Have you had a Pepsi lately?

In the previous decade, C.I. Holdings Bhd (CI) was a darling among fundamental investors as it derived consistent growth in sales and profits to shareholders via its main subsidiary, Permanis Sdn Bhd. It is the local manufacturer of beverages such as Pepsi, 7Up, Mountain Dew, Twister and Gatorade in Malaysia. Investing in CI was likened to owning stocks in F&N and Nestle back then.

That was until 2011. CI sold Permanis to Asahi Group for RM 820 million, which was more than 11 times its initial purchase cost of RM 72 million in 2004. Since then, CI became a cash company and slowly faded away into oblivion.

So, why am I writing about CI?

Three Reasons.

- Firstly, CI is making a comeback. CI has embarked on a brand new business venture and has reaped increasing profits from it over the last 3 years.

- Secondly, CI’s stock price has yet to reflect upon its earnings growth.

- Thirdly, there are little awareness of CI’s positive developments among investors in Malaysia.

Hence, in this article, I’ll cover 7 major things to know about CI before investing in it.

#1: Continental Resources Sdn Bhd (CRSB)

In 2014, CI Holdings acquired CRSB for RM 42 million. It is involved in purchasing, selling, manufacturing, and packing of edible oils in Malaysia. Today, CRSB has 2 plants based in Banting, Klang which is equipped with 18 packing lines with a capacity to pack 260,000 metric tonnes (MT) of edible oils per year and 31 oil tanks with a total tankage capacity of 2,800 MT. In addition, CRSB has a total of 8 jerry can moulding machines which is capable of producing 500,000 jerry cans a month.

#2: Palmtop Vegeoil Products Sdn Bhd (Palmtop)

In 2015, CRSB acquired 60% stake in Palmtop for RM 8.25 million. It is into the same business as CRSB.

Presently, Palmtop has 2 plants in Pasir Gudang, Johor which is equipped with 14 packing lines with a packing capacity of 550,000 MT of edible oils a year and 20 oil tanks with a total tanking capacity of 1,800 MT.

#3: CI Holdings’ Management Team

As at 30 June 2018, the list of major shareholders and their shareholdings in CI are as followed:

– JAG Capital Holdings Sdn Bhd: 32.72%

– Continental Theme Sdn Bhd: 7.98%

– Lee Cheang Mei: 6.49%

– Fung Heen Choon: 6.36%

Lee Cheang Mei, Fung Heen Choon and Datin Mariam Prudence binti Yusof are appointed as Non-Executive Directors of CI Holdings. Lee and Fung themselves are main shareholders of CI. Meanwhile, Datin Mariam is a substantial shareholder of CI Holdings via her interest in Continental Theme Sdn Bhd, Du AIn Sdn Bhd (2.05%), Duclos Sdn Bhd (3.31%), Leasing Corporation Sdn Bhd (2.89%), Sisma Water Techology Sdn Bhd (2.17%) and Syed Ibrahim Sdn Bhd (2.80%).

Suffice to say, there are three directors who are substantial shareholders of CI. Hence, their interests would be aligned to shareholders.

