In my previous article (read here), we talked about 4 REITs that could outperform in 2023.

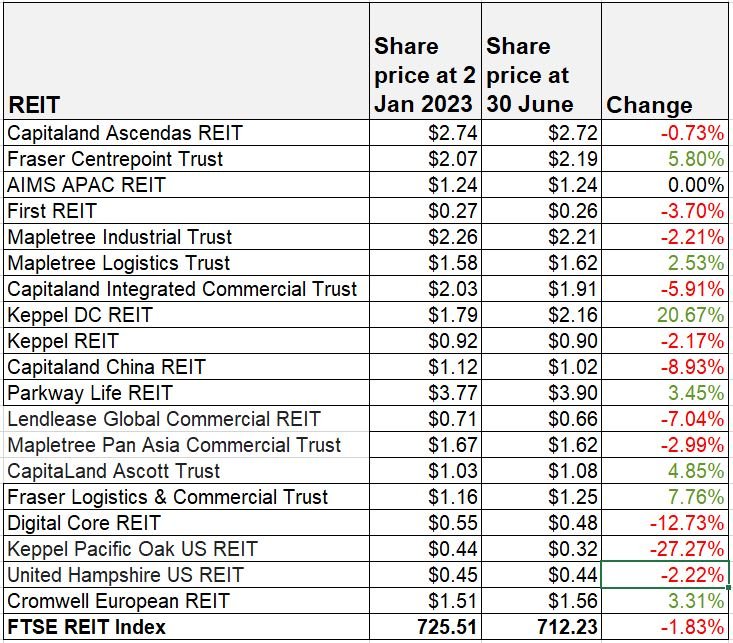

So lets find out on how the REITs have perform so far by collating the performance of the REITs vs the REIT Index…

*Not all REITs are mentioned

Out of the 4 REITs mentioned, 3 of them have outperformed the FTSE REIT index except First REIT. And from the table, we can conclude that:

- Not all big REITs are good. Capitaland Integrated Commercial Trust, Keppel REIT and Mapletree Pan Asia Commercial REIT underperform the REIT index.

- Overseas REITs perform poorly. The only exception is Crowmwell European REIT

- REITs that has office REITs tend to perform poorly. This is despite reports of higher rental rates in CBD area

But to wrap up, the overall REITs market wasn’t doing so well due to the increase in interest rates.

3 REITs for 2nd half 2023

But that said, onward to the 2nd half in 2023, lets check out another 3 potential S-reits that could beat the index.

1. CapitaLand Ascendas REIT

In the latest business update, Capitaland Ascendas REIT (CLAR) maintain a healthy Aggregate Leverage of 38.2% while interest cover is at 4.7x.

It has a well-spread debt maturity with the longest debt maturing in FY2032 and the average debt maturity remains healthy at 3.2 years. Overall portfolio occupancy remains above 90%.

The average portfolio rent reversion is at double digit of 11.1% for leases renewed in 1Q 2023 while rental reversion for FY2023 is expected to be in the positive mid-single digit range.

You can view the REIT website here.

