Many investors may not have heard of Walter Schloss before, but he was a fellow disciple of Benjamin Graham with Warren Buffett. More importantly, his partnership had achieved a staggering 21% CAGR from the stock market over 28 and 1/4 years.

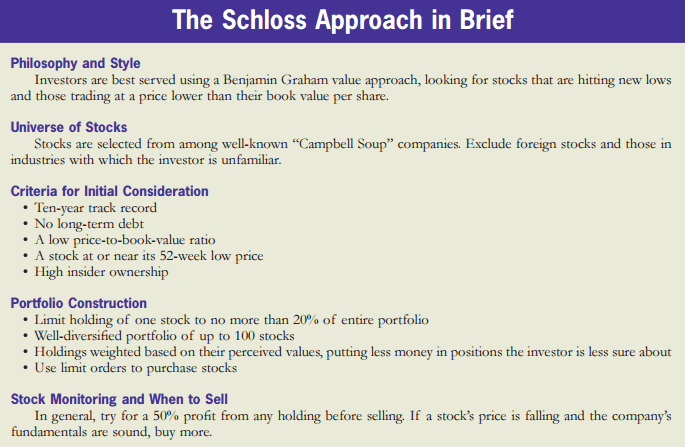

Now that you have taken notice, you would also be amazed at his profoundly simple approach to investing (See below)…

While most professional money managers focus on earnings, Schloss concentrated his purchases on asset value – and look for stocks hitting new lows and those trading at low P/B per share.

With that in mind, we check out 3 Singapore stocks which are trading at low P/B recently too.

#1 Hanwell Holdings Limited (SGX: DM0)

Hanwell Holdings is a leading provider of consumer essentials as they distribute and market a diverse range of safe and quality consumer products in both Singapore and Malaysia.

In Singapore, it distributes tissue products (Beautex brand etc.) under http://www.tipex.com.sg/our-brand.html and tofu products (Fortune brand) under http://fortunefood.com.sg/product/our_brands.asp.

In Malaysia, they exclusively distribute many more household brands including Mentos, Chupa Chups, Smint, Fruitella, Tao Kae Noi, Tai Sun, Indomie and Jia Duo Bao under their subsidiary (url: http://www.socma.com.my).

Other than consumer products, Hanwell also holds 64% stake in Singapore-listed Tat Seng Packaging Group Ltd. Tat Seng is one of the leading manufacturers of corrugated paper packaging products with operations in Singapore, Suzhou, Nantong, Hefei and Tianjin in China.

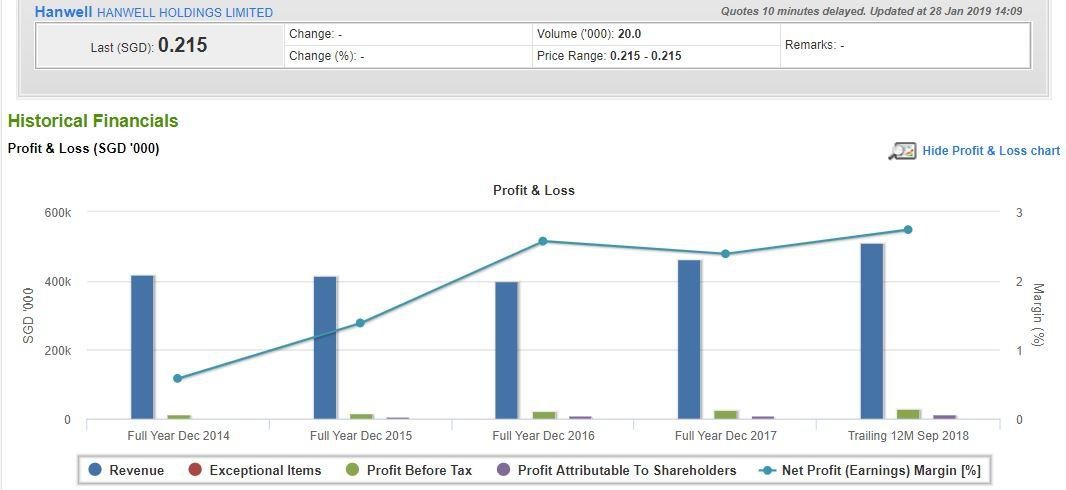

Source: Shareinvestor.com

The group’s revenue and net earnings have achieved a record high of S$509 million and S$13.9 million respectively in TTM Sept 2018. According to the latest third quarter report, it was mainly attributed to stronger demand in Packaging Business (Tat Seng Group) and higher revenue contributed by consumer business in Malaysia.

