Property management operator LHN Limited (“LHN”) offers space optimisation solutions, property development, facilities management and energy services in Singapore and other Asian countries.

The Group currently has 4 main business segments, namely:

- Space Optimisation

- Property Development

- Facilities Management

- Energy

It has announced its FY2023 results ended 30 September 2023 and declared a final and special dividend in FY2023. On top of that, LHN announced that from it is moving from the Catalist board to the Mainboard of the SGX-ST on 13 December 2023.

With this in mind, here are 7 things investors should know about the company.

1. Growth driven by Co-living Brand Coliwoo

According to the latest FY2023 results, the Group’s main source of revenue and key driver of growth comes from the Space Optimisation Business, constituting 64.5% of the Group’s total revenue.

Revenue generated from this business segment saw a year-on-year increase of 46.1%, reaching S$60.4 million in FY2023, as compared to S$41.4 million in FY2022.

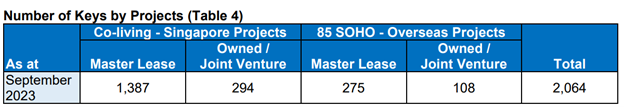

As seen from the table above, the Group’s residential properties managed a total of 2,064 keys as of September 2023, primarily fuelled by Coliwoo’s co-living business.

The ongoing renovation projects for 404 Pasir Panjang, as well as 48 and 50 Arab Street, are progressing as planned and are anticipated to contribute to the co-living business’s performance in FY2024.

In FY2023, the occupancy rates for key Coliwoo projects within the Group remained robust. Coliwoo Orchard reported an occupancy level of 93%, while Coliwoo Lavender and Coliwoo 298 River Valley achieved occupancy rates of 86% and 100%, respectively, as of September 2023.

Singapore’s co-living industry continues to thrive, driven by a confluence of factors that include surging rents and prices in the broader residential property market, higher adoption of hybrid work, as well as accelerating demand for flexible housing options by locals and expatriates, including singles and young couples.

2. Newly Added 4th Business Segment – Energy

In FY2023, the new Energy Business made its maiden contribution. This sector offers renewable energy services to industrial clients, encompassing electricity supply, the installation of solar power systems, and the provision of electric vehicle (“EV”) charging stations.

The firm has successfully deployed solar panels in 3 internal and 6 external locations throughout FY2023. Despite this segment representing only a small 0.5% share of the Group’s overall revenue, it is profitable from the onset – achieving an adjusted segmental profit of S$0.4 million for the same year.

3. Healthy Revenue and Operating Cashflow Growth

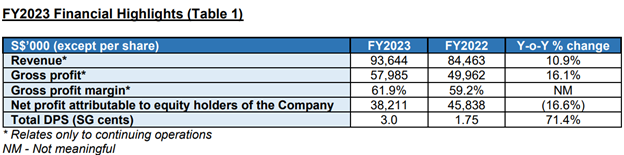

The Group experienced an 10.9% Y-o-Y increase in total revenue from continuing operations to S$93.6 million due to a broad-based growth in all business segments.

In contrast, net profit attributable to equity holders was down 16.6% to S$38.2 million over the same period, primarily due to net fair value losses amounting to S$8.7 million, as compared to a sharp fair value gains in FY2022 of S$24.8 million.

One should also note that the FY2023 net profit comprises of a gain of S$19.7 million following the successful divestment of LHN Logistics Limited and its affiliated companies (referred to as the “Logistics Group”) on 28 August 2023. The Logistics Services Business segment will no longer contribute to the Group’s performance from the next financial year onwards.

On a bright note, net cash generated from operating activities increased from S$41.2 million in FY2022 to S$54.2 million in FY2023, underpinned by enhanced working capital management.

4. Improving Balance Sheet

As of 30 September 2023, the net gearing ratio of the Group decreased to 43.6% compared to 44.5% a year ago, largely due to a few divestments during FY2023 which include:

- A 20% interest in associate in car-sharing platform GetGo Technologies Pte. Ltd. for S$7.9 million

- 50% interest in a JV of Amber 4042 Hotel Pte. Ltd. for S$23.3 million

- 05% controlling interests in LHN Logistics Limited for S$31.9 million

These capital recycling initiatives helped to shore up its financial position while funding the growth of its Coliwoo business.

5. Higher Dividends to boot

Notwithstanding the reduced profit attributable to equity holders, LHN has recommended a special dividend and final dividend of 1.0 Singapore cent each per share.

If we were to include the earlier interim dividend of 1.0 Singapore cent per share, the total dividend per share for FY2023 stands at 3.0 Singapore cents per share.

Based on the closing share price of $0.34 as of 26 November 2023, the dividend yield comes up to an enticing 8.8%, much higher than the estimated 3.5% yield of the STI ETF.

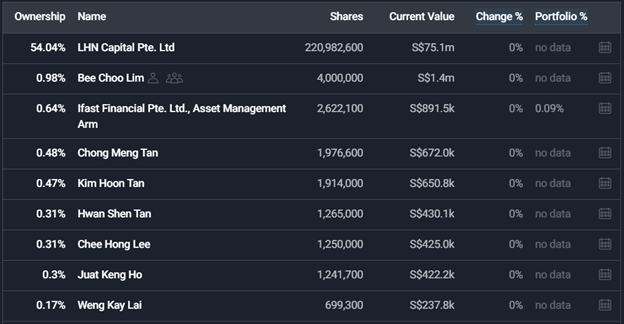

Looking at the dividends chart, LHN has been dishing out dividends consistently since FY2020. This shows the commitment of the management to continue rewarding shareholders – note that the management team happens to be the the Group’s biggest shareholder as well.

6. Management Team

From the table above, we can see that LHN Capital is the largest shareholder of the firm with a 54% interest. The holding company LHN Capital is in turn owned by the Lim family – Mr. Kelvin Lim and his sibling Ms. Jess Lim.

Mr. Kelvin Lim has been the Executive Chairman & Group Managing Director since July 2014 and possesses over 20 years of experience in the property leasing business, including over 10 years of experience in the logistics services and facilities management business.

Ms. Jess Lim, Executive Director & Group Deputy Managing Director, has over 20 years of extensive and varied experience in business and supply chain management, comprising of over 15 years of experience in the leasing and facilities management business.

Given that both of them own more than half the company, this aligns the interest of owner-management with minority shareholders.

7. Bright Outlook Ahead

In general, LHN expects a bright outlook for the company as its biggest segment stands to benefit from the rising demand for space optimisation solutions, as more people and businesses seek flexible and affordable space options.

Notably, the firm is gunning for substantial growth in the Coliwoo Co-living business as the ongoing renovation of properties at 404 Pasir Panjang Road, 48 and 50 Arab Street, and 99 Rangoon Road are on track for completion in FY2024. These developments are projected to contribute an estimated 121 keys to the Co-living portfolio.

Last but not least, the shift of its listing to the SGX Mainboard will bolster the Company’s standing both domestically and internationally, fostering greater visibility and recognition in the market and among investors.

Some industry background on the dynamics of Singapore’s co-living sector – for your consideration