The REIT sector has been in a bear market since 2022. This was due to the high interest rates raised by the FED to curb high inflation. However, recently due to the uncertainty caused by the Trump Tariffs, the 10 year treasury yield has fallen below 4%. This result in rebound of REITs share price.

In fact, President Trump has called for the FED to cut rates. However, recent comment by the FED chairman indicated there was no hurry to cut rates as tariffs will result in higher inflation.

Hence, investors need to be prepared for a stagflation environment where there is persistent high inflation and high unemployment. In this situation, it will be very difficult for the FED to cut rates.

Faced with these challenges, I highlight 4 Singapore REITs That can weather high interest rates.

Parkway Life Real Estate Investment Trust

For the full year ended 31 Dec 2024, PLife REIT reported gross revenue decreased from S$147.4 million to S$145.2 million. Net property income dropped from S$139.0 million to S$136.5 million.

Full year DPU increased from 14.77 cents to 14.92 cents which translate to a dividend yield of 3.5%. Gearing ratio remain healthy at 34.8%, with no long-term debt refinancing needs until September 2026.

Low all-in debt cost still remained very low at 1.36% with interest cover of 10.2 times. Given its resilient business model and high interest cover, PLife REIT is one of the 4 Singapore REITs that can weather high interest rates. You can view the REIT website here.

AIMS APAC REIT

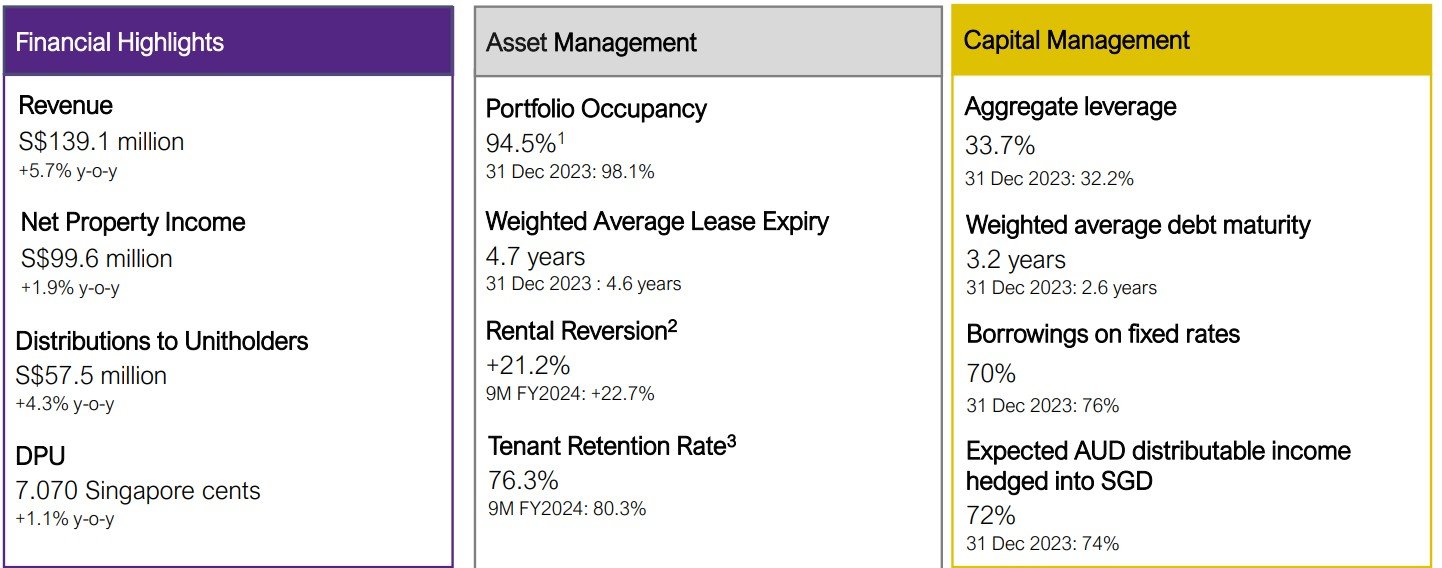

AA REIT reported its 9M FY2025 business update on 28 Jan 2025.

Revenue was up 5.7% to S$139.1 million while net property income was up 1.9% to S$99.6 million. DPU increased by 1.1% to 7.07 cents which translate to an annualized dividend yield of more than 7%.

Gearing ratio remained low at 33.7% with average debt to maturity of 3.2 years. 70% of debts was on fixed rates. Interest cover is at 3.9 times. AA REIT also reported healthy portfolio occupancy of 94.5% and an excellent rental reversion of 21.2%.

Hence, with a low gearing and healthy interest cover, AA REIT is one of the 4 Singapore REITs that will be able to withstand high interest rates. You view the REIT website here.

