“How to invest ah?”

This question has originated from the beginning where share ownership is made available in the world.

It is also a question I get a lot from my friends/acquaintances who knew that I have decent investment knowledge or is fanatical about looking at businesses.

Although I will go all out to help them get started, they didn’t really get off the ground except maybe to open an account and such.

These are some typical responses I get when I checked in with their progress:

- “No leh, too busy to get started”.

- “Hmmm, I am scared to lose money”

- “I don’t know who to approach or how to find ideas suitable for me”

After many years of this ‘routine’, I finally found the underlying reason behind. It’s always about the WHY.

Why You Must Invest?

People often procrastinate on some stuff because they don’t feel the importance or sense of urgency.

And this is also the reason why so many people put off investing until their retirement age draws closer.

Or only invest in the stock markets right at the top of the markets only to see it come tumbling down.

“Know the Why, and Everything will become clear”

— Anonymous

Thus, if you would ask me what is the single, most important thing in Stocks Investing… it is understanding the real reasons why you have to get started.

Because once you know why its a MUST to invest, you will spare unlimited resources (time, effort, overcoming your fears) to keep progressing until you make it.

Here are 3 main reasons why You need to invest

1. Beat Inflation

According to Investopedia, Inflation is defined as a sustained increase in the general level of prices for goods and services, measured as an annual % increase. As inflation rises, your purchasing power will drop as you buy a smaller % of the same good/service.