2. Fraser Centrepoint Trust

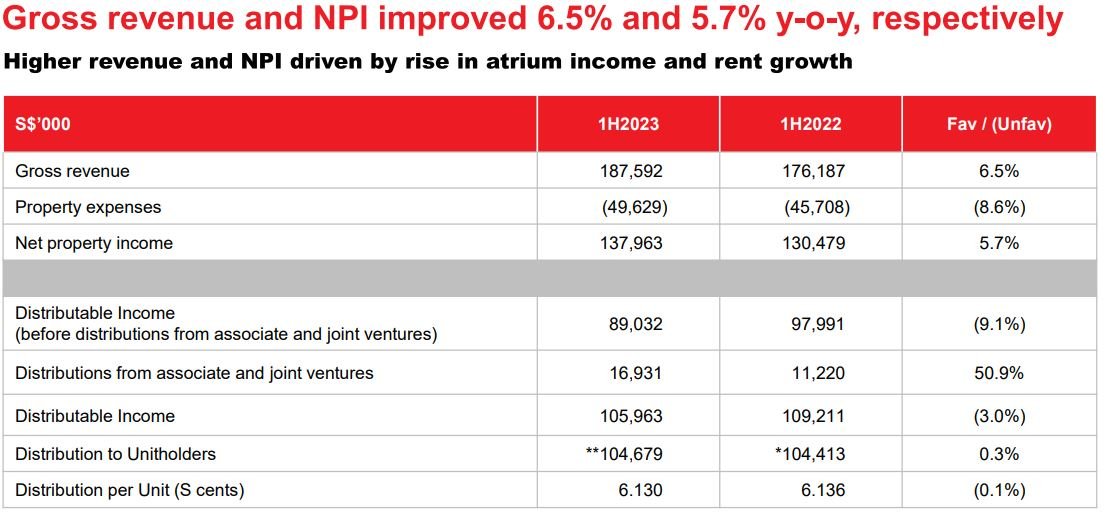

Fraser Centrepoint Trust (FCT) reported a decent set of results in its half year ended 31 March 2023. Net property income is up 5.7% to $137,963M while DPU only has a slight drop of 0.1% to 6.13 cents.

Overall committed occupancy hit a high of 99.2% while 1H2023 tenants’ sales is 9.2% higher y-o-y and shopper traffic is 35.3% higher y-o-y.

Retail portfolio rental reversions in 1H2023 was +4.3% (average vs average). Aggregate leverage is relatively high at 39.6% with adjusted ICR of 4.39x.

With FCT being the largest suburban retail space owner in Singapore, it is well positioned to continue to outperform the REIT index in 2nd half 2023.

You can view the REIT website here.

3. Sabana Industrial REIT

This REIT has been in the news recently with some messy affairs between the top 2 shareholders – ESR Group Ltd and Quarz Capital Asia. However, despite these news, the share price did not suffer greatly as what most would have anticipated.

In fact, Sabana Industrial REIT share price has outperformed the REIT index with a positive gain of 1.16% in the first half of this year.

Looking at the latest business update, Sabana REIT actually did well operationally wise.

It achieved a portfolio occupancy of 92.6%, a new high since 1Q 2021 and signed 180,262 sq ft of new leases with tenants, driven mainly by significant growth in demand for Warehouse and Logistics properties by third-party logistics providers.

The REIT renewed 156,388 sq ft of leases with a positive 13.6% rental reversion, sustaining the positive quarterly rental reversion track record since 1Q 2021. The only master lease that is due to expire in 2023 has been renewed.

The REIT has relatively low aggregate leverage ratio of 33.1%. 80.0% of borrowings are on fixed rates and weighted average fixed debt expiry of 1.8 years. Average borrowing maturity is at 2.6 years and the REIT has an interest coverage ratio of 3.8x.

Caveat: many investors do not fancy Sabana REIT as it does not have a strong sponsor. To add fuel to fire, the recent disputes between ESR Group and Quarz Capital may deter investors from investing in this REIT.

However, Sabana Industrial REIT share price is down only 1.14% for past 5 years compared to AIMS APAC REIT which is down more than 9%.

It also beat strong sponsor REIT like CapitaLand Integrated Commercial in terms of share price which is down more than 8% for the past 5 years.

You can view the REIT website here.

Conclusion – 3 REITs to watch

In summary, CapitaLand Ascendas REIT, Fraser Centrepoint Trust and Sabana Industrial REIT are the 3 Singapore REITs to watch for the 2nd half of 2023.

Investors should also beware that the FED could raise 2 more interest rates hikes and a possibility that the US could slip into a recession in second half 2023.

In addition, Singapore faces a high risk of technical recession this year, it will be prudent to stick to REITs that has stable prices.