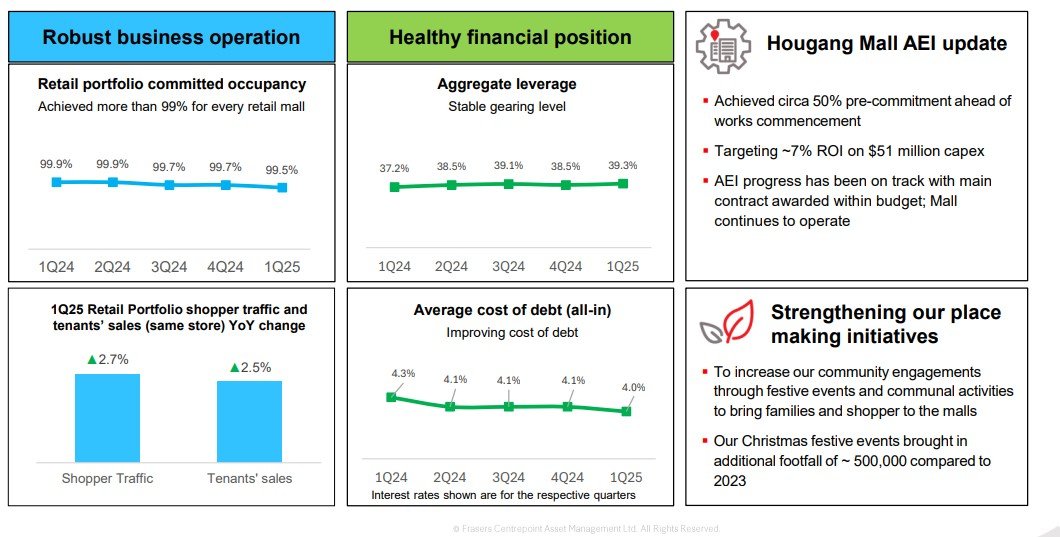

Frasers Centrepoint Trust

FCT reported its 1Q25 business update on 22 Jan 2025.

Portfolio occupancy remained very healthy at 99.5%. Tenants’ sales was up 2.5% while shopper traffic was up 2.7%. Gearing ratio remained below 40% at 39.3% with average cost of debt of 4%.

Interest cover is at 3.33 times. With high portfolio occupancy of more than 99% due to its strong position in suburban malls couple with a stable interest cover, FCT should be considered as one the 4 Singapore REITs that will be able withstand high rates should there be a resurgence in inflation.

You can view the REIT website here.

CapitaLand Ascendas REIT

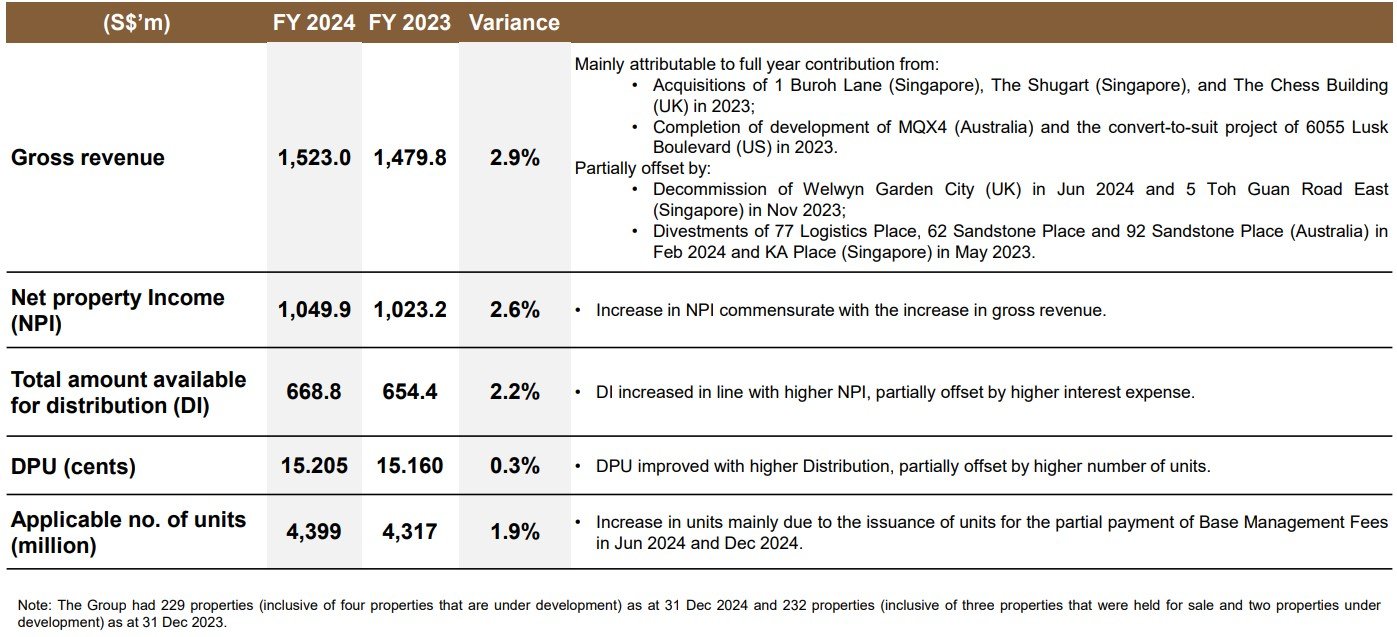

CLAR reported its full year results for year ended 31 Dec 2024 on 6 Feb 2025.

CLAR reported gross revenue increased by 2.9% to S$1,523.0 million while net property income edged up 2.6% to S$2.049.9 million. DPU inched up 0.3% to 15.205 cents which translate to a dividend yield of 5.5%.

Gearing ratio was healthy at 37.7% with 82.7% on fixed rate debts. Average cost of debt was 3.7% with interest cover of 3.6 times. With a well-diversified portfolio and efficient capital management, CLAR is one of the 4 Singapore REITs that can weather high interest rates. You can view the REIT website here.

Disclaimer: Please note that the REITs mentioned in this article are not a financial recommendation to buy and investors need to do their own research and due diligence before investing in any of these REITs.