On 14 April 2023, Autocount Dotcom Bhd (Autocount) issued its IPO Prospectus (Part 1 and Part 2) at 33 sen a share on Bursa Malaysia.

Upon listing, its market capitalisation shall be lifted up to RM 181.7 million.

The subscription to its IPO shares will end on 25 April 2023 and the listing date is set tentatively to be on 9 May 2023.

Source: Page 17 of Autocount’s IPO Prospectus

Here, I’ll summarize 7 things to know before subscribing to its shares as follows:

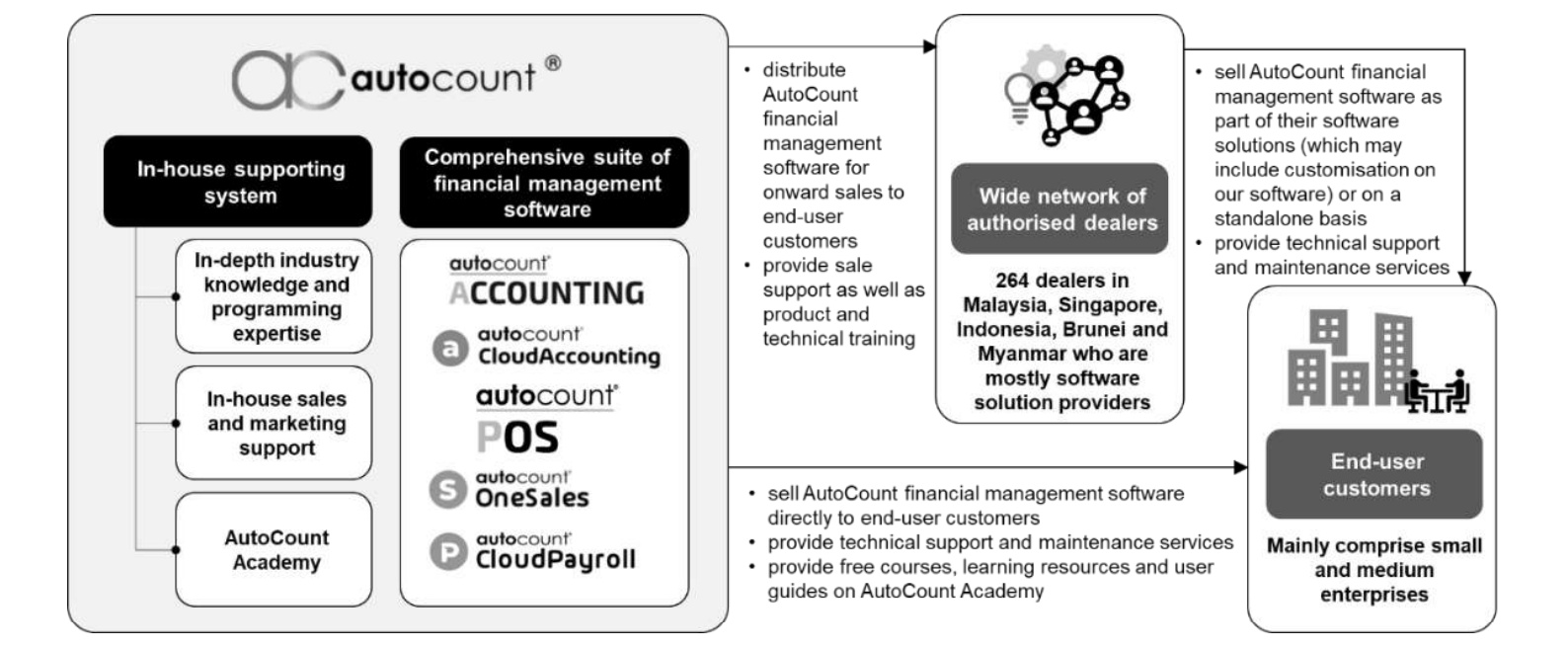

#1 Business Model

Autocount develops financial management softwares (accounting, payroll, POS) under the ‘Autocount’ brand and distributes them via its network of Authorised Dealers and its internal sales and marketing team to end-users (mainly SMEs) in the ASEAN region (mainly Malaysia and Singapore).

Presently, Autocount has:

- 269 authorised dealers.

- Sold 70,000 Autocount Software Licences.

- Used by 210,000 businesses & companies of diverse industries.

- Main presence: Malaysia and Singapore.

