Many investors love REITs for their dividends. However, many have omitted to look at Business Trust. There are Business Trusts other than REITs that is offering high yield too.

These 3 Business Trust companies may do the trick. These Business Trusts act as a steady stream of passive income that helps to boost your earned income.

We identified 3 Business Trusts that offer a juicy dividend yield of more than 8% which you might consider to add to your watchlist.

1. Keppel Infrastructure Trust

Keppel Infrastructure Trust (KIT) is a listed business trust that provides investors with the opportunity to invest in a large and well-diversified portfolio of core infrastructure assets located in countries that support infrastructure investment.

In 1H 2023 results, KIT reported 51.8% increase in distributable income to S$132.9 million mainly due to acquisitions completed in FY2022. DPU increase by 1% to 1.93 cents which translate to an annualised dividend yield of 8.4%.

With the recent completion of the fund raising exercise, the gearing is relatively low at 38.5% with 77.4% of debt on fixed rates.

KIT has been driving portfolio growth through acquisitions especially in clean energy assets such as wind farms. The pivot to green energy assets bodes well for KIT as many countries are reducing their carbon footprint.

You can view the business trust website here.

2. Asian Pay Television Trust

Asian Pay Television Trust (APTT) is the first listed business trust in Asia focused on pay-TV and broadband businesses.

APTT has an investment mandate to acquire controlling interests in and to own, operate and maintain mature, cash generative pay-TV and broadband businesses in Taiwan, Hong Kong, Japan and Singapore.

APTT’s sole investment, Taiwan Broadband Communications Group (TBC), is a leading cable operator in Taiwan.

For half year ended June 2023, revenue is down 6.9% to S$135.3 million while EBITA is down 8.8% to S$85.6 million. Gearing is relatively high at 48.1%. Please note that unlike REITs there is no statutory gearing limit for business trusts.

APTT declared distribution of 0.525 cents per unit declared for 1H 2023 and re-affirmed distribution guidance of 1.05 cents per unit for the full year 2023 which translate to a whopping dividend yield of 11%!

APTT intends to grow by continuing to build on the up-sell & cross-sell initiatives across TBC’s subscriber base to drive growth in future cash flows.

In addition, APTT will intensify marketing efforts by stepping up partnership programs with mobile operators to focus on fixed-line broadband-only segment.

You can view APTT website here.

3. Hutchison Port Holding Trust

Hutchison Port Holdings Trust (HPH Trust) is the world’s first publicly traded container port business trust. HPH Trust operates Hongkong International Terminals, COSCO-HIT Terminal and Asia Container Terminals.

In mainland China, HPH Trust operates Yantian International Container Terminals and Huizhou International Container Terminals.

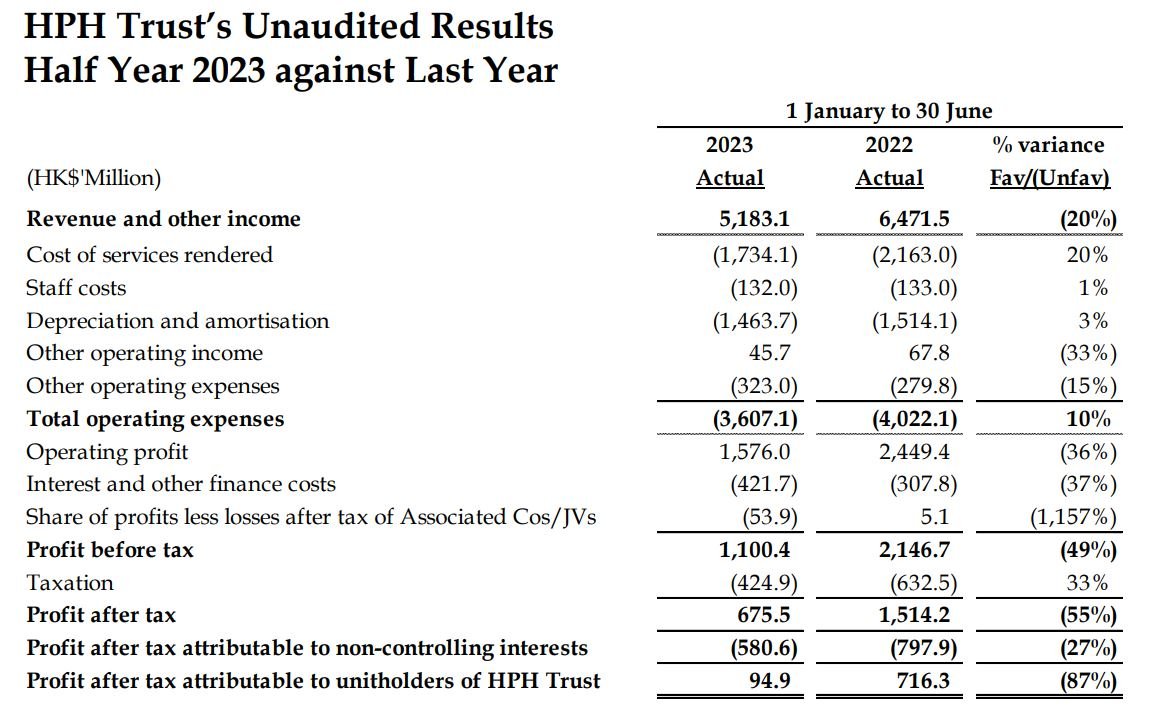

HPH Trust revenue was down 20% to HKD 5,183.1 million for first half 2023 while profit after tax was down 55% to HKD 580.6 million. HPH Trust declared interim dividend of 5.50 HK cents which is about 0.96 Singapore cents which translate to an annualised yield of 12%!

However, HPH Trust has not much growth prospects due to the ongoing China and US trade war. Hence, HPH Trust embarked on a debt repayment programme since 2017.

In the first six months of 2023, HPH Trust continued reducing debts by HK$1.1 billion to further deleverage its balance sheet and manage its interest rate exposure.

You can view HPH Trust website here.

Conclusion

These are the 3 Business Trusts with juicy yield of more than 8%. However, investors should not based their investing decision just based on yield alone.

In fact, these 3 business trust share price has declined double digits this year with HPH Trust faring the worse dropping 18.5%. Similar to REITs, business trust has not been spared from the high rates environment.

Hence, it is imperative that investors need to be very selective in buying business trust or REITs and not just go by dividend yield.

Want to find out if this stock is in our watchlist? Check out our full REITs + Dividend portfolio on Patreon. We also offer insights into interesting analyst reports as well as macroeconomic developments. Follow us for FREE on Patreon now!

Thank you for the write-up. Is it true, unlike REITs, Biz Trusts are not obligated to payout 90% of their net earnings to shareholders?