On 20 June 2023, Skyworld Development Bhd (Skyworld) had recently issued its IPO Prospectus (Part 1, Part 2, Part 3, and Part 4) on Bursa Malaysia and from it, extended an invitation to subscribe its IPO shares at 80 sen per share.

Upon the successful listing of its shares, Skyworld’s market capitalisation shall be lifted up to RM 800 million.

The subscription of its IPO shares shall end on 27 June 2023. Its shares would be listed on Bursa Malaysia on 10 July 2023.

Source: Page 20 of Skyworld’s IPO Prospectus

Here, I’ll summarise 7 things to know before subscribing to its shares. They are:

1. Corporate Profile

Skyworld is a property developer based in Kuala Lumpur. Since establishment in 2014, Skyworld has completed 7 property development projects as follows:

On 22 May 2023, Skyworld has 6 ongoing property projects as follows:

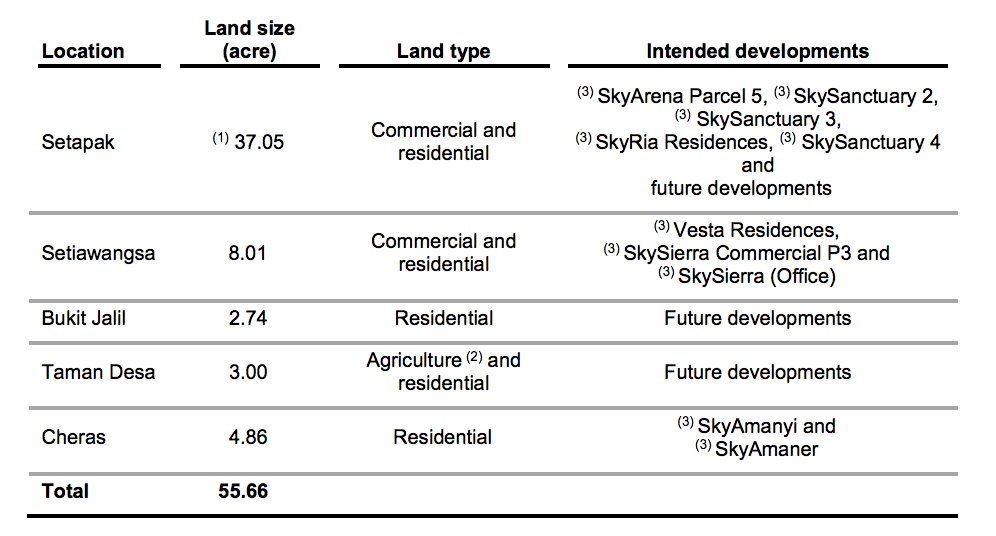

In addition, Skyworld has a total land bank of 55.66 acres in places as follows:

Source: Page 152-155, 163 of Skyworld’s IPO Prospectus

2. Financial Results

Source: Page 329 of Skyworld’s IPO Prospectus

Profits in 2021-2022 were contributed by key projects such as:

- SkyMeridien Residences (completed on February 2023)

- SkySierra Residences (expected to be completed on June 2023)

- SkyAwani Residences Ⅲ (completed on April 2022)

- SkyAwani Residences Ⅳ (expected to be completed on Dec 2023)

Upon completion, they would not contribute substantially to Skyworld. As such, Skyworld would rely on other on-going projects and future projects for revenue and profits.