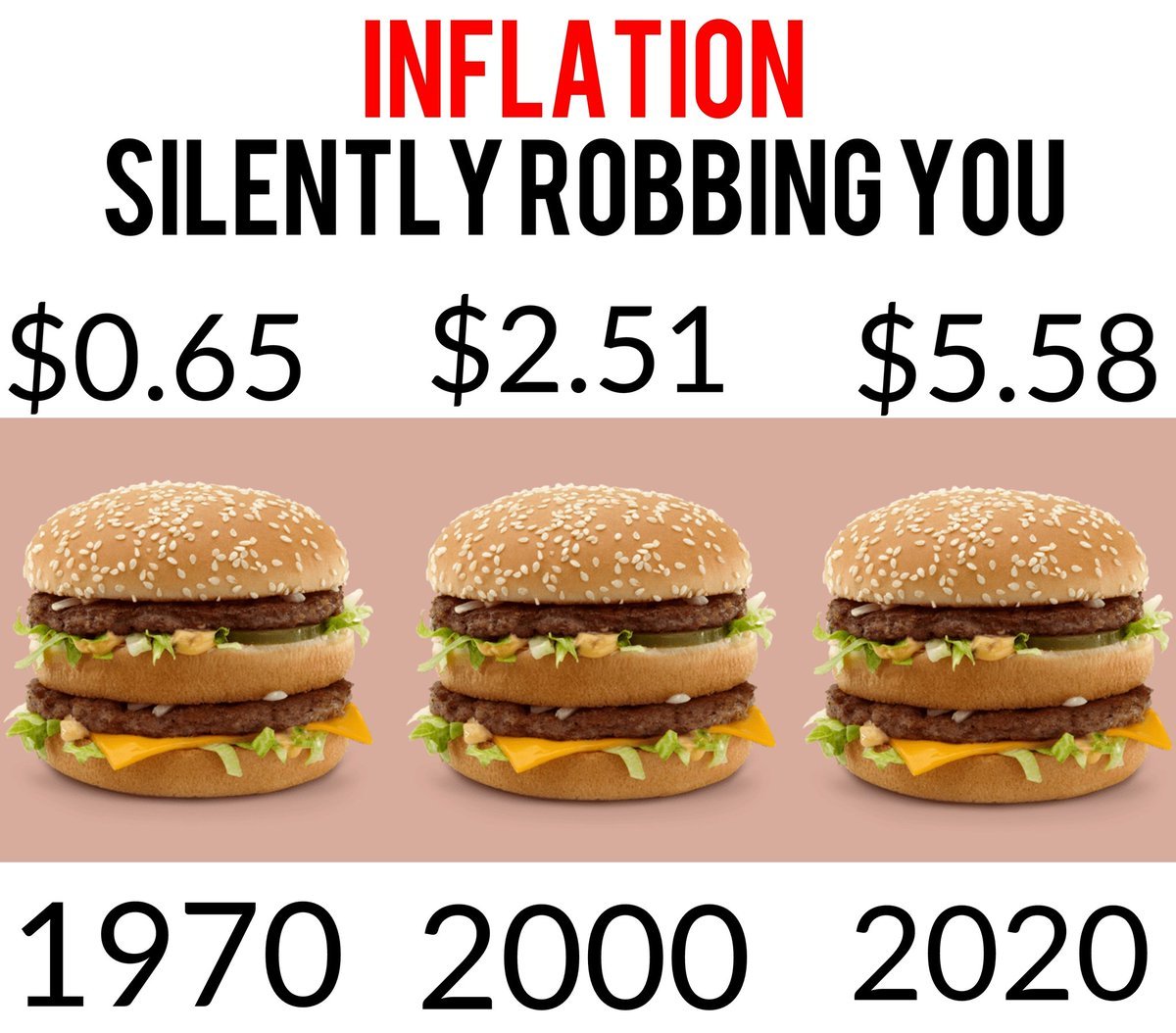

One case in point is how Mcdonald’s increase its prices year after year because of inflation. Let’s take their Double Mac as an example.

While it used to cost only $0.65 in 1970, it now costs $5.58 for the same thing in 2020.

A whooping 858% inflation over 50 years or 4.4% CAGR in inflation (not too off the mark now?)

Therefore, many people think of Inflation as a Pac-Man going around eroding every dollar you have over time.

However, you can flip the thinking to your advantage too.

With the constant increase in prices of goods and services, companies all over the world rake in higher sales and profits which in turn, lead to a rise in their stock prices too.

Just look at the same Mcdonald’s who hike your burger price by 858% over 50 years.

Imagine if you have invested during its IPO in 1981, you would have made 30,100% returns!

Pretty obvious that the investor is the one who win at the end of the day.

In short, inflation can be viewed as a double-edge sword. So, as opposed to letting inflation continually eroding your wealth, why not leverage on inflation to help you as an investor?

By investing in stocks in which its Returns outperform Inflation, you would have beat inflation in its own game!

2. Achieve Your Financial Goals

Many people have big dreams for what they want to achieve in life such as:

- Sending the kids to college overseas

- Retire on a yacht in the Mediterranean

- Be a millionaire with a few properties for passive income

These are reasonable and comfy goals but are hard to accomplish unless you draw out a plan and work on the incremental steps to get there.

For example, as opposed to saying i want a comfortable retirement, put in specifics like:

Retire at age 65 with a $1,000,000 warchest vested to give 4% dividend yield = $3.33K passive income.

And chances are you would need to invest wisely to get to where you want to be – a round-the-world vacation, a new house, starting a business, and any other financial goals you might have.

Just remember not to solely depend on a monthly pay-check as it hinges on the huge risk of losing the job anytime (see the Covid pandemic).

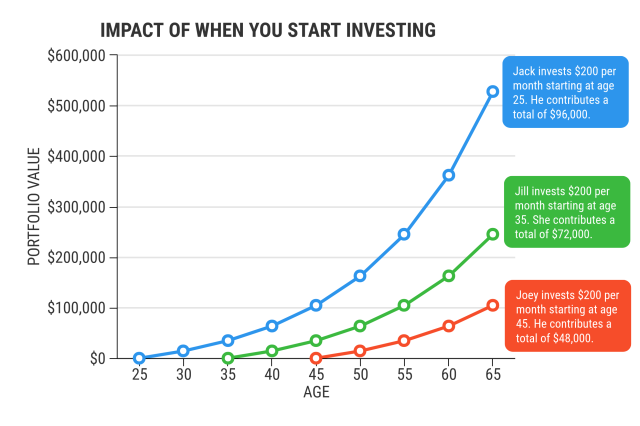

3. Behold the Marshmallow Test

I have heard of countless, intimate (wrong word but you get my meaning) stories from my customers that they have procrastinated investing until they are like late 40s and 50s.

By that time, they lamented about all the lost opportunities but yet they are terrified to take the 1st step because the huge sum of capital is literally what they have left!

As the Chinese proverb goes,

“The best time to invest was 20 years ago.

The 2nd best time to invest is Now.”

Just because the retirement is 20 years down the road doesn’t mean that you should forsake it for instant gratification stuff now.

Investing takes time and you can’t expect it to become rich in a short few years (OK…maybe crypto can…)

Anyway, the bottom-line is this:

The reason to start investing is so that you can compound your wealth early until its too late. You have many viable options be it stocks or crypto or ETFs etc… you just need to learn and get started on the right path.

Conclusion

All in all, investing is wonderful – it leverages on the power of inflation and compound interest and allows you to achieve your financial ‘dreams’.

So, knowing your “WHY” to invest is so important and so is downloading this DIY Investing Checklist.

It’s time to take it and take charge of your financial life today!