1,000 of equity/funds.

How does Crypto Margin Trading works?

Besides understanding what leverage means, crypto traders should also pay attention to these 3 things:

-

Maintenance Margin

According to Investopedia, maintenance margin is the minimum amount of equity (in the form of funds/positions) that must be maintained in a margin account. In the context of the crypto market, an investor must stake a certain coin like USDT or BTC as equity.

In the event that the coin moves in the opposite direction of your position and goes below your maintenance margin, a “margin call” is triggered. The exchange will either start liquidating your assets to get its money back or will simply request the funds from you through SMS/email.

Thus, the maximum you can lose is the amount you invested (your initial margin) in order to open the position.

TIP: A margin call can be offset by contributing more funds to the order book you have the margin in (eg. BTC/USDT). When you deposit more funds, the margin ratio is increased.

-

Interest Rate

As the saying goes – there is no free lunch in the world. For crypto exchanges to ‘lend money’ to you for leveraged trading, you will need to pay interest for the borrowed coins.

The range of the interest rates varies widely across crypto trading platforms and crypto trading pairs. It is similar to Forex where the more popular trading pairs (e.g. BTC/USDT or ETH/USDT) gets a higher leverage as there is more volume for them.

Take for example: Huobi Pro platform, their daily rate of loaning USDT is 0.1%. Daily rate of loaning altcoins such as BCC, ETH, LTC, ETC, DASH, XRP, EOS, OMG, ZEC is 0.02%.

Most platforms use 24 hours as a day and any time less than 24 hours will be considered as the full 24 hours. Do remember to repay the interest when you repay the loan too!

-

Going long or Short positions.

The good thing about margin trading is that you can choose to go long or short.

The price of Bitcoin has fallen from its all time high of USD19,000+ to around USD9,240+ at the time of writing. That is a drastic of more than 50%!

You would have been grinning from ear to ear if you have initiated a short position back then. In fact, I will consider it as a good hedging strategy if you hold many various altcoins and want to ‘protect’ your gains.

Going back to Huobi exchange as an example; they provide up to 3x leverage for the BTC/USDT pair.

Thus, if you believe that BTC price will drop from 20,000 USDT to 10,000 USDT, you can put up 10,000 USDT (or 0.5 BTC) as maintenance margin. With that you can loan 1 BTC from the exchange.

Proceed to sell 1 BTC at the price of 20,000 USDT and buy back that 1 BTC at the price of 10,000 USDT.

The total profits gained would be 10,000 USDT, double that if you have only used your own funds.

Exchanges that offer Crypto Margin Trading

Cryptocurrency used to be in its infant stage and are booming at a rapid pace. Similarly, cryptocurrency exchanges are racing one another to offer margin trading services, on top of the usual trading we do.

Here is a list of several popular Crypto Exchanges/Trading Platforms which allow margin trading:

- Bitmex

BitMEX is a derivative exchange that offers margin trading with the highest leverage on the market — up to 100:1 — as well as a whole package of futures contracts. That said, it has a complicated interface and high withdrawal fees. Beginners should stay away.

- Bitfinex

Bitfinex offers up to 3.3x leverage by receiving funding from the peer to peer margin funding platform. Unfortunately, the exchange is suffering from a reputational loss after the hack in 2016 and liquidity has somewhat dried up.

- Poloniex

One of the few largest crypto exchanges, Poloniex is a reputable choice for traders looking for a decent selection of altcoins to margin trade. Despite that, users have complained about slow website and poor support from Poloniex.

- Huobi Pro

Huobi Pro has been offering margin trading for a few years now and established itself as the leading provider for margin trading of cryptocurrencies such as EOS. In addition, there are many trading pairs available and the interest rate is relatively lower compared to other exchanges.

Without further ado, let’s move on to the actual margin trading process.

Getting Started on Crypto Margin Trading

Now that you have gone through the intricacies of margin trading, I will briefly run through the actual process of how to get started.

Huobi Pro has done a comprehensive guide here so we will take it as an example.

- Log into www.huobi.pro and click on the “Margin” button. You will enter the “Margin Trading” Page.

- Check out the available trading pairs for Margin Trading on the left.

