For those uninitiated, Temasek Holdings is Singapore’s sovereign wealth fund with AUM north of $380 billion and growing bigger each day.

Founded in 1974, it transformed itself to be one of the biggest investors in the world and has the opportunity to do many early Private Equity deals.

Its portfolio spans across different continents with its main portfolio in Singapore, China, the Americas, and Europe/Middle East/Africa respectively.

There are over 100 companies in Temasek’s portfolio and we have cherry picked 8 Temasek Holdings stocks that you should take note of!

#1 DBS Group Holdings Ltd

As of its latest quarterly results, DBS’s revenue decreased by 4% to $2.3 billion. Its net profit increased by an amazing 72% to $2.0 billion. This was due to the reversal of allowances provided during COVID.

The group’s non-performing loan dropped from 1.6 to 1.5, which shows the credit resilience of DBS’s portfolio. Moreover, MAS has also lifted the dividends requirements recently on local banks. Dividend yield of DBS might go back to its original 5%, which will be very appealing to dividend hungry Singaporeans.

Source: ShareInvestor WebPro, as of 15 Nov 2021

Temasek is the largest shareholder of DBS and holds approximately 28.7% of DBS’s total share. Being an iconic company in Singapore, it is no wonder DBS makes up approximately 5.8% of DBS’s total AUM.

DBS last closed at $32.04, which valued the company at a P/B ratio of 1.5x and dividend yield of 2.7%.

#2 Singtel Ltd

Singtel is Asia’s leading communications technology group, operating in a dynamic region that is undergoing rapid and unprecedented digital transformation. Together with Optus and our regional associates Airtel, AIS, Globe and Telkomsel, it provides an extensive range of telecommunication and digital services across 21 countries.

Singtel is not the only telecom company getting disrupted by new entrants such as Circles Life and TPG from Australia.

However, Singtel has taken note of these changes and have taken steps to conduct a strategic initiative targeting growth in the 5G area and digital solutions. There are also sizable divestments along the way which free up capital for the growth areas.

Source: ShareInvestor WebPro, as of 15 Nov 2021

Temasek is the largest shareholder of Singtel and holds approximately 51.99% of Singtel’s total share. Being one of the largest companies in Singapore and on STI, it is no wonder Singtel makes up approximately 5.1% of DBS’s total AUM.

Singtel last closed at $2.56, which valued the company at a trailing P/E ratio of 40.7x and dividend yield of 2.9%.

#3 Singapore Exchange Ltd

Singapore Exchange (SGX) is Asia’s leading and trusted securities and derivatives market infrastructure, operating equity, fixed income, currency and commodity markets to the highest regulatory standards. It also operates a multi-asset sustainability platform, SGX FIRST or Future in Reshaping Sustainability Together.

SGX is a renowned company in Asia as it not only has equities listing, it has also ventured into commodities and data sales.

SGX has done increasingly well for itself and its share holders as its share price has risen from approximately $7.5 in 2016 to close to $12 currently. Moreover, its dividends have increased from $0.273 in 2010 to $0.315 in 2020.

SGX has continued to reinvent itself by moving with the market and taking up more roles in derivatives – be it on Equities or on Commodities.

Source: ShareInvestor WebPro, as of 15 Nov 2021

Temasek is the largest shareholder of SGX and holds approximately 23.3% SGX’s total share. SGX makes up about 0.78% of Temasek’s AUM.

SGX last closed at $9.47, which valued the company at a P/E ratio of 22.8x and dividend yield of 3.3%.

#4 Mapletree Industrial Trust

Mapletree Industrial Trust (“MIT”) is a real estate investment trust listed on the Main Board of Singapore Exchange. Its principal investment strategy is to invest in a diversified portfolio of income-producing real estate used primarily for industrial purposes in Singapore and income-producing real estate used primarily as data centres worldwide beyond Singapore, as well as real estate-related assets.

As at 30 June 2021, MIT’s total assets under management was S$6.7 billion, which comprised 86 properties in Singapore and 28 properties in North America (including 13 data centres held through the joint venture with Mapletree Investments Pte Ltd).

MIT’s property portfolio includes Data Centres, Hi-Tech Buildings, Business Park Buildings, Flatted Factories, Stack-up/Ramp-up Buildings and Light Industrial Buildings.

MIT’s mother company, Mapletree is one of the biggest real estate development, investment, capital and property management companies headquartered in Singapore. Temasek is one of its biggest shareholders and Temasek invests in its subsidiary whenever the opportunity arises.

MIT has shown immense progress on its DPU since it was listed on 2010. Its DPU increased from 8.41cents per year in 2010/2011 to 12.55 cents in 2020/2021. Moreover, it is also progressing with times with its recent foray into data centers.

Source: ShareInvestor WebPro, as of 15 Nov 2021

Temasek is the largest shareholder of MIT and holds approximately 23.6% MIT’s total share. MIT makes up about 0.5% of Temasek’s AUM.

