No time for the article? Click on my video above for a quick 5min review~

Tiger Brokers has recently launched another groundbreaking offering called the “Tiger BOSS Debit Card” – supported by the strategic partnership between Tiger Brokers Singapore and Wise.

What is unique about this card is that it rewards users with fractional shares when you use it for your everyday spending.

It captures my interest especially because this first-of-its-kind feature in Singapore brings about a whole new concept of rewards beyond the usual points system or cashback.

With that in mind, follow me through this article where I go through the things you need to know about the Debit card and whether it is worthwhile to sign up for it.

Key Features of the Tiger BOSS Debit Card

First off, lets dive into the key features of the Tiger BOSS debit card where there are some that stand out to me…

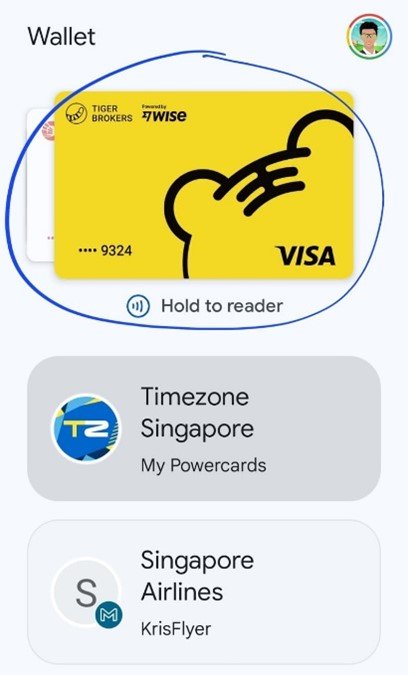

Instant Usage: Immediately after registration, users can dive into the digital world with their virtual card.

This card can be added to popular e-wallets like Google Pay, Apple Pay, and Grab Pay, making it ready for use within moments. The physical card follows, arriving in just about 10 business days.

High Efficiency: The efficiency of the Tiger BOSS card is notable, with transaction details appearing almost instantly online.

Moreover, rewards are credited swiftly, just one working day after the transaction, enhancing user satisfaction.

Fast Application Process: Applying for the Tiger BOSS card is a breeze through the Tiger Trade app.

Upon approval, the digital card is activated instantly, and users can view their card details directly on the app. This process not only simplifies access but also encourages immediate engagement with the card’s benefits, including earning fractional shares right from the start.

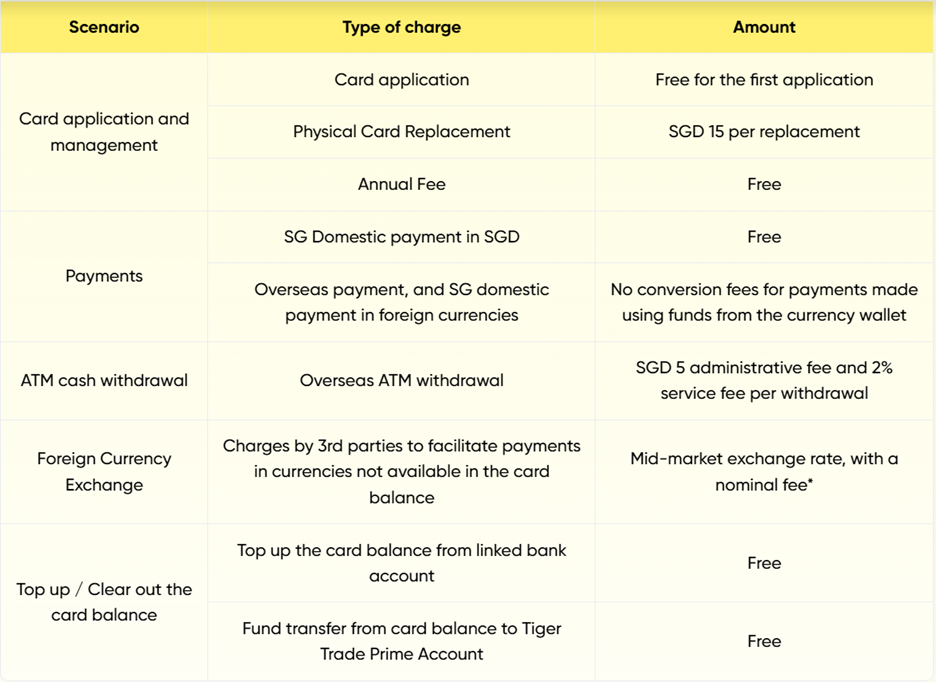

No Annual Fees + Competitive FX: There is no annual subscription fees (hooray!), coupled with competitive mid-market exchange rates for international transactions. You can also check out the fees table below for better understanding.

Utmost Security: Tiger Brokers enhances the safety of your funds with features like Tiger Pin and the ability to freeze/unfreeze the card instantly. Transaction notifications provide an additional layer of security.

For any queries or issues, Tiger Brokers also offer support via phone, email, and an online chat/WhatsApp service, ensuring users have access to assistance when needed.