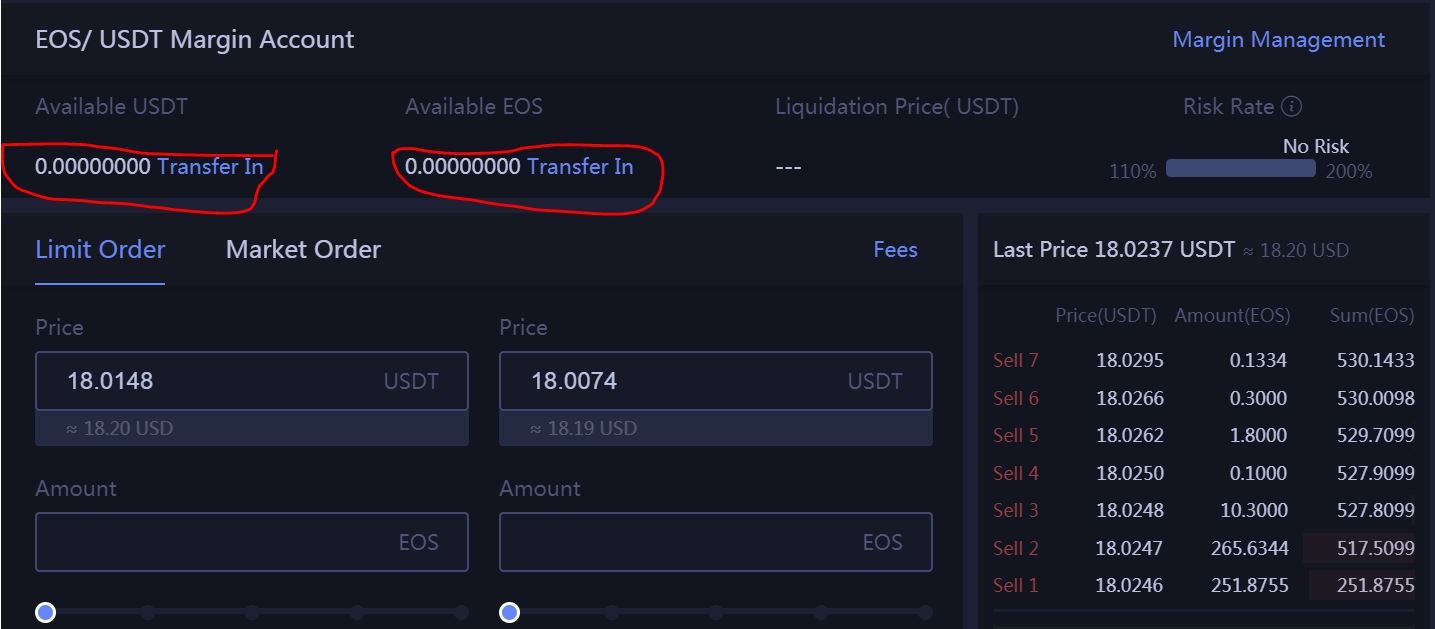

- After which, you have to transfer funds as Margin to this Margin Account. Here is an example of EOS/USDT pair:

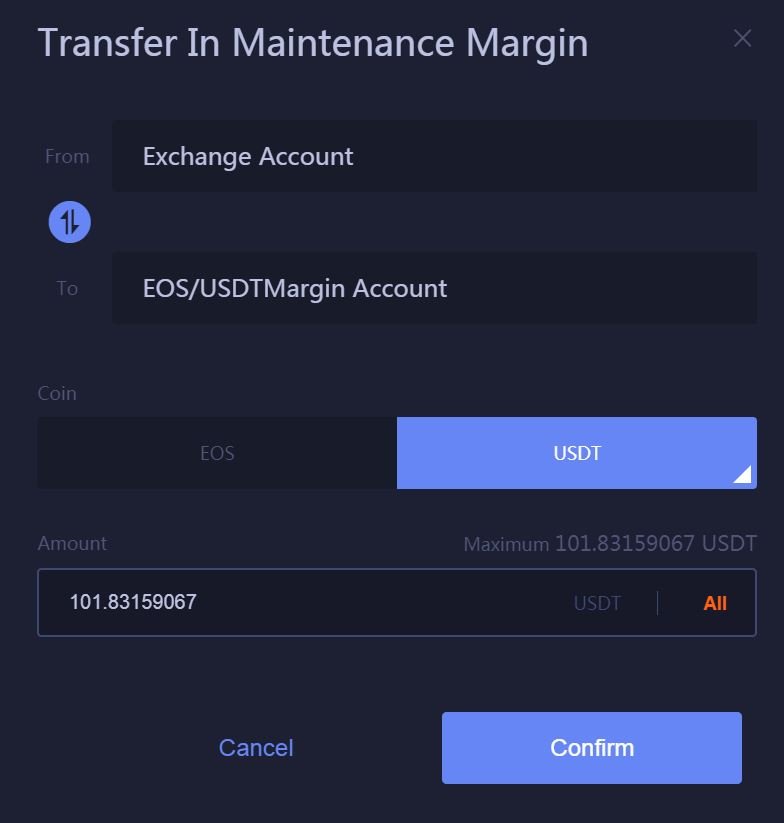

- Once you click on the “Transfer In” button, a pop up (shown below) will appear showing the maintenance margin (as mentioned previously). Enter the coin and amount, and proceed with “Confirm”.

- Once successful, click on the “Margin Management” button on the right to get started.

- In the “Margin Trading” page, the available amount is based on your Margin amount and leverage time; you can loan as you need. Using my example, I loaned USDT and my available USDT went up from 201.37 to 301.37.

- Scroll down further and you will see loan position and its details such as Loan Date and Rate, etc. in the Loan Position.

A few things to take note here:

- Each coin has a minimum and maximum loan amount. “Loaned” refers to the amount that you have successfully loaned from Huobi Pro. “Maximum” refers to the max limit that you can loan based on a formula (we shall not go into it) subject to what is shown on your page.

- Each trading pair has an independent Margin Account with independent funds. The funds will not be transferred between Margin Accounts.

In the event that you have many open leveraged positions and 1 Margin Account is forced to Liquidation or Margin Call, funds from other accounts will not be automatically transferred to this Account. - Do remember to repay the loan and interest periodically or if you have stopped trading by clicking on the “Repay” button.

To learn more on how to long/short coins with margin, check out the detailed guide here.

A Word of Caution

Crypto coins are digital assets with wide volatility and sometimes has such extreme fluctuations which may cause your position to reach liquidation value. When the risk rate of a Margin Account reaches a certain percentage ie. 110%; the account will be forced into liquidation (check out the margin call warning guide).

Thus, while margin trading of cryptocurrencies can potentially amplify your gains, your risks increase in tandem as well. Therefore, it is advisable to make short-term trading leveraged positions instead.

At the end of the day, crypto margin trading works as a double-edged sword and you should only trade with money you can afford to lose.