MIT last closed at $2.69, which valued the company at a P/B ratio of 1.68x and dividend yield of 4.45%.

#5 SATS Ltd

SATS is Asia’s leading provider of food solutions and gateway services with 13,000 employees delighting customers in over 55 locations and 13 countries across the Asia Pacific, UK, and the Middle East.

SATS has suffered greatly during COVID as flights and travelling have been cancelled. With travelling restrictions in placed, basically the main bulk of revenue of SATS have been cut. The good news is that with populations around the world getting vaccinated, travelling would return soon.

Moreover, SATS have also started to diversify into frozen food production which would provide a new stream of revenue.

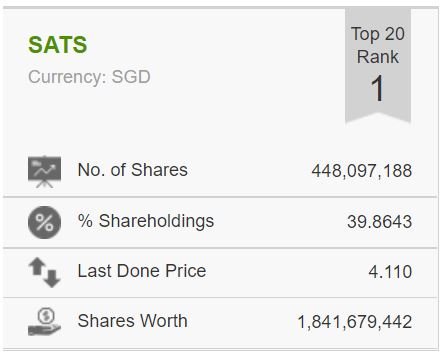

Source: ShareInvestor WebPro, as of 15 Nov 2021

Temasek is the largest shareholder of SATS and holds approximately 39.8% SATS’s total share. MIT makes up about 0.5% of Temasek’s AUM.

SATS last closed at $4.11 and doesn’t have a P/E ratio due to losses incurred in the past year.

#6 Blackrock Inc Ltd

BlackRock is one of the world’s leading asset management firms and a premier provider of investment management, risk management and advisory services to institutional, intermediary and retail clients worldwide.

It offers a range of solutions — from rigorous fundamental and quantitative active management approaches aimed at maximizing outperformance to highly efficient indexing strategies designed to gain broad exposure to the world’s capital markets.

The most noteworthy aspect of Blackrock is that it has an operating margin of 40.1%, which is exceptional in the finance world.

Blackrock is the biggest investor in the world with AUM under the company approximately at USD 8.68 trillion. Its investments stretch across different continents, industries and assets. It has its own ETFs, funds, etc.

Source: ShareInvestor WebPro, as of 15 Nov 2021

Temasek is the sixth largest shareholder of Blackrock and holds approximately 3.35% of Blackrock’s total share. Black makes up about 1% of Temasek’s AUM.

Blackrock last closed at $953.4, which valued the company at a P/E ratio of 29x and dividend yield of 1.5%.

#7 Alibaba Group Ltd

Alibaba’s businesses are comprised of core commerce, cloud computing, digital media and entertainment, and innovation initiatives.

In addition, Ant Group, an unconsolidated related party, provides digital payment services and offers digital financial services to consumers and merchants and other businesses on our platforms.

An ecosystem has developed around our platforms and businesses that consists of consumers, merchants, brands, retailers, third-party service providers, strategic alliance partners and other businesses.

Alibaba continues to reinvent itself by expanding into other businesses such as cloud platform and financials.

It has not forgotten its roots in the e-commerce industry and is always aggressively expanding into new regions such as Southeast Asia.

Notably, it has acquired Redmart and Lazada in the Southeast Asia region. The immense presence of Alibaba in the Asia region is felt by many tech companies in Singapore.

Source: ShareInvestor WebPro, as of 15 Nov 2021

Temasek is the fifteen largest shareholder of Alibaba and holds approximately 0.44% of Alibaba’s total share. Alibaba makes up about 0.6% of Temasek’s AUM.

Alibaba last closed at $168.08, which valued the company at a P/E ratio of 20x.

#8 Paypal Holdings Inc

PayPal has remained at the forefront of the digital payment revolution for more than 20 years.

By leveraging technology to make financial services and commerce more convenient, affordable, and secure, the PayPal platform is empowering more than 400 million consumers and merchants in more than 200 markets to join and thrive in the global economy.

It is in the continual expansion into other continents and countries such as South America, Asia, etc. Moreover, Paypal was the first few payment company that took up cryptocurrency in its portfolio.

This shows the forward looking management that Paypal possesses.

Source: ShareInvestor WebPro, as of 15 Nov 2021

Temasek is the seventeen largest shareholder of Paypal and holds approximately 0.81% of Paypal’s total share. Paypal makes up about 0.6% of Temasek’s AUM.

Paypal last closed at $215.56, which valued the company at a P/E ratio of 52x.

There are of course many more holdings as seen below.

This is found in ShareInvestor WebPro’s ownership feature so do sign up for the membership here if you’re still not one!

If you want to copy the success of Temasek Holdings, there’s even a better candidate – Billionaire Warren Buffett, arguably the most successful investor of all time.

Check how you can learn the secrets to Warren Buffett’s investment success by downloading the Free Guide below: