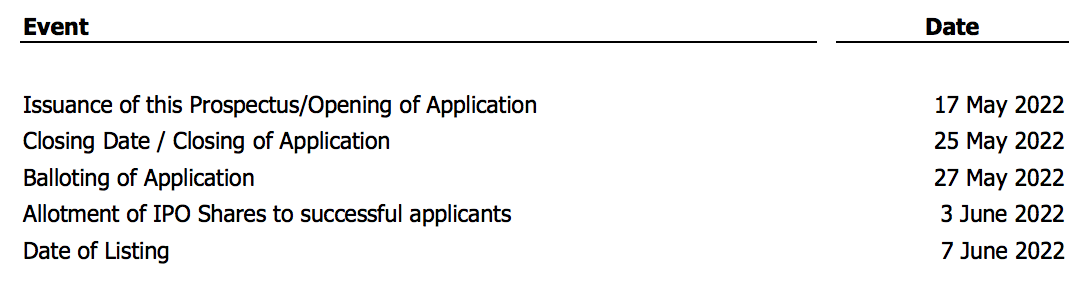

On 17 May 2022, Yew Lee Pacific Group Bhd (Yew Lee) issued its IPO Prospectus (Part 1, Part 2 and Part 3) on Bursa Malaysia and offered the public to subscribe its shares at RM 0.28 a share.

Upon IPO listing, Yew Lee would raise the amount of market capitalisation to RM 149.1 million. The closing date of its subscription is set to be on 25 May 2022.

Before deciding an investment into it, you can read this article where I had summarized 8 key things to know about Yew Lee.

#1 Business Model

Yew Lee earns income from manufacturing industrial brushes and trades a wide range of industrial hardware & machinery parts in Malaysia.

Yew Lee had raised its manufacturing lines from 11 in 2018 to 13 in 2021 and hence, had raised the company’s production capacity, from 1.9 billion pieces of industrial brushes to a total of 2.8 billion pieces of industrial brushes per year.

Yew Lee has maintained its production utilization rate at 80%-90% over the 4-year period of 2018-2021.

Source: Page 106 of Yew Lee’s IPO Prospectus

In 2022, Yew Lee had bought 1 semi-automated CNC continuous cycle drilling & filling machine. Thus, it has 14 manufacturing lines presently.

#2 Financial Results

Yew Lee increased its revenues from RM 27.8 million in 2018 to RM 45.5 million in 2021.

This is contributed by higher sales volume of its industrial brushes & its industrial hardware and machinery parts mainly to glove manufacturers such as Top Glove, Hartalega, Careplus Group, Latexx Manufacturing, VRG Khai Hoan, & Precious Mountain Enterprise Corporation Taiwan Branch in that period.

Source: Page 170 of Yew Lee’s IPO Prospectus

This raised its earnings, from RM 5.1 million in 2018 to RM 10.1 million in 2021.

Its earnings per share (EPS) grew from 0.95 sen in 2018 to 1.90 sen in 2021.

Source: Page 161 of Yew Lee’s IPO Prospectus

#3 Balance Sheet

Since 2018, Yew Lee maintained 1.0+ in current ratio and <50% in gearing ratio.

Source: Page 161 of Yew Lee’s IPO Prospectus

#4 Utilization of IPO Proceeds

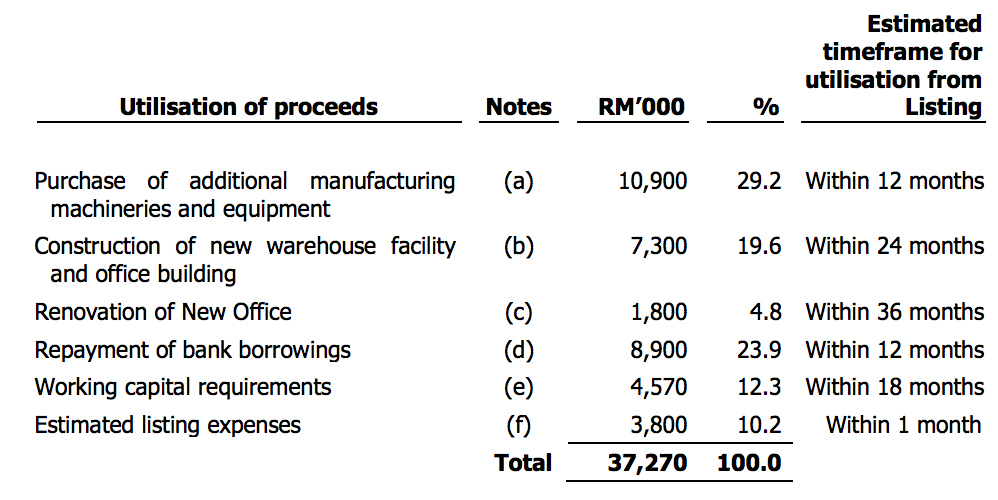

Yew Lee intends to raise RM 37.3 million in gross IPO proceeds and use it for:

Source: Page 26 of Yew Lee’s IPO Prospectus

1. Purchase of Manufacturing Machineries & Equipment (RM 10.9 million)

Presently, Yew Lee has 14 manufacturing lines, which could produce 3.08 billion pieces of industrial brushes per annum.

Yew Lee is allocating RM 10.9 million to buy 4 additional units of semi-automated CNC continuous cycle drilling & filling machines.

These shall increase its manufacturing lines to 18 that could produce up to 4.26 billion pieces of industrial brushes per annum.

2. Construction of New Warehouse Facility & Office Building (RM 7.3 million)

Yew Lee plans to construct a new 3-storey office building and would relocate its existing office space to the new office building.

Yew Lee then intends to convert its existing office space into additional manufacturing spaces.

In addition, it had revealed that it plans to construct a 12,788 sq. ft. warehouse to better organize its raw materials and finished goods.

3. Repayment of Bank Borrowings (RM 8.9 million)

The loan facilities to be repaid are as follows:

Source: Page 31 of Yew Lee’s IPO Prospectus

4. Working Capital Requirement (RM 4.6 million)

This includes expansion of its workforce and purchases of raw materials.

5. Renovation of New Office (RM 1.8 million)

6. Estimated Listing Expenses (RM 3.8 million)

#5: Major Shareholders

Source: Page 39 of Yew Lee’s IPO Prospectus

The current positions held by the 3 major shareholders are as follows:

Source: Page 40 of Yew Lee’s IPO Prospectus

Ang Poh Yee, daughter of ALL and Chee Wai Ying is also an Executive Director of Yew Lee.

#6 Concentration Risk

Yew Lee derives 50.4% of its sales in 2021 from its top 5 customers.

They are all rubber glove manufacturers, where the largest revenue contributor for Yew Lee is Top Glove (32.1% of its 2021 sales).

Source: Page 130 of Yew Lee’s IPO Prospectus

#7 Dividend Policy

Yew Lee does not have any formal dividend policy.

#8 Valuation

Based on 28 sen a share, the IPO offer is valued at P/E Ratio of 14.74x (2021 EPS) and P/B Ratio of 1.99 (Net Assets after IPO Utilization).

Conclusion

Overall in 2018-2021, Yew Lee had attained higher revenue and earnings due to higher sales volume of its industrial brushes to key rubber glove manufacturers.

The company has a high current ratio and low gearing ratio in its balance sheet.

The key question to investors is on the concentration risk to its main customers, the level of interest on its growth initiatives and the valuation of its IPO offer.