Singapore has always been more synchronous with Income generating dividend stocks or REITs.

In fact, many of the blue chip stocks have suffered setbacks and massive disruptions to their businesses such as stiff competition among Telcos and sluggish oil prices slaughtering our O&G stocks.

That said, there are still growth stocks clocking in multibagger returns over the past few years. We have identified 3 growth stocks that may have more potential to run.

Growth Stock#1 – Cortina Holdings Ltd

Cortina has established itself as a brand synonymous with impeccable, high-quality timepieces,

renowned amongst discerning individuals. Cortina remains focused on its mission of being a leading retailer and distributor of luxury timepieces and accessories across the Asia Pacific region.

Cortina continues to expand its network of retail outlets, seeking opportunities in countries and cities with high growth potential, while augmenting and strengthening our presence in key markets like Singapore, Malaysia and Thailand.

As of its latest annual report, Cortina’s revenue decreased by 15% to $436.8 million. Its net profit increased however by 2.7% to $42.8 million.

The group’s free cash flow came in at $90.3 million which brings it cash level to $130.0 million.

Cortina’s earnings per share grew from $0.071 in 2017 to $0.239 in 2021. It is an impressive 236% growth over 5 years! On a 5-year CAGR basis, the company grew at 27.4% per annum!

Stock price grew from $0.74 in 2017 to $2.80 as of last close. This is an impressive 278% growth, which closely relates to its earnings per share growth over the last 5 years.

Cortina last closed at $2.80, which valued the company at a P/E ratio of 11.72x and offers a dividend yield of 0.81%.

Growth Stock#2 – iFAST Corporation Ltd

iFAST Corporation is a leading wealth management fintech platform, with assets under administration of approximately S$17.54 billion as at 30 June 2021.

Incorporated in the year 2000 in Singapore, iFAST Corp provides a comprehensive range of investment products and services to financial advisory firms, financial institutions, banks, multinational companies, as well as retail and high net worth investors in Asia.

The Group offers access to over 13,000 investment products including unit trusts, bonds and Singapore Government Securities, stocks and exchange traded funds, and insurance products; while services offered include online discretionary portfolio management services, research and investment seminars, IT solutions, and investment administration and transaction services.

The company is also present in Hong Kong, Malaysia, China and India.

As of its half-yearly report, iFAST’s revenue increased by 37.8% to $106.1 million. Its net profit increased by a remarkable 94.7% to $ 15.7 million.

Free cash flow came in at $15.5 million. Cash balance of the company as a result increased to a healthy level $41.6 million.

iFAST’s earnings per share grew from $0.02 in 2016 to $0.075 in 2020. It was an impressive 275% growth over 5 years! On a 5-year CAGR basis, the company grew at 39% per annum!

Stock price grew from $0.89 in 2016 to $9.90 as of last close. This is an impressive 888% growth, which even exceeded its earnings per share growth. This shows the favourable sentiments that investors have on the company due to its rapid growth.

iFAST last closed at $9.90, which valued the company at a P/E ratio of 98.25x and dividend yield of 0.31%.

Growth Stock#3 – AEM Holding Ltd

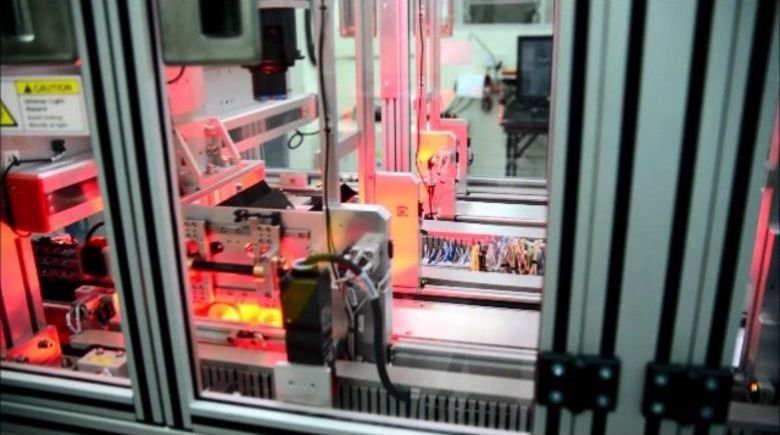

AEM is a global leader in test innovation and electronics test solutions, underpinned by the best-in-class technologies, processes, and customer support.

The company has a global presence across Asia, Europe, and the United States with manufacturing plants located in Singapore, Malaysia (Penang), China (Suzhou), and Finland (Lieto).

As of its latest half-yearly report, AEM’s revenue decreased by 29.8% to $192.2 million. Its net profit decreased by 45.4% to $36.4 million.

Free cash flow came in negative due to acquisition of subsidiaries and cash balance is at a healthy level of $70.8 million.

AEM’s earnings per share grew from $0.071 in 2016 to $0.351 in 2020. It was an impressive 394% growth over 5 years! On a 5-year CAGR basis, the company grew at 49% per annum!

Stock price grew from $0.80 in 2016 to $4.27 as of last close. This is an impressive 433% growth, which even exceeded its earnings per share growth. As the world moves towards semi-conductor with more companies in need of it, investors are extremely positive on the company.

AEM last closed at $4.27, which valued the company at a P/E ratio of 16.7x and sports a decent 1.55% dividend yield.

Billionaire Warren Buffett is arguably the most successful investor of all time.

Learn the secrets to Warren Buffett’s investment success by downloading the Free Guide below: