Insiders buying is the purchase of shares in a corporation by a director, officer, or executives within the company. Insiders buying are considered positive signs espoused by the management. This action usually indicates that the management has a view that the company is undervalued.

It is also vice versa that management may want to sell in view of pending bad news. However, it is not a definitive tool for buying or selling a stock, but an aid to provide an insight of what the management thinks or feels.

With all these points in mind, let us look at 3 companies with insiders buying shares recently.

1. Fuji Offset Plates Manufacturing Ltd

Fuji Offset specialises in the manufacture and supply of printing cylinders. The group supplies a range on products to cater to the gravue printing industry. The group has been listed in Singapore since 1988.

Teo Kee Bock, the chairman of Fuji Offset bought 1.505 million shares totalling $677,054 in the open market on 16th October. This raised his shareholdings to 27.22% of the company.

In its latest half-yearly results, the group registered a drop of 15% Year-on-Year in its revenue from 2.7 million to 2.3 million. Operating income turned negative to a -S$0.23 million.

However, a noteworthy point is that net profit is positive due to higher finance income and relatively good performance from results of associate. This boosted its net profits to a +ve S$0.69 million. This shows the investment made by the group has yielded good returns in terms of profits.

Fuji offset closed on 29th October at a price of S$0.395 giving a P/E ratio of 5.9x and a dividend yield of 0.7%.

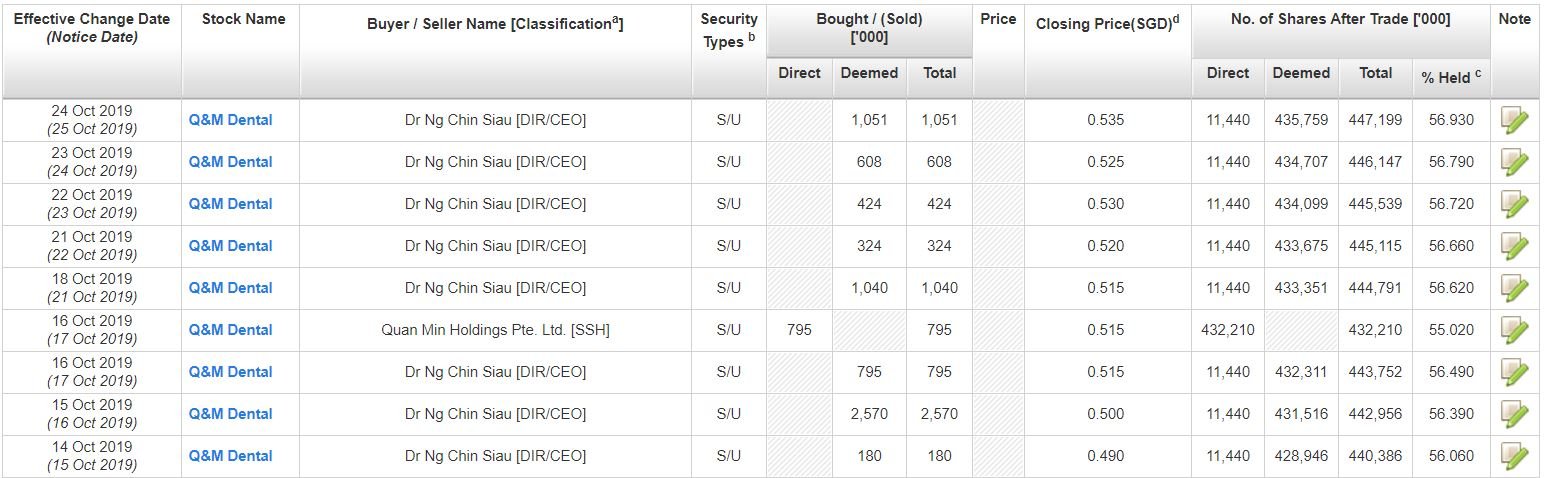

2. Q&M Dental Group

Q & M dental group is a private dental healthcare group. It has operations across Singapore, Malaysia, and the People’s Republic of China. The group operates 92 dental outlets, 4 medical clinics and 3 dental supplies and equipment distribution companies across the 3 countries.

In the month of October, CEO Dr Ng Chin Siau have acquired almost 7 million shares at an average price of S$0.51. This enlarged his shareholdings of the company up nearly 1% in a month from 56.06% to a significant 56.93%.

In its latest half-yearly results, the group registered an increase of 3% in its revenue to $55.4 million to $53.79 million. Net profit of the group dropped slightly by 7% to $8.4 million from $9.1 million. The lower net profit was due to higher expansion costs and training costs incurred by its equity-accounted associates Aoxin Q & M.

Q & M dental’s share price closed at $0.52 on 29th October. This gives it a P/E ratio of 28.5x and a dividend yield of 1.58%.

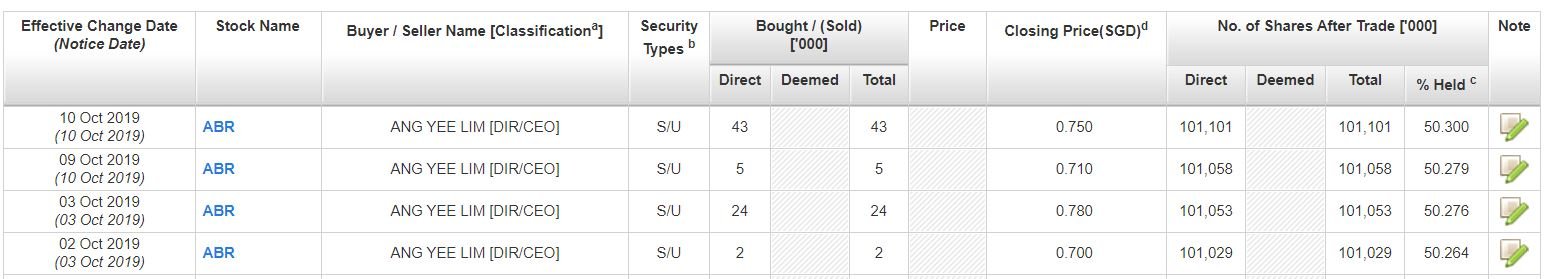

3. ABR Holdings

ABR holdings is primarily a food and beverage company which owns several popular brands in Singapore such as Swensens, Tip top, Seasons, etc. The group has its main operations in Singapore, with a small portion of its operations in Malaysia and other parts of Asia.

Managing Director Mr. Ang Yee Lim bought a total 74,000 shares with the closing prices ranging from S$0.70 to S$0.78. The transactions took up around $54,000.

In its latest quarterly results, the group registered an increase of 2.9% in revenue to $31.4 million from $30.5 million. Net profit dropped by 28.6% from $956,000 to $683,000, mainly due to an increase in interest expense.

However, the group has achieved and admirable increase in cashflow from operation activities from -$875,000 to $4.9 million.

ABR Holdings share price last closed at $0.75 on 29th October. It is trading at a lofty P/E ratio of 56.6x and dividend yield of 3.3%.

Looking to lead a comfortable retirement? You need to learn how to save and put those into work by investing well. Right here, You can develop your own Unique Investing System via a simple 10-Step Checklist.

Simply click to find out more today!