Regarding the trade war between the US and China, the management provided the following guidance:

“The Packaging Business will face uncertainty and challenges from volatile raw material prices and the escalation of trade tension between the US and China. This segment will continue to execute its strategy to improve operational efficiencies and further reduce costs diligently. Its new production line in Nantong Tat Seng is expected to commence operation in the fourth quarter of 2018.”

As its last market price of S$0.22, it offers a 58% discount to Hanwell NAV per share of S$0.5127. To top it off, Hanwell has paid out a dividend of S$0.0025 per share in 2017, which translates to a dividend yield of 1.13%.

#2 Multi-Chem Ltd (SGX: AWZ)

Multi-Chem is a specialist drilling and routing service provider and also a distributor of speciality chemicals and materials to printed circuit board (PCB) manufacturers.

The company was incorporated in 1985 and was listed on SESDAQ in January 2000. It was then upgraded to the Main Board of SGX consequently in the same year.

Multi-Chem claims itself as one of the leading PCB drilling providers, in terms of both capacity and technology. Besides, the company also diversified into the business of IT distribution where they focus on best-of-breed internet security, WAN optimisation, network management and video conferencing products from industry leading vendors.

Their IT business has expanded in both product range and geographical coverage since inception and now spans across Singapore, Australia, China (including Hong Kong), India, Indonesia, Japan, Korea, Malaysia, New Zealand, Philippines, Taiwan, Thailand and Vietnam.

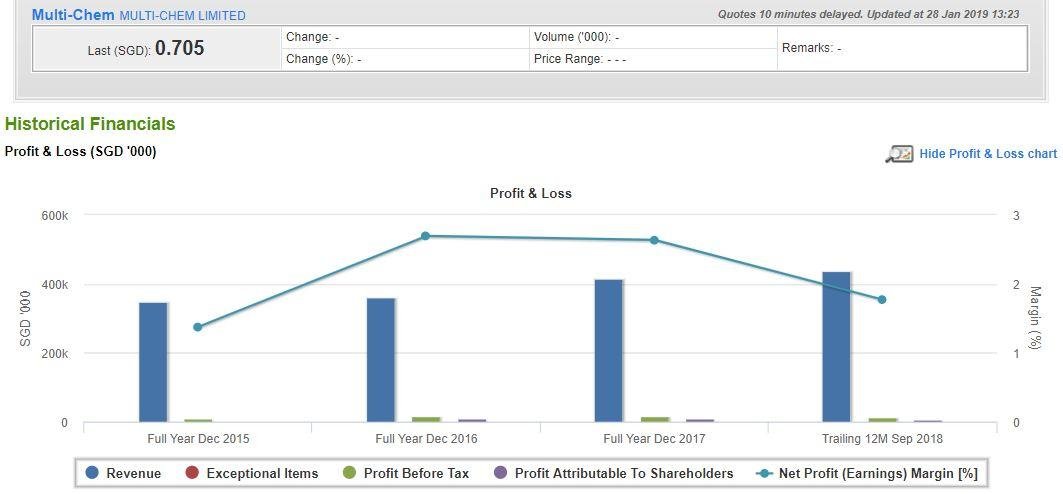

Source: Shareinvestor.com

Multi-Chem recorded revenue of S$438 million in TTM Sep 2018, while its net earnings declined to S$7.76 million in the same period.

