REITs has been under pressure practically for the first quarter of 2024 due to the surging 10 year treasury yield. At the point of writing this article, the 10 year treasury yield is at 4.20%. As such, the FTSE REIT index dropped by 8.75% for the first quarter of 2024.

Correspondingly, many REITs have tumbled to near 52-week lows. Income investors who are hunting for bargains will naturally look for REITs that have seen their share prices being punished.

These REITs could be victims of poor investor sentiment and or deteriorating financial metrics.

In this article, we will talk about 3 Singapore REITs trading near 52-week lows and see whether they qualify as attractive bargains for investors to buy.

Ireit Global

IREIT Global mainly owns properties which is used primarily for office, retail and industrial purposes. IREIT’s portfolio comprises five freehold office properties in Germany, four freehold office properties in Spain and 44 retail properties in France.

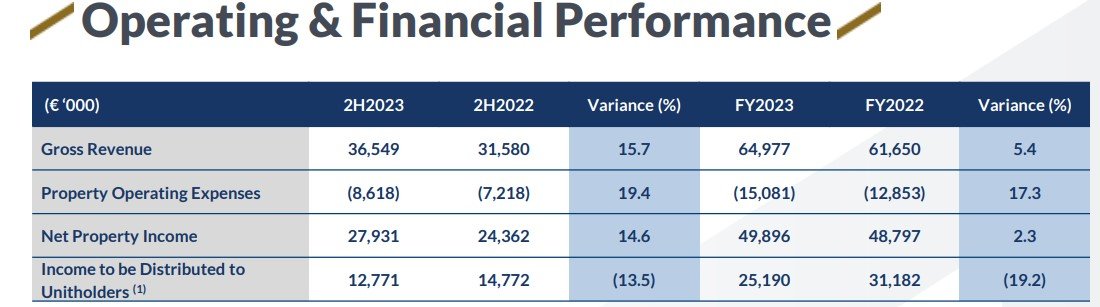

For FY2023, IREIT reported net property income increase by 2.3% to Euro49.8 million while income distributable to unitholders decline by 19.2% to Euro25.1 million. DPU drop by an astonishing 30.5% to Euro1.87 cents due to the enlarged units base.

NAV dropped 24.1% to Euro 0.41 per unit. This is mainly due to decrease in valuation of the investment properties and enlarged number of units.

With the declining financial metrics and Europe on the brink of a recession, investors need to be wary before buying or DCA this REIT. You can view the REIT website here.

Frasers Logistics & Commercial Trust

Frasers Logistics & Commercial Trust (FLCT) has a portfolio comprising 108 logistics and commercial properties worth approximately S$6.7 billion, diversified across five major developed countries – Australia, Germany, Singapore, the United Kingdom and the Netherlands.

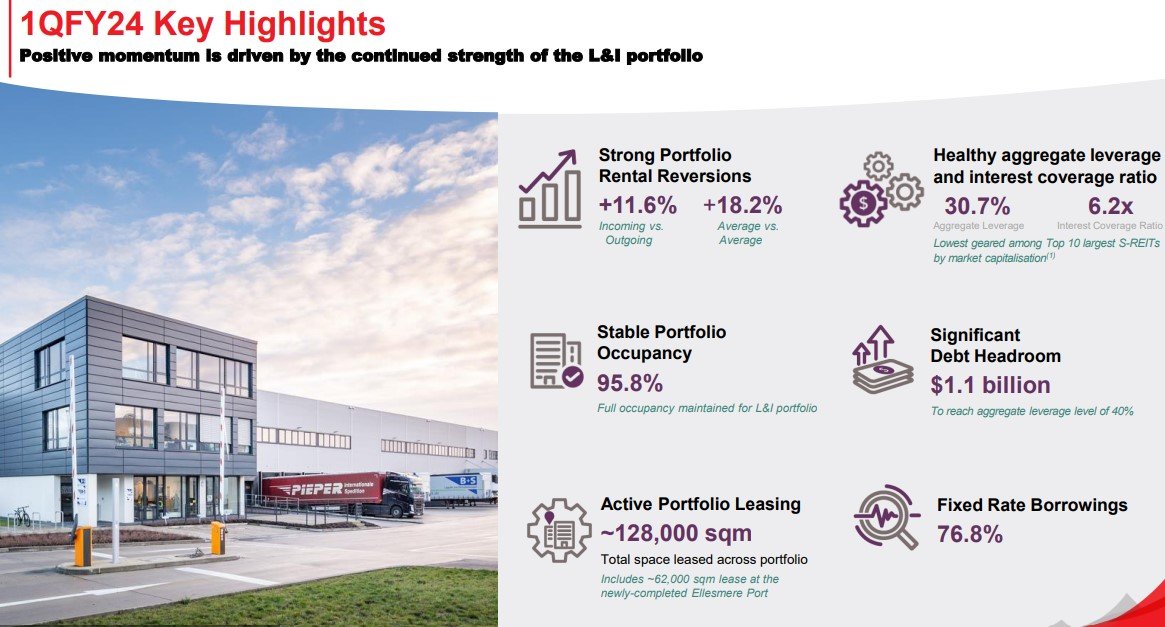

In its latest business update for 1QFY24, FLCT reported strong portfolio rental reversions of 11.6%. Portfolio occupancy remained stable at 95.8%. Gearing remained healthy at 30.7% with interest coverage ration of 6.2x.

However, its debt maturity profile is a cause for concern. as more than 25% of its debts is due in FY2024. This will inadvertently lead to higher interest costs.