#4: CI Holdings’ Financial Results

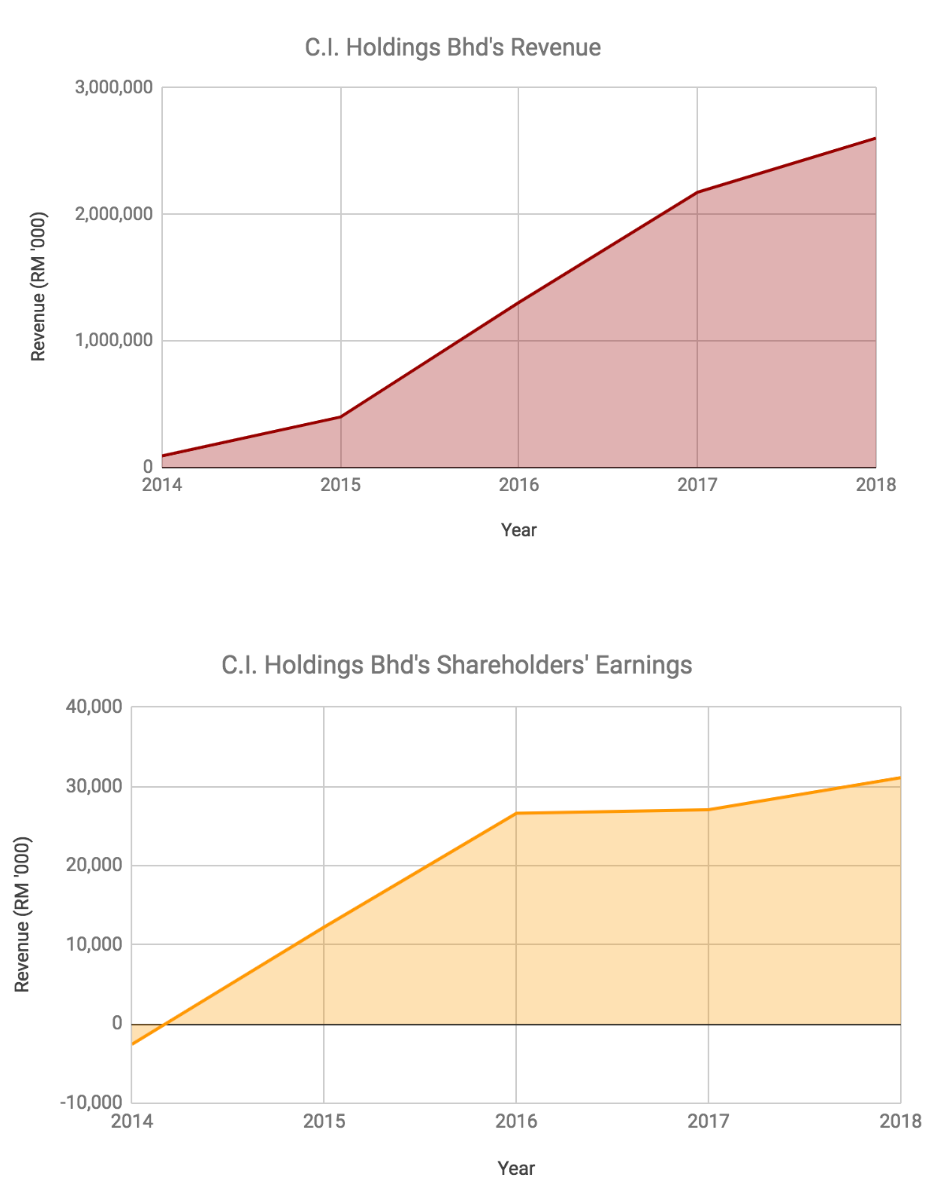

As a result, CI has reported substantial growth in sales from RM 91.9 million in 2014 to RM 2.60 billion in 2018. From which, CI had returned to profitability in 2015 and grown its shareholders’ earnings from RM 12.3 million in 2015 to RM 31.1 million in 2018.

CI has reported return on equity (ROE) of 14 – 15% a year over the past 3 years. This means, CI has made, on average, RM 14 – 15 in annual earnings from every RM 100 in shareholders’ equity from 2016 to 2018.

#5: CI Holdings’ Balance Sheet Strength

As at 30 June 2018, CI has gearing ratio of 6.55%, current ratio of 1.52 and cash balance of RM 120.3 million.

Thus, it maintains a strong balance sheet with low debt-to-equity ratio and a healthy cash balance.

#6: CI Holdings’ Future Plans

In 2018, CI has expanded its customer base to 746 and intends to further grow this figure in the future. CI is seeking to reorganise its current production floor plan to cater to increasing demand for its edible oil products and concurrently, boost its production efficiency to control costs.

In addition to edible oils, CI has a manufacturing plant which produces taps and sanitary ware in Senawang, Negeri Sembilan. Contributions had been small and insignificant over the past 5 years. This may change in starting in year 2019 and beyond as CI had recently entered into a business cooperation with among the largest retail hardware stockists in Malaysia with a huge network of 1,100 retail hardware stores nationwide.

CI had revealed that it expects a steady stream of income from the cooperation based on its current orders placed and expectation of repeated orders in every two months.

#7: CI Holdings’ Stock Valuation

As I write, CI Holdings is trading at RM 1.88 a share. Hence, its market capitalisation is RM 304.6 million presently.

In 2018, CI had made earnings per share (EPS) of 19.20 sen. Hence, CI’s current P/E Ratio is 9.79, a drop from 15.52 in 2016. This is due to combination of both an increase in CI’s EPS and a drop in CI’s stock prices from 2016 to 2018.

As at 30 June 2018, CI has reported net assets a share of RM 1.30. As such, CI’s current P/B Ratio is 1.42, a drop from 2.38 in 2016. Once again, it is caused by a combination of both an increase in CI’s net assets a share and a decline in stock prices during the period.

CI has no fixed dividend policy. But, it has declared growing dividends per share (DPS) from 5 sen in 2016 to 10 sen in 2018. At RM 1.88, my dividend yield from CI is 5.32% if I invest in it presently, as I write. Its Ex-Date is fixed at 29 October 2018 and the DPS 2018 of 10 sen would be paid on 14 November 2018.

Conclusion:

So, should I invest in CI Holdings?

Like always, I can’t answer that question for you. Instead, let me end by asking a series of questions which could act as a guide to help you make your decision on it.

- Do you fully understand CI’s business model?

- Do you like CI’s growth prospects into the future?

- Is gross dividend yield of 5.32% attractive to you?

- Do you intend to keep CI’s shares over the long-term?

- What do you intend to do if CI’s shares drop in stock price?

FREE Download – “7 Top Stocks Flashing On Our Watchlist”

Want to find out about more exciting growth stocks? We’ve dig into 7 companies poised to skyrocket >100% in the years to come. Simply click here to uncover these ideas in our FREE Special Report!