REITs investing used to be an easy way to invest in something and get recurring passive income.

However, amid the interest in interest rates and poor global economic outlook, REIT investors are feeling the heat as things take a drastic turn.

Hence, investing in REITs is not a walk in the park now and here are a few important things to note when doing so.

What are REITs

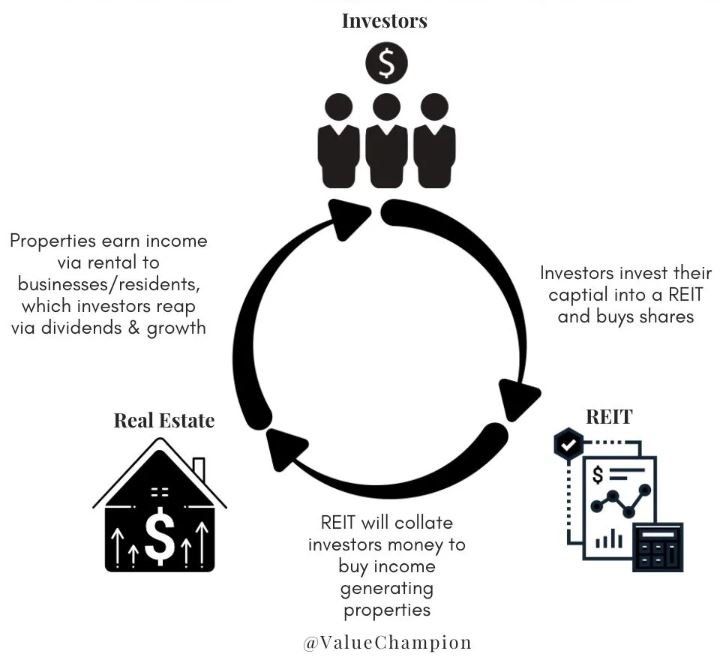

Investors of REITs would have their investment capital pooled (similar to how a mutual fund works) for them to invest in a portfolio of Residential (rare in Singapore, but common overseas), Industrial, & Commercial properties. They will collect dividends based on the dividend yield and annualised returns of the investments.

You can check out ValueChampion for more information on REITs.

REITs are a good investment vehicle for those new to investing, especially with the simplicity and similarity to ETFs and Mutual Funds, which are equally beginner-friendly investments.

1. Nature of REITs/Industry

As mentioned, REITs can come in the form of specific sectors, such as retail, industrial, hospitality or commercial.

Certain sectors like the healthcare and infrastructure REITs will be more resilient whereas the hospitality and industrial REITs may prove to be good for a rebound.

Hence, you may want to identify the nature of the REIT first in order to understand what to expect a few years down the road.

2. REIT’s Profitability

What interests you next will be the dividends it can offer. As it is mandated for a REIT to distribute at least 90% of income as dividends, the higher the profitability, the higher returns you can get.

To determine the REIT’s profitability, a simple guide will be to look out for its property yield and occupancy rate.

(i) The property yield gives you a percentage of how much the company is earning, as compared to the value of its property.

It is calculated by dividing the total loan of a REIT by its total assets’ size.

Property Yield = Net Property Income (NPI) / Total value of properties (based on the latest available valuation) * 100%

The higher the rental yield, the higher the income for the company. However, do take note that if the rental yield is too high, it may pose an issue in retaining its tenants.

(ii) On the other hand, the occupancy rate gives you a good indication of the percentage of property being rented out.

More importantly, we want to see a constant or increasing %. A decline in the occupancy rate may sound an alarm that the REIT is not able to attract tenants and it will affect it over the long run.

3. REIT’s Gearing Ratio

REITs deals with real estate which involves a HUGE initial outlay of capital and its only sensible to borrow from banks to leverage on their balance.

But as investors, we should then watch over the amount of debt it carries under its belt. A good ratio to look at will be the debt-to-asset ratio which gives you the proportion of debt as compared to the asset value.

The gearing ratio is calculated by dividing the total loan of a REIT by its total assets.

Gearing Ratio = (Total borrowings / Total Assets) * 100%

Under the MAS regulations, REITs in Singapore require the gearing ratio to be below 45%. But the covid-19 situation has let MAS change the leverage limit to 50%.

This is to provide S-REITs greater flexibility to manage their capital structure amid the challenging environment created by the COVID-19 pandemic.

That said, a relatively low gearing ensures that when asset prices come down, there’s still enough margin of safety before the gearing limit is breached.

Another area you may want to look at is the interest coverage ratio.

This ratio allows you to determine if the company is able to pay off the interest expenses on its outstanding debt.

It is calculated by dividing a company’s earnings before interest and taxes (EBIT) by the company’s interest expense for the same period.

4. REIT Management Fees

Different REITs will incur different fees and charges. An example will be the asset management fees payable to the REITs managers.

Other charges may include repair or maintenance costs for the buildings. These fees may take a bite out of your returns so it is wise to take a look at them before making a decision.

The gist is that the REIT manager should be taking credit when they perform well – aligning their interests with the unitholders.

5. Dividend and Management/Sponsor Track Record

Other factors you may want to consider include:

- Past track record of dividends – Do the REIT consistently deliver its dividends for the previous few years?

- Is the management team capable of developing AEI (asset enhancement initiatives) OR sourcing for new, income-accretive assets?

- How about the sponsor? Is it one with a strong financial backing and big pipeline of buildings which can be injected into the REIT for steady growth in future?

Conclusion

The above-mentioned is meant to be a quick guide to help you take your first step into REITs investing.

Considering how the future is pivoting towards an online one – REITs need to keep up with the times or risk being replaced in future. As investors, we should also pay close attention as the events unfold.

[…] REIT FY19 and 1H20 Performance by REIT Pulse 2) KDC Ta analysis by Vitamin Cash 3) 5 Quick Things To Know Before Investing Into REITs by Small Cap Asia 4) 3 Industrial REITs That are Well-Positioned for Growth by The Smart Investor 5) Data […]