Source: Page 9 of Autocount’s IPO Prospectus

#2 Financial Results

Autocount has increased its sales of softwares namely:

- Autocount Accounting

- Autocount POS

- Autocount Cloud Accounting

- Autocount Cloud Payroll

This had contributed to its growth in revenues, up from RM 18.9 million in 2019 to RM 38.7 million in 2022.

With slight improvements in margins, shareholders’ earnings had grown, up from RM 4.2 million in 2019 to RM 13.8 million in 2022.

Its earnings per share (EPS) grew from 0.76 sen in 2019 to 2.51 sen in 2022. The company had brought in rising operating cash flows during the period.

Source: Page 220 & 224 of Autocount’s IPO Prospectus

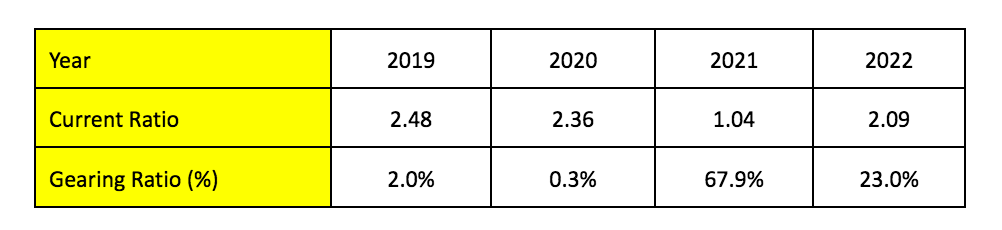

#3 Balance Sheet

In that 4-year period, Autocount has maintained well above 1.0 in current ratio.

In 2021, Autocount recorded 68% in gearing ratio as it raised RM 5.50 million in term loan to finance its OASIS office.

But subsequently in 2022, its gearing ratio had improved to 23% mainly due to an increase in total equity in that year.

Source: Page 281 & 224 of Autocount’s IPO Prospectus

#4 IPO Proceeds

Autocount intends to raise RM 30.88 million in gross proceeds.

Source: Page 24 of Autocount’s IPO Prospectus

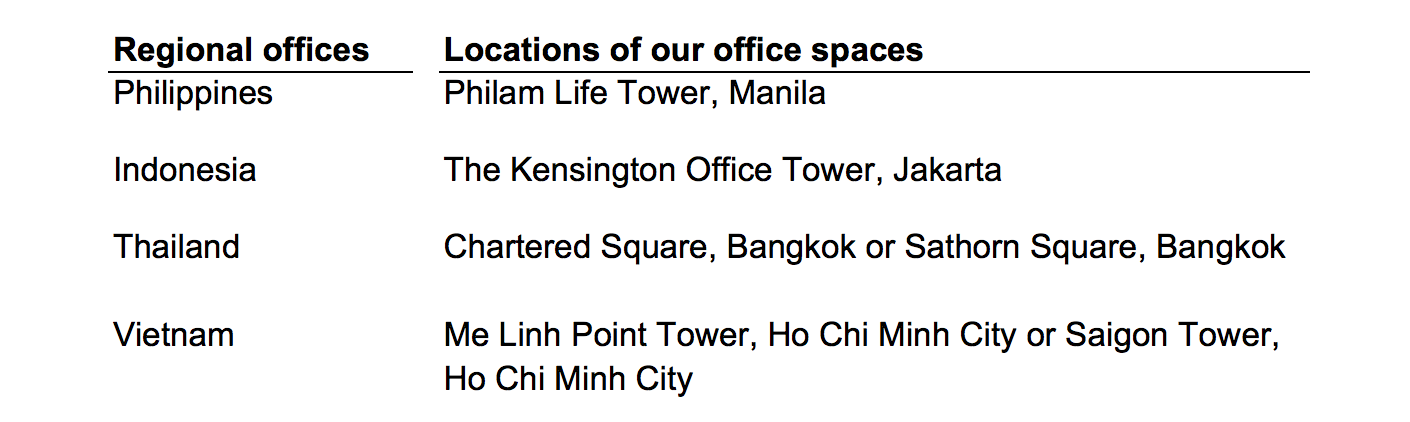

1. Regional Expansion (RM 17.4 million)

This refers to:

- Expanding its team in Singapore.

- Setting up offices in the Philippines, Thailand, Indonesia & Vietnam.

The expansion costs will mainly consist of payroll, marketing and office costs.

Source: Page 25 of Autocount’s IPO Prospectus

Autocount has identified the following relevant exhibitions and forums where it could participate to showcase its softwares. They are as follows:

- Franchise & SME Expo in Thailand and Indonesia.

- DigiTech ASEAN Thailand

- Indonesia Digital Technology Expo

- Vietnam ICTComm

- Vietnam-Asia DX Summit

- The Philippines SME Business Expo

- Annual National Convention by the Philippines Institute of Certified Public Accountants.

- The Philippines Software Industry Conference

- SMEICC in Singapore

In addition, Autocount has identified the following premises to set up its offices:

Source: Page 26 of Autocount’s IPO Prospectus

2. Research & Development (R&D) (RM 5.2 million)

This refers to enhancing its capabilities in various softwares as follow:

Source: Page 27 of Autocount’s IPO Prospectus

Presently, Autocount has 31 programmers.

To work on the R&D activities stated above, Autocount intends start its hiring programme on Q4 2023 where it plans to hire another (over a period of 24 months):

- 11 programmers: enhance POS and e-commerce solutions.

- 20 programmers: hosting and storage

3. Working Capital (RM 4.4 million)

This refers to its hiring of 23 employees which consist of:

Source: Page 28 of Autocount’s IPO Prospectus

4. Estimated Listing Expenses (RM 3.9 million)

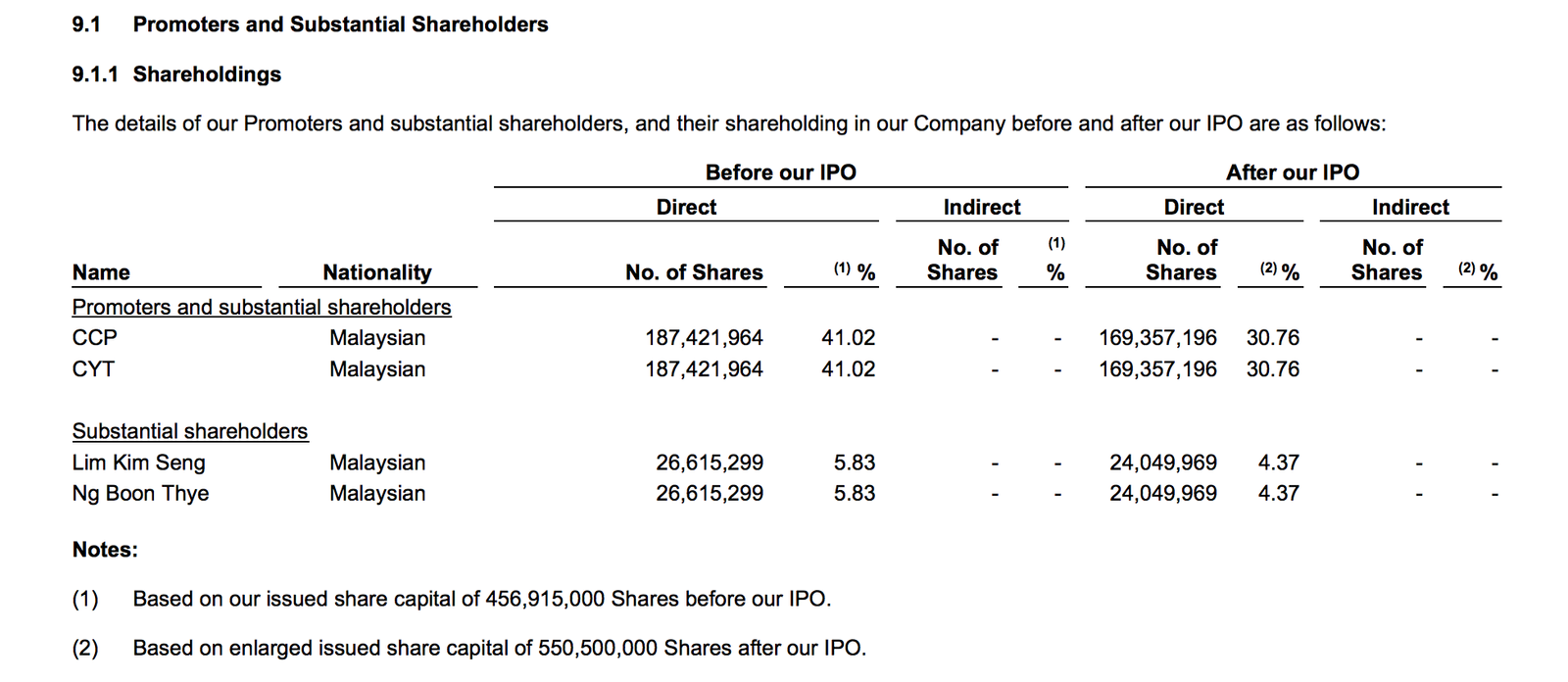

#5 Major Shareholders

Choo Chee Peng, Choo Yan Tiee, Lim Kim Seng and Ng Boon Thye would remain as major shareholders with 30.76%, 30.76%, 4.37%, and 4.37% shareholdings in Autocount respectively.

Their positions in the company are as follows:

- Choo Chee Peng (CCP) is appointed as its Executive Chairman.