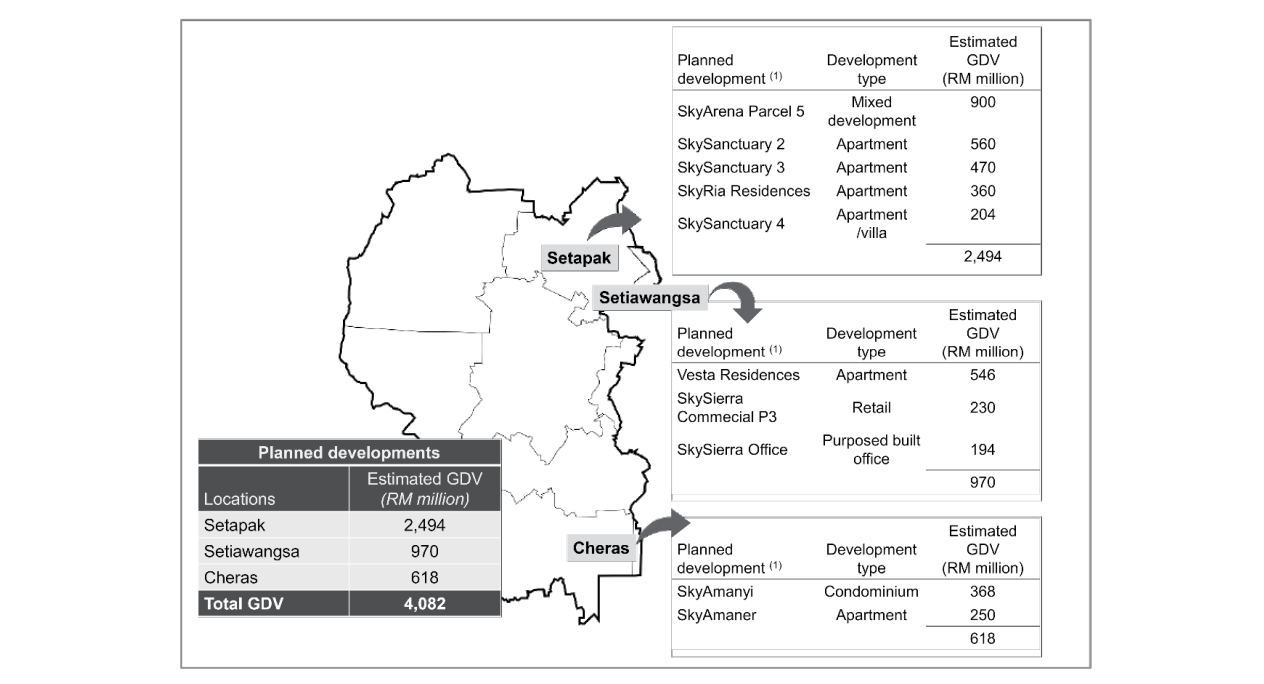

Its future projects worth RM 4.08 billion in GDV are as follows:

Source: Page 166 of Skyworld’s IPO Prospectus

3. Utilisation of IPO Proceeds

Source: Page 31 of Skyworld’s IPO Prospectus

- Acquisition of Land for Development (RM 100.00 million)

As of now, Skyworld is still in the midst of identifying suitable land to be bought for property development.

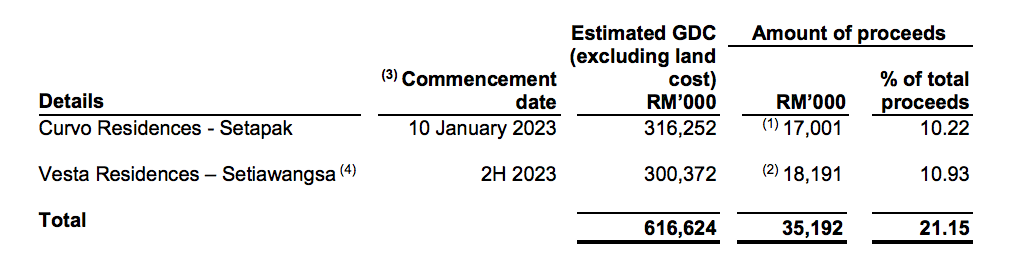

- Working Capital for Property Development (RM 35.19 million)

They refer to piling and main building works for two projects as follows:

Source: Page 32 of Skyworld’s IPO Prospectus

- Repayment of Bank Borrowings (RM 20.00 million)

Skyworld estimates that it can attain RM 1.12 million in annual interest savings.