For its future prospects, the management commented:

“The near term outlook in the IT business is dependent on events such as those political or economic in nature and such events could affect business in certain markets. With the recent US-China trade war, the global economic outlook remains uncertain which will, in turn, affect the Group’s business. With the increase in US interest rates, the cost of business is expected to similarly increase. However, IT is still a critical requirement in businesses and security will continue to remain an integral part of the IT infrastructure. This should augur well for the Group as more efforts are put into growing the IT business.”

Multi-Chem Ltd changed hands at S$0.70 on the last trading day. At that price, it is valued at 0.6511 times its NAV. It offers a total dividend of S$0.0551 in FY2017, which translate to a dividend yield of 7.9%.

#3 ISDN Holdings Limited (SGX: I07)

ISDN Holdings Limited is an engineering solutions company specialising in integrated precision engineering and industrial computing solutions. The company offers a wide range of engineering services, mainly to customers who are manufacturers and original design manufacturers of products and equipment that have specialised requirements in precision controls.

It also provides the full spectrum of engineering services from conceptualisation, design & development to prototyping, production, sales & marketing and after sales engineering support.

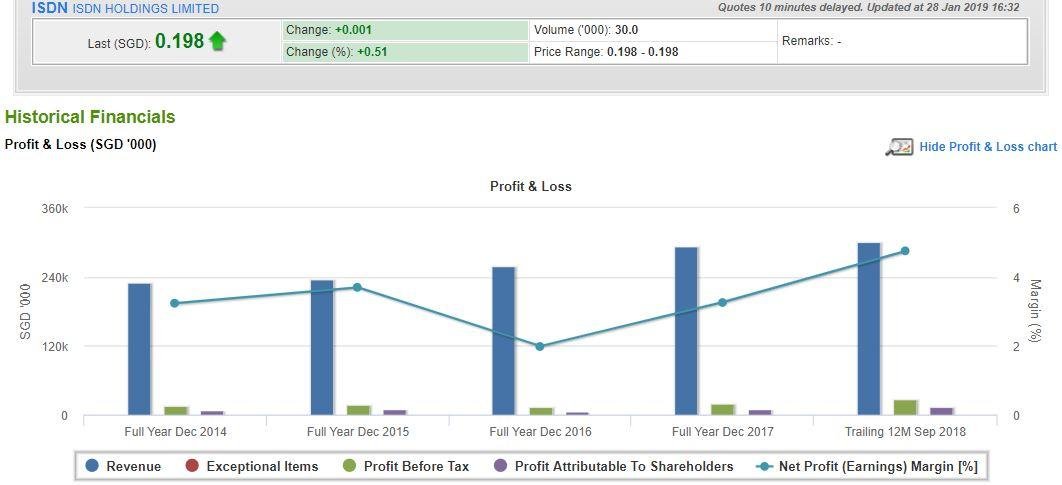

Source: Shareinvestor.com

ISDN Holdings reported steady growth in the top line from S$230 million in FY2014 to S$300 million in TTM Sep 2018. In addition to that, its net earnings nearly doubled from S$7.4 million to S$14.3 million in the same period.

From its latest quarterly report, its strong growth was mainly attributable to the growing domestic demand for high-tech precision control system from medical device manufacturers, coupled with the consistent growing customer base.

Looking forward, the company plans to expand its business into the development of mini-hydropower plants:

In Indonesia, ISDN’s venture into the development of mini-hydropower plants will yield some definitive results from 2019. Its first two plants, capable of producing 4.6MW and 9MW of electricity respectively, are expected to be operational by the middle of next year, while a third plant, which can yield 10MW, will be ready by 2020.

ISDN Holdings is currently trading at PB of 0.5362 times with a share price of S$0.20 per share. The company has paid out a dividend per share of S$0.006 in the previous financial year, which translate to a dividend yield of 3%.

FREE Stock Guide – “7 Top Stocks Flashing On Our Watchlist”

Psst… We’ve found 7 exciting companies that are poised to skyrocket >100% in the years to come.

Simply click here to uncover these ideas in our FREE Special Report!