In a nutshell, I really like how this digital integration represents a significant step towards integrating both your daily or overseas spending with the ability to “reinvest back the cashback” into fractional shares, all while ensuring ease of use and security for its users.

Earn Fractional Shares (and more!)

Speaking of which, its time to jump into the highlight of the BOSS card – fractional shares.

Users enjoy 1% cashback in Tesla (TSLA) fractional shares for each eligible transaction. For example, spending S$100 yields S$1 in TSLA shares, which is immediately accrued without any expiry date or lock-up period.

This seamless integration of spending and investing promotes financial literacy by encouraging users to think about their spending as potential investment opportunities.

Here are some of the details you need to know about the campaign:

Who Can Join: Both new and existing Tiger Brokers clients with Prime Accounts who register for a Tiger BOSS Debit Card for the first time.

Campaign Duration: The campaign runs from 22 February 2024 to 13 May 2024.

P.S. The selection of fractional shares/cashback may change over and you should look out for it.

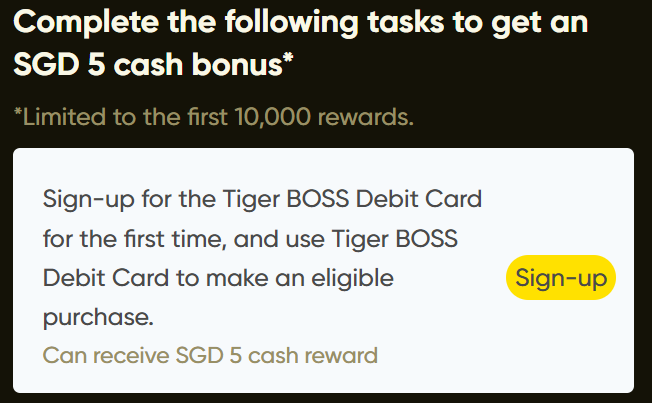

Sign-Up Bonus: A $5 credit is instantly awarded upon completing the first eligible transaction, accessible under ‘My Rewards’.

Referral Rewards: Each successful referral brings an additional S$5, with the chance to win S$888 for every three successful referrals.

| Exclusive S$10 Bonus: As long as you fulfill the 1st Task (sign up and make an eligible purchase), you can get SGD 10 [Welcome SGD 5 + SmallCapAsia SGD 5 (exclusive)].

Click Here for this Limited Time Offer – capped at 1st 500 users! |

How To Sign Up For The Tiger BOSS Debit Card

The registration for your BOSS card can be done easily on your Tiger Trade app. For non-existing Tiger Trade users, you’ll need to sign up for an account first.

For existing Tiger Brokers’ users, here are a few steps on how to apply for the Tiger BOSS card.

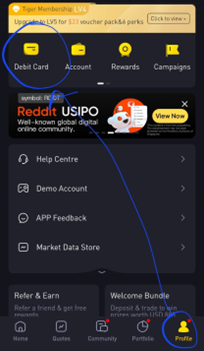

Step 1 – Visit the [Profile] page at the bottom right – see below picture.

Step 2 – Simply click on the Debit Card] icon, confirm your address, and then you can complete the card application.

Step 3 – You will get a digital card and a physical card at the same time. Virtual cards are free, Physical cards are also free upon your first application. Physical cards will be delivered to your mailing address from 10 business days.

Step 4 – You may choose to start using your digital debit card instantly, upon approval.

*Quick Tip – Add the virtual card to Google/Apple Pay, top-up some cash inside the Tiger Trade app and you’re good to spend!

Final Verdict: Is the Tiger BOSS Card worth it?

Considering the card’s compelling blend of convenience, investment incentives, and the promotional campaign that further enhances its appeal, the Tiger BOSS Debit Card emerges as a good addition for both tech-savvy consumers and those new to investing.

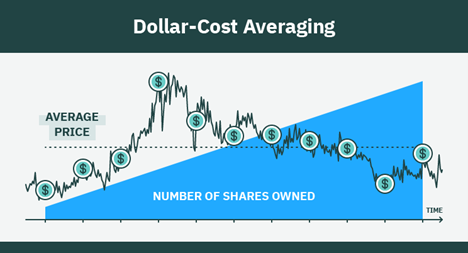

Personally, I like how easy it is to integrate the dollar-cost averaging investing concept into your everyday spending. Simply put, when you channeling your current spending into investing for the future instead of the usual points/cashback where it entices you to spend again.

With that, you should start utilizing and maximizing your spending in this current promotion since there is no cap on the 1% fractional shares! As for the current 1% promotion, I also understand that we can look out for potential attractive cashback/shares promotion in the near future too.

Finally, there is really no harm signing up the Tiger BOSS Debit Card since there’s no annual fees involved and you can even show off to your peers that you are investing for your future!

To get started, apply for the Tiger BOSS Debit Card here and don’t forget to grab the $10 signup bonus by just making 1 eligible transaction – exclusive SmallCapAsia deal *_*