FLCT has proposed to acquire 4 logistics properties in Germany with 100% occupancy. Gearing will rise to 32.5% which is still at comfortable level. According to the management the acquisition should be DPU accretive.

FLCT is one of the 3 Singapore REITs trading near 52 week low. Its share price is presently trading at $1.05 as at 2 April 2024. It is very near the 52 week low price of $1.00.

Is the share price being unfairly punished and does it present a buying opportunity? You can view the REIT website here.

Mapletree Logistics Trust

Mapletree Logistics Trust (MLT) invests in income producing logistics real estate in Singapore, Australia, China, Hong Kong SAR, India, Japan, Malaysia, South Korea and Vietnam.

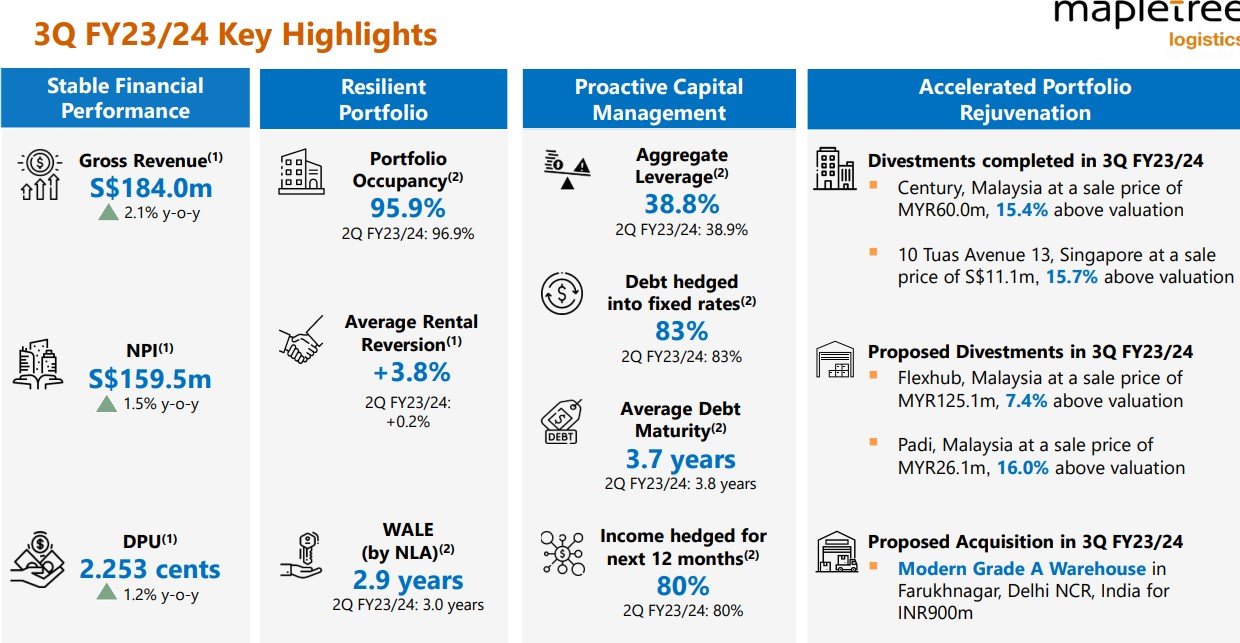

MLT reported DPU increase by 1.2% to 2.253 cents in its 3Q FY23/24 results. Net property income increase by 1.5% to S$159.5 million with positive rental reversion of 3.8%.

Gearing ratio dipped slightly to 38.8% which is still comfortable. Interest cover ratio is at 3.7x. MLT financial metrics looks healthy on surface.

However, investors need to be wary that MLT has been very active in acquiring and disposing properties and could the management be doing it at the expense of shareholders?

In addition, as at 31 Dec 2023, the China properties has the lowest occupancy rate compared to the rest of the properties. Did the management acquire the China properties at the wrong time and thus leading MLT share price to underperform compared to the FTSE REIT index?

MLT is another one of 3 Singapore REITs trading near 52-week low. MLT share price is currently trading at S$1.47 which is very close to the 52 week low price of S$1.41. Before investors decide to buy or DCA this REIT, we have to consider the economic headwinds facing China. You can view the REIT website here.

Conclusion

These are the 3 Singapore REITs trading near 52-week lows. Investors need to do their due diligence before buying or DCA these REITs. Investors should consider the following before buying:

- With rising food inflation such as Cocoa, Coffee and now rising oil price etc, will the Fed be able to cut rates 3 times as indicated this year?

- Will the 10 year treasury yield remain elevated at more than 4% depressing REITs share price?

- Macro economic headwinds in China as well as Europe and soon US.

[…] Invest REIT Posts of the Week @ 13 April 2024 By REIT-TIREMENT • April 13, 2024 If you've come across any REIT posts that you think are missing, please don't hesitate to let me know and I'll be more than happy to include them. On the other hand, if you're looking for even more up-to-date information and insights, I highly recommend joining REIT Investing Community or Singapore REITs Post Telegram Channel. You'll find a wealth of knowledge and a great community of like-minded individuals there. See you soon! Article 1) Better Buy: Keppel DC REIT Vs Digital Core REIT by The Smart Investor 2) Should You Invest In Daiwa House Logistic Trust [Fundamental Analysis] by Dan Consultancy 3) Money and Me: Manulife US REIT where could it be heading? Are we at the tail end of the down cycle for S-REITs? by REITsavvy 4) Should You Invest In CapitaLand Integrated Commercial Trust [Fundamental Analysis] by Dan Consultancy 5) 3 Singapore REITs Trading near 52-Week Lows – Are they … […]

[…] Source link […]