- Choo Yan Tiee (CYT) is appointed as its Managing Director.

- Lim Kim Seng is appointed as its Sales & Marketing Director.

- Lim Kim Seng is appointed as its Software Development Director.

Source: Page 153 of Autocount’s IPO Prospectus

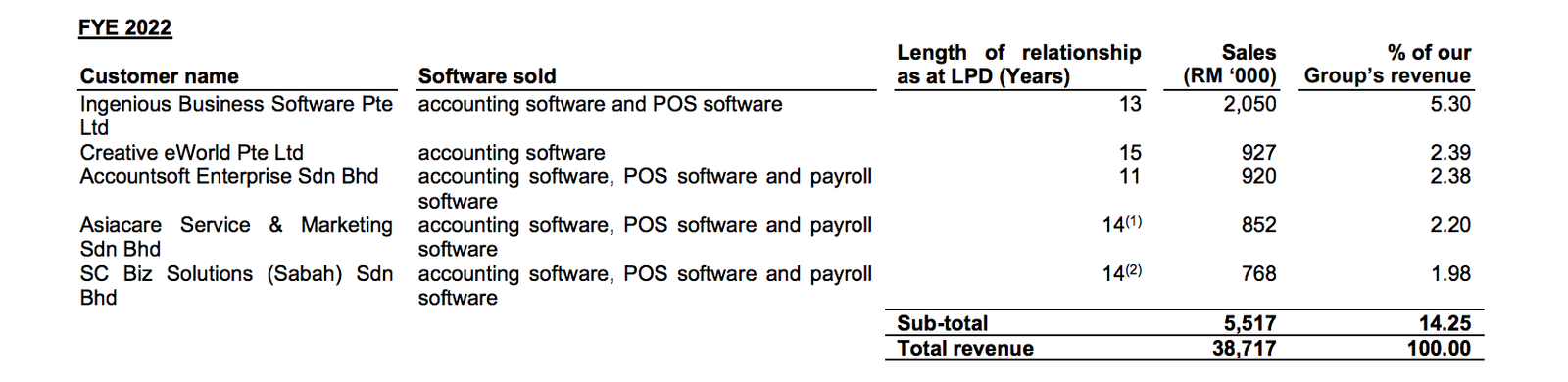

#6 Major Customers

In 2022, Autocount generated 14.25% of its total revenue from 5 key customers (authorised dealers) as follow:

Source: Page 106 of Autocount’s IPO Prospectus

Presently, Autocount has 269 dealers and thus, is not heavily dependent on one major dealer for its revenue contribution.

#7 Valuation

Based on its IPO price of 33 sen, the offer is valued at a decent P/E Ratio of 13.15x.

Autocount does not adopt any formal dividend policy at the moment. Hence, in this case, calculation on its dividend yields would not be given.

Conclusion

Autocount had achieved growth in sales, profits and operating cash flows in the last 4 years (2019-2022). It maintained a healthy balance sheet in that period of time with above 1.0 in current ratio and had a low gearing ratio of 23% in 2022.

Autocount has built its presence in Malaysia and Singapore. Moving forward, its growth would be dependent on its success in penetrating into key markets such as Thailand, Vietnam, Indonesia and the Philippines.

Based on its offering of P/E Ratio of 13.1x, investors should ask if the valuation is attractive and to compare the company with other listed peers and competitors to decide on its investment viability.

cialis 10mg uk

cialis 10mg uk

Hi Ian, this is Allen Yeong. I am the IR for AutoCount Dotcom Berhad. Thanks for your coverage.

Thank you for the summary.