Another REITs exchange-traded fund will be listed on SGX mainboard on 29 March 2017. Its name is…

NikkoAM-StraitsTrading Asia ex Japan REIT ETF (SGX:CFA).

We have written a 5-min guide to bring you through the important points you need to know before jumping in!

1. Objective of Fund

The investment objective of the fund is to replicate as closely as possible, before expenses, the performance of the FTSE EPRA/NAREIT Asia ex-Japan NET Total Return REIT Index. It will adopt the full replication strategy which basically tries to replicate the same weightage as reflected in the actual Index.

Besides that, it targets for an estimated 5% dividend distribution, paid quarterly at the manger’s discretion. The manager of the fund is Nikko Asset Management Asia Limited – a well-known fund house you may have heard of. They also run many other funds which include the ABF Singapore Bond Index Fund and Nikko AM Singapore STI ETF.

2. Composition of the Fund

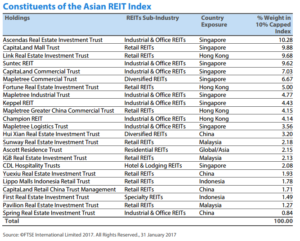

The Fund is mainly concentrated in Singapore (60.5%) and Hong Kong (23.0%). Other countries include Malaysia, China and Indonesia.

For sector-wise, it is mainly concentrated in Industrial & Office REITs (44.7%) and Retail REITs (39.7%). The largest constituent is Ascendas REIT with 10.28% weightage. Other powerhouse with huge weightage include CapitaLand Mall Trust, Link REIT and Suntec REIT.

The entire list of constituents is as shown below, taken from their product info sheet.

3. Fees & Charges

The fees and charges can be found in their Product Highlight Sheet. But for the benefit of time, you can look at the quick summary below.

1) Management Fee – 0.50% per annum of the Deposited (Max 0.70% per annum)

2) Trustee Fee – Up to 0.04% per annum of the Deposited Property (Max 0.05% per annum, subject to a minimum fee of S$15,000 per annum)

3) Custodian fee – Subject to agreement (May amount to or exceed 0.10% per annum)

4) Administration fee – 0.04% per annum of the Deposited Property (Max 0.05% per annum, subject to a minimum fee of S$15,000 per annum)

4. Risks to note

One risky component which I find prominent is its geographical diversification. As the fund is mainly concentrated in the Asia exJapan region, a regional shock can potentially bring down your whole portfolio.

To add on, investments of the Fund may not be denominated in SGD so fluctuations of other exchange rates may also affect your returns.

Furthermore, like with all other ETFs, there can be no assurance that the Fund will achieve its investment objective (hence, your 5% dividend) or that it will be able to fully track the performance of the Index.

5. Investment Horizon

From its prospectus, it states that “Investments in the Fund are designed to produce returns over the long term and are not suitable for short term speculation”. Therefore, you should only consider jumping into it if you seek medium to long-term capital appreciation.

However, my personal take is that 5% dividend yield to lock in your money for the long term is generally unattractive. There are definitely bigger fishes out there that can bring you better returns.

We’ve released our 3 HOT growth stock picks which could skyrocket >100% by the end of 2017. History has shown that getting in early on a good idea can often pay big bucks – so don’t miss out on this moment.

Simply click here to receive your copy of our brand-new FREE report, “3 stocks poised for explosive growth”.

Do Like us on Facebook too as we share the latest investing articles and stock ideas for you!