Investors are growing concerned over the coronavirus that has swept across China, and thus selling off stocks and piling into havens like the Japanese Yen

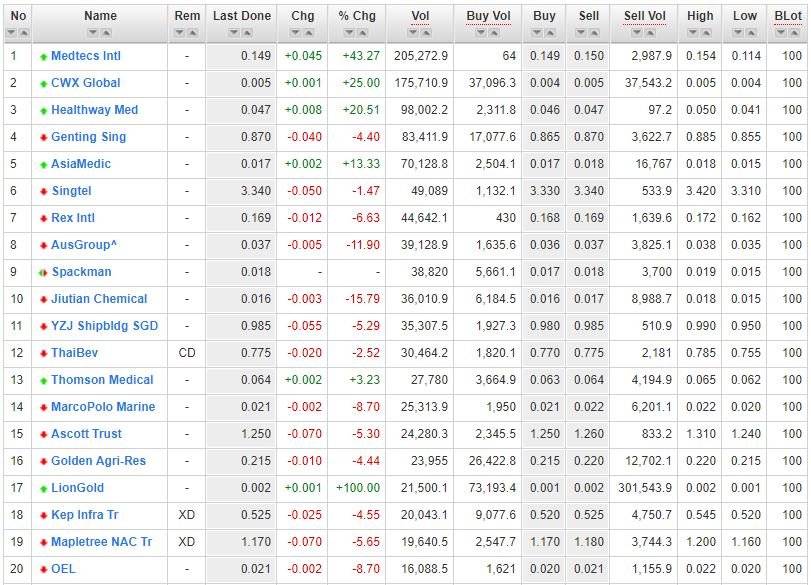

See how the Healthcare stocks like AsiaMedic and Medtecs jumped 13% or 43% when their business operations may not have that kind of a drastic improvement?

Or that YZJ and Mapletree NAC Trust drops 5.3% and 5.6% simply because their operations are tagged to China?

In my opinion, this is overblown out of proportions and have no link to the virus spread. That said, my personal belief is that this is a trigger for a long overdue market correction and will persist for a longer while — until we get much clarity that the virus spread is slowing down/vaccine cure is out.

This is also in sync with what Marc Chandler, chief market strategist at Bannockburn Securities told his clients: “The coronavirus is an economic and financial shock. The extent of that shock still needs to be assessed, but it could provide the spark for an arguably long-overdue adjustment in the capital markets”.

But given the fast and furious market correction, is there anything we can do? Below, we have written an article on what you can do during a market correction.

What To Do During A Market Correction

1. Review your Portfolio Holdings

As such, we tend to get lazy and don’t bother to re-assess the companies after we invested in them. One important point is to check for your initial hypothesis to see if it still stands.

For example: You believe that the oil price recovery will lead to more orders for KeppelCorp. Hence you have to check back regularly to see if that’s still the case.

Besides that, check for businesses which are over-leveraged and may not have the fundamentals to withstand tougher times. These are the companies that tend to crash harder in a correction. You can find this information from the balance sheet under the borrowings.

Remember that you should not just ‘buy-and-hold’. Instead, adopt the buy-and-monitor approach as part of your continual review of your portfolio.

2. Rainy Day Fund

Ask yourself this important question:

“Do you have any cash/rainy day funds to tide you over if you lose your income suddenly?”

By having a rainy day fund as a safety net, you can at least ‘close your eyes’ and pass by the bad times. However, if your whole savings or retirement fund is fully vested, you will definitely have butterflies in your stomach when the market turns against you.

It’s devastating to have to sell stocks to raise cash after a market crash. We highly recommend that investors be prudent so that you can sleep soundly at night.

3. Whip out your ‘shopping list’ for stock bargains.

We all know that stock markets move in cycles and legendary investor Warren Buffett have made his fortune buying big stakes when there’s bloodshed in the markets.

Bear markets can provide great opportunities for investors. The trick is to know what you are looking for. Start by jotting down a list of stocks you’d like to acquire at lower prices.

I have heard many investors lamenting that they miss the bull run for the banking and telco stocks during the sharp spike the past 12 months. Is it time for them to dive in or wait at the sidelines during a correction?

I can’t answer this crucial question for them but there is one thing i know can be beneficial for them. Prepare a watch-list beforehand such that you eliminate more than 80% of your emotions/anxiety.

Warren Buffett often view bear markets as great opportunities to load up on companies he favour over the long run. For example, Buffett acquired US$5 billion in preferred shares of Goldman Sachs during the Global Financial Crisis, and got another $5 billion worth of warrants (can be converted to common shares).