- Estimated Listing Expenses (RM 11.21 million)

4. Major Shareholders

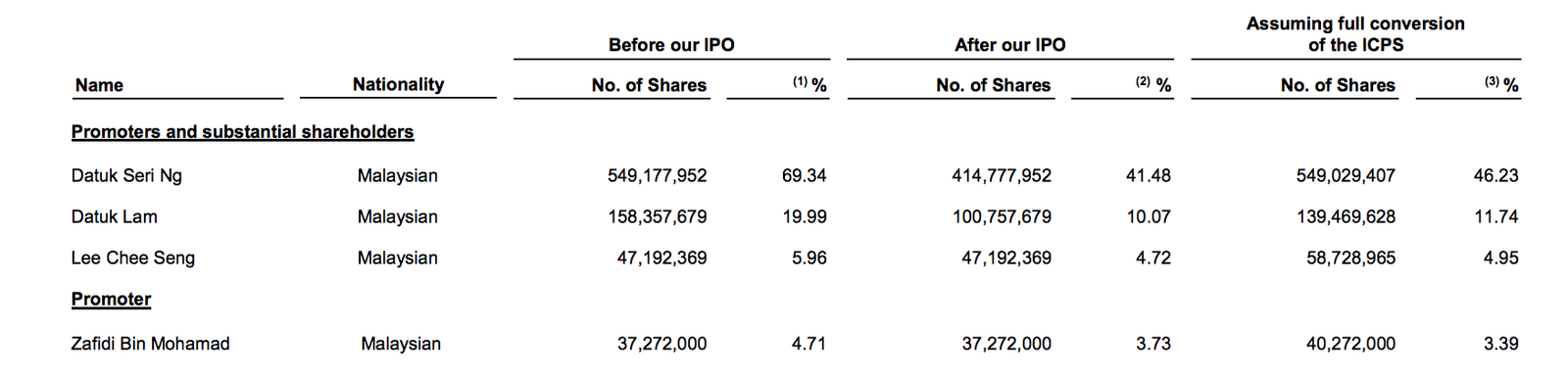

Source: Page 42 of Skyworld’s IPO Prospectus

Upon its successful listing, Datuk Seri Ng Thien Ping, Datuk Lam Soo Keong, and Lee Chee Seng would remain as substantial shareholders of Skyworld.

Ng would sit on the board as Skyworld’s Chairman. Lam is an Executive Director while Lee is appointed as the CEO of Skyworld.

#5: Expansion into Built-to-Rent Developments

In addition, Skyworld intends to expand into built-to-rent properties, where the company develops commercial properties with the intention of earning rent for the long run.

Currently, Skyworld embarks in 2 built-to-rent projects in Setapak, Kuala Lumpur. They are:

- Sama Square

It is proposed to be a development that has 44 retail lots and commercial space with a total lettable area of 55,646 sq. ft.

The construction work for this project commenced in December 2022 and is expected to be completed by 2H 2023.

- Skyblox

It is proposed to be a development of 128 units which have 320 lettable rooms, which can be leased out as a community hostel.

Its construction work started in December 2022 and is expected to be completed by 2H 2023.

Source: Page 171 of Skyworld’s IPO Prospectus

#6: Dividend Policy

Skyworld targets to pay out at least 20% of its PAT to its shareholders.

Hence, based on 2022 earnings per share (EPS) of 10.6 sen, its dividends per share (DPS) shall be at least 2.12 sen, which works out to be 2.65% in initial dividend yield a year.

#7: Valuation

Based on its IPO price of 80 sen, the offer is valued at P/E Ratio of 7.55. This is calculated based on its 2022 EPS of 10.6 sen.

Conclusion

Skyworld had completed 7 project development projects and has profited from them for the 3-year period in 2020-2022.

These projects would not contribute substantially to Skyworld as these properties had already been handed over to its buyers.

Moving on, Skyworld is working on the few key projects listed above, including its built-to-rent developments, to generate income in the future.

Thus for investors, it is key to assess these projects before making a decision on it.