More often than not, retirees not only want steady dividend payouts but they are looking at growth as well.

Hence, in this article, we cherry picked 3 exceptional growth REITs that are poised to continue growing their Net property income -> DPU.

These 3 REITs combine the potential for capital appreciation with consistent dividend payments which makes them worth a spot in your retirement strategy. Read on more below:

1. Capitaland India Trust

CapitaLand India Trust (CLINT), is the first Indian property trust in Asia. Its principal objective is to own income-producing real estate used primarily as business space in India.

In the latest business update for first quarter ended 31 Mar 2023. CLINT reported net property income increase by 5% to S$42.0m.

Gearing ratio is still manageable at 39% while 78% of the debts is on fixed rate. This should help CLINT to weather any further potential rate increases.

CLINT launch a preferential offering in June at issue price of S$1.06 to part finance the development and construction of Block A of International Tech Park Hyderabad.

It is also partially used towards the extension of ongoing funding to the developers of the properties known as aVance A1, HITEC City, Hyderabad and Gardencity, Hebbal, Bangalore.

It will be a DPU accretive and value-enhancing transaction for CLINT Unitholders with DPU accretion of 4%. It now sports an attractive distribution yield of 7.3%.

With bright economic prospects in India especially that it is becoming the most populous country in the world, CLINT could be part of your retirement portfolio.

You can view CLINT website here.

2. Keppel Infrastructure Trust

Keppel Infrastructure Trust (KIT) is a listed business trust that provides investors with the opportunity to invest in a large and well-diversified portfolio of core infrastructure assets located in countries that support infrastructure investment.

KIT’s portfolio comprises strategic businesses and assets in the three core segments of

- Energy Transition

- Environmental Services

- Distribution & Storage

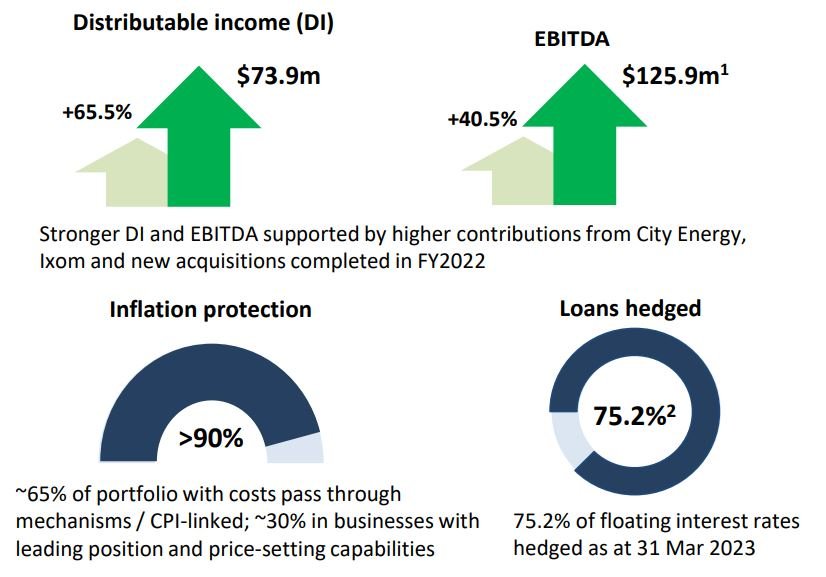

In the latest business update, KIT distributable income is up a whooping 65.5% to $73.9m while more than 90% of their assets are inflation protected. KIT also has 75.2% of their loans hedged.

KIT net gearing is relatively high at 42.5% with weighted average interest rate of 3.7%.

That said, given the nature of its recession proof properties, it is able to offer resilient cashflows and a good distribution yield of 7.4%.

You can view KIT website here.

3. NetLink NBN Trust

NetLink NBN Trust (NLT) owns the only nationwide fibre network supporting Singapore’s Nationwide Broadband Network (“NBN”). NLT designs, builds, owns and operates the passive fibre network infrastructure of Singapore’s NBN.

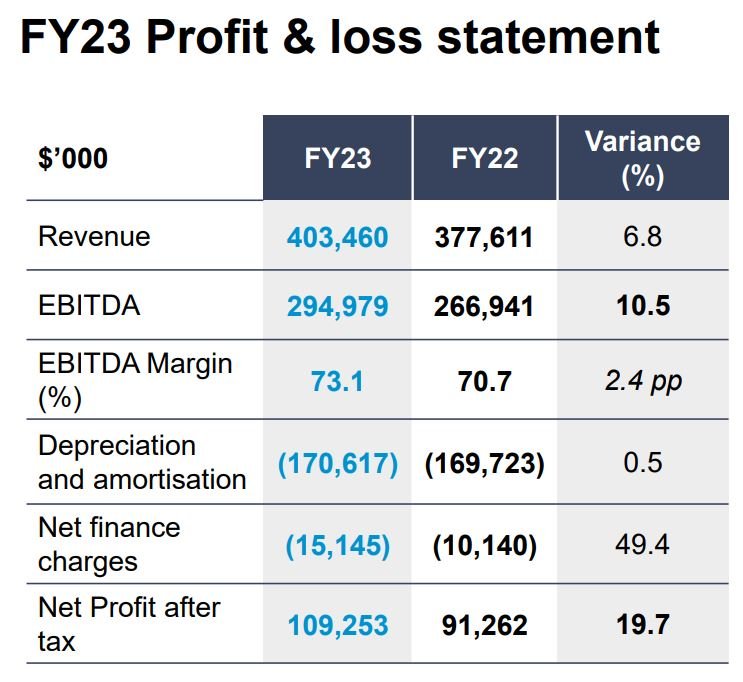

In its latest results for full year ended 31 March 2023, NLT’s revenue is up 6.8% while EBITA is up 10.5%. Its weighted debt to maturity is 3.4 years and its effective average interest rate is low at 2.1%.

With distribution yield of 6%, resilient business model and recurring, predictable cash flows, NLT should be able to provide stable distributions to shareholders.

However, investors need to note the uncertainty in its ongoing review of the terms and conditions (including prices) of NetLink’s services offered under its Interconnection Offer by the IMDA. The review is expected to be completed this calendar year.

You can view NLT website here.

Conclusion

Incorporating growth REITs into your retirement portfolio can be a smart move for long-term financial security. The 3 REITs highlighted in this article have demonstrated impressive growth potential and a track record of delivering consistent returns.

As always, remember to conduct thorough research, consider your risk tolerance, and consult with a financial advisor before making any investment decisions.