In 2011, Buffett earned a whooping US$500 mil after Goldman bought back the preferred stock for US$5.64 billion; warrants not included!

Hence, ask yourself this question:

“What stocks would you be willing to scoop up with both hands when their share prices are falling with the market?”

4. Don’t Time the Market | Do Nothing

One good strategy is to simply do nothing. Yes – do nothing.

Over the last 20 years, the S&P 500 rose by an annualized 7.7%. This is a fabulous return compared to almost any other asset class: A US$100,000 investment in the S&P 20 years ago would have compounded into US$440,873.57 today (before fees), if all you did was buy and hold. In short, all you did was nothing.

Instead, the average investor has earned a sad 2.3% annually over the last 20 years. Today, that $100,000 nest egg is worth $157,584.20. The sum is almost 1/3 as compared because the investor has attempted to time the markets to no avail.

Hence, avoid timing the markets. No one can know for sure when a correction or rebound will happen. The Wall Street Journal doesn’t know, and neither does Warren Buffett.

5. Turn off the Media ‘Noises’.

Every day, the media is full of news, commentaries and opinions that aim to influence you into making the wrong investment decisions.

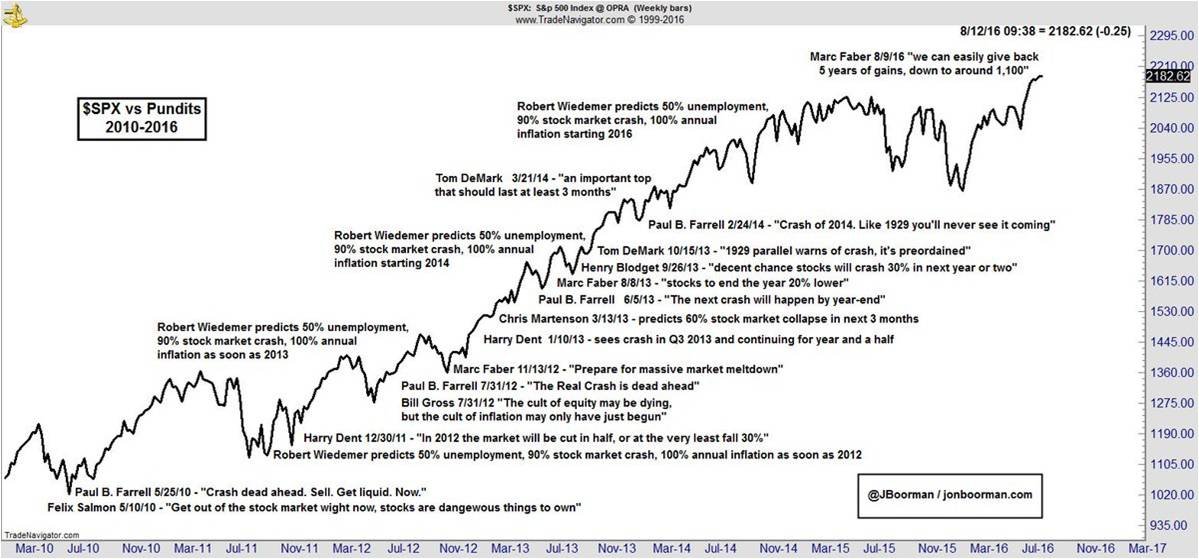

I always like to use the above picture sourced from broadswordcapital.com. If you look at the comments from Marc Faber, the markets’ prognosticator known as “Dr. Doom”, he has predicted that the markets will suffer a meltdown 3 times over the course of 3 years.

Each time, the markets continue to punch higher. In fact, S&P 500 Index is trading at around 2,800+, more than double from Dr Doom’s first comment in 2012. If you have avoided investing due to all these ‘noises’, you would have been pretty disappointed.

Conclusion

To end off, remember to invest in only what you can afford to lose. While investing is important to build your nest egg in the future, but so is eating and keeping a roof over your head in the present.

It is also vital to not assume that minor corrections can’t morph into prolonged bear markets. Having a cash hoard can be liberating in the sense that it can tide you over the down periods and even allow you to snap up bargains when others are stuck in the rut.

FREE Download – “7 Top Stocks Flashing On Our Watchlist”

Psst… We’ve found 7 exciting companies that are poised to skyrocket >100% in the years to come. Simply click here to uncover these ideas in our FREE Special Report!